Here's my Top 10 links from around the Internet at 3 pm in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I will not welcome any mention of this wedding thing in Britain. Interest.co.nz is officially a wedding-free zone this week. Or at least we don't take it seriously. Reference Number number 11

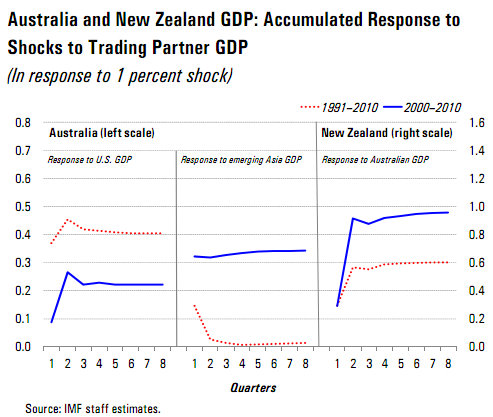

1. Our Australian exposure - The IMF has published its regional economic summary for Asia Pacific with an interesting little section on how exposed Australia and New Zealand are to changes in emerging Asian (read Chinese) growth.

Australia is more exposed to China than us directly, but we are exposed indirectly through Australia and the linkage is almost 1 to 1 between New Zealand and Australia (chart below).

The note about the linkage between our banking systems is most interesting.

Hence we should be watching what happens in China with commodity prices and how the Aussie bank CEOs feel about New Zealand.

We should ignore this bloody wedding tonight in the 'mother country'.

Here's the IMF's view:

The growing integration with Asia and increasing dependence on commodity exports make growth in Australia and New Zealand more vulnerable to swings in commodity demand and prices.

New Zealand’s business cycle is exposed to emerging Asia mostly through Australia, its single most important trade and financial partner. Shocks from emerging Asia are found to have a negligible direct impact on New Zealand.

Rather, New Zealand’s GDP is most responsive to shocks from Australia, and the responsiveness has strengthened to almost “one-to-one” during the last decade. IMF staff analysis also suggests that shocks from Australia to New Zealand have been transmitted mostly through financial variables, as the financial system of New Zealand is dominated by four subsidiaries of Australian parent banks.

Here's the chart:

2. The problems with PPPs - There seems to be growing momentum in New Zealand for using Public Private Partnerships (PPPs) to 'solve' our capital shortage problem for public infrastructure such as schools, prisons, roads and hospitals.

The theory is that one alternative to government borrowing is getting private capital involved through PPPs.

But this is not a new idea. It's been tried extensively in Britain and Australia. The history is ugly. The profits are privatised and the losses are socialised.

The borrowing costs in these deals are much higher than government borrowing costs.

They cost taxpayers much, much more in the long run.

Here's the Guardian on the latest warning from the National Audit Office in Britain against PPPs or Private Finance Initiatives (PFIs) as they're called there. HT No Right Turn.

The government's spending watchdog has issued its strongest health warning to date over the use of PFI deals to build new schools and hospitals, saying the government should urgently find alternative ways to invest in major infrastructure projects after some costs spiralled out of control.

Private finance initiatives (PFI), whereby banks and construction companies pay for public sector capital projects then lease them back for a period of up to 30 years, have become increasingly expensive since the credit crisis and the government should consider slowing down the number of new deals it enters into, the National Audit Office says.

3. Irish haircut required - London Business School Economics Professor Richard Portes argues in this VoxEu commentary that Ireland should default and restructure its debt.

Portes makes the point that the Germans are blocking any haircut because it would damage German banks. That's not sustainable or fair, he says.

Buckle up for more grief in the rolling cluster-fxxck to the poorhouse that is the European Sovereign Debt crisis.

Here's Portes:

After many subsequent capital infusions of taxpayer funds, the latest stress tests and restructuring plans are supposed to draw a line under the shocking costs of the guarantee and to launch recovery. But the burden of the debt on the sovereign is now unsustainable. The projections in the original IMF programme, endorsed by the European Commission and the ECB, see the debt-to-GDP ratio peaking at 120% in 2013. The IMF itself clearly thinks that the downside risks to the programme are high, likely to materialise, and difficult to mitigate. The government has not convinced the markets – Irish sovereign spreads are today about the same as in November before the IMF programme, and the latest actions have led the ratings agencies to downgrade the sovereign (while upgrading the banks). Yes, a couple of investment banks are now saying Irish debt is a good buy – doubtless because they are now convinced the new government will not dare to restructure the debt. The programme requires some access to market funding from next year. That is not credible unless the debt is restructured.

Debt restructuring would impose significant costs on German and British banks, as well as others. That might reduce moral hazard, going forward. But the underlying issue is even more fundamental. The European governments have in effect bailed out their own banks exposed to Ireland, transferring the fiscal costs to the Irish taxpayers through the European Financial Stability Facility, all the while maintaining the moral and political high ground of creditors. So far, there is in fact no ‘transfer union’ of the kind so castigated in Germany (no solidarity there)4. There have been no transfers from the creditor countries, just loans. The true transfers have been going from debtor countries to the banks of the creditor countries, making good their bad loans.

Yes, Ireland had more than its share of crony capitalists and reckless lenders – but there were plenty of reckless foreign lenders, too, and they are being made whole by the Irish state.

4. The death of reputation on Wall St - Steven Davidoff laments at the NYTimes' Dealbook that Wall St's banks' reputations are dying, but they continue to grow.

Today, both people and institutions seem to bear no penalty for their actions. They are rewarded. Why does reputation no longer matter?

The reason is unfortunate and partly attributable to why we got into the financial crisis. People simply don’t matter as much on Wall Street as they used to. Instead size and technology carry the day.

Reputational sanctions ensure people act appropriately and fill the gap between poor or unethical conduct and law-breaking. It ensures that people are penalized for their mistakes and inappropriate behavior. It is the most important of oils that ensures that the capital markets work.

But in the wake of the financial crisis, cynicism rules. Reputation is ignored, and we have a much diminished financial system as a consequence.

5. Biggest bank lobbyists took biggest risks - The WSJ reports the bankers who lobbied hardest for deregulation took the biggest risks and received the biggest bailouts from the US government.

Sigh

Will we ever learn. South Canterbury Finance and AMI come to mind in New Zealand.

This is the sort of reason why ACT's solutions for completely open and unfettered markets just won't fly in an era after the Global Financial Crisis.

Big financial corporates of this kind simply can't be trusted. They have to be regulated. ACT-types would say they should have been allowed to fail. Fair enough. But when they are Too Big To Fail there is a problem, particularly for financial institutions.

Three International Monetary Fund researchers said the mortgage lenders who lobbied most aggressively in Washington for less regulation took more risks and exposed themselves to worse outcomes during the financial crisis than more conservative firms that didn’t lobby.

Deniz Igan, Prachi Mishra and Thierry Tressel said these same lenders were more likely to receive money under the federal government’s bank bailout, possibly because these firms were hit harder during the crisis and had relationships with key lawmakers. (Read the full paper)

The researchers noted that Citigroup Inc., for instance, which nearly collapsed during the crisis and which required $45 billion in government support to stay alive, lobbied intensely against a 2001 bill that aimed to put tighter restrictions on lenders.

The researchers noted that, from 1999 through 2006, 93% of bills introduced in Congress that promoted tighter regulation were never signed into law. But two key pieces of legislation that paved the way for lax mortgage markets were enacted, one in 2000 and another in 2003.

6. European Crisis landmines - Wolfgang Munchau at FT.com has this sober assessment of the risks facing Europe over the next year or so, starting with Greece and talk by Finnish and German nationalist parties that Greece should be forced to default.

On my calculation, the cost of a Greek default to the German taxpayer alone would be at least €40bn ($58bn), including recapitalisation of the ECB. A bail-out would be cheaper.

A premature Greek default would change everything. As would the failure by the EU and Portugal to agree a rescue package in time; or an escalation in the EU’s dispute with Ireland over corporate taxes; or a ratification failure of the ESM in the German, Finnish or Dutch parliaments; or a German veto for a top-up loan for Greece in 2012; or the refusal by the Greek parliament to accept the new austerity measures; or a realisation that the Spanish cajas are in much worse shape than recognised, and that Spain cannot raise sufficient capital.

Then there is the downgrade threat for French sovereign bonds. I recall asking a French official about this, and getting the smug answer that the rating agencies could hardly downgrade France if they maintained a triple A rating for the US. That was before last week. By extension, France must also now be in danger. A downgrade would destroy the logic of the European financial stability facility. It is built on guarantees by the triple-A countries. Without France, the lending ceiling of the EFSF would melt down further.

7. And then there's the US debt ceiling - Everyone seems to think the debt ceiling in America is not an issue for the financial markets because the Congress would never be so stupid as to actually allow America to default.

Ezra Klein at the Washington Post is not so sure:

Raising the debt ceiling may be economically necessary, but it’s politically lethal. Only 16 percent of Americans want the debt ceiling raised, according to an NBC/Wall Street Journal poll. Sen. Marco Rubio said he wouldn’t vote for an increase unless it included “a plan for fundamental tax reform, an overhaul of our regulatory structure, a cut to discretionary spending, a balanced-budget amendment, and reforms to save Social Security, Medicare and Medicaid” — everything on the conservative agenda, basically.

And this is where things get dangerous. Republicans and Democrats both bear substantial blame for the country’s rising deficits. The Bush tax cuts and the Medicare Prescription Drug Benefit and our various wars — none of which have been paid for, and all of which are ongoing — are major contributors to our mounting debt, and all were passed by Republican majorities. The debt ceiling had to be raised seven times during the Bush years, and the policies that helped drive those increases — not to mention the financial crisis that followed them — have not been undone under Obama.

But the GOP wants to pin the debt on the Democrats, and it wants major concessions in return for its vote. Democrats, however, aren’t going to agree to the GOP’s plan to deny partial responsibility for the country’s debt and hold the country’s credit rating hostage in order to reshape the government along more conservative lines. Fear over exactly this sort of political gridlock is what led Standard Poor’s to downgrade the nation’s credit outlook to “negative” Monday.

8. Keynes vs Hayek Round Two - Remember the Rap video of John Maynard Keynes vs Frederick Hayek? The last one got over 2 million views. Who would have thunk it.

Here's the sequel: They have new microphones and new moustaches.

Just as brilliant.

The Bernanke doppelganger is the spitting image of Helicopter Ben.

HT Kristoffer via email.

9. Solution to Auckland's harbour crossing problems - We have a couple of North Shore residents in the office (Amir and Amanda) who wonder how they will be able to commute to the office once the oil price hits US$200 a barrel and the petrol price heads for NZ$4/litre.

Here's a suggestion for getting across the harbour to our offices in Herne Bay.

Some very cool ideas and I love the German commentary.

The rabbit hoppy hydrofoil boat is my favourite.

10. Here's The Onion with a panel of caged Americans giving their views on the economy. The host seems to have had a lot of work done...and a lot of hair straightening...and a lot of blondeing...

Panel Of Caged Average Americans Weigh In On Economy

11. Bonus Clarke and Dawe - John Clarke is very excited about being in London for that fricking wedding.

42 Comments

FYI Australian house prices are slumping

http://www.businessspectator.com.au/bs.nsf/Article/House-prices-flat-again-pd20110429-GD2QZ

Capital city house prices fell 2.1 per cent in the three months to March – the sharpest fall in any quarter since 1999 when the group's property series began.

During the month, prices edged down 0.2 per cent, on a seasonally-adjusted basis, while regional prices rose 0.2 per cent.

On a quarterly basis, the median house price fell in every capital city, with Sydney managing the strongest result, down 1.1 per cent to $500,000, while flood damaged Brisbane dropped 4.6 per cent to $430,000.

Melbourne house values declined 1.5 per cent to $465,000 and Perth fell 3.4 per cent to match Melbourne's median.

But Bernard.....neoliberal theory says private is always better than public. We can't let mere facts get in the way of this.

I really do hope Greece, and Ireland and Portugal for that matter, defaults. There is growing nationalism/xenophobia in Northern Europe with each bailout, and a default would clear the air.

Oh and Bernard, don't let Amir and Amanda know that you want the Kiwi at around US50c, or they'll have to start swimming now.

And many thanks to the IMF for their wonderfully clear chart.

your Friday laugh from the Daily Mash.....

Three Billion Names Added To Forbes Poor List 12-03-09

THE worldwide boom in grinding poverty has led to more than three billion names being added to Forbes magazine's annual 'poor list'.

Around six billion incredibly low net worth individuals are now members of the elite club and for the first time in it's history brown people now out number pink people by just two to one.

A spokesman said: "We are seeing a fundamental shift in the make up of the list with millions of Europeans and Americans finally staking their claim to a life of untold f..k all."

But despite the surge in western poverty, the world's poorest person remains Victor Undungwe of Chad whose net worth has dropped from a bag filled with bits of old toenail to a small pebble and half a dead spider.

He said: "I made the mistake of investing half my toenail bits in RBS and the other half in Woolworths.

"My broker has advised me to put my pebble into defensive stocks such as oil and telecoms and have the spider for lunch."

Meanwhile Forbes 'rich list' of billionaires has shrunk dramatically with more than 300 individuals now forced to admit they are worth just several hundred million dollars.

Tom Booker, founder of investment fund Berkshires Thataway, said: "I lost a lot of money short-selling African toenail bits.

"I don't know how I'm going to cope without being on some list or another. I suppose I'll just drift around the Aegean in my yacht until I start to cheer up."

Meanwhile the UK government is to introduce a new scheme to help poor people buy cars they can then sell to pay for food.

2> Think I commented on this while back....its a dog of a solution and a rip off....it saves the Govn going and getting cheap credit so it "saves" up front but cripples us later, two killer problems as the piece says, it cosst more for private investors to get credit plus then thier profit margin which is hefty.....only fools go this way...

regards

obviously the best test for PPP's is to go to GolmanSachs, ask them if they think its a good idea, and if they say yes then IT"S NOT A GOOD IDEA

Re #9, can't you just let Amir and Amanda telecommute?

Yep, wouldn't it be nice if more employers were prepared to use today's technology... Related article on stuff here http://www.stuff.co.nz/life-style/wellbeing/4941877/Sickies-linked-to-commuting-misery.

We've started working on a document today outlining the business model we'd like to trial when we start employing (not yet but I like to think ahead). It's focused on full flexibility, both in location where and time during which work would be performed. In addition to being good for employees it'll be good for the environment too...

Elley - good on you. It's the way it'll go, and anyone in the front of the wave always does better than the sheep who follow late.

I do all my income-earning from home (or at least, where I choose) - wrote the last article on the deck of a foreign yacht parked off Abel Tasman Nat Park, well into the second bottle of shiraz too :)

But - it's true. The office/ commute lifestyle was only courtesy of cheap energy - a mere blip.

Back in '99, we cruised the Queensland coast for a year. Even back then, we met an architect (parked in the lagoon at Middle Percy Island with us, as it happened) who worked from his catamaran. He had a secretary and a small shared-presence in Brisbane, but he was never there. Didn't have to be. :)

Bernard - a long time ago, Mark Drela rode the ultimate cycling commuter.

Not being on broadband at the mo, I'm assuming it's not part of your collection.

The boat was called Decavitator - was foil-borne, air-prop driven....

http://www.youtube.com/watch?v=l2UOH65QOI4

Now you can live on the North Shore......

Love to see the crossing of the Waitemata in a good westerly though PDK:)

I have thought about this one for some time and the weakness is that only one of the three major muscle groups are used.

Can't help but wonder if the air prop should be exchanged for something that is closer to nature, mimicking the fluke of a dolphin. Would work more along the lines of the kangaroo method in the video.

170 odd jobs to go at Christchurch CC:

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10722343

Yep the great NZ recovery is going just fine

Throw in the events in Hawkes Bay, and I suspect at least one more economically damaging storm this winter

Bernard's comments on the wedding are funny. I don't really give a stuff but I might have a look. Woman at work is convinced there will be a terrorism event.

More interested in the Breakers - go you good things!!!!

"More than 170 Christchurch City Council staff are to lose their jobs as a result of the city's devastating February earthquake. Council staff employed at facilities badly damaged and which remain closed following the February 22 quake were this week told their jobs were being "disestablished". herald.

I wonder if the fatheads on the Council are still going to blow their $4000 'training' dosh on a trip to California to press the flesh and we are told, to develop the personal links that will allow them to phone up and ask what's the best way to blow one hundred million on Chch .!...

Not another trip by CCCr's to learn sand-castle construction ? ........ I'd have thought the Feb 22 'quake showed that we've been making those for the past 150 years .

http://peakoil.com/enviroment/massive-crop-losses-feared-from-us-drough…

So crop loss in russia fallowed by crop loss in texas....seems the year of bad weather is set to continue...wheat....oops

regards

someone who gets it:

http://www.energybulletin.net/stories/2011-04-27/it-isnt-gridcrash-make…

New values - first.

The “Broom Economy” is caused by us not respecting nature/ environment and morality and as a consequence costing us trillions. How much longer can insurance companies - even Re survive ?

Today - philosophical questions/ issues are much more important in context of problem solving in economics then experts in that field deal with.

Bernard’s brilliant link two days ago – highly recommended.

Yes a great piece. Someone posted a video of Jeremy on here about six months ago and he seems rather credible.

From my take on this our cities are going to look dismal in a post oil world. But that will be for the better in the long run as they are dysfunctional all round.

"Spain unveiled a crackdown on underground employment as the government seeks to shrink one of the region’s largest shadow economies, bolster tax revenue and reduce the Europe Union’s highest jobless rate.

The plan increases fines for companies hiring workers without registering them with authorities and for people working at the same time as claiming jobless benefits" blommbergers

haha...in NZ we have growth....in the size and spread and compexity of out very own "black market"...

Pretty soon the red tape bureaucrats will be let lose to impose fines on people who give away or swap their veges with the neighbours....keeping chooks will carry a tax....doing odd jobs for cash will lead to prison terms....

Bill English will create a whole new department aimed at clamping down on you orrible lot....it will of course begin with a "Black Market Working Group" because quite a few National Party hacks have yet to suck on the public tit.....once they have had their fill for their useless advice...we will get the red tape.

Yet again the world's banks wriggle out from under regulation that might restrict their profits and bonuses.

This from the WSJ

The Treasury Department plans to exclude foreign-exchange instruments from key portions of new derivatives rules, as being devised under last year’s Dodd-Frank financial-overhaul law. Treasury officials said the instruments, known as foreign-exchange swaps and forwards, shouldn’t fall under the same rules as other derivatives because doing so could expose the market to greater risk and instability.

http://online.wsj.com/article/SB10001424052748703655404576293321520340178.html?mod=djemalertNEWS

'Holy cow' Just had a talk with my local honey man. He is with Arataki in Hastings.

They have this new disease called Nosema Ceranae

http://en.wikipedia.org/wiki/Nosema_ceranae

It appears to have arrived on Kiwi fruit pollen, even though Pollen imports are meant to be illegal. He told me that the USA is losing 1/3 of its bees every year and no one knows why.

This disese also kills bumble bees. He believes that with the three new diseases (Chalkbrood and Varroa the other two) it may become uneconomical for him to continue after 67 years in the industry.

He said the precedence of free trade over bio-security is going to ruin his business.

We are run by Morons.

chill.... Monsnto are probably working on a GM bee....

Margaret Atwood's Year of The Flood, Oryx and Crake. First the frogs and now the bees. What screwy things we are doing.

No need KWJ...the CIA have a half inch drone that'll do the job...immune to disease they say...it's the colour of dry clay so the ragheads fail to spot it...no trouble to reprogramme it to take over from the Bumble Bee....

Just another example of many:

Industries committing crime on nature – honey bees are dying in the millions.

http://www.reality-choice.org/123/industry%E2%80%99s-war-on-nature-%E2%…

--

By the way - just look what's going to happen on the weather front here in NZ in the next few days,

FYI STats NZ has delayed Q1 GDP stats release by two weeks to July 7 due to the earthquake.

The dates for most releases are unchanged following the 22 February

earthquake in Christchurch but several have now been rescheduled, including

Gross Domestic Product: March 2011 quarter, which will now be released on 7

July instead of 23 June.

Love the Keynes v Hayek rap

"All the talk about deleveraging and conservative household balance sheets is nonsense..... households haven’t deleveraged, they’re just broke. They aren’t 'not spending at the retailers because they’re saving '; they’re not spending because they’ve got no money left to spend!"

Confirmed by Walmart's CEO

"Wal-Mart shoppers, many of whom live paycheck to paycheck, typically shop in bulk at the beginning of the month when their paychecks come in.

Lately, they're "running out of money" at a faster clip, he said.

"Purchases are really dropping off by the end of the month even more than last year,"

http://consumerist.com/2011/04/walmart-says-customers-running-out-of-ca…

Yep, read that, to be expected when they have gas guzzlers which are all but essential to get anywhere and do anything and pay cheques are not rising or even dropping. They are complaining its nearly $100 to fill a tank....oh wow....yet we are paying the equiv of over $6US a US gallon....to their $4...my heart bleeds for ppl to stupid to realise they need a 40mpg car and not a 15mpg car....not.

regards

Interesting piece, thanks

regards

Careful snarly...big brother is watching you...keep to the script...be cheerful and talk about recovery...say the growth is about to happen....that way the morons won't spot you.

Oh no no no we can't have this carry on going on...I mean to say it's just not cricket suggesting a banking chap is a crook and a bloody swine as well...dear me we must put a stop to this...where's the whitewash?....

"Some of the biggest names in global investment banking face a European Commission competition probe into their role in the market for a derivative that played a crucial role in the credit crunch and has also been blamed for the eurozone's sovereign debt crisis.

The Commission said yesterday that it is to investigate 16 banks, including Goldman Sachs and Britain's Barclays, HSBC and Royal Bank of Scotland, amid its suspicion they "may hold and abuse a dominant position" in the credit default swap (CDS) market."

Reuters) - Chevron Corp is switching to Europe's Brent crude benchmark from West Texas Intermediate (WTI) when calculating production-sharing contract changes, to better reflect moves in international oil prices.

Makes sense.

And:

http://money.cnn.com/2011/04/28/news/economy/oil_prices_speculators/ind…

Anyone wanna buy a Landcruiser?

haha actually I do PDK, because wood gas needs a bit strokey motor, and the gasifier weighs a substantial amount so a bit vehicle is the sensible choice. Will be waiting until they come down a bit price though, won't take much longer:)

Touche. It was a rhetorical ask - mine's on hold there last three years, awaiting just such a project!

40 acres of tree thinnings has to be enough feed....

But I suspect the society we see unfolding will lack a lot of 'givens', we might be busy doing other things. Doing what's happening in Libya, to regain ownership of our power generation, comes to mind.......

http://www.stuff.co.nz/business/4947053/Directors-square-off-over-succe…

When they agreed to swap those debentures for shares in Allied Farmers in December 2009, they were supposedly worth $396m. Last week they were worth less than $25m.

That's $500m up in smoke.

With such enormous losses you would expect the people involved to be fighting like cats in a sack to avoid being ruined by the debacle. And indeed they are.

On Thursday, Allied's forthright managing director Rob Alloway resigned abruptly from the board, driven to quit over his distaste for a fellow director's role in the deal with Hanover.

That director is Andrew McDouall, an affable investment banker who has served on Allied's board since 1999. McDouall's firm McDouall Stuart has worked on deals for Allied several times and, according to public disclosures, from 2006 to 2009 it received $831,100 in fees for a range of services including several capital raisings.

Two weeks ago it emerged publicly for the first time that McDouall Stuart also had a pivotal role in creating the Hanover deal and received hefty fees for its efforts.

The question is – how much did the board know about McDouall Stuart's involvement?

And should more have been disclosed to investor

John Clarke has still got it!! classic.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.