Here's my Top 10 links from around the Internet at 11 am in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

Must be a devil between us...

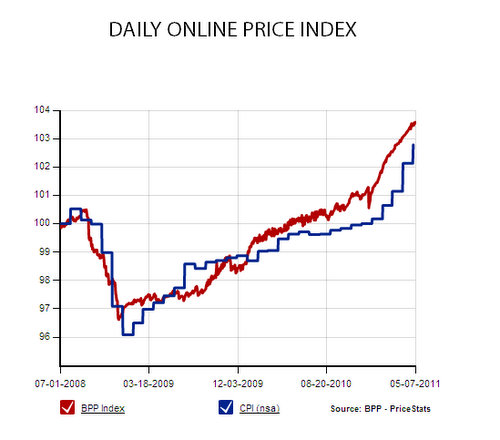

1. Does New Zealand need a Billion Prices Project (BPP)? - Two MIT professors are now monitoring prices online to get a more immediate measure of inflation.

It shows US inflation at 3.2% over the year to April vs the official inflation rate of 2.1% in 12 months to February. See the chart below.

James Surowiecki writes at the New Yorker about the project.

How hard would this be to do in New Zealand?

As it is at the moment, it can take three months after inflation happens for New Zealanders to know about it.

I'd love it for the Reserve Bank and Stats NZ to get together with TradeMe etc to come up with this for New Zealand.

The B.P.P., which was designed by the M.I.T. economists Alberto Cavallo and Roberto Rigobon, gathers price data not via survey but, rather, by continuously scouring the Web for prices of online goods around the world. (In the U.S., it collects more than half a million prices daily—five times the number that the government looks at.) Using this information, Cavallo and Rigobon have succeeded in building what amounts to the first real-time inflation index.

The B.P.P. tells us what’s happening now, not what was happening a month ago. For instance, after Lehman Brothers went under, in September, 2008, the project’s data showed that businesses started cutting prices almost immediately, which suggested that demand had collapsed. The government’s numbers, by contrast, didn’t show this deflationary pressure until that November. This year, there’s been a mild uptick in annual inflation, and again the B.P.P. detected the new trend before the Consumer Price Index did.

That kind of early heads-up could help governments make more timely decisions.

2. The real problem in America - Here's what American consumers really think. They are feeling poorer and don't expect to see their income rise much. They are heavily indebted too.

It's the reason why they're not spending.

Remember, American consumers make up about 60% of the world's biggest economy.

3. Way beyond Greece - Bloomberg reports Blackrock's Larry Fink says Europe's problems are much deeper than just Greece. Europe's banking system needs a reorganisation.

Is everybody ready for this and aware of what it means?

So why is Kiwibank borrowing from this system at a rate of almost NZ$1 billion every six months?

Inspectors from the EU, International Monetary Fund and EuropeanCentral Bank are set to wrap up a review of Greece’s progress in meeting the terms of last year’s 110 billion-euro ($157 billion) bailout in coming days. The EU will then formulate its plan for further aid to Greece, which remains shut out of financial markets a year after the rescue package.

Many smaller banks in Europe will need to be recapitalized, said Fink. The largest banks on the continent are well capitalized, though devaluation of some of the sovereign credit will put stress on them, he added.

“The banking system in Europe owns all this debt,” Fink said. “If we restructure one country, we’re now basically putting huge capital stress on these banks. Before we restructure any country, we’re going to have to restructure the banking system in Europe.”

4. Goldman's American handout - The details are now emerging about how Goldman Sachs was bailed out by the American taxpayer, thanks to US Treasury Secretary Timothy Geithner, who is as close to US President Barack Obama as anyone in his administration.

Here's Robert Scheer at TruthDig.com.

What was Timothy Geithner thinking back in 2008 when, as president of the New York Fed, he decided to give Goldman Sachs a $30 billion interest-free loan as part of an $80 billion secret float to favored banks? The sordid details of that program were finally made public this week in response to a court order for a Freedom of Information Act release, thanks to a Bloomberg News lawsuit. Sorry, my bad: It wasn’t an interest-free loan; make that .01 percent that Goldman paid to borrow taxpayer money when ordinary folks who missed a few credit card payments in order to finance their mortgages were being slapped with interest rates of more than 25 percent.

One wonders if Barack Obama was fully aware of Geithner’s deceitful performance at the New York Fed when he appointed him treasury secretary in the incoming administration. The president was probably ignorant of this particular giveaway, as were key members of Congress. “I wasn’t aware of this program until now,” Barney Frank, D-Mass., who at the time chaired the House Financial Services Committee, admitted in referring to Geithner’s “single-tranche open-market operations” program. And there was no language in the Dodd-Frank law supposedly reining in the banks that compelled the Fed to reveal the existence of this program.

It was merely one small part of that reckless policy of throwing mad money at the banks while ignoring the plight of homeowners whom the banks had swindled, a plan pursued by both the Bush and the Obama administrations that set the stage for the current slide into a double-dip recession.

5. Politically unsustainable - Here's why the European debt situation is unsustainable without a restructuring. Jean Pisani-Ferry says in this video below Greece needs to run a budget surplus of 6% to dig itself out of its hole. This is impossible. HT Yves Smith at Naked Capitalism.

This INET interview with Jean Pisani-Ferry gives a useful overview of how Greece and Ireland came to have sovereign debt woes and the viability of the remedies proposed for each.

Pisani-Ferry argues, as many other economists do, that austerity measures will not succeed in Greece because they will prove to be politically unsustainable.

6. Sustainable growth? - Dick Smith of Dick Smith Electronics has launched an A$1 million 'Wilberforce' award to find a young person with an alternative to consumption-obsessed growth.

Right now I believe we could be sleepwalking to catastrophe because we are failing to both acknowledge that there are limits to growth in a finite world and to prepare for a more sustainable way of organising our economy. In the 19th Century, empires were built on the labour of slaves, and it was believed economies would collapse if slavery was abolished.

But brave people like William Wilberforce fought to end the slave trade – and economies still flourished. We need brave people like Wilberforce today, and I want to encourage a new generation of clear-thinking and inspiring young leaders.

He spoke on Radio New Zealand National on Tuesday. Here's the interview, which various people have recommended to me.

7. Here's an idea - HT to Nadine at TVNZ's AMP Business for this great device for sleeping at work. It's called the Ostrich.

It could also be used to ignore all sorts of things. Must send a few to the Beehive.

Working patterns are constantly evolving. We gradually spend more time in our working environments, and this in turn means that we often need to make work and rest fully compatible within the same space. Some cultures have assimilated this concept more naturally than others, but in general the workplace has rarely adapted to this new working-resting paradigm.

8. So what does price stability mean? - James Grant from Grant's Interest Rate Observer is one of my heroes. He's usually worth watching, so here he is in full colour and moving image below.

He makes some great points about crazy US farmland prices and is particularly critical of the US Federal Reserve.

It's 26 minutes long and well worth every second.

9. A heart warming video - For those who say I'm too grumpy by half, here's a fun video that you may have seen, but it's enjoyable to watch again.

10. Totally Gummy Bear video especially for the Gummster. It's all about an itsy bitsy bikini.

11. Here's another of my favourite songs from the great Chris Knox and Alec Bathgate (Tall Dwarfs) called Nothing's Going To Happen.

One again for the Beehive to watch when contemplating why their budget forecasts are wrong again.

12. Totally bonus video from The Pixies - Hey.

Been dying to meet you...

27 Comments

Here's a Reuters analysis of talk that QE III is near after this morning's rout on US stock markets.

Might the Federal Reserve extend its bond purchases beyond June? What until this week was a pie-in-the-sky notion is suddenly fair game for market speculation.

The triggers have been many.

The latest one-two punch came from reports on Wednesday showing both a sharp deceleration in private sector hiring and a slowdown in manufacturing.

Compounded with weakness from China and Europe, the news was enough to knock stock prices -- a key beneficiary of the Fed's ultra easy policy -- more than 2 percent lower. The Standard & Poor's 500 index suffered its worst day since August.

"The U.S. economy is hitting the brakes at exactly the wrong time for the Federal Reserve," said Douglas Borthwick, managing director at Faros Trading in Stamford, Connecticut.

"With the expected end of QE2 within reach, the U.S. economy is in a situation where its only form of life support is about to be ripped away from it."

http://www.reuters.com/article/2011/06/01/us-usa-fed-qe-idUSTRE7507HX20110601

Hitting th brakes suggests its on purpose...

I prefer the analogy of, they got a dodgy WOF (bank stress tests) that over looked a rusted out body shell and now after hitting a small bump the suspension is falling off....add in that the brake pipes were rusted out so there are no brakes....the seat belts were sold off to save money (who wants the weight of regulation after all!!!) and the throttle is jammed oopen and we've been running at 7000rpm without enough oil (greece) so the hydraulics tappets are destroying themselves (banks gambling) and the cam belt is about to snap terminating the engine.....

So, scrap value......

regards

A generation of US graduates are loading up with so much debt they are ending up as indentured servants

http://www.marketwatch.com/story/college-is-a-scam-lets-make-some-money-off-it-2011-05-26

We can’t deny it anymore: College is a scam and a bubble — and the reasons why appear below. But I’ll be the first to admit it’s going to take years for that bubble to burst. And while college tuitions are still skyrocketing and student-loan debt is creating a generation of indentured servants, we might as well benefit from it.

For anything you want to do in life, try it first rather than waste money and time learning something you ultimately never think about again.

Tuitions have gone up 10 times faster than inflation in the past 30 years and three times faster than health-care costs in the past 30 years. We need to have an active discussion on this as a society. Meanwhile, the greatest entrepreneurs, artists and inventors in history either didn’t go to college at all or dropped out (or were kicked out).

A very valuable, interesting article – Bernard – great to see so many bloggers commenting – ha !.

Where are decent NZjob opportunities for the majority of next generation after leaving a decent NZeduction ? NZ brain and skill capital lost to other nations – what a waste !

Totally agree....A university degree was fairly rare years ago and was worth a lot....these days you almost need one to be a bus driver, which frankly is loopy...

I think Uni's etc are in for a shock as it dawns on students that a degree isnt a ticket to a [good] job.......Over the years I think Polytechnics have suffered as younsters have gone to Uni to get a "worthwhile" qualification, I think a new dawn wil rise over the Poly's...they will be offering more relevent quals for teh real world....Uni's I think will shrink to half their size...

regards

A university degree could seldom ever be considered a "ticket to a [good] job".

But without one you had very little chance of even getting your foot in the door.

Without a degree, and a Ph.D in particular, you wouldn't even be considered for those positions.

The only thing that has really changed is many employers demand applicants have a degree when often it's unnecessary.

When times are good, degree holders can choose the positions they wish to take, while in bad times they have to fight alongside everyone else.

Many people without degrees like to make themselves feel better by dismissing academic qualifications as being "worthless" and "irrelevant", and claim that those with such qualifications are Ivory Tower elitists with their heads lost in the clouds.

Here's Robert Reich on the US malaise

http://robertreich.org/post/6072567291

Housing prices continue to fall. They’re now 33 percent below their 2006 peak. That’s a bigger drop than recorded in the Great Depression. Homes are the largest single asset of the American middle class, so as housing prices drop many Americans feel poorer. All of this is contributing to a general gloominess. Not surprisingly, consumer confidence is also down.

The recovery has stalled. It’s unlikely America will find itself back in recession but the possibility of a double dip can’t be dismissed.Washington’s paralysis in the face of a stalled recovery is bad news – not just for average Americans but for the world. Ironically, it also worsens America’s future budget crisis because it postpones the day when the debt begins to shrink as a proportion of the GDP. Yet as the 2012 election season looms, the prospects for sensible policy seem to decrease by the day.

33%...approaching BH's prediction....

;]

regards

but steven, get with the program, it will never happen in NZ because "we're different" :)

If we were the same as the USA we would;

1. Have jingle mail scenarios where it's easy to walk away from your mortgage

2. Have a culture of 'we want to rule the world and we know everything'

3. Have falling immigration and shaky prospects for future immigrants

4. Have massive tracts of land to build houses on

5. Print money when we need it so that we feel wealthier than we are

6. Have falling house prices due to low demand

NB. I dont think all states have jingle mail....but Im hard pushed not to see it use here.

regards

Here's a great Felix Salmon riff on a column on the Euro debt crisis from Martin Wolf

Debt restructuring looks inevitable. Yet it is also easy to see why it would be a nightmare, particularly if, as Mr Bini Smaghi insists, the ECB would refuse to lend against the debt of defaulting states. In the absence of ECB support, banks would collapse. Governments would surely have to freeze bank accounts and redenominate debt in a new currency. A run from the public and private debts of every other fragile country would ensue. That would drive these countries towards a similar catastrophe.

The only other choice, says Wolf, is equally intolerable: Europe’s richest governments aiming a firehose of their taxpayers’ euros, in open-ended and unlimited quantities, at any country facing massive outflows.

Given these choices, it’s easy to see how Europe’s politicians and central bankers are doing everything they can to kick the can down the road and put off the moment that they have to make a big decision. But the longer they wait, of course, the more momentous and more difficult any such decision is going to be. Just how much risk are Europe’s central banks going to take on, before they draw the line and say no mas?

The firehose of taxpayers' euros is of course the correct approach. It is no different really to wealthy Wellingtonians allowing their taxes to go to help impoverished people in peripheral Northland.

However, it will not happen, because when the euro was designed, this sort of money transfer was not included, instead everything is a LOAN which has to be paid back down the line. And the populace of the central eurozone have been conned into believing that they have no responsibilities to their fellow zone members, whom they regard with increasing contempt. Yes sadly, the elephant in the room here is nationalism, even racism.

The fact is Germany and its close neighbours have gained a lot more from the euro than their politicians have ever let on to their own populations.

There is only one honorable way out of this mess. At least one country must default and withdraw from the euro. In some ways it would be best if it was Ireland, as there is probably more sympathy for their situation.

Have a nice day!

Chinese land prices are crashing, the FT reports. This may bankrupt local governments who are now dependent on land sales for income...

http://www.ft.com/cms/s/0/df7075b4-8c6c-11e0-883f-00144feab49a.html#ixzz1O4VJlHHc

The average transaction price for land sales across the country fell 32 per cent in April from a month earlier and has dropped 51 per cent since the start of the year, according to government data published by Credit Suisse. In some cases, local government land auctions have failed as bids fell short of the minimum level required.

2. I thought it was 70%? has it dropped to 60%?

regards

Banks buy bulk of £39.8bn of new gilts

Britain's banks have emerged as by far the largest buyers of Government debt in the last six months, as demand from other UK investors and foreign buyers fell away.

http://www.telegraph.co.uk/finance/economics/gilts/8550716/Banks-buy-bu…

then give this future taxpayer’s money to the NHS, Education and Entitlements.

This troika (very fashionable word) of the biggest spending

departments then pays many more people more than necessary, maintains many more facilities than necessary and upholds the propaganda that the nation will collapse if the state does not continue with their monopoly status.

And most of the British populace, fearful of losing something for nothing, trembles at the thought of this troika being transformed

into highly efficient and effective competitive industries. The socialists who run the show are laughing all the way to the bank at such foolish dependency.

Many on these blogs are vehement opponents of socialism but

the irony is that their perceived self-interest prevents them from supporting the one action that will do most to eradicate deficits, debt and promote much higher outcomes for less money in health, education and entitlements in general – they have willingly swallowed the socialist lie that only the state should run these industries.

Britain now finds itself in the position where there is only one way to prevent a collapse of the house of cards which describes its banking system and currency – and that is sustainable growth.

Sustainable growth is not more government spending of future

taxpayers’ money, nor is it austerity but rather it is the transformation of the troika into fully fledged competitive industries with voluntary buyers and sellers and low barriers to entry.

What is the alternative? That would be victory for the socialists as British politicians sell out a failing financial system to the fatal

charms of a new Euro.

It is vitally important to remember that Brussels is not just seeking more power but has at its core a visceral hatred of the British as the Fascists and Marxists who run Brussels are agreed that individual liberty is their common enemy.

Jonathan

http://www.zerohedge.com/article/vancouver-real-estate-market-rollercoa…

Best viewed in full screen mode.

6. DSE, great piece....

regards

Bad analogy JK

Most of us in Northland are quite ok thanks with good fishing beaches etc. We would prefer the wellingtonians to actually not be so wealthy earning money from our hard earned taxes. Dont think the country would miss the largesse if they werent there . I wonder what the net benefit of wellington is to the rest of the nation

#6 titled "sustainable growth?"

There is no such thing as 'sustainable growth'. Sustainable means to be able to maintain. Clearly any continual increase (ie growth) eventually leads to a level that is no longer sustainable.

Note that in the interview Dick Smith doesn't talk about 'sustainable growth', he talks about being sustainable, but not growing. Bright guy IMO; wish there were more like him.

Our apologies to readers.

We had a technical snafu that took down the site, but we're back up again.

cheers

Bernard

A bit of a concern for folk in the shale gas business here;

"The first company to explore for shale gas in the UK has suspended operations at one of its sites after scientists said there were indications its activities might have triggered two small earthquakes near a test well close to Blackpool.Cuadrilla Resources, a privately held exploration and production company, said it had temporarily halted the use of hydraulic fracturing or “fracking” at its site at Weeton in Lancashire while a review was being conducted. Fracking is a process that involves injecting water, sand and chemicals under high pressure into rock formations to extract gas."

http://www.ft.com/intl/cms/s/0/0577dda0-8c82-11e0-883f-00144feab49a.htm…

Why can't I stop getting email replies to my comments...????????????? BERNAAAAAARD

Wolly,

You need to untick the box that says email me when someone responds to my comment.

Which comment did you tick the box for?

If you can't remember we can untick it for you.

Do you want us to do it?

cheers

Bernard

Got it sussed BH...for some time that weee box just was not there!....are you ready for QE3?...

Psssssst...wanna know a secret.....?

"the Old Men from Sicily"

http://www.marketoracle.co.uk/Article28423.html

It's a good read for those who would like to know who is carrying out the greatest financial crime in the history of mankind...

How's the debasement of the Kiwi currency going...

What will the Sir Humphrey mob receive by way of fatter salaries for saving Bill a few bob on their dept budgets!

Which pollies are in line for bums on seat fat incomes positions in NZs foreign posts....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.