Here's my Top 10 links from around the Internet at 3 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

The Muppets are back (again) at number 10.

1. Yikes! - The European project is in deep, deep trouble.

The Greeks are begging to be let off their austerity plan.

German voters are revolting at the prospect of having to bail out Southern Europe.

US money market funds are refusing to fund European banks.

The German constitutional court is about to rule on whether the Greek bailout breaks the rules.

The Italians are backsliding and a national strike is due tomorrow.

The Eurozone is in deep trouble. And that's before its economy stalled. Which it is now.

Here's Curious Capitalist at Time with a nice take on the situation and a cracking photo of Angela Merkel. Perhaps her surname needs to become a verb, as in 'Why did you Merkel me' or 'I've been Merkeled. Or maybe just: 'I feel a right Merkel'. HT Christov.

The Greeks want more time to meet their budget targets without having to make more cuts that would cause more public angst. The Germans, whose opinions arguably matter the most since they have the financial ammo, are already in a huff with German Chancellor Angela Merkel about expanding the eurozone's bailout fund. More pushback from Greece about meeting its current austerity measures only fuels the fire.

The ECB, meanwhile, is struggling to salvage its cherished reputation after vacuuming up billions of dollars in dodgy European sovereign debt, so more slack from its camp is also a tall order. And dinky Finland is making a fuss by demanding collateral for any more cash it forks over to Greece.

Of course, normally Finland would be a sideshow in European matters big or small. But the fact that all 17 members of the eurozone have to agree to the terms of Greece's next bailout (they already agreed to it in principle) before the funds are released makes the country a pretty effective spoiler. If the latest kerfuffle – the negotiations for which are set to resume in 10 days – leads to Greece not receiving its next tranche of bailout money, get ready to revisit the threat of financial meltdown. (As in, remember the market freak-out from a few weeks back?)

2. The limping middle class - Former Clintonite Labor Secretary Robert Reich has written a broad piece at the New York Times about the hollowing out of the Middle Classes over the last 20 years or so. It's today's must read I reckon.

The economy won’t really bounce back until America’s surge toward inequality is reversed. Even if by some miracle President Obama gets support for a second big stimulus while Ben S. Bernanke’s Fed keeps interest rates near zero, neither will do the trick without a middle class capable of spending. Pump-priming works only when a well contains enough water.

Look back over the last hundred years and you’ll see the pattern. During periods when the very rich took home a much smaller proportion of total income — as in the Great Prosperity between 1947 and 1977 — the nation as a whole grew faster and median wages surged. We created a virtuous cycle in which an ever growing middle class had the ability to consume more goods and services, which created more and better jobs, thereby stoking demand. The rising tide did in fact lift all boats.

During periods when the very rich took home a larger proportion — as between 1918 and 1933, and in the Great Regression from 1981 to the present day — growth slowed, median wages stagnated and we suffered giant downturns. It’s no mere coincidence that over the last century the top earners’ share of the nation’s total income peaked in 1928 and 2007 — the two years just preceding the biggest downturns.

The accompanying graphic below is becoming an increasingly viral must read.

3. How the hell did they get away with it - The Daily Mail reports the bosses of the biggest banks bailed out by British taxpayers are now getting paid more personally than they were before the 2008 crisis. WTF.

Despite the fact that they have the job of salvaging the banks propped up with more than £65billion of taxpayers’ money, they are among the best-paid executives in this country.

Their average wage is almost more than 40 times that of the country’s average of £26,000 and it dwarfs the £142,500-a-year salary earned by our Prime Minister.

When bonuses and other perks are included bank chiefs enjoyed average total earnings of £3.7million last year.

4. The Germans say 'Nein' - Ambrose Evans Pritchard has a nice piece at The Telegraph previewing the possible decision of the German constitutional court on Wednesday on the new EU bailout plans. Ambrose also looks at the other German big wigs complaining about what Merkel and the ECB are doing to Germany's democracy.

You can feel the storm brewing in Germany. Within days of each other, President Christian Wulff accused the European Central Bank of going "far beyond" its mandate and subverting Article 123 of the Lisbon Treaty by shoring up insolvent states, and Bundesbank chief Jens Weidmann said bail-out policies had "completely gutted" the EU law.

Both believe the EU Project has taken a dangerous turn. Fiscal powers are slipping away to a supra-national body beyond sovereign control. "This strikes at the very core of our democracies. Decisions have to be made in parliament in a liberal democracy. That is where legitimacy lies," said Mr Wulff.

Otmar Issing, the ECB’s founding guru, fears that the current course must ultimately provoke the "resistance of the people". Instead of evolving into an authentic union with a "European government controlled by a European Parliament" on democratic principles, it has become deformed halfway house.

Ambrose points to a small risk from the court decision.

The assumption this time is that the eight judges will insist on beefed up powers for the Bundestag, but will not disturb the existing nexus of bail-outs and bond purchases. That is the most likely outcome.

Whether they go any further is the existential question for EMU. If they rule that the permanent bail-out fund (ESM) after 2013 breaches treaty law, they will queer the pitch greatly since the viability of the current fund (EFSF) depends on a hand-over.

If they rule in any significant way that the EFSF itself breaches Lisbon’s `no bail-out’ clause, or even that Germany cannot participate until the Treaty is changed, market confidence in monetary union will collapse instantly.

5. The problem with American manufacturing - Yves Smith at Naked Capitalism runs an excellent case study on a US coated paper (magazine paper) mill that did very well until a bunch of leveraged private equity investors got hold of it and cut back on maintainance.

Sound familiar?

Here's a taste:

The 1980s were the heyday for papermakers. By the later 1990s, Mead had started scrimping on shutdowns, which is when the plant’s equipment gets maintenance and repairs. Twice a year shutdowns were replaced by annual shutdowns.

In 2002, Mead merged with WestVaco to form MeadWestVaco. The shallow dot-bomb era recession led to further reductions in reinvestment. A $5 million shutdown budget for Escanaba was reduced to under $2 million, even as the departing Mead CEO received a $30+ million golden parachute.

Cerberus acquired the Escanaba mill along with four other MeadWestVaco mills in 2005, forming the company now known as NewPage. Cerberus set return on invested capital targets that were, to put it politely, audacious for the paper industry, which led it to scrimp even more on keeping the plant operations up to snuff.

Cerberus also, in a remarkably bone headed move, bought some troubled mills from Stora Enso, apparently on the hope that it would be able to corner the coated paper market. Consistent with that strategy, Cerberus prefers to shutter mills that don’t meet its return targets rather than sell them, apparently out of the misguided view that it can remove enough capacity to affect its pricing power

6. The problem with Sean Quinn - Irish Times writer Simon Carswell has written a behind-the-scenes book on the implosion of Anglo Irish Bank. He details how a CFD position by a single investor, Sean Quinn, drove a lot of the activity by the board to save the bank after its share price collapsed on St Patricks Day of 2008.

The St Patrick’s Day Massacre had come close to breaking Anglo; it had taken the intervention of the Central Bank and Financial Regulator to halt a sell-off of shares that could have sparked a fatal run on the bank.

Anglo believed that any public disclosure of Quinn’s shareholding and a disorderly unwinding of his investment in the bank could cause the same sort of chain reaction – and it could not necessarily count on the regulators to turn the tide a second time. The Quinn situation had to be resolved.

He also details a culture of excess and a fascination with golf:

The bank put up a select group of about 25 customers and their wives in a hotel in Paris before taking them on the Orient Express to Venice, where they spent another night before flying home.

In the year after the nationalisation of the bank, the new management installed by the government discovered the bank had spent a fortune on golf paraphernalia and other trinkets to give to customers on its junkets. The total expenditure on such items came to a whopping €1.38 million between 2006 and 2009, more than €200,000 of it on golf balls alone.

7. Killing two birds with one stone - Wikileaks cites a US diplomatic cable showing China is buying gold to diversify away from US dollars. HT Zerohedge

"According to China's National Foreign Exchanges Administration China 's gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the U.S. and European countries. The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold's function as an international reserve currency. They don't want to see other countries turning to gold reserves instead of the U.S. dollar or Euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar's role as the international reserve currency. China's increased gold reserves will thus act as a model and lead other countries towards reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the RMB."

8. Ugly, Ugly, Ugly - Here's the Economist on the Euromess

The situation threatens to grow very ugly very quickly. Europe's economy is teetering on the brink of recession. In August, factory activity shrank in the euro zone as a whole, and the slowdown in industrial activity accelerated in Spain, Italy, and Greece. Against this backdrop, German Finance Minister Wolfgang Schäuble is preaching that austerity is the only cure for the euro zone. The ECB may have put its rate increases on hold, but the damage is already done. Meanwhile, European banks are sucking credit out of the economy.

The darnedest thing is, it has been clear for over a year now that something in the euro zone has to give. If it isn't euro-zone chequebooks—in the form of greater fiscal transfers, loans, and bank recapitalisation—or euro-zone inflation then it will be the euro zone itself. Barry Eichengreen has argued, compellingly, that this would be an economically unacceptable outcome, giving rise to bank runs and economic collapse. Paul Krugman's response is: sure, but if you've already got the bank runs, economic collapse, and a likely sovereign default, you may as well get a devaluation to go along with it. Euro-zone governments have effectively spent the past year making a departure from the euro zone ever more attractive, and therefore vastly more likely.

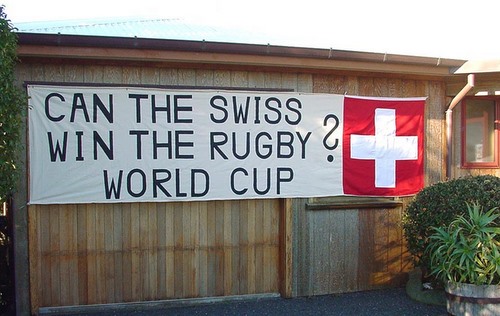

9. Interesting question mark - Long time commenter Walter Kunz has a great World Cup themed banner on his Kaikoura Art Gallery and Bed and Breakfast at the moment. HT Walter.

10 Totally The Count introducing the Beetles singing 'Letter B'

27 Comments

US dollar hit another low, it takes over 1900 of them to buy an ounce of gold.

Heres a story about the future for commodity producers.

WARNING it's a bit positive.

http://www.smh.com.au/opinion/politics/the-future-in-the-lucky-country-…

Judging by the comments the peasants/sheep don't seem to see it that way.

Good use of the pic there Bernard ...equally good editorial...HT.to yourself.

And yes I think it will stick and become a "Doing a Merkel" in the most dire of circumstances.

Cheers.

Deutsche Bank CEO Joseph Ackermann just gave a terrifying speech about the fragility of the Euro banking sector right now.

It is an open secret that numerous European banks would not survive having to revalue sovereign debt held on the banking book at market levels."

Read more: http://www.businessinsider.com/josef-ackermann-euro-banks-speech-frankf…

Fancy that , both the Count and Kunzie getting mentions in dispatches ! ... Well done to both of you . It has been a memorable day , made mostly by Bernard's admission of a walk in the sunshine , taking his daughter to school .

.... how quickly we overlook the simple & satisfying things , when world events conspire to merkelise our minds .

Well done , one and all .

Roger - my charming wife told me off today (again), not to talk about current and upcoming world reality, but to enjoy the wonderful spring weather and the blossoming garden. It is frustrating times - I know.

Another 135 jobs gone in another NZplant.

She is very wise , you are indeed blessed to have such a wonderful partner .

... even the Darth Vader of financial journalists , Bernard , succumbed to appreciation of a splendidly sunny spring day ..

Rest assured gloomsterisers , he'll be back , merkelising our souls and senses again , tomorrow .

With all the risks in Eurozone and USA, New Zealand would be one of the few safe havens !!

9) Of course they can, but they may look like the women in number 1) – many thanks Bernard.

We created the 5m x 1.2m banner thinking cheering up visitors, especially the ones from Chch and now in difficult times anyway, lure some overseas tourists into our interesting ArtGallery.

Henry Ford said, 'There is one rule for industrialists and that is: Make the best quality of goods possible at the lowest cost possible, paying the highest wages possible.

It didn't take long to forget about the wages part.

Apparantly he was very unpopular with is peers because he paid well....initially anyway, by the GD it looked ugly on all sides.

regards

RBA leaves rates unchanged. Here's its statement:

Statement by Glenn Stevens, Governor: Monetary Policy DecisionAt its meeting today, the Board decided to leave the cash rate unchanged at 4.75 per cent.

Conditions in global financial markets have been very unsettled over recent weeks, as participants have confronted uncertainty about both the resolution of sovereign debt problems and the prospects for economic growth in Europe and the United States. As a result, the outlook for the global economy is less clear than it was earlier in the year. Some temporary impediments that had contributed to a slowing in growth in some countries over recent months, such as the supply-chain disruptions from the Japanese earthquake and the dampening effects of rising commodity prices, are lessening. But the uncertainty and financial volatility is reducing confidence and may result in more cautious behaviour by firms and households in major countries. A number of forecasters have scaled back their global growth estimates over the past couple of months.

At this stage, little evidence is available to gauge any effects of the European and US problems on other regions. Prices for key Australian commodities have remained very high thus far, with growth in China continuing to look solid. As a result, Australia's terms of trade are now at very high levels and national income has been growing strongly. Investment in the resources sector is picking up very strongly and some related service sectors are enjoying better than average conditions. In other sectors, cautious behaviour by households and the high level of the exchange rate are having a noticeable dampening effect. The impetus from earlier Australian Government spending programs is now also abating, as had been intended. Overall, the near-term growth outlook continues to look somewhat weaker than was expected a few months ago. Beyond the near term, growth is still likely to be at trend or higher, unless the world economic outlook continues to deteriorate.

Growth in employment has been moderate this year and the unemployment rate has been little changed, near 5 per cent, for some time now. Reports of skills shortages remain confined to the resources and related sectors. After the significant decline in 2009, growth in wages has returned to rates seen prior to the downturn, though productivity growth has been weak.

Year-ended CPI inflation should start to decline towards the end of the year, as temporary weather-related effects reverse. But measures of underlying inflation have been increasing this year, after declining for the previous two years. While they have, to date, remained consistent with the 2–3 per cent target on a year-ended basis, the Board remains concerned about the medium-term outlook for inflation. A key question will be the extent to which softer global and domestic growth will work, in due course, to contain inflation.

Most financial indicators suggest that monetary policy has been exerting a degree of restraint. Credit growth has declined over recent months and is very subdued by historical standards, even with evidence of greater willingness to lend. Most asset prices, including housing prices, have also softened. The exchange rate is high. Each of these variables is affected by other factors as well, but together they point to financial conditions being tighter than normal.

At today's meeting, the Board judged that it was prudent to maintain the current stance of monetary policy. In future meetings, the Board will continue to assess carefully the evolving outlook for growth and inflation.

#2 of course there was an uncoupling between productivity and wage increases. It's called computing. I now have automated systems for many functions whereas 15 years ago I had people doing the job

If the extra productivity is due to computing wouldn't there be wage increases due to the need for people to maintain and develop these computers?

What the graph shows is a bigger sepearation between productivity and automation/computers than i would expect. The people who are unemeployed due to computing wouldn't show on the wages graph.

"In Greece, government bonds, the favorite debt instrument among politicians, have reached yields that top 70% for 1-year debt and 40% for 2-year paper. Italy needs to roll over €62 billion in debt before the end of September (the most ever in a single month). There are no buyers on the horizon except for the ECB; a scary realization."

http://theautomaticearth.blogspot.com/

regards

Harry Dent the Great Depression ahead.

http://www.youtube.com/watch?feature=player_embedded&v=UbaBM3pDer0

Very interesting piece on demographics....so we will see a depression purely on the BBs retiring, let alone anything else....

regards

+ 18 – this article contains some graphic messages, which aren’t suitable for younger people.

This middle class is being pummelled out of existence, and most Americans don't even understand what is happening

Is this the same Harry Dent who in 2006 predicted that the Dow Jones Index would reach 40 000 by 2010 , and that the NASDAQ would rise ten fold to 20 000 by 2009 ?

Walter, love your banner - hope it attracts many an o/seas customer to your studio during the festivities!

That was an interesting site you linked to.

This was said on one of the blogs regarding tax in the US;

When you add up all forms of taxation from all levels of government, approximately 40 percent of all the income in the country is taken in as taxes by government. Large numbers of Americans end up paying well over 50 percent of their income in taxes, and many of them don't even realize that it is happening.

Indeed we have just returned from a holiday there. A young nephew of mine (Masters in EE) and earning nearly a six figure income just 2 years out of university - would be a prime example of this 'lack of realisation'. He was commenting on how we NZers are taxed out of oblivion (all in relation to his view that we are a socialist nation - largely of that opinion because of our health care system), but when I explained our present tax system - and the tax credits for those with young families on lower incomes ... and then we compared it to the cumulative taxes he paid.... it was astounding to learn how much he pays if you add both federal and state income taxes, but worse yet - his property taxes (like our rates) were a further $5,000pa - and that was for a condo (a back deck, but no backyard to speak of - and attached to another condo on both sides) AND the condo corporate fees added a further $2,000pa to his bills.

Yes, he was most certainly in the 50%+ of his income paid in taxation - and that was before counting sales tax and all the road tolls that he had to pay on a daily basis to get to work. He did qualify for a number of tax rebates (such as interest paid on mortgage, and another rebate for having bought a new Chevy Volt... but of course he had to go into debt to collect both of these tax credits, which I thought a perverse incentive on the part of central government).

Suffice it to say, I found most Canadians and Americans spending like there was no tomorrow but all the while bemoaning the high price inflation they are experiencing as well as the uncertainty (likened to an obsessive paranoia) about financial security in retirement. And on top of all that, they have capital gains tax and punishing death duties.

I came home thinking NZ was a tax haven. :-)

Kate - thank you – yes we hope a few wealthy Scottish or Dutch coming in – hmm :-).

It is always interesting to know opinions from people, who experienced reality. An American Kiwi friend of mine just returned from the USA complained about the same thing – people paying a lot taxes – but standards of living going down sharply.

well yes, but seriously you don't see the same happening here in NZ re disposal income, cost of living,retirement? The working poor in this country is just as humbling here as there. Many states in the US have quite extensive social welfare systems and they do pay for that. The only clear difference is property has in nominal terms not dropped back here materially yet...however finance companies and Chch have knocked a serious number of peoples wealth. Our unemployment is held low by Australia and a lot hanging around in education still with hope.

Both Government deficit profiles are scary in my opinion.

The beat of new successful enterprises in the US I get the opportunity to work with makes me somewhat sad when returning to NZ, I like their prospects more than ours in that respect.

For the talented there are still more opportunities there than here...read and watched with amusment the discussion on the NZX here today. Holding one new company up as interesting.. which is looking for 10 million and only recently thought about getting a CFO on board for the planned listing. Really interesting prospect??!!! Clearly where I'm from seems poorly advised...look at it recent challanges you can find on a application document to be found on google...who is doing the grooming for listing??!!! lol

#1 - yikes is right, and collapse and contagion are inevitable. So what institutions here in NZ should we avoid, Bernard, if we don't want to get caught in the fallout?

#2 - ironic really that these ex-government advisors and decision makers are now "coming out" about the worngs of the trends/excesses that they presided over. It's as if they've either gone all religious and are trying to absolve their souls - or perhaps they intend to wave these articles at their eventual trial-by-angry public. And to think, Helen Clark got shot down politically when she tried to do something about inequality with the 'closing the gaps' policy platform back in her first term. She backed down on the entire set of initiatives - when indeed it now appears according to all these ex-right wing political elites, that she was well and truly ahead of her time.

Rugby will save us

Thanks for your perspective on taxes in the US Kate. You also need to factor in that the US Government is running an annual deficit of around 12% of GDP - $1.6 Trillion or a whopping $10,000 per year per working American!

Your misinformed young relative might like to consider what his taxes will be if and when the Feds are forced to balance their budget.

I also lived in the US. Consider the whole package.

Food is much cheap. Petrol is cheaper. Rents are very low and first class rentals are available. Clothing, appliances and furniture are cheap.

On the other hand the health insurance is a problem. Anyone could be broke in a year due to accident or illness. So huge risk on that side.

If someone is making six figures he should be able to bank alot of cash every month. Tho quality of life is lower (pollution,traffic etc)

Good for you...so it's a great place if you don't get sick and have heaps of dosh or daddy is a banker...otherwise it's a place to get away from...which is what you did.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.