Here's my Top 10 links from around the Internet at midday in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I wonder what it would be like to drink Dom Perignon like it was Speights with a 24 year old woman on my arm....I need to borrow some money from Allan Hubbard.

1. The left may have been right all along - The former editor of the 'Torygraph' Charles Moore begins to wonder in this column whether the Left may have been right all along.

This reads a lot like my mea culpa of last year where I said free market capitalists blew up the world.

Moore connects his growing disillusion with the revelations about how Murdoch drove the political agenda in Britain.

Fair enough.

Murdoch's support for Thatcher and his decision to break the print unions were seminal events in the rise of the free market idealogues.

Now the cloak has been removed from the emperor.

I'm still not sure the Left is really right. And neither is Moore.

But he is saying the purely Right is wrong.

And this is not some nutter. He was the editor of the right's voice, The Telegraph, for years. HT Kokila via email.

It has taken me more than 30 years as a journalist to ask myself this question, but this week I find that I must: is the Left right after all? You see, one of the great arguments of the Left is that what the Right calls “the free market” is actually a set-up.

The rich run a global system that allows them to accumulate capital and pay the lowest possible price for labour. The freedom that results applies only to them. The many simply have to work harder, in conditions that grow ever more insecure, to enrich the few. Democratic politics, which purports to enrich the many, is actually in the pocket of those bankers, media barons and other moguls who run and own everything.

The credit crunch has exposed a similar process of how emancipation can be hijacked. The greater freedom to borrow which began in the 1980s was good for most people. A society in which credit is very restricted is one in which new people cannot rise. How many small businesses could start or first homes be bought without a loan? But when loans become the means by which millions finance mere consumption, that is different.

And when the banks that look after our money take it away, lose it and then, because of government guarantee, are not punished themselves, something much worse happens. It turns out – as the Left always claims – that a system purporting to advance the many has been perverted in order to enrich the few. The global banking system is an adventure playground for the participants, complete with spongy, health-and-safety approved flooring so that they bounce when they fall off. The role of the rest of us is simply to pay.

This column’s mantra about the credit crunch is that Everything Is Different Now. One thing that is different is that people in general have lost faith in the free-market, Western, democratic order. They have not yet, thank God, transferred their faith, as they did in the 1930s, to totalitarianism. They merely feel gloomy and suspicious. But they ask the simple question, “What's in it for me?”, and they do not hear a good answer.

2. OECD proposes Britain adopt a land tax - Iain Cowie reports at The Telegraph that the OECD wants Britain to adopt a land tax and scrap all sorts of GST exemptions.

Cash-strapped governments have long wanted to grab a bigger share of the wealth we hold in housing, now the Organisation for Economic Co-operation and Development (OECD) says Britain should adopt a Continental European-style property tax.

Pier Carlo Padoan, chief economist of the OECD, says George’s Osborne’s cuts are “appropriate,” but the Chancellor must do much more to stimulate Britain’s economy. Mr Padoan argues he should scrap many VAT exemptions – including food, passenger transport and domestic fuel – and abolish council tax and stamp duty in favour of “a property tax based on market values.”

Leading accountants described the proposals, to be set out in the August edition of Prospect magazine, as “revolutionary” and predicted they would hit house prices and prove extremely unpopular. Pensioners and even tenants would suffer higher costs under a property tax, accountants predict.

3. A German revolt - Remember last week's German debt deal? Ambrose Evans Pritchard at Telegraph reckons Angela Merkel will have problems getting political approval for it.

Couldn't resist the picture. This is far from over yet.

German Chancellor Angela Merkel is facing a storm of protest at home after yielding to EU calls for radical action to shore up Spain and Italy, raising doubts over her ability to implement the package.Ms Merkel is relying on support from opposition Social Democrats to push the deal though the Bundestag, but this is politically dangerous and may threaten her grip on power if Germany has to put yet more money behind the summit pledges, as appears likely. Mr Schäffler said there is already talk of a "third rescue package" for Greece.

Jacques Cailloux from RBS said EU leaders are at last "getting the message" but the deal is not enough to halt the crisis at any level. Greece's debt burden will fall by just 10 to 20 percentage points of GDP, still leaving it "unsustainably high" near 140pc next year.

"It is a question that, I think, is worthy of serious consideration: Should we take steps to avoid a crippling, decades-long depression that would lead to disastrous consequences on a worldwide scale? Or should we not do that?" asked House Majority Leader Eric Cantor (R-VA), adding that arguments could be made for both sides, and that the debate over ensuring America’s financial solvency versus allowing the nation to default on its debt—which would torpedo stock markets, cause mortgage and interests rates to skyrocket, and decimate the value of the U.S. dollar—is “certainly a conversation worth having.”

5. Remember Jeremy Grantham's epic Peak Everything note? Here's Part II - Back in April hedge fund supremo Jeremy Grantham put out an excellent note on Peak Everything and rising commodity prices.

Now he's come out with a followup focused on soil erosion and problems with potash and phosphates.

Although we will have energy problems with peak oil, this is probably an area where human ingenuity will indeed eventually triumph and in 50 years we will have muddled through well enough, despite price problems along the way.

Shortages of metals and fresh water will each cause severe problems, but in the end we will adjust our behavior enough to be merely irritated rather than threatened, although in the case of metals, the pressure from shortages and higher prices will slowly increase forever.

Running out completely of potassium (potash) and phosphorus (phosphates) and eroding our soils are the real long-term problems we face. Their total or nearly total depletion would make it impossible to feed the 10 billion people expected 50 years from now. Potassium and phosphorus are necessary for all life; they cannot be manufactured and cannot be substituted for. We depend on fi nite mined resources that are very unevenly scattered around the world.

6. Ian Narev's dad is disappointed - Ian Narev, the Kiwi appointed to replace fellow Kiwi Ralph Norris as CBA CEO, beat out another Kiwi Ross McEwan in the race for the top job, it seems.

Here's Andrew Main at The Australian, with some comments from the news conference.

Very usefully, he has a sense of humour. Asked at the end of the press conference whether he'd ever have imagined moving from law to banking, Narev smiled and said: "My father, who's a lawyer, is very disappointed."

But there are always losers when a new chief executive is appointed and Ross McEwan, the rangy head of retail at the bank and another Kiwi, was the clear runner-up by all official and unofficial assessments.

Chairman David Turner, the former Brambles chief executive for whom adjectives such as "civilised" and "patrician" might have been devised, specifically noted that he hoped McEwan would be staying on at CBA.

7. How the Chinese will extend and pretend - Caixin has an excellent long article on how many Chinese banks are managing to roll over a lot of these debts connected to non-performing local government loans on 'Bridge to nowwhere/Ghost city' projects. They are borrowing the funds to do it from rich Chinese by offering high interest rates on sliced up versions of the bad loans...

Sound familiar?

The nation's banks have been introducing new wealth management investment products at a blurring pace over the past year, dazzling upper-class clients with fat catalogues of high-yield investment opportunities. Yet Caixin has learned from bank and regulatory sources that much of the wealthy investor cash pouring into short-term, high-risk products is being rolled over by banks to provide fresh financing for long-term investments, including unfinished property developments, local government financing platforms, railway projects and private equity.

The rollover game is providing badly needed funds for infrastructure projects for which credit has dried up over the past year with every notch of monetary tightening by the central government. It's helped offset the government's rising bank deposit reserve requirement, for example, which has crimped bank lending. At the same time, some industry experts warn, the banks may be fobbing off long-term investment risks to their wealth management clients.

By offering the well-to-do a dizzying variety of investment products along with promises of near-double-digit returns, some fear banks are leading wealth management clients into the same trap that caught U.S. investors before they were fleeced during the 2007 subprime mortgage crisis.

8. Signs of another Irish bailout - Reuters reports that European leaders agreed on the sidelines of the meeting to agree on Greece's second bailout that they would also bail out Ireland again if necessary.

Euro zone countries have agreed to keep funding Ireland beyond 2013 if it is not able to tap debt markets, Finance Minister Michael Noonan said on Friday, signaling for the first time doubts about Dublin's ability to regain its economic sovereignty.

Euro zone leaders agreed a second rescue package for Greece at an emergency summit in Brussels on Thursday and Noonan said part of the deal involved a pledge to keep propping up Ireland and Portugal provided they were meeting targets under their existing rescue programs.

9. 'He drank Dom Perignon like it was Speights' - David Fisher at the Herald on Sunday reports on Gavin Bennett, the guy at DataSouth who borrowed NZ$23.5 million from South Canterbury Finance to do some fancy things in Sydney and now it's gone missing...

Bennett, sole director and shareholder, says there is a reasonable explanation for the allegedly missing money - but refuses to say what it is.

The $23.5m is likely to be covered by taxpayers. The money was borrowed by one of his companies from South Canterbury Finance Ltd - which was covered by a taxpayer guarantee.

The paper has been told of how Bennett set up an Australian arm of the business and began enjoying the high life across the Tasman. He was seen on the town with attractive women 20 years his junior, drinking the finest champagne in some of the city's best bars - and being chauffeur-driven in luxury cars. "He drank Dom Perignon like it was Speights," said one associate.

10. Totally Jon Stewart on how much money is needed to run for US President...

16 Comments

#2 Land tax?

Wash your mouth out!

But is that not what we need right now, right here?

Certainly not a stupid CGT with nil immediate revenue.

Yes to Land Tax, but I've been saying that for a while now...

cheers

Bernard

BH - then you haven't been listening too good.

The article gets it

This is about wringing out the last of the dishcloths.

Sorry, but opening up cheap housing on the peripheries of cities will neither lower house prices (relative to average incomes) - something the curtailed ability to work must enforce.

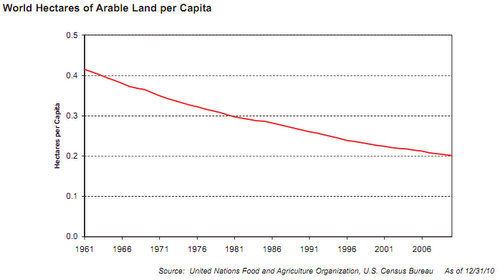

You'd have to do it exponentially, to make any difference anyway - any ideas on how that interfaces with the 'arable land' graph?

And then there the reverse gaussian graph - the one where things get cheaper and cheaper, as economies of scale chew into the easiest resources, where the process then slowes down via the fruit hanging higher, whilst becoming less plentiful. Then it drops away, less and less good fruit on fewer and fewer trees, so more relatively expensive if you can get it at all.

Caygill explained it re generation - from here on they don't get cheaper - they get to be the least-expensive option. Same with housing, I'm afraid.

But it is one way for Govts (and corporates) to sponge up the remaining small-person wealth.

Taxing land just leaves it in the hands of the richest. They're the last ones standing.

FYI America starting to get grumpy with the ratings agencies now..

http://www.reuters.com/article/2011/07/22/us-usa-debt-sp-idUSTRE76L5GI20110722

cheers

Bernard

LOL......

regards

FYI from Rob via email:

They're not. They're reacting. Driven by ideological impulse and expedience. Same here.What Were They Thinking? by Elizabeth Drew | The New York Review of Books

Someday people will look back and wonder, What were they thinking? Why, in the midst of a stalled recovery, with the economy fragile and job creation slowing to a trickle, did the nation’s leaders decide that the thing to do—in order to raise the debt limit, normally a routine matter—was to spend less money, making job creation all the more difficult?And here's Ron Paul, the godfather of the Tea Partyists, actually saying default would not be the end of the world.

Debate over the debt ceiling has reached a fever pitch in recent weeks, with each side trying to outdo the other in a game of political chicken. If you believe some of the things that are being written, the world will come to an end if the U.S. defaults on even the tiniest portion of its debt.

In strict terms, the default being discussed will occur if the U.S. fails to meet its debt obligations, through failure to pay either interest or principal due a bondholder. Proponents of raising the debt ceiling claim that a default on Aug. 2 is unprecedented and will result in calamity (never mind that this is simply an arbitrary date, easily changed, marking a congressional recess). My expectations of such a scenario are more sanguine.

I think Ron Paul is sort of the least crazy of the very Republican crazies...strange as he's more libertarian to my mind.....but at least he's somewhat honest in his views, unlike the rest of the fruity loops.... I wonder if he is right, I like a saying never fight a battle unless you have to and never fight unless you can win....leaving this mess til later will guarantee a loss....doing it now might just clean out tthe GOP, get re-balanced and see sanity and democracy return......or maybe not.

regards

Ron Paul makes sense and talks about things like scaling back the military, auditing the Fed, etc. It's unbelievable that in its current over-extended state of decay, the US will contemplate cutting all kinds of social spending but will not look at the military.

If it forced them to actually address their problems, a default at this point is the best thing that could happen.

Mish on 'Smoke and Mirrors' plans

http://globaleconomicanalysis.blogspot.com/2011/07/reid-pelosi-push-smoke-and-mirrors-debt.html

And whether China's real estate bubble is set to pop

http://globaleconomicanalysis.blogspot.com/2011/07/property-loans-halted-in-chinas-2nd-and.html

Such a shame Ron Paul is too smart for most Americans to understand he is the only guy they should vote for.

And here's UK Business Secretary Vince Cable's view of the Tea Partyists...

Business Secretary Vince Cable said "irresponsible" people who had been gleefully anticipating the collapse of the euro currency had been confounded after European leaders agreed a second rescue package for debt-stricken Greece last week.

"The irony of the situation at the moment, with markets opening tomorrow morning, is that the biggest threat to the world financial system comes from a few right-wing nutters in the American congress rather than the euro zone," he told BBC television.

Cable, a former economist known for speaking his mind, has previously denounced bankers as "spivs and gamblers."

did you google Santorum????

Do you mean Rick Santorum?

funny as....

regards

yeah.... John Stewart from the Daily Show made the suggestion... I laughed out loud in the office and not for the first time got strange looks... brilliant!

Chinese banks:

http://www.businessinsider.com/wsj-chinese-banks-are-worse-off-than-you-think-2011-7#ixzz1SxPL3hZs

Who holds US debt ?

http://prorevnews.blogspot.com/2011/07/who-holds-americas-debt.html

Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail.

Somebody should show that Grantham graph of declining arable land per capita, to Tony Alexander, HughP and PB.

Doesn't look very infinite to me.

The rest of the Grantham is brilliant and myopic to stunning degrees in both directions. He gets that capitalism is a crock in terms of ability to adjust, but he doesn't get nett energy, or EROEI at all. And that 'limitless ocean'? I't being made acidic, so shellfish will be having a little trouble with their Caco2 shells, the fishstocks are depleted to crash-point, and coral is dying from the ITC outward.

Limitless? Nup.

He's right about the need to reduce population though, and to attempt to ease out way to sustainable levels of impact.

The alternative is too awful to think about.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.