Here's my Top 10 links from around the Internet at 10 to 6 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

Back on stream properly next week.

Think about this for a minute.

A guy who is the manager of the most bonds in the world says the world's most powerful government in the world's biggest economy will eventually not be able to service its debt.

And he's saying America is likely to get away with it because the default will be done through inflation and currency devaluation.

It's astonishing really. This guy is the most qualified in the world to know these things. He has hundreds of researchers at his fingertips. He could and does pick up the phone to the most powerful people in the world. He is playing with US$1.2 trillion of savings on behalf of American savers. He cares and knows.

And he is saying out loud that America is trying to trick the world into buying what will be worthless (or at least devalued) paper.

Yet bond yields remain near record lows.

Either he is off his rocker or he is the only one saying the emperor has no clothes.

When the bond vigilantes (and he is the chief of the vigilantes) truly awake we should all be a little fearful.

Rising interest rates will be the thing that ends any pretence about the Global Financial Crisis being over.

Here's Gross:

Medicare, Medicaid and Social Security now account for 44% of total federal spending and are steadily rising.

Previous Congresses (and Administrations) have relied on the assumption that we can grow our way out of this onerous debt burden.

If I were sitting before Congress – at a safe olfactory distance – and giving testimony on our current debt crisis, I would pithily say something like this:

“I sit before you as a representative of a $1.2 trillion money manager, historically bond oriented, that has been selling Treasuries because they have little value within the context of a $75 trillion total debt burden.

Unless entitlements are substantially reformed, I am confident that this country will default on its debt; not in conventional ways, but by picking the pocket of savers via a combination of less observable, yet historically verifiable policies – inflation, currency devaluation and low to negative real interest rates.

Our clients, who represent unions, cities, U.S. and global pension funds, foundations, as well as Main Street citizens, do not want to be shortchanged or have their pockets picked.

It is incumbent, therefore, in order to preserve the integrity of the U.S. Treasury market along with its favorable global interest rates, and to promote a stable U.S. economy, that entitlement spending be reduced, and that future liabilities be addressed in terms of healthcare and Social Security cost containment. You must attack entitlements and make ‘debt’ a four-letter word.”

2. What about the goodwill? - Massey University Banking Professor David Tripe asks a good question in this piece at TVNZ's AMP Business about the NZ$3.5 billion of goodwill attached to National Bank that is on ANZ's books in New Zealand.

Tripe told AMP Business today he expects a lot of the National branches would have to be re-branded and some may be closed if the bank did move to one identity.

He says National Bank has managed to keep up its popularity despite eight years of ownership by one of the "big Aussie banks", but that could now be at risk.

"(Ditching) it would seem to be risky at the best of times and it's not something you would do in a rush," he said.

The other cost is likely to be financial with ANZ's purchase including approximately $3.5 billion of goodwill. Tripe warns that goodwill may have to be written off if the National Bank brand is ditched.

3. Why was South Canterbury Finance renewed? - Frogblog asks a good question about why the government allowed South Canterbury Finance to remain guaranteed for so long and renewed that guarantee for the extended scheme. It could have been allowed to lapse.

Here’s John Key, at a public meeting in Timaru last night, talking about (audio) the Government’s knowledge of the financial woes of South Canterbury Finance:

"But for the entire time I’ve been Prime Minister I’ve had the Treasury in my office, week after week, month after month, telling me South Canterbury Finance was going bankrupt."

Okay, John Key and Bill English may have a case to be forgiven for the first sign-off of South Canterbury Finance into the Retail Deposit Guarantee scheme – it was the day they took office as Ministers. They would have been so excited about the enhancement of their political careers that perhaps the details may have passed them by. But the guarantee was renewed on December 11 2009, updated on All Fools’ Day 2010, and amended on June 17th 2010, all signed off on behalf of Bill English.

4. Problems in Muni land - Along with the European Sovereign debt crisis, the other one to watch is 'Muni' or Municipal debt in America. Towns, cities, counties and states in America are big borrowers, but many have balanced budget rules and are struggling to finance previous debt as the economy struggles to recover.

Now the CEO of JP Morgan reckons a hundred munis could fall over, Bloomberg reports.

“I wouldn’t panic about what I’m about to say,” Dimon, 55, said today at a U.S. Chamber of Commerce event in Washington. “You’re going to see some municipalities not make it. I don’t think it’s going to shatter America, I just think it’s a part of the credit cycle.”

JPMorgan, the second-biggest U.S. bank by assets, said in February its commercial bank’s municipal-debt holdings are diversified enough to handle a likely increase in defaults. The number of issuers that can’t manage debts may be about a hundred, Dimon said today.

5. Paying their fair share - The British body politic is stirring about the way many of the globalised companies operating and/or based in Britain avoid paying tax there.

The Guardian reports a bunch of MPs plan to investigate corporate tax avoidance.

The inquiry, by the Treasury select committee, will raise the political temperature around the issue – already under scrutiny after questions over the tax bills of multinationals such as Vodafone and Barclays – and senior executives face the prospect of explaining their companies' tax structures to the committee.

George Mudie, the Labour MP for Leeds East and the chairman of the Commons Treasury sub-committee, told the Guardian that there was growing public interest. "When people see their standards of living fall and are paying their tax, and see huge salaries and questions over tax avoidance, then quite rightly they are interested in the issue," he said.

6. Worth watching - A bunch of Australian councils who bought a bunch of toxic sub-prime bonds called 'Rembrandt notes' are taking legal action against Standard and Poor's in Australia on the grounds that S&P had a duty of care to do a decent job (but didn't). This is a world first and could create an opening for grumpy pension funds the world over to destroy the ratings agency.

Here's Elisabeth Sexton from BusinessDay:

The councils allege misleading and deceptive conduct by the ratings agency, which is owned by McGraw-Hill International.

Other parties in the case are Local Government Financial Services Pty Ltd and ABN Amro Bank. It is being funded by IMF (Australia) Ltd, whose executive director, John Walker, said the 10-week trial, due to start in October, would be ''the first time worldwide that a ratings agency will have been taken to task''.The councils were among 75 investors who put $45 million into ''Community Income Constant Proportion Debt Obligation Notes'', known as Rembrandt notes, in 2006. The notes were rated AAA by Standard & Poor's.

7. 'Send lawyers, guns, money and a private jet' - Private jet sales and rentals are booming in the Middle East and Africa as airlines cut back flights in areas with civil unrest and as dictators, royalty and business people scramble for ways to get the hell out of dodge in a hurry.

Banned by many firms as an extravagance after the global downturn, jets -- some with gold-plated interiors, bedrooms and bathrooms -- are vital for businessmen, diplomats, politicians and families wanting quick, discrete exits from trouble spots.

Airspace over the world's No. 1 oil exporting region is buzzing, with passengers doling out as much as $18,000 for an hour-long flight on an 18-seater, after protests toppled rulers in Tunisia and Egypt this year and the unrest spread to Gulf states including Bahrain, Yemen, Kuwait andSaudi Arabia.

"During the peak of the Egypt unrest, we were flooded with calls," said Shane O'Hare, president and chief executive of Royal Jet, based in Abu Dhabi. "We had corporate customers, individuals, families, diplomats and others calling for our service," he said.

8. 'So that's where the copper went' - The copper price is one of the few commodities falling in price at the moment.

One of the reasons is the recent uncovering of massive copper stockpiles in China which are effectively being used as collateral by property developers to borrow money at super low rates from London and New York.

Yes. This one is for Wolly.

Property developers are using copper as collateral to borrow newly printed US dollars and pounds cheaply.

They are getting around intransigent Chinese banks to use the near zero interest rates in London and New York to borrow to invest in Chinese property developments.

Now you see why I'm such a big grump about low interest rates in America and Europe (and here for that matter)?

Here's the detail via FTAlphaville:

The scale of the refined inventory casts into doubt the size of the expected refined deficit in the copper market this year, and raises the prospect of a balanced market, or even a small surplus.

• More worryingly however is that the primary use of copper in bonded warehouse appears to be as a financing mechanism to provide cheap working capital for various types of business often unrelated to the metallic industry.

Initially via a letter of credit and then by using deferred payment LC, they create a borrowing vehicle. Estimates for the amount of metal tied up in such a way range from 40-80% of total bonded stocks. Our estimates are towards the upper end of this range.

• Property developers (or the property developing arms of conglomerates), appear to be behind the lions share of this type of activity, driven by an unwillingness by domestic banks to extend finance, or the imposition of interest rates of anything from 10-20% when they do. On that basis, interest rates on metal of LIBOR + cost of funding look very attractive indeed.

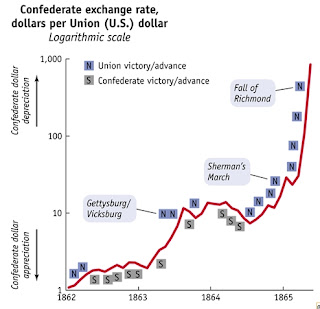

9. Ain't history fascinatin' - Texas State Economics Professor David Beckworth points out on his blog that America used to have three separate currencies. During the Civil War the Union under Lincoln went off the gold standard and started printing 'Green backs'. Meanwhile California stayed on the gold standard and its dollars were known as 'Yellow backs'. The South printed its own money that rose in fell in value depending on how the Rebel army was going.

Here's one of the more interesting currency charts I've seen in a while that shows rampant inflation/develuation that fluctuated depending on the outcome of battles.

Gettysburg was a bad day for holders of confederate money.

10. Totally relevant video today as the Irish face up to yet another bailout of its banks and impending default.

11. Totally bonus weekly video on John Clarke and Brian Dawe.

81 Comments

America's Congress spent more than three times more investigating Bill Clinton's links with Monica Lewinsky than it spent investigating the Financial Crisis, Dylan Ratigan points out with Michael Lewis here. HT someone from one of the 300 emails I got today. sorry.

http://www.youtube.com/watch?v=shoPWQcgDHs&feature=player_embedded

Here's how one group is demanding Ben Bernanke step down. The mood of rebellion is growing in Europe and the United States.

http://www.youtube.com/watch?v=7D6neBzTnOQ

It's called the Empire State Rebellion and is scheduled for June 14

http://ampedstatus.org/prepare-for-revolution-the-empire-state-rebellio…

cheers

Bernard HT Cosmic

FYI

The G20 is considering including yuan/renminbi as part of the IMF's Special Drawing Rights.

http://www.bbc.co.uk/news/business-12905205

Australia is looking at a crackdown on corporate tax avoiders. This will be a theme in many indebted industrialised economies.

http://www.theaustralian.com.au/business/opinion/shorten-races-to-plug-…

A buyers strike is happening in Australia's housing market

http://macrobusiness.com.au/2011/03/house-buying-strike/

I feel sympathy to my bones for those that are running the buying strike campaign and those that participate in it. I understand completely where they are coming from. A buyers strike is an entirely appropriate and justifiable response to the Australian politico-housing complex. It is a political act targeted at a political system that lies to their face.

Here we go with the biggest flybuys deal. If you buy a Jennian home you get 8,000 fly buys points.

Wonder if they'll accept a frequent fliers credit card when I pay for the house...

https://www.flybuys.co.nz/CollectPoints/Pages/Participant.aspx?CompanyI…

cheers

Bernard

I'm off to be a miner in Australia....

Travis Marks, a 24-year-old with no college degree, is hitting pay dirt as Australia’s mining bonanza fuels demand for workers. Already making triple the nation’s average salary, he expects to get even richer.

“With what’s going on in the industry, there’s lots of big jobs coming up,” said Marks, who earns A$220,000 ($227,150) a year -- more than Federal Reserve Chairman Ben S. Bernanke’s $199,700. His job as a rigger for a company providing construction and maintenance services to the resources industry is “a really good way to get ahead as a young bloke,” he said.

This look familiar. Today's must read I reckon. I agree with this completely.

http://www.salon.com/news/politics/war_room/2011/03/29/failure_of_shareholder_capitalism/

Most Americans work in the nontraded service sector. In the last decade, as the economist Michael Mandel has pointed out, almost all of the new jobs have been created in health, education and government, which share one characteristic in common: low productivity and rapidly escalating costs. The other big growth area, before the 2008 crash, was in the largely unproductive FIRE (finance, insurance, real estate) sector, where high salaries enticed smart young Americans who might have manufactured useful goods and services into manufacturing the toxic financial products that brought down the world economy. The homeland of Margaret Thatcher became even more dependent on a bloated financial sector than the over-financialized U.S.

Still not convinced that the Anglo-American model of the last generation is a failure? Orthodox economists recite the dogma that if productivity goes up worker compensation will follow. But according to the economist Alan Blinder in a Wall Street Journal Op-Ed titled "Our Dickensian Economy" last year, since 1978 productivity in the nonfarm business sector has grown by 86 percent, while real compensation -- wages plus benefits -- has grown only 37 percent. Take out the increased benefits, which tend to be eaten up by cancerous health insurance costs, and the real average hourly wage has not increased in 35 years.

Where have those missing gains from productivity growth gone? To a small number of rich American shareholders, CEOS and highly paid professionals, thanks to "shareholder capitalism."

Courtesy of Ryan Keen Queenstown's Mountain Scene, here's a verbatim interview with bankrupt property developer Rod Nielsen. A fascinating view of what a bankrupt property developer really thinks.

He is more concerned about paying his subbies than repaying loans to finance company investors...

Here's Vanity Fair editor Graydon Carter, a member of the New York elite, saying some startling things about the rich getting richer and the poor getting poorer.

http://www.vanityfair.com/magazine/2011/05/graydon-201105

Today, the top 1 percent of Americans takes intwice as much of the country’s income as it did then—nearly 25 percent. And, incredibly, the richest 1 percent now controls 40 percent of the nation’s wealth. As Vanity Fair’s Joseph E. Stiglitz, a Nobel Prize winner for economics, writes in his column, “Of the 1%, by the 1%, for the 1%,” on page 126, “In terms of income equality, among our closest counterparts are Russia of the oligarchs and Iran.” He predicts that the trend will only continue, and as it does, the lower 99 percent of Americans, the underdogs, will continue losing ground to the overdogs.

Stiglitz looks beyond the simple injustice of this economic imbalance to the frightening long-term consequences. History, he says, has not been kind to societies so heavily skewed toward the rich. When wealth is concentrated in a small group, so is power—and power is almost invariably used to keep that wealth concentrated in those few soft hands. The result? Investment in education and infrastructure dries up. Laws meant to level the playing field are changed to make it tilt. A sense of national common purpose slowly, and then quickly, erodes. Says Stiglitz: “Virtually all U.S. senators, and most of the representatives of the House, are members of the top 1 percent when they arrive, are kept in office by the money from the top 1 percent, and know that if they serve the top 1 percent well they will be rewarded by the top 1 percent when they leave office.” What the rich never seem to understand, he says, is that it is in their own interest to look out for the interest of other people.

Here Neil Barofsky, the inspector of America's TARP bailout has this to say:

http://www.nytimes.com/2011/03/30/opinion/30barofsky.html?_r=2&partner=rss&emc=rss

In the final analysis, it has been Treasury’s broken promises that have turned TARP — which was instrumental in saving the financial system at a relatively modest cost to taxpayers — into a program commonly viewed as little more than a giveaway to Wall Street executives.

It wasn’t meant to be that. Indeed, Treasury’s mismanagement of TARP and its disregard for TARP’s Main Street goals — whether born of incompetence, timidity in the face of a crisis or a mindset too closely aligned with the banks it was supposed to rein in — may have so damaged the credibility of the government as a whole that future policy makers may be politically unable to take the necessary steps to save the system the next time a crisis arises. This avoidable political reality might just be TARP’s most lasting, and unfortunate, legacy.

"Right now, this afternoon, just 400 Americans -- 400 -- have more wealth than half of all Americans combined," Michael Moore said.

Politifact checked this out and found it to be true. 400 people do indeed have more more wealth than the poorest 100 million American households.

And here's some heavy duty research saying the same thing: the rich got very, very rich and the poor and middle got poorer. A lot poorer in relative terms.

Robert Peston at BBC details just how much deleveraging Ireland's banks will have to do inside the next two years -- 50% of GDP. Utterly impossible without a complete collapse. Ireland will have to default.

http://www.bbc.co.uk/blogs/thereporters/robertpeston/2011/03/the_hole_in_irelands_banks.html

The banks are also being forced to shrink to a size that poses less risk to the Irish economy. They've been instructed to reduce the net loans on their balance sheets by £63bn (71bn euros) by the end of 2013 - or by an amount equivalent to around half the value of the Irish economy.

Even the Australians are talking about unaffordable housing now...

AUSTRALIAN house prices are a "national disgrace"' according to futurist, economist and population analyst Brian Haratsis.

Mr Haratsis told a national development conference in Adelaide yesterday there was an immediate need to increase house and land supply to soften the impact of rising prices.

"It's a national disgrace. No one will take responsibility for it,'' he said.

"Town planning regulatory systems must be changed to reduce land prices by 50 per cent as globalisation hits.''

Founder and managing director of MacroPlan - a consultancy of economists, strategic planners and property research analysts - Mr Haratsis said Australian house prices had increased by 40 per cent since 2005 while wages had only increased 24 per cent.

The bursting of the housing bubble in America has destroyed US$8 trillion of wealth.

http://www.epi.org/publications/entry/the_state_of_working_americas_wealth_2011

The Great Recession officially lasted from December 2007 through June 2009—the longest span of recession since the Great Depression. The recovery since then has proceeded on two tracks: one for typical families and workers, who continue to struggle against high rates of unemployment and continued foreclosures, and another track for the investor class and the wealthy, who have enjoyed significant gains in the stock market and benefited from record corporate profits.

The Main Street–Wall Street divide remains as big as ever in the aftermath. This brief takes a historical view of wealth and its components, and places a special emphasis on the bursting of the housing bubble, which thus far has

resulted in $6 trillion of lost wealth; an additional $2 trillion is expected.

Bernard - the penny drops slowly, eh?

"The bursting of the housing bubble in America has destroyed US$8 trillion of wealth".

Um, it must be a year ago or more, I poiinted out the obvious: That the 'wealth' hadn't existed in the first place.

It was 'investments' made largely on boosed, leveraged 'valuations' of existing items (mostly real estate).

Not surprising that something that hadn't existed, finished up not existing.

You sound just as much a believer as Bollard.

Come on, man - get with reality, it's so much closer to the truth than economics.

Yes I find it wierd, I have 250k of "savings' in my home because its gone up in "value" but its money I cant get out without destroying my home.....so who cares...

Another way, its funny money....it doesnt really exist....why do ppl think they have gained when they have not worked for it or expanded energy in making a something.....? Its a pile of wood, concrete and glass....thats it......

Hmmm so "paper" money that was created out of nothing more than the flick of a pen to lend out for something that never existed (profit)....why do ppl have to pay back something that doesnt even exist.....and never did?

PIs, mind boggles at ppl who cant see they offer little or anything to society...but leverage based on debt they expect someone else will pick up the tab for when it goes wrong....even when it will be their kids.

regards

A comment from one of today's links...

"There never was any such money. It was just figures written in accounts.

e.g. if a year ago I said you house was worth a million, then this year I said it was worth only half a million then nothing has appeared or disappeared.

Suppose you used your house as collateral; the bank lent you a million then when you defaulted (hypothetically) they'd have lost half a million. Your house looks just the same."

http://krugman.blogs.nytimes.com/2011/03/30/austerity-games-here-and-th…

"Meanwhile, in Britain, via Yves Smith, people have been digging into the details of the government forecast, and finding that it relies on the assumption that household debt will rise to new heights relative to income:"

Quite why? so it isnt going to work....no more debt = deflation and once that sets in its a depression and a long drop....

All I can say is we get to see the experiment live in front of us, involving us...as the National Govn makes cuts it will or rather we will pay for it.

regards

Bernard

#1, What Bill Gross is saying or campaigning for is despicable, since he manages billions of dollars that were accumulated in the biggest wealth concentration of all time, he's now suggesting that the US government will have to default or not pay any benefits to those he and those of his ilk have left in the gutter.

Debt a four letter word? what an arsehole, how about systematic psycopathic corporate greed, how do you describe that in a pithy sound bite?

Let the riots begin

Neven

1# Bernard, I remember when I planted the Pimco story into your blog here hardly anyone talked about, while in my home country the story made headlines in the news.

Bernard and/or Iain, some simple questions -

Regarding the millions of $ NZ borrows every day -

1. Who is giving NZ those $ and does NZ know if the $ are real?

2. Do the $ NZ borrows have to be real?

3. Is it ok for NZ (or anyone for that matter) to borrow $ that are "created" out of thin air?

4. When we pay the $ back (it is April 1st of course) would we pay the $ back in cash, assets, land, or would we simply "create" the $ and use those to pay the debt?

5. When the people that have lent $ to NZ sense they may never be paid back and that NZ can't afford to pay the interest on the loans they've drawn - what do you think they will do?

Yes, re-empower our own Reserve Bank to issue Public Credit backed by the full credit of the nation. Pay down our national debt then run an internal balanced economy within the boundaries and balances of sustainable resources and population.

This is meaningless waffle. What's the "full credit of the nation"? What's an "internal balanced economy"? What are the "boundaries and balances of sustainable resources and population"?

Throwing around pleasant-sounding words like "balanced" and "sustainable" doesn't change the fact that while the current government-monopolised, central bank-ravaged monetary system is a wealth-destroying abomination, your solution of "public credit" (guess it's been re-branded due to the association of "social credit" with tinfoil hat-wearing conspiracy theorists) would be far, far worse.

Your answer to a problem caused by central banks printing money to keep interest rates artificially low is to allow central banks to give away money for free to the government and politically-connected groups. You show no understanding of the importance of interest rates in coordinating consumption, savings and investment, not to mention balancing out the amount of capital invested in each stage of production.

The sad thing is that you're right in about 90% of what you say. The current banking and financial system is a government-sponsored cartel allowing the banks to create money out of thin air. Your answer to that is to allow the government to create money out of thin air. It's almost as if you were doing a maths test and got all the working right but somehow ended up at the wrong answer.

The answer is to get the government out of the money business because central planning doesn't work. Public credit would take central planning of money to a whole new level.

Yes well I think you will have as much luck educating Iain, as you would trying to convince Mohammed to become a Jesuit....pretty long odds Kleefer.

He will likely evolve into an investing capitalist machine the day his mortgage is paid off.

Iain,

It appears that either the respondent in Bill English's office either doesn't know how the monetary system works (worrying as it reflects poorly on the advice provided to someone responsible for the democratic oversight of monetary policy) or they were wilfully deceptive to an Official Information Act request. I will address point by point the many misconceptions contained in the response. I've drawn the information, not from woefully misinformed neoclassical economic textbooks, but instead from official Reserve documents.

"People purchasing government bonds must do so with New Zealand dollars. Settlement of the transaction between the purchaser and the Crown is by electronic cash transfer rather than physical cash."

People don't purchase government bonds. As you know only approved primary dealers are allowed to purchase government bonds, e.g. major investment brokers, banks, insurance companies etc. Anyway what is a New Zealand Dollar? It is nothing. It is not money. The Oxford Dictionary defines money as a current medium of exchange in the form of coins and banknotes; coins and banknotes collectively: and the Reserve Bank of New Zealand reports that The total value of notes and coins in circulation as at June 2003 was $2.9 billion, approximately 2.3% of nominal GDP. As a percentage of the public’s total money balances, notes and coins comprise about 12% of the narrowly defined money supply (M1) and 2% of the broad money supply (M3).

Payment and Settlement Systems, Reserve Bank of New Zealand

The Reserve Bank acknowledges that electronic transfers aren't legal tender in their treatment of a controversy regarding the acceptance of money after the recent changeover to lighter coinage (debasement).

For example, it may specify that payment be made electronically or by cheque, in which case the debtor has no right to insist on payment in legal tender....

"With large sums, where the contract is unspecific as to the form of payment the courts are likely to conclude that payment by legal tender is, in the words of one

author “unthinkable and cannot possibly be within the contemplation of the parties”

Payment and the concept of Legal Tender

The New Zealand Dollar (non banknote or coinage) is nothing more than a numerical artifact that no one is legally bound to accept unless it is explicity stated within the terms of a contract negotiated between two parties.

“The actual form of payment – whether it is by legal tender or some other method – is determined by the contractual context. A contractual provision may specify the form of payment as something other than legal tender.”

Payment and the concept of Legal Tender

"This is done through the process of financial intermediation. Commercial banks, and other financial institutions, take deposits from members of the public and firms who wish to hold cash in the form of bank deposits."

This process as described, is no doubt drawn from neoclassical textbooks is factually incorrect and furthermore isn't even logically consistent. It totally overlooks the facts of debt and the need for repayment. It does not explain where the deposits initially originate nor how there could be enough deposits to ensure continued economic growth whilst debt is being paid down. Most conventional textbooks claim that savings create deposits when in fact the inverse is true and furthermore savings aren't money approximates but merely claims on money approximates. Perhaps there is a slight overhang in the supply of money approximates, because there is a temporal lag in repayment of borrowed credit, but not nearly in quantities required to honor all claims on it, let alone provide for compound interest, profit, or rising costs (inflation). The monetary system literally demands continued expansion in the economy either in terms of the value of money as opposed to what it buys or in material growth.

“This is done because at any one time only a fraction of depositors will want to withdraw their funds.”

This is purely incidental. It has nothing to to with the monetary creation process itself, but instead a consequence of it. As the publication, Modern Money Mechanics, written by the Federal Reserve Bank of the United States says, “In the absence of legal reserve requirements, banks can build up deposits by increasing loans and investments so long as they keep enough currency on hand to redeem whatever amounts the holders of deposits want to convert into currency....The bank must be prepared to convert deposit money into currency for those depositors who request currency.... The public's demand for currency varies greatly, but generally follows a seasonal pattern that is quite predictable.”

Modern Money Mechanics, Federal Reserve Bank of Chicago

According to an article in the Financial Times, banks in Europe and the United States securitise credit through the use Structured Investment Vehicles to avoid cash reserve requirements of their Central Banks, but its not necessary in New Zealand, because there aren't any.

"Moreover, even where banks still issue loans there is a trend to "securitisation". This means that the loans are sold to non-bank investors who are not subject to reserve requirements."

http://www.samuelbrittan.co.uk/text14_p.html

"Banks are not subject to cash reserve requirements but locally incorporated banks must hold capital equal to at least 8% of risk weighted assets."

The Official Cash Rate in actionhttp://www.rbnz.govt.nz/education/0114246.html

Great article as usual Im new to these top 10's but i like em!

@ Bernard Point 1 is exactly why Im saying we are just at the beginning of massive rise in commodities including metals, agricultural commodities , oil . This is why I dont believe highly productive farmland is overpriced or in a bubble anywhere. As opposed to housing which is IMHO. They already is structural fundamental supply demand imbalances on supply side for Ag coms. Throw in the massive inflation explosion looming /coming and anything that is a real asset or producer of such , ( mines , Farms , and assoc co's etc) will sure increase in price exponentially. ALthough i am not invested in any farmland. I am quite happy to disclose my whole investment thesis is based on this argument for commodities. And i welcome anyone to critique my theory or strategy including yourself.

The video in 10 is awesome! Exactly sums up the criminal actions of these greedy parasites supported by the people own central banks.. Get rid of central banks and back to gold standard ASAP. Its inevitable anyway . I predict no central banks within 20 yrs

I fear you are missing the effect of price of oil in particular on everything including growth....when it gets too expensive a recession results....Another example farm value is based on its output, when you cant afford to pore oil and gas onto the earth then its output will drop substantially.

Inflation, again you are missing the net effect, Govns are printing sure but that money is staying in bank vaults and more importantly the consumer isnt spending...the NET effect is less money is in circulation, so its dis-inflationary and even deflationary.....

regards

Guess that confirms that Blow Jobs mean a lot, or if not then, cost alot.

You can ask Monica, she will probably have a mouthfull, take a while to answer.

I was not at all surprised re the copper revelation Bernard....just thankful I sold out....since I think something important has been left out of the report...!

There is a very high risk that a good deal of the inventory is being used to back more than one property deal....if you are able to obtain finance from bank A for a property splurge using the 10ooo tons in the shed at the port...why not do the same with bank B and then C and so on....until the banks are exposed to so much loss, and loss of face!, they will refuse to expose the rort and hide the scam, for a cut of the profits of course......all good Chinese business standards.

Who in China would expose this?......make no mistakes here, it would cost you your life.

You can't go wrong with copper. Copper doubles in value every 7 years ... just like houses!

Since it's inception, Kiwisaver has been thrashing housing. I will not disclose my investment bias.

Disclaimer: My Kiwisaver has been thrashing housing average capital gains.

Unemployment in the US has dropped to 8.8 % ......... The jobless recovery is over . Expansion in the economy is creating real jobs in the private sector , displacing un-real jobs in the public sector .

........ If only NZ could be so lucky !

All goody good in the US of A , Bernard ......... But hey , keep doing that " grumpy-old-man " act of yours , ..... Got it down to a tee , old chum !

Bullshit Gummy...go and do some proper research...unemployment in the States is far worse than reported and it is not falling.

Bullshit Wolly : All the hard work and deeply investigative research is done for me ..... I watch CNBC .

Here's your weekend homework Gummy...no bloody gummy bears until you do your lessons.... http://www.marketoracle.co.uk/Article27263.html...and keep out of the bullshit especially cnbc....

Okey diddily dokily : And here's something for you : Estimates are that China will construct 50 000 more " skyscrapers " ( buildings in excess of 80 metres tall , above ground ) over the next 25 years .......... How much copper and iron ore will be required &/ or , what will that do to commodity prices ? ........

........ How much timber from NZ will be required ( aha ha haaaaaaaaaaaaa ! )

..... Meanwhile , back in Christchurch , the army of bureaucrats still debate the pros and cons of beginning the re-build ............

Of course the demand for copper will grow on the back of asian demand during their expansion phase...never doubted it...but they will have market gut busting drops along the way and you would be wise to wait until then to buy copper company shares...way too much fed manipulation going on at present..throw in this likelihood that a mighty copper rort is going on in China and that sooner or later it explodes.....kaaaabooooom and the pe ratios drop to 5 or less..........and that's without the jump in credit costs crushing company profits...oh and not to leave out the piigs pigsty of debt and lies....

Hey Gummy I've just had a brilliant idea based on your excellent logic here. Let's just bulldoze or burn a few Citys every year and that will get our economy rocking. Where shall we start....

Haha, not too far from the truth!

I've been discussing with my wife about buying a house/apartment in her hometown in China (somewhat more affordable than here, but only because of exchange rates), and one of the deals at the moment is that folks are buying a piece of land in an area that they know will have metropolitan development on it soon (often public-private-partnership-funded housing developments), and then sticking a third-rate shack on it (ostensibly residential), which the government then recompenses you for at greater value than you invested. Everyone wins - the Govt/private company partnership gets its land for housing, which it then sells for a profit once the development's complete, and the original house owner also makes a profit! Of course, NZ govt cannot afford to do this, so it'll never happen here.

Don't worry, we're certainly not going to partake in and thereby encourage such unsustainable and ethically-dubious money-grubbing activities :) But it seems tempting...

Of course, it only works if you are in areas in which the Chinese government is making a high level of investment - otherwise low compensation can lead to horrible results: http://www.telegraph.co.uk/news/worldnews/asia/china/7532424/Chinese-fa…

Why go home, Jetliner. Just get yourself elected to The Council; buy some out of the way industrial land that suprise, suprise, just gets re-zoned residential a few months later, and Tao Huixi’s your uncle! But that sort of thing doesn't happen here, of course....

Gummy and logic....hmmmmmm....not sure that would be a wise mix FYI.....!

Bullshit FYI : April Fool's Day has gone ! .... What you extrapolate from my blog is utterly wrong !

........ If the Chinese construct 50 000 new skyscrapers , then that is not the same as the idiotic scenario that you envisage ........

No Gummy Bears for you today ...... Try again ...........

Mornin Gummy....are you still over in Tazzee with the Jumping Jacks.....Bernard has called for a 15 to 20% drop in the Kiwi$...I think he must have sold his Bentley and now that he survives on a cracka a day he never sees the food prices.......

I'd have a modicum of respect for Bernard's choices , if he did drive a Bentley ....... But he owns a Toyota " Windom " ...... and is actually proud of the fact ! ........ Unbe-fecking-lieveable .

What the hell is a "Windom"?

Buddhist flatulence?

Gummy, Wolly and KW, your comments would not be missed. Get a life...and an education. What a wast of time and energy.

........ and a " wast " is what , Dannte ? ...... I can see that your English teacher felt great joy at your progress , no waste of time nor energy there .

Gummy, Wolly and KW, your comments would not be missed. Get a life...and an education. What a wast of time and energy.

Hey Gummy....does this mean I am not likely to be invited to Dante's xmas booze up....bugger.

No great loss there Wolly , given his inability to spell , Dannte's drinks cupboard will be full of Bee , Win ........ and Whisk !

Sall in the mynd Gummee....only sosheall convenshin....

Re#1 all will be revealed on 27 April when we find out from Bernanke if all that hawkish talk from other Fed members is just bluster or not. Problem is markets are playing a game of chicken with him, they don't believe he's got the balls to make a tough call. The markets are probably right.

So where's the trade? The financialisation? Bloody hippies.

KW- it's there in your link - you been on the turps?

"A complex calculation is made to determine how well the recipient country has done but this year $40m is being transferred".

sorry PDK... should have followed the links around a bit...

Begs a question about whether a country is better than a private equity firm though...

Can we all get solar panels with a similar deal? I'm about to cut down a rimu for firewood... act now please...

Thanks Iain appreciate your answers - they make so much sense to me. Notice nobody else comments about your answers - your writing style might be a bit technical and difficult for many to understand. Just sayin'... It's a shame you couldn't dumb all your answers down to a few bullet points that would really make people sit back and take notice. Imagine if NZ joe average knew the truth about the money-go-round and how it is all BS really. Love your insight!

Gee , it's taken 4 years , but Parksy finally has someone who thinks he can understand him . .....

.... . Good on yer mate , saves the rest of us from bothering anymore with those long-winded conspiracy theories ........

Imagine if NZ "Joe average" had to work their way through all of Iain's bullet points....the crime rate would collapse....

Hmmmmmm : .........Iain .......... Bullet ..........Points ............ any way that we can join the dots , Wolly ?

Try these 'dots' Gummy....

"........America is now out of the economic woods.

If only it were so. The trouble with this latest US recovery is that it amounts to little more than an economic “sugar-rush”. The recent growth-burst is built on monetary and fiscal policies which are wildly expansionary, wholly unsustainable and will surely soon come to an end. When the sugar-rush is over, and it won’t be long, the US will end up with a serious economic headache. Investors should keep that in mind."

Huh ! ....... I missed that bit ...... the piece I read said " Guess what ! America is on the mend . That's right , the world's biggest economy is now forging ahead , escaping it's subprime malaise "

......... Now sounds amazing , oarsome , and pretty brilliant to me , Wolly .

....... But what is a " malaise " ....... isn't that the gooey muck that Mum dribbles over the summer salads ?

I fink you are taking the pith Gummy...Bernanke's days are numbered...so are Obama's....a revolution is brewing over there...be able to drink "Revolution Beer" soon....beats tea any day!

My Kiwi money is on rates like launching to the moon any time soon.

Hard part is knowing where to hide....Bolly has his 'nuclear option' all mapped out...the printers are just waiting for the off and fresh notes will spew forth to save us from our indebtedness by destroying the Kiwi ....this will be fun to watch...from across the ditch..

Did you manage to sit on a Jumping jack?

Gummy, don't get into an argument with Wolly now that he is advising Bill English about what to do. And also he is in Marlborough, so there.

You finally got out of bed muzza...me I been up since 4am...gotta get the best from the day boy....thinking of buying some land....would that be wise?

Yes, but void buying where few people want to live and work. And don't buy something that doesn't generate an income stream, so give sections a miss, unless you propose to do something with it. Not rocket science. Olly might have some pointers, but he exaggerates, and I realise you don't like exaggeration.

What gave you that idea?......thing is I want to offload some cash before Bolly goes for his "nuclear option"...which seems even more orrible now given the chaos in Japan. Res must be ok if you wanna build a box on it?...even in marlborough!...I shall avoid the beach given the fact the land is only a foot above king tide levels........and the boggy areas which might turn to porridge in a quake...and the wrong side of the rail line....and the area where the Policeman visits regular like...and the bits that are flood prone......!

I see that TWO major NZ specialty cheese factories are closing in the North Island. Could this be due too Fonterra making their base product (raw milk) too expensive to produce a cheese at reasonable cost?

"I see that TWO major NZ specialty cheese factories are closing in the North Island. Could this be due too Fonterra making their base product (raw milk) too expensive to produce a cheese at reasonable cost?"

I don't think that they would have closed because of Fonterra making the milk to expensive, because I'm sure in the news report on the Commerce commission inquiry into milk prices, concluded with the statement that there are already price controls on the wholesale end of the market. Surely that would make it cheaper for the factories that at retail.

bit of a giggle here---big al is a book reviewer--one particular author has problem,s with criticism and has gone ballistic--result--end of one,s writing career --see comment,s

http://booksandpals.blogspot.com/2011/03/greek-seaman-jacqueline-howett.html

wow - thanks for the link

Genetically modified cows produce 'human' milk

"The scientists have successfully introduced human genes into 300 dairy cows to produce milk with the same properties as human breast milk."

Heard about the Bernard von NotHaus case Bernard?

He's the guy who been convicted of conterfeiting US currency via his own "liberty dollars'. Worth a read

"Mr. von NotHaus was convicted under a section of the United States Code that makes it a crime to manufacture or pass "any coins of gold or silver or other metal, or alloys of metals, intended for use as current money, whether in the resemblance of coins of the United States or of foreign countries, or of original design." The law was enacted during the Civil War, soon after the Union began issuing the paper scrip known as greenbacks.

It is too soon to say what Mr. von NotHaus's grounds of appeal will be, but it is not too soon to say that his case will be one to watch at a time when so many believe our economic troubles are tied to the fact that the dollar has become a fiat currency, and when leaders world-wide are calling for a new reserve currency."

http://online.wsj.com/article/SB100014240527487044258045762203836736089…

I think he is distantly related to both Bernanke and Obama by way of a Chinese ancestor on his great aunt Fanny's side of the family...and has been offered a zillion dollars for his 'story' by Fox.

Best to keep his aunt's fanny out of things, Wolly

Talking about Aunt Fanny's things...look at what some Yanks are up to....!

"Lawmakers in several states, including Tennessee, Virginia, New Hampshire and South Carolina, have introduced bills to look into minting their own currencies in the event of a complete breakdown of the U.S. Federal Reserve. In Georgia, a bill to make the state only use gold and silver is in committee"

http://globaleconomicanalysis.blogspot.com/2011/04/ron-paul-on-legal-tender-laws-coin.html

Just 7 months out from Goofy's greatest test , and his Labour Party is unravelling at the seams , it seems . We had the unedifying spectacle of young Derryn Hughes buggering his political career .

....... And now we have Judith Tizard claiming that she was bullied in the media by Andrew Little into stepping aside from assuming her rightful place in parliament . ......... Some bully , given that the entire Labour Party were pooping their nappies at the thought of Tizard returning to their ranks .

Those of us from the printing industry , would agree entirely with Tizard's assertion , about the power of Little to bully . As head of the EPMU ...... he got a well desrved reputation .

Tizard to see Bully Little becoming anything more than he is now. Tizard's return must have put the wind up Goofy...and cunny, klinger and king......

....... If Labour lose the next election , grab a ringside seat to see who back-stabs Goofy first , Cunny or Little . And then watch those two turn upon each other , brother .

Trevor Mallard is a mere " choir boy " , compared to Andrew Little . ....... ( has Hughes gone yet ? ....... probably shouldn't have used the term " choir boy " ..)

Trevs in rehab Gummy....rule him out....Goofy has as much chance winning as Darren has of becoming the Gov Gen....we have to thank Darren for taking what Little pressure there was off JK's back...leaves Tweak and Fiddle with a chance to screw the State splurge once and for all...

What are the implications for NZ, from these two 'across the ditch' stories in the Age:

"Going up: food prices set to soar Richard Webb

April 3, 2011

.

"Higher world prices for commodities such as wheat and sugar will place pressure on related food prices", says the Reserve Bank of Australia.

With global food prices at record highs, a supermarket war isn't enough to keep prices down.

DON'T kid yourself, the cost of food in Australia is rising, not falling. The recent supermarket price wars over milk, beer, wine, beef, chicken - you name it - may have caught the public attention, but the overall price of basic foodstuffs is on the up. Not anything like overseas, but heading higher nonetheless.

********************************************

Mining boom fuels wages surge Michael Heath, Jason Scott

April 2, 2011

.

TRAVIS Marks, 24 and with no university degree, is hitting pay dirt as the mining bonanza fuels demand for workers. Already making triple the country's average salary, he expects to get even richer.

''With what's going on in the industry, there's lots of big jobs coming up,'' said Marks, who earns $220,000 a year."

Travis Marks can afford to buy beef and beer, and we won't be able to?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.