Here's my Top 10 links from around the Internet at 10 am in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

Plenty of meat from the Euro debt crisis overnight to chew over...

1. What was he thinking? - Bloomberg reports Richard Chandler, the Kiwi billionaire based in Singapore, has increased his stake in troubled Chinese firm Sino-Forest to 11%.

You might recall the share price on this one collapsed after an independent analyst said the company, which has bought forests in Northland, was fraudulent.

Chandler is getting in after John Paulson, the guy who made a fortune shorting the US sub-prime market, got out in a hurry.

Chandler has a history of buying into Korean companies with corporate governance problems and helping to clean them up.

This could be entertaining.

Good luck to him.

Here's Bloomberg.

Chandler, a New Zealander who Forbes said last year had a net worth of $3.1 billion, is the third-largest shareholder in Sino-Forest after Davis Selected Advisers LP and Wellington Management Co., data compiled by Bloomberg show.

In 1986, Chandler and his brother Christopher founded emerging-markets investment firm Sovereign Global, which eventually grew to hold $5 billion in assets, according to Institutional Investor. They eventually parted ways amicably and closed Sovereign. Richard started Singapore-based investment firm Orient Global in 2006.

2. It's not over yet - Jeremy Warner at The Telegraph makes the good point that the European 'Marshall Plan' for the PIGS is no ultimate solution.

That ultimate solution is a full fiscal union for Europe where essentially the Germans control tax rates and spending in every European country.

That's the only way to keep the euro together.

Here's Warner:

For months now, eurozone leaders have been promising to do whatever it takes to save the euro. Yet up until now they have failed to match words with actions, if only because what needs to be done to keep the show on the road – move towards some form of fiscal union – has been politically unacceptable to the nations who must sign the cheques.

Now, finally, we have some movement. Thursday's draft package of measures to ease Greece's debt burden and enhance the scope of the bailout fund was rather more comprehensive than I'd been expecting. It's not quite what some are portraying it as – the day that Europe signed up to the creation of a superstate – but it's another big step in that direction. The more positive mood in markets on Thursday suggests that it might even buy some temporary respite.

Yet any analysis of the detail immediately reveals the package to be shot through with difficulties and ambiguities, both political and economic. It's messy and incoherent, as well as falling some way short of what's ultimately required to knock the wider euro crisis on the head. By creating extreme moral hazard through ultra low interest rates for the afflicted nations, it also threatens to sow the seeds for an even worse eurozone debt crisis at some stage in the future.

3. Planning for default - The Telegraph reports the Federal Reserve has started making plans for a default of the United States.

Not so reassuring.

"We are in contingency planning mode," Charles Plosser, president of the Philadelphia Federal Reserve Bank, told Reuters. "We are all engaged ... It's a very active process."

Despite repeated warnings of the financial disruption that's likely to ensure from a default, The White House, and both parties in Congress, appear no closer to striking a deal as this week draws to an end. President Barack Obama and the Republicans and Democrats are trying to reach an agreement on how to cut America's long-term deficit as a condition of raising its debt ceiling.

Mr Plosser said that the Fed is currently examining the multiple questions and dilemmas that would ensue from a default. The central bank, for example, accepts US government bonds, or Treasuries, as collateral for the loans it makes on a daily basis to banks.

"Do we treat them as if they didn't default, in which case we would be saying we are pretending it never happened," Mr Plosser said. "Or do we treat them as if they defaulted and don't lend against them?"

4. Useful steps but not much of a strategy - The FT's Wolfgang Munchau is always a useful read on the machinations of European debt deals.

Here's his view on the one(s) overnight:

It appears that the eurozone is forcing Greece into a selective default. As part of such a package, short-term Greek debt will be more or less forcibly converted into long-term debt. The wretched bank tax is mercifully off the table. And the European financial stability facility will most likely be allowed to purchase Greek debt at a discount. Let us not mince words here.

This would be a default, the first by a western industrialised country in a generation. I am not quite sure how it is possible for the European Central Bank to agree to this, or to all of this. But I will surely be intrigued to hear how Jean-Claude Trichet will manage to be consistent with what he said a few days ago. There are also reports that the eurozone leaders may accept a more flexible EFSF beyond those bond purchases.

The outlines of the agreement, as they have been presented so far, still fall short of the main goals – to have an EFSF capable of dealing with Italy and Spain – and to have a Greek package that reasserts debt sustainability one way or the other. Like all decisions in the European Council, this is a compromise for sure. But there are limits to compromises when you are dealing with a contagious debt crisis. You either do enough, or you do not. They are still lacking a strategy to deal with the wider crisis.

5.' Dig into the toolbox' - As John Key meets the US Federal Reserve in Washington this week, the world's most important central bank is busy digging through its money printintg tool box looking for ways to rescue the US economy.

Here's the latest chat from one of the Fed Governors via Reuters:

If the U.S. economy does not show signs of sustainable improvement this quarter, the Federal Reserve should dig into its toolbox to find new ways to help it along, a top Fed official said on Thursday.

The Fed has held short-term rates near zero since December 2008 and in an unprecedented move, bought a total of $2.3 trillion of long-term securities to stimulate an economy struggling to right itself after the worst downturn since the 1930s.

But signs the recovery is flagging, again, suggest the economy needs more gas, and soon, Chicago Federal Reserve Bank President Charles Evans told a small group of reporters in a joint interview.

"If it were easy to do, if we had a very effective policy tool like a positive funds rate, if we could cut that by 100 basis points, then I would almost surely be advocating something like that," Evans said. "But in the absence of that, I think we have to think about the other tools."

6.Privatisation won't work - UBS economist Stephane Deo argues privatisation is not the solution to fixing a nation's debt problems. Are you listening John Key?

Here's the Economist on Deo's paper:

Deo suggests three alternatives to privatisation.

First, the likes of Greece may be able to return to the bond market earlier if they pledge revenue from state-owned assets as security against new bonds. Second, leasing state-owned property rather than selling it would provide consistent deficit-reducing revenue year after year, rather than a one-off debt reduction. Finally, rather than privatising state-owned enterprises, why not impose market discipline, while retaining ownership of the subsequent profits?

Deo is right to criticise the Pavlovian reaction of governments faced with a combination of high debt and readily available assets, to sell the assets, and sell them quickly. That neither maximises long-term revenue, or, more importantly, lays the ground for effective institutional reform. However to argue privatisation should be avoided altogether places too much trust in governments, whose poor economic management created problems in the first place.

7. Markets betting on no debt deal - The Economist's freeexchange blog highlights how the markets have started pricing in a US default in recent days.

It's worth noting today's big market move—at Intrade. Contracts on conclusion of a debt deal by the end of July dropped sharply today on high volume, indicating that no deal is seen to be the most likely outcome. More worrisome still, contracts on completion of a deal by the end of August also sank. Let there be no doubt: the failure to reach a deal on the debt ceiling through the month of August would mean a return to recession. That this isn't entirely out of the question is a frightening thought.

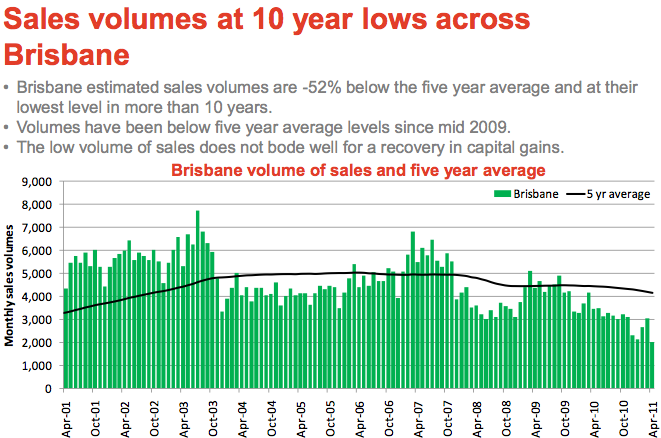

8. Problems in Brisbane - MacroBusiness points out a Queensland real estate agency group called Go Gecko has kicked out its CEO. The pressures are growing in Australia's housing market.

Unless we see a major turn around in credit issuance I really can’t see the other branches lasting. It would seem that the Real Estate market is in for some consolidation. Death of the little players while their carcasses are picked over by the big boys as they too down-size to meet the market.

Next to go Mercedes and BMW leasing services.

9. Totally Saturday Night Live on Ronald Reagan - Maybe he didn't have Alzheimer's...

10. Totally Clarke and Dawe - They do their thing on Murdoch's appearance before the British parliament. All they can do is read between the lines...

42 Comments

...privatisation is not the solution to fixing a nation's debt problems. Are you listening John Key?

John there are just two ways to grow the economy:

1/ Increase working-age population or

2/ Increase productivity

GDP - Consumption (Business & Consumer) + Investment + Government spending + NET exports (exports - Imports.)

But can you win an election promising harder working conditions and longer working career

You're seeing the objective of privatisation as being to raise some quick money to pay off debts. But that's not the objective of privatisation. The objective of privatisation is to raise the productivity of the assets - your point 2. That's why it says, in the very article that you are quoting,

However to argue privatisation should be avoided altogether places too much trust in governments, whose poor economic management created problems in the first place

So how about privatise the management and operations only, and government learn to manage facilities management specialists and then deploy the same approach into other sectors? We retain the assets, the income and gain efficiency.

So why privatise, in the manner being discussed, if it's all about efficiency?

It's not even about paying down debt, Labour have shown another way - what's wrong with it, from a whole economy perspective?

Cheers, Les.

What garbage. Public and private owned businesses can equally be poorly or well run. There is nothing inherent in public ownership that says greater inefficiency than the private sector.

The real reason for the privitisation (like the last round and the round before that) is so that well connected people can loot the common wealth.

Andrew the usual silly throw away lines

Colin

The usual intelligent denial. :-)

There is nothing inherent in public ownership that says greater inefficiency than the private sector.

Yes, there is. Perverse incentives, unclear objectives and short term political expediency.

You mean like the perverse incentives for traders on Wall Street? Or short term expedincy shown by TransRail?

Hello, missed Enron? look it up

Simple, I have yet to see any significant difference between public or private well run companies/institutions....on the other hand both can be in-efficient....This is where I like the SOE model, it seems to be functioing very well.

regards

MdM - you're more intelligent than that.

You know very well that - all things being equal - the private sector will be more expensive due to the need to generate profit.

That, in turn, means that private enterprise can't/doesn't look far ahead, and left to it's own devices, will keep using resources until it hits the wall (it will keep up a maximised cash flow with no other goal). That also means it will pay - if necessary - spin-doctors to confuse any issue that threatens it's cash flow. It's not a matter of ethics or responsibility, it's a matter of collectively myopic madness. Homo Lemmingus.

Come on - you're obviously on the high side of 100 IQ - the next generation need folk like you to work it out. We can forget the Gonz and the Martyh (did you work out who he was?) types. It need your kind to epithanise.

Now that there is more proxy in existence, than there is ability to underwrite, you really think a profit-only motive, jointly and severally - is any kind of answer?

Oh Puhleeze.

The Objective of Privatization, for the consultants, is a big fat consultants fee. Whatever drivel they have to spoon out, such as, "the objective of privatization is to raise the productivity of the assets" should really be read as "the object of privatization is to fleece the morons that sell and line the pockets of the smarmy consultants who dribble on about efficiency"

The objective of private owners is to make a big, fat profit. IF they run it more efficiently THEN they get a BIGGER, FATTER profit. And if they can both run it more efficiently AND charge more, then the bigger, the fatter the profit.

If it continues in public ownership, run mildly inefficiently, and makes a smaller profit, the END USER is likely to pay LESS for the service. For me, that is the most important result. What is the end result on my spend each month?

And just as importantly, instead of a one off boost to the budget, which is quickly spent, If the profitable SOE's are retained in public ownership, then there is an ongoing income stream which can go towards REDUCING my tax contribution.

As a taxpayer, I object to taxpayer owned assets that are producing ongoing profits going into priviate ownership for a one off fee. Especially when I will then have to pay more for the privilege. And especially when it will probably result in higher taxes on my income.

GDP has to be used with great caution ..

Building prisons, Fixing Leaky homes, Rebuilding CHCH all expand GDP but these are unlikely to make us wealthy.

One can argue they are not growth in the conventional sense

We need to focus on the net exports component .. providing goods and services that someone wants to buy and selling them for more than it costs to make them including a return on capital.

Greece to default as EU agrees €159bn bailout

Greece set to lead the eurozone's first-ever default as deal paves way for economic integration.

http://www.telegraph.co.uk/finance/financialcrisis/8653634/Greece-to-de…

3) Spend less

Italy's property sell-off: 9,000 lots in state sale

drjonathanwilson

12 minutes ago

http://www.telegraph.co.uk/finance/financialcrisis/8653634/Greece-to-de…

Will the Bundestag block this illegal putsch on the German

taxpayer? – No

- Will the German constitutional court block this illegal putsch

on the German taxpayer? No

- Does the eurozone's €440bn bail-out fund (EFSF) have sufficient

fire-power – No but it does not matter as the principle of "collectivisation of risks" has been established

- Does this illegal putsch on the German taxpayer solve the

collective on-going insolvency of the PIIGS – No

- Will the German Bundesbank, step by step, via guarantees

to the ECB become the eurozone’s toxic bank for Italian, Spanish, Greek, Portuguese, banks’ bad debts – Yes

- Who will rescue the now insolvent Bundesbank (Germany) as

their spreads rise inexorably? The American taxpayer via the Fed and the IMF as it will be classed as “too big to fail”

- When does this madness dressed up as “remorseless logic”

finally take down the global financial system? – soon but I am not a theologian

An Ode to Insanity

For the want of a Drachma, Greece was lost

For the want of a Greece the PIIGS were lost

For the want of the PIIGS, Germany was lost

For the want of a Germany the Euro was lost

For the want of a Euro the Dollar was lost

For the want of the Dollar the global financial system was

lost

For the want of a global financial system a global economy

was lost

For the want of a Drachma

Jonathan

FYI from Citigroup's William Buiter on the subject of water HT Troy

http://ftalphaville.ft.com/blog/2011/07/21/629881/willem-buiter-thinks-…

I expect to see in the near future a massive expansion of investment in the water sector, including the production of fresh, clean water from other sources (desalination, purification), storage, shipping and transportation of water. I expect to see pipeline networks that will exceed the capacity of those for oil and gas today.

I see fleets of water tankers (single-hulled!) and storage facilities that will dwarf those we currently have for oil, natural gas and LNG. I see new canal systems dug for water transportation, similar in ambition and scale to those currently in progress in China, linking the Yangtze River in the South to the Yellow River in the arid north.

HB ... Fresh water production is not a technical issue - just public emotion and cost

Nukes are ideal for running desalination plants.

The waste cooling heat can be used directly as the major energy source required to heat the water prior to evaporation at low pressure.

Small problem of public perception despite nuclear generation never having killed anyone in the western world while thousands die from coal mining and emissions every year.

I would suggest a nuclear desalination will always be cheaper than shipping it with all it's own emission issues.

Looks like shipping ... Sigh !

JB - I think you dropped a 'de'.

Now fund managers and ratings agencies are preparing plans to deal with a US default.... HT Troy via email

http://www.nytimes.com/2011/07/21/business/economy/wall-st-makes-fallba…

On Wall Street, Treasuries function like a currency, and investors often use these bonds, which are supposed to be virtually fail-proof, as security deposits in their trading in the markets. Now, banks are sifting through their holdings and their customers’ holdings to determine if these security deposits will retain their value. In addition, mutual funds — which own billions of dollars in Treasuries — are working on presentations to persuade their boards that they can hold the bonds even if the government debt is downgraded. And hedge funds are stockpiling cash so they can buy up United States debt if other investors flee.

The rating agencies, which control the fateful decision of whether the nation deserves to have its credit standing downgraded, are surveying other entities that would be affected by a United States default — like insurance companies and states — and issuing warnings that a United States downgrade could result in several other ratings cuts. States that might be downgraded, in turn, are trying to reassure the market that they could still pay their bills on time.

This looks like fun. It's a 75 page academic paper by a Deakin University Masters Student, Philip Soos on "The end of Australia's A$2 trillion housing party". HT Danielle by email.

http://www.prosper.org.au/wp-content/uploads/2011/07/PhilipSoosBubbling…

Many property related ratios and valuations, for instance, house price to rent, household debt to assets, median house price to income multiple, mortgage debt to GDP, household debt to disposable income, indicates that residential property is severely overvalued. Having tracked the rate of inflation from 1992 to 1996, house prices have increased substantially by 127% during 1996-2010, indicating that

prices are no longer in step with underlying fundamentals. Rents have not moved in line with housing

prices, and it has been found that Australia has no shortage or undersupply of housing.

Without further government intervention in the property market, a collapse in housing prices appears

unavoidable, with prices peaking in the last quarter of 2010. While a “soft” landing can be hoped for,

the likely result will be a severe recession or a debt-deflation, with values declining by approximately

40% in order to return to underlying fundamentals. If this unwanted outcome occurs, it is argued that

the most efficient course of action is to follow the Swedish model of the early 1990s crisis and bail out

debtors by writing down debts commensurate with the ability to pay while ensuring that creditors are

held responsible for their role in over-lending and thus playing a primary role in the formation of the

bubble.

Mark Steyn has some useful things to say here HT Brendan via email.

http://www.steynonline.com/content/view/4271/26/

From Athens to Madison, Wis., too many people have gotten used to a level of comfort and ease they haven’t earned.

FYI from Sophia Rodrigues at Market News. She thinks (from an unnamed source) there's a real chance the RBNZ might hike next Thursday. We'll see.

https://mninews.deutsche-boerse.com/acl/insight-rbnz-actively-consideri…

cheers

Bernard

This is fun. One of the options to reduce the size of the US budget deficit is a bigger and stronger capital gains tax...

http://www.bloomberg.com/news/2011-07-20/senate-debt-cutting-plan-yield…

The bipartisan deficit-reduction plan gaining momentum in the U.S. Senate would likely require lawmakers to curtail or end the preferential tax treatment of capital gains and dividends.

The proposal from the so-called Gang of Six doesn’t mention capital gains and dividends. The plan’s goals for income tax rates, federal revenue and progressivity would likely require Congress to raise tax rates on investment income, said tax analysts who favor and oppose preferential tax rates on capital gains and dividends.

I wouldn’t laugh for too long if I were you Bernard. Here’s some paragraphs from the Bloomberg article.

Individual and corporate income is taxed at a top rate of 35 percent. Dividends and capital gains on most assets held longer than one year are taxed at 15 percent, under tax laws set to expire at the end of 2012.

The outline calls for three individual income tax brackets with a top rate between 23 percent and 29 percent, and the corporate rate would drop to a single rate of between 23 percent and 29 percent. The tax system would need to retain its current progressivity and keep benefits for low-income workers such as the earned income tax credit.

To make up the revenue and to offset lowering top income tax rates on high earners, lawmakers will look at investment taxation.

First of all, Labour’s silly scheme wants to introduce a CGT AND put the top tax rate up! Not lower it. And to 39 percent! The Americans want to drop theirs to 29 percent! Labour’s gay proposal is very different to what the Americans are debating.

DavidB - the US top rate at 35% starts at an income of in excess of $370,000pa.

Lowering that'll help a whole heap of middle income Americans! - NOT

And as far as the "tradeoff" of raising taxes on capital gains - a laugh, given the deflationary state of the asset market over there.

Looks to me like another round of income tax cuts for the privileged classes.

And Felix Salmon at Reuters points out that Greece has defaulted...

http://blogs.reuters.com/felix-salmon/2011/07/21/greece-defaults/

Overall, this looks like a deal which can quite easily be scaled up and used as a framework for future default/restructurings. I don’t know if that’s the intent. But there’s nothing here to reassure holders of Portuguese and Irish bonds — or even Spanish and Italian bonds, for that matter — that they’re home safe. Greece will be the first EU country to default on its debt. But I doubt it’ll be the last.

Here's Paul Krugman on America's "Lesser Depression"

http://www.nytimes.com/2011/07/22/opinion/22krugman.html

Even if we manage to avoid immediate catastrophe, the deals being struck on both sides of the Atlantic are almost guaranteed to make the broader economic slump worse.

In fact, policy makers seem determined to perpetuate what I’ve taken to calling the Lesser Depression, the prolonged era of high unemployment that began with the Great Recession of 2007-2009 and continues to this day, more than two years after the recession supposedly ended.

thats a great Krugman piece thanks Bernard, although I don't know if "thanks" is the right word as it is pretty depressing!

so ignore bank economist BS about robust recoveries, the world is really only faced with 2 scenarios - depression, or a very very sluggish and long "recovery" (I'm not sure if that is the right word) ala Japan since the 1990s. I think the latter is more likely (there is my "optimism" coming to the fore)

Bernard,

Robert Shiller says you need to chillax a little about debt ...

http://www.slate.com/id/2299718/

Oh yeah...debt is not relevant....so says Robert Shiller....!

He has Shiller for brains.

There is a possibility of some earth shaking news from Greece in the next 3 days.....

Monetary union, always unworkable, has set in train a European disaster

The eurozone is edging closer to doomed fiscal union. But sceptics shouldn't celebrate, as the chaos will reach Britain too

http://www.guardian.co.uk/commentisfree/2011/jul/21/monetary-union-euro…

For those of you who saved during the bubble of insanity...now you can pay the price to bail out the splurging deeply indebted idiots...a decade of negative returns on your savings ought to teach you not to save again.

Our Alan has you by the short hairs and you will be taxed on any return you get and Alan will debase your capital a good 40% by 2017....serves you bloody right.

And you other buggers who bust your arse to have a nice home and a show garden....a bloody good dose of higher rates ought to teach you not to improve your property. The name of the game is to make it a slum neighbourhood...that way you get rewarded with subsidised rates.

Wally

Nice, I especially liked your term "Bubble of Insanity" - because thats what it was!!!!

I was thinking about this recently. Its just incredible really the ride that everyone went on from 2002 to 2008, it was just a debt fuelled mirage of wealth, anyone who wasn't religously wedded to it could see it a mile away. I knew come 2005 that when professional couples were struggling to afford even a low-middle house price in Auck that something was seriously wrong.

another thing I've contemplated is to what extent 9/11 might have been, at least partly, a catalyst for all that wicked nonsense? Did 9/11 suddenly bring home more strongly our mortality in the west? Did this fuel even more of a "live for today, not tomorrow (because we mightn't be around tomorrow)" approach?

BTW here's a good balanced piece on the RWC, suggesting that its economic benefits mightn't be as great as the spin suggests (nothing really new, a number of us here have been arguing similar things months ago):

http://www.stuff.co.nz/national/5331464/Slow-uptake-for-RWC-packages

Funny if silly Kiwi woke up to being rorted and started to dump old cars on the front paddock and spray graff on the walls...let the paddock grow heaps full of weeds, bash holes in the fences and work hard to lower the tone of the street....must be a huge saving on rates you know. Hell we might see competitions to be the worst street in the town.

An what is Alan going to do when his masters tell him they are pissed cos punters have stopped depositing the savings...are we to face court imposed punnishments for not opening bank accounts and depositing the little we might have left over each week...He did afterall leap over his Terrace building when his masters screamed out that too few were borrowing the credit cos rates was too high...!

A smelly old Billy Goat or a barking shite of a dog or three usually lowers the tone of the street quicker than most things....jeez there might even be scope for a business here...suss out where the valuation pointy heads are going next and turn up offering to bugger the street for a few bob...I doubt the pointy heads will recognise the same wrecks, dogs,goat and graff on the walls...

Hyper-inflation? no...

So what do the Libertanians? yes of course hyper-inflation....so after 3 years, where is it?

http://krugman.blogs.nytimes.com/2011/07/22/this-age-of-hicks/

regards

Our defining moment will be when the USA finally admits to the world that they are one of the poorest nations in the world, not the richest? Imagine that level of honesty? Unfortunately we can probably only imagine it.

Starting a big war will be far less embarassing for them.

When's the war? When some big power decides to wrestle the reserve currency status off USA. How embarassing that will be for the USA - caught with their hands in the lolly jar.

Here's an interesting thought for Sunday....Alan's efforts to debase the kiwi are being thwarted by a rising fx rate which means us savers can get more bangs for a buck if we buy imported muck....which kinda buggers his wishful dream that we might save and save and save...so sod the local banks and the pisspoor deposit returns that are taxed to hell and back...we shall be the splurgers now...we will blow our savings on the imported muck and by our actions the trade deficit will grow like Jack's beanstalk. hahahahaha

Oh and keep the costs of each import below $400...no theft tax to pay that way..hahaha

Or take a trip overseas and blow the savings somewhere else....no point in dying rich is there!

Hah....named the two pups finally...hope it gives them more energy when chasing the sheep...Higgs and Boson...gotta be a sure bet!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.