Here's my Top 10 links from around the Internet at 9 pm in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

What a day. A tax reform package. A GDP growth surprise. A new NZ$ record high. Major fraud charges. A new Fonterra CEO. Could someone stop the news now please?.

1. How curious - TV3 reports that ANZ wrote to some mortgage customers to say their payments would be automatically cut to the minimum amount unless they contacted the bank.

This could be a big issue because the rate cut last year meant many people left their repayments at 'high' levels to repay debt faster, which is a good thing for customers, but not so good for the bank.

Anyone else experienced this at ANZ or any other bank?

ANZ appear to have blamed a technical glitch.

Is something else going on here?

Is this one way to stop deleveraging and keep lending growing?

Here's the details via TV3:

Last week she got a letter from ANZ instructing her to contact the bank, or have her payments slashed. “If you'd like to keep your repayment amount the same as it is now, all you need to do is contact us, “If you don't contact us, in due course, we'll reduce your repayment amounts to the minimum amount needed to repay your loan,

“Reducing your payments means you'll have more money to use for other things,” the statement read.

“I'm angry about the letter, and I'm still in limbo because I still don't know quite what to do,” says Mrs Sorasio.

ANZ says it's all happened because it's changing computer systems. It denies it's being irresponsible, or trying to make more money out of interest payments.

“If we've caused confusion and inconvenience I apologise for that,” says ANZ head of transformation Craig Sims.

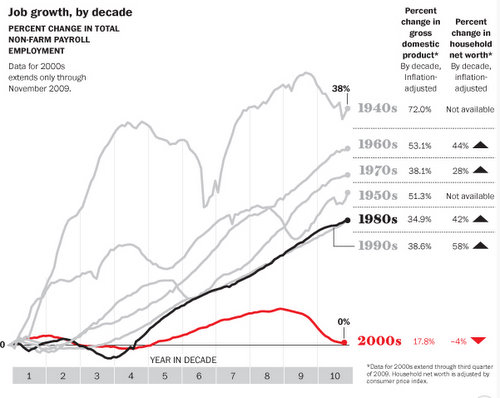

2. America's lost decade - Ryan at Swift Economics points out there were no net new jobs created in America in the 2000s and household net wealth fell 4%, which is the worst since the Second World War. HT Troy.

Productivity and technological innovation did improve people’s lives last decade, but the benefits probably don’t exceed the costs if you have no job, are underemployed, and/or have been pushed into a less prosperous line of work. Why weren’t there any net jobs created in the Aughts? The continued rise of globalization, with countries like China and India utilizing cheap labor to take over the production of our goods, is one story. So, too, are technological innovations. From factory jobs to office assistants, technology has simultaneously made many positions obsolete AND increased the productivity of the economy.

omehow I have a feeling the lost decade will be the fault of capitalism and corporations. And let’s not forget all of our wonderfully free markets. While corporations deserve some of the blame, particularly the financial industry, let’s not forget the government. They have fostered a system in which GE allegedly just paid zero federal taxes for last year’s $14.2 billion in worldwide profits, with $5.1 billion of the total from operations in the United States. There has been a colorful debate over the New York Times claim, but it appears GE has used the ridiculously large tax law to pay zero or very little federal taxes; a tax law with all sorts of exemptions, credits, and deductions fought for by lobbyists of special interests groups, or groups in politician’s favor.

3. Flashing red - Ambrose Evans Pritchard at The Telegraph is very worried about money supply contraction in Italy and France.

Monetary experts are increasingly disturbed by the pace of money supply contraction in Italy and most recently France, fearing that it could prove a leading edge of a sharp economic slowdown over the winter.

RBS said the eurozone storm is far from over. "We expect the crisis to continue deteriorating, and threaten to undermine the entire euro area as European policy-makers still misunderstand market dynamics. They show no sign of catching up with reality," said Jacques Cailloux, the bank's Europe economist.

Mr Cailloux said the EU's bail-out machinery (EFSF) must be increased to nearly €3.5 trillion in committed funds to staunch the crisis. This would give the authorities effective firepower of €2 trillion. "It is a lot of money but the euro is a big project. This is all about political appetite. The longer they wait, the worse it gets.."

4. German bank spits dummy - BBC reports German bank Helaba reporting it will pull out of stress tests for European banks later this week to make sure it doesn't fail the test. Hmmm. That's one approach to bad news....

Helaba said it would have passed the test if regulators counted a debt-equity hybrid, called "silent participation", as a capital reserve.

It said the European Banking Authority (EBA), which runs the tests, had said it would accept silent participation but then changed its mind.

Its withdrawal will raise concerns about the credibility of the tests.

5. Obama loses his temper - BusinessInsider reports the game of debt ceiling chicken is getting to Barack Obama.

President Barack Obama abruptly left today's negotiating session to raise the debt ceiling and lower the deficit, House Majority Leader Eric Cantor (R-VA) told reporters after the meeting.

Cantor said Obama walked-out "angrily" after he offered to support two separate debt ceiling votes — a proposal Obama had repeatedly said he would veto.

"Eric, don't call my bluff," Obama said according to Cantor moments before storming out of the meeting. "I'm going to take this to the American people." Cantor said all progress in the debt talks has been erased.

6. 'Don't worry I'll just print again' - Helicopter Ben Bernanke reassured his mates in the stock markets that he would print again if necessary.

Federal Reserve Chairman Ben S. Bernanke signaled the central bank has more tools for monetary easing should the economy weaken and stymie efforts to generate jobs for 14.1 million unemployed Americans.

The Fed could pledge to keep the main interest rate at a record low and hold its balance sheet at $2.87 trillion for a longer period, Bernanke said yesterday in congressional testimony. It could also buy more bonds, increase the average maturity of its securities holdings or cut the interest rate it pays banks on their reserves, he said.

“We have to keep all the options on the table,” Bernanke said in semi-annual testimony to the House Financial Services Committee. The “economy still needs a good deal of support.”

8. Watch the debt - Harvard economists Carmen Reinhart and Kenneth Rogoff have been very influential with their studies of how economies coped with financial crises over the last 200 years and how much of a drag on growth high debt really is. Here is their seminal work on 'Growth in a time of debt'

It is the intellectual underpinning for my bearish view about growth in the developed world over the next decade or two.

Here at Bloomberg Reinhart and Rogoff warn the Krugmans of the world that simply ignoring the (albeit sleeping) bond market vigilantes is not a solution. Governments can't hope to grow their way out of debt by racking up ever-larger government deficits. This is today's Must Read I reckon.

Our empirical research on the history of financial crises and the relationship between growth and public liabilities supports the view that current debt trajectories are a risk to long-term growth and stability, with many advanced economies already reaching or exceeding the important marker of 90 percent of GDP. Nevertheless, many prominent public intellectuals continue to argue that debt phobia is wildly overblown. Countries such as the U.S., Japan and the U.K. aren’t likeGreece, nor does the market treat them as such.

Indeed, there is a growing perception that today’s low interest rates for the debt of advanced economies offer a compelling reason to begin another round of massive fiscal stimulus. If Asian nations are spinning off huge excess savings partly as a byproduct of measures that effectively force low- income savers to put their money in bank accounts with low government-imposed interest-rate ceilings -- why not take advantage of the cheap money?

Although we agree that governments must exercise caution in gradually reducing crisis-response spending, we think it would be folly to take comfort in today’s low borrowing costs, much less to interpret them as an “all clear” signal for a further explosion of debt.

Those who remain unconvinced that rising debt levels pose a risk to growth should ask themselves why, historically, levels of debt of more than 90 percent of GDP are relatively rare and those exceeding 120 percent are extremely rare. Is it because generations of politicians failed to realize that they could have kept spending without risk? Or, more likely, is it because at some point, even advanced economies hit a ceiling where the pressure of rising borrowing costs forces policy makers to increase tax rates and cut government spending, sometimes precipitously, and sometimes in conjunction with inflation and financial repression (which is also a tax)?

Even absent high interest rates, as Japan highlights, debt overhangs are a hindrance to growth.

9. Totally compulsive viewing of an encounter between Australian PM Julia Gillard and an agrieved voter in a shopping Mall.

The background here is Gillard promised not to bring in a carbon tax before election and yet is doing one now.

Why does John Key get off so lightly about his promise not to raise the GST?

10. Totally yet another Downfall parody video - But I still laughed. It's about the News of the World debacle.

30 Comments

Here's Bloomberg with a story on how flash mobs are forming to block foreclosures in Spain.

Anarchy is getting a run on. Good.

Spain has become a battleground between banks hurt by a five-fold increase in residential mortgage arrears since 2007 and debt-laden homeowners who are appealing to the government to reduce the burden on those facing foreclosure.

“In large parts of the U.S., you can just walk away from your home and your debt, and that contributed to the country’s banking crisis,” Jordi Fabregat, a professor of management and financial control atBarcelona’s Esade Business School, said by telephone. “That can’t be done here, so the banks are protected from defaults during a crisis.”

That ANZ letter is a serious breach by ANZ - a breach of ethics, trust, etc. How kosher is it to offer financial advice of sorts by stating "you'll have more money for other things"....it's a bloody disgrace and exposes the bank's true colours. Is it time for Kiwis to think seriously about shifting to building societies perhaps - or mattresses?

Then to blame a computer glitch - I can see this guy losing his job for lying if nothing else!!! This lady needs to get to the bottom of this by going to the Ombudsman - hopefully he has some teeth.

ANZ definitely do have a big mainframe upgrade going on, so it could possibly be true what they are saying, still strange though.

Pretty clever new computers they've got - codenamed Shark

Check out this 1 minute Bernanke - Ron Paul exchange where Paul reveals that helicopter Ben knows very little about money - why not use diamonds as reserves hahaha

http://money.cnn.com/video/news/2011/07/13/n_bernanke_paul_gold.cnnmoney/?iid=HP_Highlight

Ha.!.... wonderful exchange between Paul and Bernanke... I'll give that one to Ron Paul.

Ron Paul looks honest and trustworthy.... Ben B looks slippery like an eel.... (The dangers of having a powerful intellect without a heart.... maybe )

If you watch the video from TV3, they actually speak to the Ombuds(wo)man and her attitude is basically ... ANZ say they will be responsible and I trust them.

So, do you call that teeth?

And if it is true that this is all down to a "computer glitch" (and I think there's a Tui billboard in there somewhere) then that's almost more concerning. I pretty much expect them to push the boundaries of ethics in the pursuit of profit, but if their computer system is that out of control them I'm really worried.

I've written to ANZ's Talking Head, asking the following question:

Mr Simms

Please help me understand how "changing computer systems" has generated self-written letters to mortgage holders without human intervention.

The same question goes to the Banking Ombudsperson

Nice!

Re ANZ Letter

The mainframe did not write the content of the letter and the content is the problem.

Exactly Plan B.

There are two issues, the letter being sent in the first instance and then the content.

Both are disgraceful but the second is indefensible.

Maybe a lot of ANZ customers are quite happy to lower their mortgage repayments - they may have other higher interest debt as a higher priority to repay.... They can always elect to repay extra if on a floating mortgage anyway.

Some people complain if the repayments are held at previous levels if interest rates decrease ..

Well that is a stupid statement and you completely miss the point, the customer has already elected to pay a higher amount off their mortgage. They can always unelect to if they wish.

They can elect to do a lot of things other than the minimum payment, and all it takes is a call to the bank

But Since when did the bank and any right to 'elect' to adjust their customers payments options without asking?

Im arguing the same thing

you can still keep your current payments the same , but the term of the loan has to be reduced to reflect the increased payments .

what concerns me is when rates go up does that mean you can elect to increase the term back to what it originally was ? that seems to be the grey area .

What gets my goat is that I choose / signed a contract to float on a 30yr term but have the flexability to increase payments when in suits , not to have them say that I need to pay the minimum based on the changing terms .

MortgageBelt, people like you give the mortgage market the bad name.

FYI Graeme Hart may be encountering some resistance with his plan to take over the packaging world

Graham Packaging Co. bondholders plan to reject the company’s offer to buy back or change terms of outstanding debt before its $4.5 billion takeover by Reynolds Group Holdings Ltd.

“The offer is fundamentally flawed for all parties involved,” according to a letter to Credit Suisse Group AG, the manager of the tender offer, from lawyers at Willkie Farr & Gallagher LLP. “The holders do not intend to tender or consent pursuant to the terms proposed,” according to the letter, obtained by Bloomberg News from an investor.

High debt a risk to growth!....so does this apply to farm owners also or is it good for them to borrow massive amounts to convert to dairy or to buy the place next door at a high price because the bank's valuer mate said it was worth so much.

I suspect the bank employees who are foolish enough to drive their logo 4wd toys to the farms to try and sell more debt....well it might be a good idea to find out whether the farmer is a good shot first.

Banks are parasitic. It is up to individuals to learn from the stupidity of others or themselves on this score. The less we borrow, the better we will be. All debt is a risk to growth.

Producers of booze and fags, are forced to pay an excise tax...( this is a penalty tax because the products cause health costs...)

so why are banks not slapped with special penalty taxes on profits .... the product they sell obviously causes social costs too...???

How about a tax on borrowing then..

Now there's an idea - tax the overleveraged and those loaning to the overleveraged - given they're costing us all.

Wolly,

Ive never understood this line "Banks are parasitic". I feel very protective of the weak & vulnerable to loan sharks (the 30% type), but those who borrow to farm capital gains, aye ? what?

Banks ARE parasitic and lenders are greedy. Proportional to size.

Matt Taibbi

Courtesy of good friend and Supreme Court of Assholedom justice David Sirota comes this revolting list of Marie Antoinettoid moments from recent years, in an article called "The New 'Let Them Eat Cake!'"

http://www.rollingstone.com/politics/blogs/taibblog/the-new-let-them-eat-cake-20110713

I've got relations in the US - and indeed this statement rings so true there;

... things are so fucked that public school teachers and garbagemen making $60k with benefits are being targeted with pitchfork-bearing mobs as paragons of greed and excess. Wealth, in places outside Manhattan, southern California, northern Virginia and a few other locales, is rapidly becoming defined as belonging to anyone who has any form of job security at all. Any kind of retirement plan, or better-than-minimum health coverage, is also increasingly looked at as an upper-class affectation.

And indeed the most disaffected who think this way are the children of yesterday's middle class.

It's like those dirty rotten "feather bedding" firemen. Why can't they and the teachers and the garbos be more like hard working, selfless politicians? The likes of John Key and Phil Goff do it all for their love of their fellow Kiwis, not because of the huge salaries and incredibly generous fringe benefits.

This commenter was interesting, theres trouble coming.

Theo Hughes |14 hours, 54 minutes ago

I live in Minnesota (the 2nd highest Somalian population in the US), and my wife works in the health care business. I am a plumber and I am everywhere thru-out the Twin Cities and extended counties. Immigrants as soon as they move here go on disability, medicare, medicaid, welfare, social security, etc... I am running in to houses and apartments full of immigrant (infant to grandma) families who don't work but every one of them is getting money from the US government, and you and me are the ones giving it to them. My wife tells me daily about all of the immigrants who are on government aid and the constant hassle. And you know what? 75% of the time these scamming immigrants have a BMW or equivalent in the driveway, why? 10 people in a house with free income?, BMW baby!

Meanwhile my wife and I are middle income, and after taxes we are taking under 50% of each paycheck, and can barely afford a nanny to come to our townhouse. I vote a no confidence in our present government!

FYI via email from a reader who is an ANZ customer:

I too got this letter, I used to work for ANZ computer hitch my backside.

However, after one VERY frustrating call to customer “service” (I actually swore at the poor lady and I have never done that before). I asked for my loan payments to remain. She told me she would make the loan change application for me – but I didn’t want to change the loan!

I stated this and was told this was the process. I then received new loan documents and still do not understand why. However, this was for an additional borrowing against the house, not the original mortgage, so it will be interesting to see if my original mortgage loan payments change without my knowledge!

And here's the boilerplate response from ANZ

In the meantime I can confirm that ANZ is moving to The National Bank's

technology platform later in the year.

This means there will be some changes to products for ANZ customers, and

ANZ customers will also gain access to new products.

Our approach is always to inform those customers first via a letter and

then to speak directly with them to help them through any changes.

There are options for customers that give them the same banking outcomes

as they currently have. For example, if customers want to keep their

repayment amounts the same as they are now, all they need to do is

contact us to confirm this.

We also make sure that we talk with our customers about options that

best suit their financial needs.

For most customers the transition to The National Bank's technology

platform will be a seamless transition and they won't need to do

anything.

Customers being uncertain or confused by our letter is the last thing we

want to happen so we're sorry for any confusion or inconvenience caused.

Yours sincerely,

Craig Sims

COO, ANZ National Bank Ltd

Just how stupid do these people think their customers are? (Hint: probably "very")

And I'm now waiting for a letter from ANZ/NBNZ informing me that they've changed my credit card payment preferences from full balance to minimum payment. (Just to leave me with more to spend, you understand)

All I have to do is reapply for a credit card to avoid this happening.....

A coincidence is that last week BNZ didn't follow my instruction to keep my repayments at the same rate after my mortgage interest reduced by around 1% (the fixed term rate changed to a floating rate). And BNZ had told me by email a month and half ago that it would keep the repayment at the same rate.

Are they using the same computer?

Nope, but they share the same ethical compass, current heading swinging between "Dishonest" and "Incompetent"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.