Here's my Top 10 links from around the Internet at 4pm in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I will not welcome any mention of this wedding thing in Britain. Interest .co.nz is officially a wedding-free zone this week. Or at least we don't take it seriously. Reference Number 10

He is essentially saying the world needs to end its obsession with growth.

This is fascinating as it comes from someone nowhere near the Green spectrum.

He is saying that the jump in the oil price and the price of many foods indicates we are nearing the limits of expansion and growth.

It it today's must read I reckon.

The implications are profound. It means it we have to find a new way to run our economy that uses a lot less physical resoures.

Here's a taste:

The problems of compounding growth in the face of fi nite resources are not easily understood by optimistic, short-term-oriented, and relatively innumerate humans (especially the political variety). The fact is that no compound growth is sustainable. If we maintain our desperate focus on growth, we will run out of everything and crash. We must substitute qualitative growth for quantitative growth.

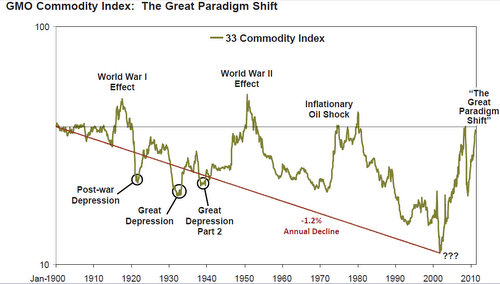

But Mrs. Market is helping, and right now she is sending us the Mother of all price signals. The prices of all important commodities except oil declined for 100 years until 2002, by an average of 70%. From 2002 until now, this entire decline was erased by a bigger price surge than occurred during World War II.

Statistically, most commodities are now so far away from their former downward trend that it makes it very probable that the old trend has changed – that there is in fact a Paradigm Shift – perhaps the most important economic event since the Industrial Revolution.

2. The Greek bond run continues - The Telegraph reports the bond run in Greece is still on, reminding us all that the European Sovereign Debt crisis is far from over despite everyone looking elsewhere in recent days. Greece's budget deficit was also worse than expected.

The European Central Bank, the only major potential buyer, "won't buy whilst [some eurozone countries such as Germany] continue to speak and put pressure on Greece to restructure", said one trader.

A restructure of Greek debt, cutting the interest rates and lengthening the terms of the loans, would represent an effective default as the debt would be worth much less.

Jose Manuel Gonzalez-Paramo, a member of the European Central Bank's executive board, warned on Tuesday a restructure would be "quite likely more devastating" than the fall of investment bank Lehman Brothers, which precipitated the financial crisis.

Portugal also disappointed as Eurostat confirmed the figure out from Lisbon at the weekend that upped its 2010 deficit to 9.1pc of GDP, compared to earlier estimates it hwill it its 7.3pc target for the year.

3. How the bursting of the US housing bubble broke the middle class - Charles Hugh Smith has an excellent analysis of fresh data on US wealth. HT AndrewJ in today's 90 at 9.

His conclusion:

The bursting of the housing bubble wiped out half of the net worth of the Mortgaged Middle Class.

So here's the reality: over one-fourth of all households are at or below the poverty line: 28 million. The top 10%--10.5 million households--own the vast majority of the financial assets ($45 trillion)(the total owned by non-profits is not broken out).

The next 10% own 10% of this wealth, or about $4 trillion. So the top 21 million households own 93% of all financial wealth. The Great Middle Class between those in poverty and the top 20%--56 million households-- owns about $2.7 trillion in financial wealth, and the millions with mortgages own an additional $1 trillion in home equity. That comes to $3.7 trillion, or about 6.5% of the total household net worth.

Back at the top of the bubble, the middle class had $6 trillion more assets on the books. Considering the Mortgaged Middle Class now owns about $6 trillion in net assets, then the bursting of the housing bubble caused their net worth to drop by 50%.

4. Positive money.org - At the risk of encouraging Iain Parker (sorry Iain we all love you really we do), here's a British website that thinks about an alternative monetary system that controls the monetary supply and effectively destroys modern banking. Worth a look, although utterly radical.HT Tom via email.

Here's a taste.

Firstly, the rules governing banking are changed so that banks can no longer create bank deposits (the numbers in your bank account). Currently these deposits are considered a liability of the bank to the customer – after the reform, they would be classified as real money and only the Bank of England would be able to increase the total quantity of them.

The Bank of England would then take over the role of creating the new money that the economy requires each year to run smoothly, in line with inflation targets set by the government. In order to meet these targets, the decision on how much or little money needs to be created would be taken by the Monetary Policy Committee. To maintain international credibility and avoid ‘economic electioneering’, the MPC would be completely separate and insulated from any kind of political control or influence – in other words, the elected government would not be able to specify the quantity of money that should be created.

The Monetary Policy Committee would decide how much money needs to be created in order to meet the inflation targets by analysing the economy as a whole – not the spending needs of the government, nor the needs of the banking sector.

5. The Fed is just like Charles Ponzi - It's hard to believe this given who's saying it, but the world's biggest bond fund manager (PIMCO) reckons the US Federal Reserve is effectively running a Ponzi scheme that is about to blow up in everybody's faces when its second round of Quanttitative Easing ends on June 30.

Have a read of this to get a sense of how the world's biggest central bank has lost the confidence of many serious players:

Just as Charles Ponzi needed donuts to turn back a suspicious crowd of investors, the Fed needs “donuts” in order to fill the bellies of the literally millions of investors worldwide who worry about the alarmingly large U.S. budget deficit and the impact that the U.S. debt dilemma could have on their Treasury holdings. Investors are no doubt worried they may have bought into an unsustainable scheme: the creation of a scourge of debt so large that the Fed itself has had to purchase the debt to keep the game going.

All that the Fed has had to do thus far to keep the game going is press the “on” button to its virtual printing press, crediting the account of the U.S. Treasury. In the process, the Fed has kept the demand for U.S. Treasuries high, perhaps deceptively so, attracting with its redolence many classes of buyers, including households, banks, pension funds, insurance companies and foreign investors. Their collective buying has created what we believe to be a profit illusion with many investors mistakenly believing they can continuously reap profits from perpetually falling bond yields and rising bond prices, just as they have had opportunity to do over the past 30 years, amid the great secular bull market for Treasuries and the bond market more generally.

For many reasons, this “duration tailwind” for Treasuries can’t last, particularly because the United States has reached the Keynesian Endpoint, where the last balance sheet has been tapped. In addition, with inflation expectations rising in the context of low levels of initial jobless claims, and with Federal Reserve officials themselves expressing reluctance to go beyond Quantitative Easing (QE) II, the Fed’s Treasury buying is expected to end in June, leaving others to carry the Treasury’s heavy load.

The Federal Reserve’s colossal bond purchases therefore will likely, to the chagrin of millions of unsuspecting Treasury bond investors, be one of the markers for the latter stages of the bull market for Treasuries. For now, however, the Fed’s purchases have the sweet aroma of freshly baked jelly donuts and many a Treasury bond investor has been drawn to their savory, sugary, scrumptious taste.

6. The carry trade is back - Bloomberg reports the carry trade is back. Our currency at near record highs certainly suggests it is. And what drives such a trade?

Low interest rates in places like Japan and America and higher interest rates here make it possible for speculators and/or investors to borrow at virtually zero% in America and Japan and then lend to New Zealanders at higher interest rates and 'carry' the difference as profit.

A currency rise increases the profit in the trade. This is only possible when a country has no capital or currency controls...

Cue New Zealand.

Brazil is trying to reintroduce controls. Why aren't we?

Here's the details.

Investing the proceeds of yen loans in New Zealand dollar- denominated assets has earned 305 percent in annual terms since March 17, the day before the Group of Seven sold yen to help Japan stem currency appreciation, data compiled by Bloomberg show. Borrowing in U.S. dollars to invest in Brazil reais has earned 104 percent. The UBS V24 Carry Index rose as high as 510 this month from 486.5 on March 18, the lowest level since 2009.The carry trade is reviving as traders step up bets that the Fed and BOJ will keep their target interest rates at record lows for longer than was anticipated earlier this year. While stronger currencies may help emerging economies damp inflation, they also risk curbing exports they rely on to bolster growth.

“The dollar and the yen are good funding currencies as their rates are so low now,” said Tsutomu Soma, a bond and currency dealer at Okasan Securities Co. in Tokyo. “The yen is especially ideal as Japan won’t be able to raise rates for a very long period of time due to the earthquake and the intervention may prevent the yen from rising.”

Brazil will soon adopt more measures to contain the appreciation of the real, Trade Minister Fernando Pimentel said on April 20. He accused the U.S. of “deliberately” devaluing the dollar to boost the economy.

Since October, the government has increased taxes on foreign capital inflows, stepped up dollar purchases in the spot and futures market and imposed reserve requirements for banks betting against the dollar to contain the rally of the real.

7. How Goldman Sachs created the Food Crisis - Foreign Policy's Frederick Kaufman blames Goldman Sachs for rising food prices. Grantham says above it's supply and demand. Kaufman says it's the bankers.

Who to believe?

Here's Kaufman.

The result of Wall Street's venture into grain and feed and livestock has been a shock to the global food production and delivery system. Not only does the world's food supply have to contend with constricted supply and increased demand for real grain, but investment bankers have engineered an artificial upward pull on the price of grain futures. The result: Imaginary wheat dominates the price of real wheat, as speculators (traditionally one-fifth of the market) now outnumber bona-fide hedgers four-to-one.

Today, bankers and traders sit at the top of the food chain -- the carnivores of the system, devouring everyone and everything below. Near the bottom toils the farmer. For him, the rising price of grain should have been a windfall, but speculation has also created spikes in everything the farmer must buy to grow his grain -- from seed to fertilizer to diesel fuel. At the very bottom lies the consumer. The average American, who spends roughly 8 to 12 percent of her weekly paycheck on food, did not immediately feel the crunch of rising costs. But for the roughly 2-billion people across the world who spend more than 50 percent of their income on food, the effects have been staggering: 250 million people joined the ranks of the hungry in 2008, bringing the total of the world's "food insecure" to a peak of 1 billion -- a number never seen before.

8. The drums are beating - Leith van Onselen writes at Macrobusiness about a growing push to end negative gearing for property investors in Australia. Bring it on, I say. Here too please.

In early March, Fairfax’s Michael McNamara wrote a fantastic article arguing to abolish negative gearing. This article was followed up in Fairfax by Saul Eslake, who lambasted Australia’s dysfunctional tax system, especially negative gearing, for the way in which it encourages borrowing and speculating, and penalises working and saving.

Then last week, Fairfax published an article noting that the Gillard Government is considering curbing negative gearing for multiple investment property holdings.

And on Monday, Saul Eslake followed up last month’s piece with another fantastic article in Fairfax once again attacking Australia’s tax system for encouraging borrowing and speculating, and penalising working and saving. Mr Eslake’s article covers a number of aspects relating to Australia’s tax system, and I encourage you to read it for yourself.

9. Repeat - This spoof piece in The Onion on Ben Bernanke is worth repeating today.

The U.S. economy ceased to function this week after unexpected existential remarks by Federal Reserve chairman Ben Bernanke shocked Americans into realizing that money is, in fact, just a meaningless and intangible social construct.

"Though raising interest rates is unlikely at the moment, the Fed will of course act appropriately if we…if we…" said Bernanke, who then paused for a moment, looked down at his prepared statement, and shook his head in utter disbelief. "You know what? It doesn't matter. None of this—this so-called 'money'—really matters at all."

"It's just an illusion," a wide-eyed Bernanke added as he removed bills from his wallet and slowly spread them out before him. "Just look at it: Meaningless pieces of paper with numbers printed on them. Worthless."

10. Totally taking the piss video from Jon Stewart about that wedding.

29 Comments

Why are so many people slaves to the fallacy that the money supply needs to grow for the economy to grow? This is absolute hokum. If the economy grows and the money supply stays the same prices will fall, making things cheaper for everyone. This is the way it should be and the way it was in the 19th century, before central banks were installed in most countries.

Printing money, which Bernard Hickey advocates, is a blatant transfer of wealth from the poor and powerless to those with first access to the newly-created money (bankers and governments). It also distorts the capital structure of the economy and causes the boom and bust cycle.

Have these "Positive Money" nitwits not learned the lessons from the failure of communism around the world? Central planning doesn't work. How will these bureaucrats work out how much extra money the economy "needs" every year? We already have central planning of the money supply through central banks, which have caused the current global financial crisis through artificially low interest rates. No wonder people are buying gold.

How to damage tourism in one silly bylaw..... Tasman district

"Only vehicles with self-contained toilet and wastewater systems will be allowed to camp in the district's open spaces under the new rules, which come into effect on May 31" stuff

Who will police the new red tape?

Who will pay for those who police the new red tape?

What does the term "to camp" mean in law?

Will this lead to idiots taking the bylaws into their own hands and to violence against visitors?

Are there enough toilet facilties in the district 24/7 to cope with tourist demand?

What if a camper van has self contained wc and waste water systems but the owner/user has not paid money to someone to rubber stamp it because this is not free....and who gets to check whether a black market for approval stickers does not pop up.?

What if folk stop for the day but drive during the night...are they camping?....who decides? and what about those in vans etc not self contained who stay at a site all day but travel at night ...is that camping...is stopping camping...what the hell is camping...

Warning to folks overseas thinking of hiring a van to tour the Tasman area...don't...go someplace where you are wanted and where the local council provides adequate toilets and other facilities...just go somewhere else....

Tasman District Council is the reason that I'm selling my properties there, giving up the idea of building a house on one of them and NOT putting $x00k into the local economy.

This is the incident that tipped it- the most recent in a long line of obstructive, small-minded, petty and uncooperative encounters over the past 4 years:

If you're working anywhere near a road or on the road reserve - digging trenches for Telecom and power cables, for example, or putting in a vehicle access - you're required to use an approved contractor.

I called the Engineering Services department to find out how I can get a list of approved contractors - it's not on their website - to get some quotes for trenching and vehicle access work.

"Well, you have have to lodge a permit application for a vehicle crossing and then we'll give you the list of approved contractors"

He then proceeds to talk in acronyms (DPA?), refuses my request for explanations of the terms and proceeds to the end of his lecture, then patronisingly decodes the bureaucrat-isms. (Developer's Professional Advisor)

I point out that I couldn't lodge the application until I have the name of the contractor so it would be reasonable to expect to get the list of contractors before I make the application.

Didn't go down well.

After demanding to know details of the subdivision and starting to tell me which conditions I have to fulfil (which I know and and which I recited to him) and wanting to know which contractors I'd engaged to do do this work and that work (which is none of his business, but I didn't say so..), I asked him if there was a valid reason for TDC NOT providing me with a list of contractors.

Didn't go down well, either.

He agrees to send it to me.

And of course doesn't.

And in other news....

The European Parliament is introducing legislation requiring all households in the EU to retrofit taps and showerheads at an estimated cost of €400 per household (and where have I heard THAT before...?) to reduce consumption in areas of chronic water shortage i.e southern Europe.

Household water consumption in Germany (no shortage of water) has steadily dropped over the years to 44m3 per capita and year (and it's metered, so there's an incentive to be thrifty) which means that the infrastructure providers are having to use fresh water to flush the sewers to remove build-up that's not removed by normal household activity.

Madness

Sounds as though they not only don't want tourists in the Tasman district...but they wish to discourage migrants as well....come over the hill to Marlborough John...nice helpful council staff every day of the week.

I guess overseas tourists will get the message. Go south fast and forget Nelson and Golden bay where you get fined if you stop and sleep the night regardless of whether you leave rubbish or not....

I know some shites leave their filth and they are the ones who ought to be fined. I know there are not enough toilet facilities and those that exist are poorly sign posted. The Tasman council need a boot up the bum.

You raise some good points, sounds like it is moving to be like parts of the north Island.

Now what is worth keeping in mind is what is called the burden of proof. When it comes to prove that you were camping then an overnight stay is usually involved. Unless the enforcement officer can prove you were there all night, then they have no case. Means up late and then up early, which I doubt they would.

Have crossed words with one or two officials when out and about in the horse truck I used to have:)

Grantham has to be right. Kaufman has to be wrong.

Simply, we are talking about exponential growth here, of things physical.

Sooner rather than later, the graph goes vertical - and Grantham has seen it.

Good on him - his life would be easier if he continued to believe it were not so.

Some of us worked it out a bit earlier, but. :)

#1." The prices of all important commodities except oil declined for 100 years until 2002, by an average of 70%". Looks correct but there were also increases during this cycle and each increase looks like it matched the previous decrease and vice versa.

"Statistically, most commodities are now so far away from their former downward trend that it makes it very probable that the old trend has changed – that there is in fact a Paradigm Shift". It is also very probable that history repeats and the downward trend happens again. A probability does not make a fact.

#3. How do you lose 50% of an illusion? If it's worth what it is now, was it really worth what it was then?

meh - do you look forward or backwards when you drive?

I figured there would be a 'paradigm shift' somewhere between 2000-10.

http://jayhanson.us/page25.htm

Note that the folk who poo-poo'd that, did so 'because it didn't happen', and they did so in the '70's.

Note that it didn't say anything would happen in the '70's.

And because nothing happened then, some think nothing will happen now......

Sounds like self-justifying horsepoo to me.

I've had that second graph on my wall since '83, first saw it in '75. I used it as a 'make sure you're ready by then' reminder.

Caveat horsepoo emptor.

I'm not poo pooing the idea. I've read your posts as well as many others and logically they make perfect sense. At the same time a particular graph was shown that has historical data and one can pick any point and provide their interpretation/opinion on what may or may not happen next. What if Kaufmann is correct and Grantham is wrong - nothing is fact until it happens.

My point was we don't know what is going to happen in the future. Anything could happen. You could be proven right or a natural disaster wipes out half the population and the issue is delayed, or a substitute energy source could be discovered. Who knows - I certainly don't and I'm not making any predictions. I prefer to leave that up to you and the rest of the "experts".

When we can't see the future we don't have many options but to use history to assist us going forward, so yes I do look forwards when driving because I can actually see what is happening in front of me.

I'm happy you discovered it back in '75 but you might like to remember that the masses are a lot more ignorant than you or I. Maybe you could do more to bring it to the attention of the masses. The problem is a graph such as the one above will not make sense to the average punter. Why not show something with actual production vs actual consumption compared with oil production/consumption that is simple for the masses to understand. It's not really going to matter though is it? Unless the population stops growing and infinite oil can be discovered we're headed for a Mad Max scenario and we'll all have to adapt one way or another.

PS. I was merely stirring the pot and it's interesting so see how some react.

Fair enough.

I just hope we do it without Tina Turner

:)

I would think you pick the points with care and logic...... "What if Kaufmann is correct and Grantham is wrong" Actually both are saying we are resource limited....others have said that the only way specualtors can get leverage is if there is a real symptom, the speculators just amplify it......to that degree I think both are right....there is a shift it just maybe hard to pick the new slope due to high noise/volitility....Grantham would seem to be good at picking up these changes, Kaufman I dont know....as an engineer I do know engineering and some math....the Peak Oil problem is genuine and its here give or take a few years....food is also about peak because oil and gas are about peak....

I agree no one really knows...its like a pinball machine.....its fast and furious with lots of noise and lights....but the game always ends... So I guess you go with the fundimentals as the most likely outcome....which is how I go.

Population has to decline....what will happen is the poor of the poor will drop out all together from energy purchasing game....and so it will work up the ladder as there is less energy "market forces" have determined thats how it will be....NZ though actually had something of value, food...

Mad Max.....thats a possibilty if society really goes to custard, we have seen riots already....hoping NZ is small enough, productive enough and low populated enough that we are going to be OK---ish. The unkown for me is when those with commodities stop exporting to protect their own population....we've seen that before....just what will happen.....so consider pakistan...over-populated, under-educated and oil and food scarce....they also have nukes....they could throw them around or sell them....the desperate will do anything..........

Adapt, yes we will...

regards

Steven - Good points. There's one I'm coming to more and more as a future scenario:

These folk (the what's in it for me, '84 and on folk) are setting up to get into the public wealth again. As they had to, it's the end-game - not many pieces on the board now.

One of those is the energy generators - along with water and food, it's essential.

There will be the usual 'sell', and the usual duped peasants, but own it, they will. Along with water.

Looking forward, there will be an angry, poor, cheated mob at some point.

Just to stir the pot a bit more with some other ingredients:

Oil is not fossil fuel and AGW is non-science:

http://www.canadafreepress.com/index.php.article/3952

I know the immediate reaction of some, yes, I am aware about the exponential curve and yes, about doubling time and overpopulation.

But I am also weary of people who always are so sure they have the only truth and know what is right and they always knew it long ago.

There are so many insights and inventions out there, new and old, known and unknown, to have the only "truth" appears highly suspicious to me.

How about the reexamination of some of Tesla's inventions lately, or the experiments of Prof.Rossi in Milan, now repeated by a Swedish team of scientists, etc.etc. there might be more out there.

Yes I am aware of theory that oil isn't fossil fuel, but that doesn't necessarily change the numbers involved. Look at how much oil we consume on a daily basis and ask yourself if that quantity could be produced synthetically, and in short time.

Tesla was a genuis by all accounts but it is psychology needed at the moment, someone more like Freud.

Gertraud - some things are immutable, and others are as-good as immutable, truths.

Oil, for instance, and coal, are still being formed, but to all intents and purposes are finite.

The laws of thermodynamics, too, are immutable.

So you can work from first principles, and get a long way down the track. It's just a logic-path thing.

Tesla, like all smart inventive folk, made mistakes. Edison championed DC transmission, Bell got it wrong with aviation, Barnes-Wallis had fizzers too. In hindsight, we can laugh, but they did better than 99% of the population.

Eventually, though, you have to address the predictable future, with the proven. Any other approach sooner or later runs out of 'wait' time.

Denial of pending issues, and/or belief in yet-to-be technologies, can't possible be socially-acceptable approaches, not if the object is continuance of this and other species. That's just a permanent state of Russian Roulette, with ever-bigger stakes. There's only one way that ends.

There are ordinary mortals having a crack at it - I push the power-down thing, Scarfie here obviously does it in a smarter way, and I know a host of others. Note that few are interested, most disparaging! That's the real key to it - getting folk onboard - and I fear that we are out of time on that one.

:)

NB the URL doesnt work...

Do you have any good science or high level of engineering training? I can but assume not....otherwise I think you would have a clearer view.

Apart from that, you dont even need science or engineering for this one,

Take an empty glass and place it under a dripping tap and leave it overnight.....in the morning get up, find a straw and drink......all you want....but then try and survive the day on that refilling rate......

Is it clear now?

Its the same with the argument on fossil fuels, even if oil is not based on fossil fuels and come from great depths at slow rates, its really simple, the oil fields where it accumaltes are trap points and so reserves are built up.....so the day to day "manufacture" of oil is obviously tremendiously less than our extraction rate...so we will run out.....the only difference is when and by the odd year or so.....

Fossil fuels. Also Ithink the actual oil has been examined and has a genetic footprint in it....seem to recall reding that somewhere.

Inventions....these are not laws of nature/universe, which are un-beatable....They are just machines to make some action(s/work easier or possible....

Tesla......you cant get energy without energy...nothing to re-examine. Entropy, you cannot reverse the cycle of a high quality energy moving to a lower grade....perpetual motion etc is at best a strorage medium.

AGW.....there is direct scientific work but also a seperate and clear piece of evidence that of insurance costs....these are based on events happening at known intervasl eg a 1 in 100 year event is just that once in a century...insutrance is based on that...now when they start saying these 1 in 100 year events are happeing in 1 in 50 or 1 in 20 then our insurance greatly increases in cost. or we cant get it. Then there is the huge damage being done to pine forests etc as the winters are milder so the bugs survive, we are seeingepidemics and destruction....

So its pretty clear there is climate change/global warming....the only Q left is what is doiing it and if its man what can we do to stop it....and I think any reasonable person whos shown the strength of the evidence will still say no....

So, I think pretty much even the deniers with the exception of the hard core have stopped saying there is no warming....now they are arguing the degree is small....or not human so nothing we can do...etc.

regards

steven

of course, there are much cleverer people than me, like with a high level engineering degree etc.etc. ...........

Just wanted to add some other ingredients to the pot to stir it a bit more.

corrected link:

RE # 7 : We could believe in conspiracy theories , Ken Ring , or witch hunts to vilify Goldmoney Sacks ( yet again ) .......... Or we could locate the facts ! ........ The USA produces an astounding 316 million tonnes of corn .......... nearly enough for 46 kg of food for every single person on planet earth , annually .

Brilliant , bloody brilliant !

........ But , and this'll make you laugh , in order to reduce their dependence on foreign oil , and as a sop to the green movement , ex-President Bush pushed for 10 % ethanol from corn to be included in gasoline .......... And now 43 % of the total crop , 138 m. tonnes in 2010 , goes to produce car fuel ........ Subtract 20 kg / person / planet .........

In 1980 , just a lowly 1 million tonnes of theannual US corn crop was utilised in gasoline production . And even now , the return of energy is so low , that the US government massively subsidises farmers for the wasteful conversion of their corn , into ethanol .

.......... This is the bloody silly sort of policy that you get in a country which doesn't have a Royal Wedding between Prince Willma and Kate Middlebum , tomorrow .

i hate corn...

...... well push it to the side of yer plate , and get on with the heaping helping of catfish and apricot-gumbo soup I rustled up for yo'all ..... There's BBQ possum shanks and goat tripe for afters ..... Tuck in !

GBH- that corn comes at the rate of 10 calories of fossil oil, to one calorie of corn.

And the Ogalla Aquifer is depleting:

http://ga.water.usgs.gov/edu/gwdepletion.html

You have to locate the facts that underpin the facts..... :)

First topic - is an excellent article, thanks Bernard - highly recommended for the weeding couple also.

He is essentially saying the world needs to end its obsession with growth.

Kunst,

the weeding couple. hilarious. cheers

Bernard

Re #5 ... but, the notorious B.E.N. says that the end of QE2 is no big deal:

So which is he, liar or idiot? (or both?)

Bernard,

your link from yesterday of Jeremy Grantham http://www.gmo.com/websitecontent/JGLetterALL_1Q11.pdf is in my opinion the "Economic Bible" for the future. The content is great and should be of great educational value for our policy makers. In addition one of my greatest concern comes with the decline of wealth, affecting not only the population, but also companies/ governments. This will lead to massive budgeting measures, resulting in decline of quality in all sorts of economic sectors. As a consequence major disasters in e.g. aviation/ energy/ telecommunication/ medicine/ agriculture etc. will occur, stressing the financial resources even more. Will insurance companies such as RE survive such events ? I don't think - the majority of world will sink into desperation, hopelessness and poverty.He's one of the most thoughtful and balanced ppl ive listened to, ie he isnt hammering an overt political drum.....youtube has some great clips of him working through/discussing issues....well worth watching IMHO.

Our policy makers wont do a thing about it even if they read it....he's way to "leftie" for the likes of BE and JK let alone Brash and Hide's ilk....as PDK says they are all too busy re-arranging the deckchairs on the Titanic....but worse they dont even ak the leak (Peak oil)....interesting point the postal workers on the titanic actually drowned quite early trying to rescue the mail....so pointless......or the ppl in stowage prevented from getting into the 1/2 lifeboats before they left....kind of feels like this now....all the time the Captian is telling the 1st class passengers to not worry of course.....JK should bear in mind just where that got the captain...

Wealth, I think the biggest thing is most wealth is now illusionary.....much of it isnt based on real assets/substance, an actual touchable good if you will....so in effect I wonder if we havnt really seen hyper-inflation already just it was so drawn out it hasnt been recognised as this.....and shortly we will get to watch it deflate away....those of real wealth will be land owners I think, they might feel poor but will be able to eat / live well.....compared to many of us.....

Insurance....my concern/worry is that shortly with AGW making weather events more frequent and intense that many RE's will abandon AP....when that happens all insurnace companies here are left bare....at that point its either self or un-insured or Govn insured....Now bear in mind that Banks insist mortgages are covered by property insurnace....so such cover is either going to cripplingly expense to get or un-obtainable, what does that do to the value of houses?

Looking at big disasters I have sort of concluded that in the next few decades we will get so stretched that major repairs will simply never be done....so when the big one hits Wgtn its simply abandoned, the Govn moves to Auckland....

regards

#8: Abolish negative gearing

Won't happen here. Key has clearly stated several times that he has no interest in allowing (let alone assisting) the housing bubble to deflate.

It wouldn't be consistent with National's "step change" away from speculation & consumption, and onto productivity. Inconsistent somehow.

So a non-issue. The incentives have to remain, perhaps tinkered with a little.

Analysts, IMF, OECD, what do they know?

Cheers to all

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.