Here's my Top 10 links from around the Internet at 10 am (!) in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

Huzzah! Two days in a row on time

1. A dangerous vacuum - Chris Trotter is an astute observer of the Left in New Zealand politics.

I was his editor for a period at The Independent and always found him willing to call a left leaning spade a spade, or not.

He may be a leftie, but he's an honest one willing to put the boot in where necessary.

Here in his column at The Press today he inserts the steel toe cap deftly into the derriere of not just Phil Goff but the Labour Party.

It's well worth a read.

If only to understand how much of a vacuum there is in opposition politics.

If, over the next seven months, the Greens and NZ First are able to present coherent, practical alternatives to the Left- leaning half of the New Zealand electorate, I'm convinced Labour's share of the party vote will plummet. Increasingly the election will become a contest between a nascent coalition of parties offering a radical Left alternative to the Government's bleak neoliberal austerity, and a National Party hell-bent on securing 50 per cent plus one of the party vote.

This will not be a healthy development.

A country dominated electorally by two large and reassuringly pragmatic political parties can anticipate a high degree of ideological, economic and social stability. A country which finds itself locked in an all-or-nothing struggle between two intensely antagonistic ideological blocs should expect none of these things.

This is the true measure of Labour's failure as an Opposition. It has encouraged the most extreme elements in the National Party and Government to believe they can pursue their radical economic and social agendas without fear of adverse electoral consequences.

There is no law of nature - or politics - which requires a vacuum to be filled by pleasant things.

2. The problem with China's banks - Beijing professor Michael Pettis is a close observer from the inside of China's monetary and financial systems. He's not confident it can avoid a bust at some stage.

Here's why.

Much of China’s most obvious investment has been identified and funded over the past three decades, and in the last ten years the combination of socialized credit risk, very low interest rates, state-directed lending and tremendous pressure on the part of SOEs and local and municipal governments to generate employment and growth in the short term has increased the probability that the Chinese financial system may be misallocating capital on a dangerous scale. The growth in bank assets, in other words, would be less than the growth in bank liabilities if both were correctly valued as a function of discounted expected cash flows.

Why am I so sure? Aside from the many studies I’ve cited showing that profitability in many of China’s largest companies is substantially less than the value of the financing and other subsidies, and anecdotal evidence of unnecessary real estate and infrastructure projects, just imagine what would happen to banking deposits and stock prices if the government credibly removed all guarantees on loans extended by the banks, and furthermore removed interest rate controls. I suspect most investors and depositors would assume, correctly in my opinion, a surge in non-performing loans that would wipe out the banks’ capital base, and so would sell their stocks and withdraw their deposits.

The fact that this is unlikely to happen is irrelevant. It just means that the losses are hidden and transferred to the state, and via the state, to households. If that is the case, then since the banking system can no longer easily identify economically viable projects and is in fact wasting money, the usefulness of the bank-as-fiscal-agent model is much reduced.

3. Here's an idea - BusinessDay's Eric Johnston reports Australia's insurers are trying to cope with surging reinsurance costs by issuing their own catastrophe bonds or 'cat' bonds as they are known.

The bonds are relatively short term, mostly having maturities of between two and four years. Insurance Australia Group is believed to have run the numbers over its cat bond issue, while Suncorp Group is also weighing up tapping the market. Any issue would form part of their overall insurance risk management, sitting alongside existing reinsurance contracts.

A senior executive at one of the big two insurers said the rising cost of reinsurance made the pricing of the bonds relatively attractive.

While reinsurers are usually the biggest users of the bonds, general insurers can issue the bonds as part of their overall risk management strategy. Local insurers are facing rises in reinsurance costs of between 10 to 15 per cent after heavy payouts linked to a string of natural disasters.

4. America's Sugar rush - The Telegraph's Liam Halligan comments on the sustainablity of America's recovery which everyone is now so excited about.

He hits the nail on the head. HT Kokila

The latest “flow of funds” data from the Federal Reserve shows that “deleveraging is over”. In other words, banks are now lending again. During the final three months of 2010, while consumer credit fell by a net $20bn, this was more than offset by a $99bn rise in net corporate borrowing.

For Wall Street’s commission-based optimists, many of them with a mountain of stocks to sell, and their own home loans and credit card bills to service, such credit growth is Exhibit A when it comes to making the case that America is now out of the economic woods.

If only it were so. The trouble with this latest US recovery is that it amounts to little more than an economic “sugar-rush”. The recent growth-burst is built on monetary and fiscal policies which are wildly expansionary, wholly unsustainable and will surely soon come to an end. When the sugar-rush is over, and it won’t be long, the US will end up with a serious economic headache. Investors should keep that in mind.

As somebody with extensive personal and professional ties to the US, I’m fully aware of the dangers of under-estimating the grit and determination of the American people. It is undeniable, though, that the latest wave of euphoria to have spread across corporate America, and into the echo chamber that is Wall Street, is ultimately based on quantitative easing and a series of unaffordable tax cuts.

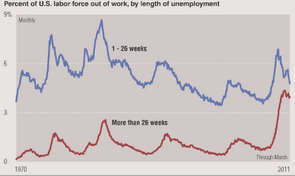

5. Long term jobless out of luck - Bloomberg's Chart of the Day shows America's long term jobless (over 26 weeks) are not benefiting from the (albeit stuttering) return to jobs growth seen in recent months.

The blue line is the unemployment rate for short term jobless. It is now dropping reasonably sharply. The red line is for long term jobless. Is is not dropping much.

While the jobless rate dropped for the fourth consecutive month in March, the number of people going more than six months without work rose to 6.12 million. That’s more than four times the average since 1970, the period covered in the chart.

Those who exceeded the six-month threshold account for only 13 percent of the drop in unemployment since December, when the rate started shrinking. Their number fell by 206,000 as people out of work for shorter periods tumbled by 1.36 million

6. Fresh Brazilian - Brazil is at least trying to control its currency and is now planning new capital controls, Bloomberg reports.

Why aren't we at least trying?

Here's the detail:

Brazilian Finance Minister Guido Mantega said he’s considering steps to reduce “excessive” dollar inflows after taxes on foreign investment in local markets failed to stop the real from rallying the most in more than 20 months last week.

“The more solid the Brazilian economy becomes, the more it tends to attract foreign investment and dollars, which at the moment is kind of a problem,” Mantega said. “The government will continue to take measures to contain the excess of dollars.”

7. Even the IMF wants a Robin Hood tax now - IMF boss Dominique Strauss-Kahn delivered a fascinating speech overnight, in which he supported the so-called 'Robin Hood' tax on financial transactions.

Here's a few juicy bits from the speech, which is really quite startling from the boss IMF. He says the Washington consensus is over too...

Mind you he will step down next year to run for the leadership of France's 'Socialist' Party. Sacre bleu.

In designing a new macroeconomic framework for a new world, the pendulum will swing—at least a little—from the market to the state, and from the relatively simple to the relatively more complex.

The new global governance must also pay more heed to social cohesion. Don’t get me wrong—the old pattern of globalization delivered a lot, lifting hundreds of millions out of poverty. But this globalization had a dark side—a large and growing chasm between rich and poor. While trade globalization is associated with lower inequality, financial globalization—the big story of recent years—increased it.The tendency was to downplay inequality, to see it is a necessary evil on the road to riches. But the crisis and aftermath have fundamentally altered our perceptions. The lethal cocktail of prolonged high unemployment and high inequality can strain social cohesion and political stability, which in turn affects macroeconomic stability.

The financial sector needs some major regulatory surgery. The crisis originated in a culture of reckless risk-taking, a culture that is unfortunately still alive and kicking.

There have been some positive steps, but these are only first steps. The Basel III accord on banking regulation should improve the quality and quantity of bank capital. But we need to extend regulation to the “shadow banking system”. We need better supervision as even the best rules are worthless without proper implementation. We need better resolution mechanisms to end the scourge of too-big or too-important to fail—including along the critical cross-border dimension. We need a tax on financial activities to force this sector to bear some of the social costs of its risk-taking behavior.

8. How a Robin Hood tax works - I've put this in before, but it's a nice video done by Bill Nighy and the Working Title mob which explains the Tobin Tax.

9. Laissez faire no nothingism - Epicurean Dealmaker is an anonymous investment banker in New York with a surprising take on the world. Informed and urbane, he often suprises, including with this comment about the lack of regulatory response in America to the financial crisis.

Remember, the Congress spent four times as much investigating Bill Clinton's links to Monica Lewinsky than it spent investigating the Financial Crisis.

Apparently Alan Greenspan says global financial markets are too complicated and 'magical' to regulate.

Here's Epicurean, who knows exactly how complicated these magical markets are:

We need a well-funded, serious, permanent agency devoted to understanding as much as we can about the elements, interconnections, and vulnerabilities of financial markets and their participants. In addition, I would suggest that the constant mutability of this system argues strenuously for the implementation of a plan like that suggested some time ago by Economics of Contempt.

Stationing a sufficient number of experienced, knowledgeable ex-market participants in regulatory oversight positions at the largest and most systemically important financial institutions would not only provide necessary close supervision (and perhaps help nip developing crises in the bud), but would also support the development of true boots-on-the-ground insight into the day-to-day workings of financial entities and markets. This type of knowledge would be invaluable to helping regulators develop a robust, dynamic understanding of global financial networks and players.So let us have no more willful ignorance, no more worship at the self-interested shrine of laissez-faire Know-Nothingism. The acknowledged difficulty of getting to grips with the global financial system is no argument against trying to do so.

Rather, it is an argument for the urgency of beginning forthwith.

The Pecora Commission investigation into the sources of the 1929 stock market crash began two and one-half years after the event, lasted over two years, and helped shape the regulatory environment for decades. In contrast, the underfunded, marginalized Financial Crisis Inquiry Commission lasted one year, at a time when the size, complexity, and interconnectedness of the global financial system has grown exponentially from 1934. In terms of academic interest, regulatory concern, and social impact, understanding the sources of the recent financial crisis must rank as one of the most important socioeconomic research projects of our time. From my perspective, it's time to stop dicking around and start trying to understand it.

10. Totally entertaining song and dance on Saturday Night Live with Stephen Colbert

48 Comments

FYI from a reader via facebook:

Absolutely agree with a Bank Trans Tax, it is the only "fair" way to tax banks. NZ's frighteningly low wages can now only be fixed though lateral solutions (no fix, no market!

Why will Kiwis stay in NZ and fight for the fools who created this mess). Internal, truly co-operative banks plus a Bank Trans Tax is the only way we can get purcghasing power back into NZ consumers pockets. There is simply no other way.

Its Bank tax and co-op banks, or financial slavery. The financial markets can resist change, but in the end they will be made to change. (The whole Banking and financial industry is nothing but an immense revenous "bully", whos only desire is to turn us all into Bank slaves, so their survival is insured) Quite disgusting in their Narcissism.

(Yup, business's can become just as delusional as people can, all they see is themselves, not the people who got them there, unbelievably responsably disordered)"

There is very little "socialism" to the degree you see/suggest. ie totalitarianism.

What we have now is the state supporting business to its advantage, its known as facism and we have a real world example from the 1930s and 40s of what that means....

What is impoversiching millions is the top 1% and their tenticles around the throats of the Pollies.....Thomas Jefferson has an excellent solution to that.

regards

That would be the slave owning Thomas Jefferson I take it.

Here's enterprise for you....

"A Hamilton doctor received $350,000 of taxpayers' money by enrolling 45 patients at his practice without their knowledge. His fake patients included four dead people.

Dr Suresh Kumar Vatsyayann" herald

What a total shite.....bet the doctors union has him back pulling rorts within the week..if not sooner.

I think Chris Trotter is wrong....both main parties are the same and in normal stable situations that is OK as in effect they both try and keep the status quo....but we are no longer in that nice status quo space. We have to change and if we dont we will be changed, simple.

We have moved past peak oil into a time of real instability and we now need to be pragmatic and agile and accept we cant keep the status quo....What we have with Labour and National are two parties hell bent on doing a King Canute....and they will do great damage as a result....

regards

Chris Trotter nails Labour's inevitable problem of a lack of talent ......... And are we surprised , after a strong leader in Helen Clark and her deputy , Michael Cullen ........ A mighty vacuum , a great sucking sound ( not Darren Hughes , this time ) has occurred .

Australia has the same problem on both sides of the political spectrum with a hollowing out of skills after the Hawke / Keating era in Labour , and the Howard / Costello team in the Liberals .

......... Labour side-stepped the much needed bloodbath after the 2008 loss to Key /English , and had a smooth transition to Goofy / Klinger ...... They needed a clearing out of the old and bereft of ideas , and an introduction of youngsters with fresh ideas and energy . ......

The fact that they left Judith Tizard on the list , as next cab-off-the-rank , shows political sloppiness , and laziness ......

Always the problem after a dictatorship... the talented ones (threats) are removed to keep the dictator in power... when the dictator leaves, only the followers remain.

GBH, Trotter is an out and out leftie....and lets face it you are an out and out Libertarian....so there is such a surprise you think Labour has no talent....and LOL agree with Trotter what strange bedfellows.

regards

steven : I can agree with Chris Trotter occassionally , because he is a rare person amongst lefties , an honest one .

........ the Libertarianz are not so hard up that they'd ever admit me .

But thankyou for the kind thought

( p.s. I could be equally disparaging of National and it's talent pool too , but they're not the focus of Mr Trotter's blow-torch ,; see the NZ Herald and Fran O'Sullivan's articles for a right old arse kicking of the Nats and the SCF fiasco )

Chris Trotter, Honest, I guess so, true to his beliefs, yes, but I dont think they are fair and achievable.....ie there has to be some incentive and benefit....So called comunism in the CCCP etc has proved it doesnt work...

I have an equal bugbear with the left and right, neither are sustainable idealoigies just capitalism is more efficient at extraction of non-renewable resources.....

regards

".....he inserts the steel toe cap deftly into the derriere of not just Phil Goff but the Labour Party."

Hey Gummy......what a derriere?

A " derriere " is a magical fantasy land , a soft and squishy place full of great warmth , yet prone to the most extraordinary carbon emissions without notice , it is a cornucopia of comings ....and goings .....

.. you know ...., where Darren Hughes goes to sleep at nights .

Poor old Darren , no doubt that when Mistress Helen made him the Senior Party Whip , he took the role literally , and hankered after some leatherings and a dungeon .

Not really, Goff is to the right of the party ie close to the centre, what made JK and National so electable in 2008 was appearing to be close to the centre....despite the claims of Labour.

Trotter has the mistaken belief IMHO that ppl will vote for the loony left now as they are sick of the rich/right...while I can understand that mistaken belief I think he is day dreaming.....The same applies to when labour was claiming that National was really far right wing and JK was the front man.....What trotter wants is rid of Labour's moderate front man Goff....National will have a field day this election if so. ie it would make Labour un-electable, same happened to Labour in the UK....no one voted for a loon like Michael Foot....result Maggie and the grey man....

The far right must be wetting themselves in the hope Goff will be toppled....

regards

The far right must be wetting themselves that Goofy is the Labour leader ! ...... His ineffectualness in opposition , and his cack-handling of the Darren Hughes / Judith Tizard affair , is taking the heat off the Nats and their little debacle , SCF .

...... JK & Wild Bill would be buggered over SCF if Labour had a " Helen Clark " at the helm , currently .

Well they can't bring the "painter" back can they..I mean what would she wear...the red rags she left behind in her dash to New York are currently being worn by those in the Beehive.

I think its a bit of both at the moment - however discoveries are being exceeded by demand at a ratio of at least 3:1 currently, so the inevitable is going to happen.

On a side note, the most scary is not the oil situation, but the forthcoming increase of food prices. Ned Schmit, a comodities investment advisor was on financial sense dot com last week talking about a 50-60% increase in meat prices.

Note that all of the middle east issues stem from people not able to eat. Look towards India as the next flash point in this saga.

Death etc - first point is correct.

Food? What do you think drives the price of food? Particularly meat?

For every calorie of grain-based food you ingest, there were 10 of oil expended.

For meat, the ratio is 27:1. (presumably an average).

The big failure of most commentators, is to understand the correlation of energy, to everything else.

No, the most scary thing is oil no ifs no buts.....our economies need cheap oil, if we then have jobs, we can buy food and yes, meat....if the price of oil collapses our economies, and we become un-employed we wont be able to buy meat.....

eg

Q, The US does what with all its spare grain? answer it makes ethanol....mexicans then go hungry....they have a low meat diet anyway, 50% more expensive meat makes no odds if you buy none.

Financial sense is in the USA (California I believe) where yes meat prices are going up....however as per most of these sites they only see problems in the context of the US....those same problems dont necessarily effect NZ or maybe NZ to the same degree.

Oil on the other hand is global...

regards

Uh....good Q.....a year or two back I would have said peak oil as in peak oil production which co-incidently just happens to match the 1/2 way point in oil used. So there is about 2.1 to 2.3 Trillion barrels of conventional crude oil.....(we will ignore hvy oils) and we have used about 1 Trillion.

Then the economic wisdom was oil would go to $200, $300 maybe $500 a barrel, however what we see today is the acceptance that realistically our global economy cant stand $150 oil and right now its probably $120 oil though it could be $100 without going into huge recession....

If you accept that $150 is the limit with corrections for inflation etc then we are probably past the 1/2 mark for what the final total extraction will be, maybe 2/3rds maybe as bad as 3/4ths...the rest will never be economicial to recover....

"Money backed by gold/hard money terms" you cant resists throwing in gold can you....weither its money backed by gold or a real economy it doesnt matter, but personally I think gold represents a waste of energy, ie we have consumed precious black gold that is of real value in order to have gold gold which has no value in and by itself.

A real world example of this is back in 2008 Thailand, India stopped the export of rice to feed its people, Jpana got really worried because it only produces 36% of the food it needs, despite its paper wealth it can see the danger of relying on food production outside its borders.....Even if that paper was gold the result is the same....in the final accounting you cant buy food/energy with it if the seller of food doesnt have enough to eat themselves and cant guarantee they can get more food with the gold....lead then becomes the metal to deal with.

Hence gold is worthless....energy is what matters and who owns it.

regards

in one of the recent episodes of Real Time with Bill Maher on HBO in the States he made the following comment:

We have this fantasy that our interests and the interests of the super rich are the same. Like somehow the rich will eventually get so full that they'll explode. And the candy will rain down on the rest of us.

Like there's some kind of pinata of benevolence. But here's the thing about a pinata. It doesn't open on its own. You have to beat it with a stick.

The mood is changing for sure - here and abroad . I think it's likely to be a kind of "long now" where society goes through many changes over a decade or two.

That said, sometimes it just takes one little obscure thing to kick it all off..... like the stall holder in tunisia whose self immoliation kicked of all this middle eastern conflict. http://en.wikipedia.org/wiki/Mohamed_Bouazizi

Very much so....Peak oil will see us in 30 years of depression IMHO....the rich still running around in fast cars and gucci kit wont be tolerated, they will either be taxed via the tax system, strung up or kicked out.....

What they dont get is the world of hedge funds and "high" finance offers no value in the real world, once voters see that, no biggee they wont be kept.

regards

"Police will continue to give a person ticketed for the first time with an unlicensed car a two-week grace period to license their vehicle before any penalties apply".NBR...

Harrrrrrrrrr hahahahaha hahaha....what a joke....bugger paying to reg again in that case...run the risk and maybe save heaps man....if the old bill stop me I can say oh bugger I forgot...."you naughty driver you here have a two week grace period"....

If not I get to drive for free hahahaha...and bugger insurance as well....

Wolly, what a jolly good idea .. using the abundant IT skills available in New Zealand .. the Government could establish a co-ordinated centralised database, NZ wide, of every registered motor-vehicle and data-match with every WOF issuer and outstanding parking fines, and outstanding speeding fines, and then put e-tag electronic number-plate reading cameras at selected spots on main roads, at major intersections and motorways. Any vehicle that is unregistered, or no WOF, or owes unpaid fines over $200 outstanding for over two months, gets pinged an automatic penalty of another $100. The beep goes off, and strategically placed officers pull em over and confiscate the car. Soon pay off the public debt.

Bernard got really worried as the weekend approached ...he had penury worries!...so I thought I would give him a way out....it really is so simple...the govt hands over control of the Treasury to whichever German regional govt is proving to be the best at generating real growth...and lets them make all the money decisions...all of them...including what Bolly gets up to...for a % of any real growth they manage to generate over the next twenty years.

Vee have vays of making you productive yes...

Having handed over the task to the professionals, the toerags can resign and the savings would be huge. The Beehive could become the emergency earth quake accomodation facility along with Parliament.

Wolly, good ideas...and the Prime Minister can be replaced by a computer...should be some savings there.

Tis true Ricardo and I'll even donate my old apple notebook....it has a smiley face every time I give it juice.

Ricardo : The current Prime Minister donates his entire parliamentary salary to charity ..........

........ and given that all his policies are also those of his predecessors , Clark & Cullen , so he bloody well should .

......... Get an original idea Key , at least Don Brash stood for something on his on two feet ...... think it was a narrow plank , it memory serves .

Ah yes, I walked that same plank many times....never fell in though.

Good debate on the automaticeath about deflation, im firmly in the deflation camp and have seen nothing to change my mind.

http://theautomaticearth.blogspot.com/

There Still Is No Viable Solution To America's Debt Crisis

Our feeling, as long-time readers will not be surprised to hear, is that this enormous debt will not be inflationary but deflationary instead. If this is the case, the stock market is headed much lower and the economy will either go into a double-dip or have such a sluggish recovery that it will feel like one. There are the two main reasons we are so convinced that we will not be able to inflate or grow our way out of this mess.First, the massive increase that QE1 and QE2 has generated in the monetary base has not been translated into anywhere near a commensurate rise in money supply (the so-called "money multiplier").

Second, the subdued rise in the money supply to date has not resulted in a big increase in GDP (the so-called "velocity of money")-.

In addition, the loose fiscal policies cannot generate the borrowing and spending that is required to get the money supply up enough to drive the economy and inflation higher. The velocity of money is also influenced by interest rates. When rates are low, people hold more money in cash. On the other hand, when rates are rising, they put more money in interest paying investments. The low rates, as we have now, results in a "liquidity trap", which is what Japan has also experienced over the past 21 years.

Unless we escape this "trap" there will be massive deleveraging by the sector that drove us into this mess. Household debt rose from 50% of GDP in the 1960s, 70s and 80s and eventually doubled to close to 100% of GDP presently. This debt will either be defaulted on, or paid down until we get back to the norm of around 50% of GDP again. This will bring household debt down below $10 trillion from $13.5 trillion now.

Another reason that makes us so convinced that the "debt situation" will be resolved by deflation and not inflation is the political environment that is currently sweeping the nation. The Republicans and Tea Party congressmen and governors that were recently elected ran on a platform of cutting government expenditures, cutting back on entitlement expenditures, and doing whatever possible to pay down the debt.

In fact, the bipartisan "Debt Commission" that was sponsored by President Obama, came up with a number of austerity measures that would cut the deficit substantially over time. The big problem, however, is that any austerity program implemented now will only exacerbate the ongoing deleveraging of this debt and throw the economy into recession.

There are two more reasons that we believe the onerous debt incurred over the past 30 years will wind up with a painful deflationary bear market rather than inflation or hyper-inflation. First, the high cost of necessities such as food and energy is much more deflationary than inflationary.

Since wages have been static for years, the high cost of these necessities acts to reduce real disposable income. This, in turn, reduces what the average consumer can purchase with his or her disposable income. More money spent on energy and food simply means less money to spend elsewhere.

In order for easy fiscal and monetary policy to result in significant inflation there must be a transfer mechanism, and that mechanism is a rise in wages by an amount at least enough to enable consumers to pay the higher prices. That just doesn't look as if it is going to happen.

Yep....this is where I am at....no where can I see inflation....at best stagflation....most likely deflation.....Inflation will only occur when ppl have more money and that happens as we exit the recession/depression.....that's years off, debt has to be removed from the system....in effect its a huge tax on things dragging down the spending and the economy....Most OECD countries only grow at a few %, if debt is costing that, even half that, thats a huge impact on growth....

regards.

There is no option but inflation once youv'e hit rock bottom with the OCR. We have inflation now, many businesses will and are putting up costs under all sorts of lame excuses just to pay their own IRD bills or creditor debts. Many don't even realise this is cutting their own throats regardless.

2.5% isn't really middle ground when real inflation is twice that (+)in all reality more.

I believe the RBNZ (and the US Fed for that matter) have put themselves into one hell of a corner. Even IF by some miracle the economy starts to pick up (which it won't cause it can't while it's debt loaded) then the only way for the OCR is.........up and the world currency values takes a dive. The USD is screwed, just a matter of time now. They know it, we know and still we head for the cliff with that very reserve currency

But they can confiscate it and have. What do you do when you want to spend your gold, cash it for fiat money? Ive a funny feeling that in deflation Gold will lose its shine. The middle east is a demographic problem, too much growth too quick. They have had the problem hidden under repressive regimes as they let the light in almighty hell will be unleashed.

Yep.....

regards

Forget about silly comparsions with the metal you love and real things. You lose fact that even if it appears that oil had not increased in price compared to gold in terms of GDP its at about 6% at or about that point a recession results...we saw that in July 2008, we are about at that again in April 2011.

"Oil price hasnt really increased"....its getting scarce, its peak production, we are also at or about peak gold production, comparing 2 things that are both becoming scarce and becoming harder and more expensive to extract will obviously not show an increase! oh and if energy costs more and it takes more energy to extract gold then gold will be more expensive.....Trying to compare and then say oh its OK oil isnt really any more expensive misses the point of a price signal....oi....we are running out, do something!!!!!

NB you are assuming that gold isnt a bubble but its a "true worth"...personally I dont agree...its way over-priced.....when everyone is buying it thats the time to bail....

"British ppl could feed themselves" this is an impact of over-population....2billion in the 1920s, 6.5billion today.....not sure in the UK's popualtion at that time, now its 70million or thereabouts....and they cant feed themselves.

Fiat money or not is an interesting conundrum....should we have stayed on the gold standard? its a hard Q to answer, ive not seen a great and convincing piece either way.

Hmm....well the mess we are in is really only a result of the last 30 years of de-regualtion and resulting short term greed....if we had stayed with the regualtion that had come out of the GD would we be in the mess we are in? in terms of the GFC, no......so woud have coming off the gold std mattered? Im fairly sure not. In terms of peak oil, no, no matter what, we were/are consuming in a non-sustainable manner...it just might have been a few decades later....

"It is important thus to separate absolute disaster (like the aftermath of a huge earthquake etc) from monetary disaster."

I think the biggest mistake gold bugs make is they are like economists they think money/gold solves problems. The thing to watch is energy invested for energy returned so peak oil is indeed an absolute disaster.....it isnt a monetary disaster though it may have helped to trigger one......I dont think we are in a monetary disaster, we are in something far far worse, within 20 years if we did indeed pass peak oil in 2004 or by 2018 then we will see a great reduction in population.....being on a gold standard or not really wont matter....

regards

The ASX and SGX merger has collapsed ...... Mark Weldon is heard to breathe a huge sigh of relief , as his plaything ( the NZX ) gets to potter along on two crutches , and the sniff of an oily rag ....... business as usual in Weldonia .

Look at the price of gas in California and tell me this isn't going to hurt, must be a double dip around the corner.

Lets look at that double dip....

a) The US economy is weaker, Ive seen a few estimates by economists at what point in $ terms per barrel of oil will the US slip back into recession, the estimates were $90 to $120USD a barrel, so we are at the top of that......the only Q is how long, 3months? 6 months....I guess we can take our lead from 2008.

b) The only reason the USA has not gone into recession is QEx....simple....but QE'ing hasnt caused a recovery, at best its flattened the dive for now, a glide if you will....watch out fo the stall.

c) EU; Ireland, Portugal, Greece, a year ago it was "just" Greece in risk of default.....now its at least three of the PIIGS, so things are sooo much better.....

d) Roubini sees a 50/50 chance of a double dip, every time I hear him say that the odds are worsening......

Just where is the real good news around the world?

And the response to that.

http://victorygasworks.ning.com/profiles/blogs/woodgas-injected-the-gasifier

Might be a use for all those pine forests when the Chinese stop buying.

NZgold your previous post and link is so cool.

My figures aren't quite right here but I am just trying to make a very valid point.

The data you posted shows 2 grams of gold in the the 1950s bought a barrel of gold then and today. On the other hand, approx $2 in the 1950s bought a barrel then, but less than a litre today.

And some people think paper money is worth hoarding for a rainy day...how dumb is that!?

My understanding is that in deflationary times the currency appreciates as people pay of debt and the money supply contracts, im happy to listen to contradictory argument as Im willing to learn but my reading to date confirms my present belief.

Yes, I agree....OAPs with fixed incomes do better as time progresses with deflation / depression, provided their capital is safe...it becomes worth more just sitting there....My worry is some of my pensions are in shares etc these could lose huge amounts...one lost 22% in 2008....

What else worries me is the length of the depression, it could have lasted as long as the long depression except for WW2....so what gets us out of this one? We wont have the energy......so I dont see how....

With the leverage of the banks a small % of loss in effect makes them insolvent, this has been well commented on.....just how long can they hide it and especially if we see clear deflation....I just hope the idea of seperating off the retail arms of banks from their risky bits happens before that, but I suspect its going to take too long....2 years? I dont think we have 2 years.....

regards

Celente loses the plot.

http://www.informationclearinghouse.info/article27828.htm

The First Great War of the 21st Century

By Gerald Celente

He lost it several years ago IMHO.

Now I watch him as a comedy act...

regards

Gold backing without physical possession is nothing more than another form of leverage....the total idea of having gold is to be able to touch it, ie a safety thing.....anything else is a joke.

Keynes, better it seems than the school of economics that got us here....

regards

Bit late for Ireland

Iain Parker, you should read this too.

http://www.bbc.co.uk/blogs/thereporters/robertpeston/2011/03/the_unbeli…

Yammani is an important guy, what he says carries some weight and he's worth keeping an eye on.

"If something happens in Saudi Arabia it will go to $200 to $300. I don't expect this for the time being, but who would have expected Tunisia?" Yamani told Reuters on the sidelines of a conference of the Centre for Global Energy Studies (CGES) which he chairs.

"The political events that took place are there and we don't expect them to finish. I think there are some surprises on the horizon," he said in a speech.

http://uk.reuters.com/article/2011/04/05/yamani-idUKLDE7340MU20110405

and

http://www.arabianmoney.net/us-stocks/2011/04/05/200-300-oil-if-unrest-…

Its not just $200 or $300 that worries me....in fact oil is supposed to be in-elastic ie it takes a huge price differential to alter demand...its the effect of that.....and the knock on effect...lots of countries go broke really fast....and become unstable and anarchy....Pakistan is quite likely and they own nukes.

Saudi in effect is 10% of the world's oil output.....even if its the one field at 5mbpd its game over IMHO.....huge shortages, hugh problems....and no one and not the NZ Govn is looking at contingency.....thats potty IMHO, especially as tis sort of thing was seen as probale risk and impact.

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.