Here's my Top 10 links from around the Internet at midday in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

The ghost cities revisted video is fun.

1. Australia's Dutch Disease - Houses and Holes writes at Macrobusiness about a research note from Deutsche Bank in Australia on the problem of Australia's high exchange rate and how its manufacturing sector is being slammed, with all the job losses that entails.

This is one to watch for us in New Zealand.

Firstly we have our own Dutch Disease problem, compounded by the influx of over U$15 billion of funds in earthquake reinsurance.

Dutch Disease is where an influx of foreign currency from an oil find or mining boom boost the currency and destroy the manufacturing sector.

Yet our own politicians and central bankers seem to care little.

They care most about getting re-elected by voters getting cheap petrol...for now.

The trouble is next year they won't have jobs. The people that is. The central bankers and politicians will keep their jobs.

2. No more bailouts for bankers - Bloomberg writes in this editorial that Europe's politicians should ignore the pleadings of its bankers for yet more bailouts.

At a big, systemically important bank, high leverage allows executives to play a heads-I-win-tails-you-lose game with taxpayers. In good times, the leverage makes the bank extremely profitable to shareholders, allowing executives to collect juicy bonuses. In bad times, as the European experience yet again demonstrates, governments have no choice but to step in and bail out the banks, and executives have nothing to fear but a highly remunerative exile.

No wonder the average tangible equity as a share of tangible assets -- effectively a simple capital ratio - - at 32 of Europe’s biggest banks is only 4.6 percent, according to data compiled by Bloomberg. Deutsche Bank’s ratio is among the lowest, at 1.9 percent.

3. Debt restructuring is needed - US Fund manager John Hussman nails the problem at the heart of the global economy. It's time bond holders and bank shareholders took some pain to break the logjam. HT Andrew Patterson via email.

Consumers are reluctant to spend because corporations are reluctant to hire; while corporations are reluctant to hire because consumers are reluctant to spend. Unfortunately, simply offering consumers some tax relief, or trying to create hiring incentives in a vacuum, will not change this equilibrium because it does not address the underlying problem. Consumers are reluctant to spend because they continue to be overburdened by debt, with a significant proportion of mortgages underwater, fiscal policy that leans toward austerity, and monetary policy that distorts financial markets in a way that encourages further misallocation of capital while at the same time starving savers of any interest earnings at all.

We cannot simply shift to a high-level equilibrium (consumers spend because employers hire, employers hire because consumers spend) until the balance sheet problem is addressed. This requires debt restructuring and mortgage restructuring (see Recession Warning and the Proper Policy Response ). While there are certainly strategies (such as property appreciation rights) that can coordinate restructuring without public subsidies, large-scale restructuring will not be painless, and may result in market turbulence and self-serving cries from the financial sector about "global financial meltdown." But keep in mind that the global equity markets can lose $4-8 trillion of market value during a normal bear market. To believe that bondholders simply cannot be allowed to sustain losses is an absurdity. Debt restructuring is the best remaining option to treat a spreading cancer.

4. Subsidising corporate profits - Hussman also nails the structural problem with profits and wages. There has been a shift in the US national income share from wages to profits over the last decade. It has been masked by borrowing and government handouts. Sound familiar?

Here's Hussman with a couple of cracking charts below:

The widening of profit margins in recent years reflects two unsustainable dynamics. One is that the increase in profits as a percent of GDP has essentially come at the expense of employees. The spike in corporate profit margins has moved hand-in-hand with the collapse in labor income. As companies cut employment dramatically in recent years, they were able to maintain relatively high levels of output, which was reflected in high productivity growth figures. At this point, however, there is little latitude to expand profit margins through further payroll cuts, and labor tensions are increasing as well. The sequential decline in measured productivity in recent quarters, and the corresponding pickup in unit labor costs, reflects the difficulty in picking much more from the bones of workers.

But if wage income is falling, how is it possible to maintain the sustained (though not growing) level of demand that is responsible for elevated corporate profits? Simple - add in a second unsustainable dynamic. Government transfer payments are now substituting for wage income to the greatest extent ever observed in history. The majority of the recent surge represents unemployment compensation.

In fact, 22 cents of every dollar of U.S. personal consumption is now financed with transfer payments. It would be absurd to imagine that this does not fall to the bottom line of corporations. In effect, the elevated level of profit margins is largely a reflection of government deficits that maintain transfer payments, and by extension, consumption demand - even in the face of wage compensation that has never been lower as a share of GDP. While we are likely to see further deficit spending in the event of a full-blown recession, which will provide at least some buffer for demand, it is doubtful that investors should bake the assumption of sustained record profit margins into their long-term valuation of stocks.

5. Australian property Tsunami to come - US forecaster Harry Dent tells Australians via AAP their property prices are likely to return to early 2000s levels as the global markets Tsunami hits in the next couple of years.

I can hear the sound of Australians choking on their weetbix from here.

"Outside Hong Kong and Shanghai, Australia is the most expensive real estate market in the world compared to income."

Mr Dent said Australia's house prices would return to late 1990s or early 2000 levels. Driving all these changes is simple demographics, specifically the peak of the baby boomers' spending, Mr Dent said.

"We predicted this (current) downturn in the US 20 years ago," he said. "We said that in 2007 the peak number of baby boomers will reach their peak spending. They would have bought all their homes and then they will start saving for retirement ... and that you are going to see this downturn."

6. The return of the Drachma - Der Spiegel reports senior German ministers are openly talking about Greece defaulting and leaving the eurozone and have been for months. HT Zerohedge.

Volker Bouffier, the governor of the state of Hesse, which is home to Germany's financial capital Frankfurt, is a member of Chancellor Angela Merkel's conservative Christian Democratic Union (CDU) party, as is Schäuble. Bouffier is now urging that the possibility for countries to leave the euro zone be created quickly. Current European Union treaties provide no provisions for a country to abandon the currency.

"If the savings and reform efforts of the Greek government aren't successful, then we need to ask the question of whether we need new rules to make it possible for a euro country to leave the currency union," Bouffier told SPIEGEL.

And there's fresher talk here via Reuters.

"To stabilize the euro, there can no longer be any taboos," Philipp Roesler, economy minister and leader of Merkel's junior coalition partner, the Free Democrats (FDP), told Die Welt.

"That includes, if necessary, an orderly bankruptcy of Greece, if the required instruments are available," he said.

Roesler, also Vice Chancellor, said sanctions should be imposed on states failing to tackle big deficits, including the possible withdrawal of EU voting rights.

FDP general secretary Christian Lindner went further, telling the Berliner Morgenpost his party had not ruled out the possibility of Greece leaving the euro zone.

7. China's ghost cities - Two years after it revealed the existence of China's ghost cities, Al Jazeera has returned to Ordos to find out if there are people there now. HT Zerohedge

Here's Al Jazeera's Melissa Chan:

"It's still pretty quiet, but here's the remarkable thing - the building has't stopped, somehow people are convinced that if you keep building, people will come. If not in a few years, then... eventually."

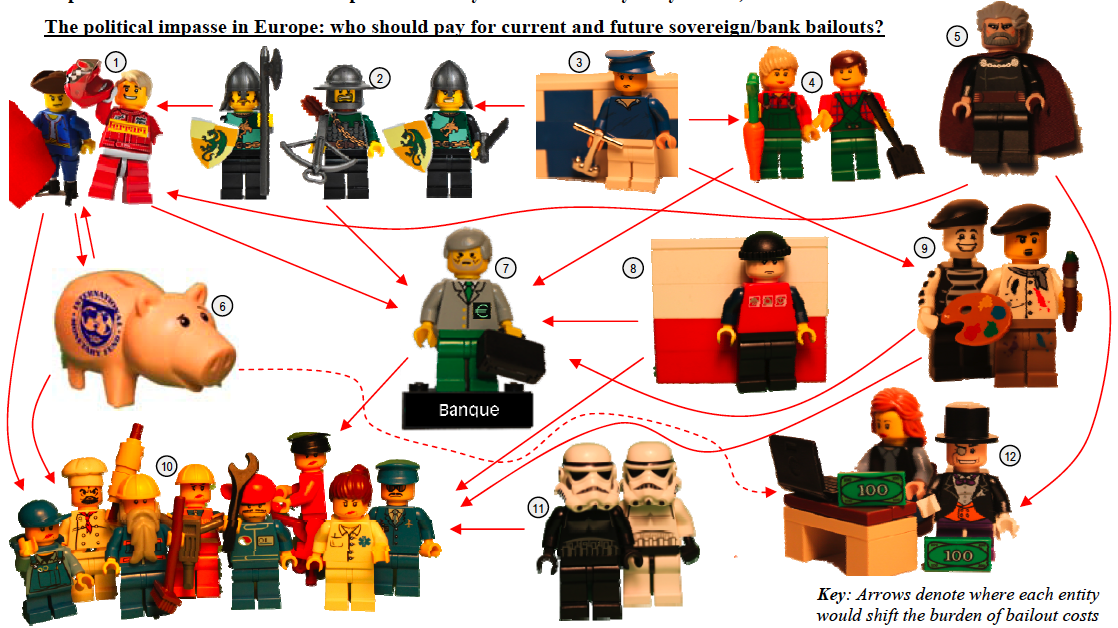

8. The euro crisis explained with Lego - Here's JP Morgan's explanation of the Eurocrisis. I particularly like the used of Star Wars stormtroopers figures. Click on the image for a bigger version.

9. Would a quick burst of inflation do the trick? - Former IMF economist Raghuram Rajan writes at Project Syndicate about whether a quick burst of inflation generated by central banks would fix the problem of too much debt. He says no. Worth reading because this seems to be the strategy that America and Britain at least are following right now. The Europeans are debating it.

Here's Rajan:

It is an attractive solution at first glance, but a closer look suggests cause for serious concern. Start with the question of whether central banks that have spent decades establishing and maintaining anti-inflation credibility can generate faster price growth in an environment of low interest rates. Japan tried – and failed: banks were too willing to hold the reserves that the central bank released as it bought back bonds.

Consider, next, whether the inflationary cure would work as advertised. Inflation would do little for entities with floating-rate liabilities (including the many households that borrowed towards the peak of the boom and are most underwater) or relatively short-term liabilities (banks). Even the US government, with debt duration of about four years, would be unlikely to benefit much from an inflation surprise, unless it were huge. Meanwhile, the bulk of its obligations are social security and health care, which cannot be inflated away.

Even for distressed households that have borrowed long term, the effects of higher inflation are uncertain. What would help is if their nominal disposable income rose relative to their (fixed) debt service. Yet, with high levels of unemployment likely to keep nominal wage growth relatively subdued, typical troubled households could be worse off – with higher food and fuel prices cutting into disposable income.

10. Totally Ry Cooder singing about how no bankers will be left behind. It's all very Woody Guthrie, who used to sing such songs about the Depression. HT Ian Fraser

Ry Cooder: … They’re on the train, a rich train that is only bankers. They’ve got all the money, they get on the train, the train pulls out, and the rest of us all stand there watching and saying, ‘where did it all go? How did they make off with all this loot?’

25 Comments

10) White collar crime – WCC –without criminal conviction - stealing money in the billions/ trillions - accepted by government/ public.

Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail.

FYI JPMorgan reckons the new Basel rules on capital are 'un American' . Sigh.

The drawbridges are going up in all sorts of ways. Trade, capital controls, currencies and politics.

All very familiar.

http://www.reuters.com/article/2011/09/11/banks-basel-jpmorgan-idUSL5E7KB11A20110911

The United States should consider pulling out of the Basel group of global regulators, Jamie Dimon, chief executive of JPMorgan Chase (JPM.N), said in an interview with the Financial Times. Dimon said he was supportive of forcing banks to have more capital but argued that moves to impose an additional charge on the largest global banks went too far, particularly for U.S. lenders. He was quoted as describing new international bank capital rules as "anti-American". "I'm very close to thinking the U.S. shouldn't be in Basel anymore. I would not have agreed to rules that are blatantly anti-American," he said in the interview.

And the Greeks are having to buy olive oil from Germany....sigh...

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_08/09/2011_405493

You gotta love the Germans:

"That includes, if necessary, an orderly bankruptcy of Greece, if the required instruments are available," he said.

There will be nothing orderly about the bankruptcy of Greece, as much as the German uber-rationalists might wish. As for Jamie Dimon........'nuff said.Miene raf....Shhhhtop mitt der truble und get on ze train...schnell..! schweinhund..!

"Signs of depression - Sighing, crying, moaning". No crying or moaning, Bernard ! Unless they're as a result of a financial not physical depression....

Excellent Rob Stock piece here on Kurtis Haiu's property disaster with Glenn Cooper.

The BNZ and Westpac are involved. As is a now-bankrupt property valuer

Here's Rob:

http://www.stuff.co.nz/business/5601530/Resale-losses-hit-Haiu-hard

Haiu was charged with assaulting Cooper at his isolated Pukekohe home over the deals. Companies related to Cooper sold Haiu properties for far more than they were worth, with Haiu securing loans with Cooper's help from BNZ and Westpac.

Haiu and his legal representatives from Kensington Swan, which is working for him pro bono at the request of the New Zealand Rugby Union for which the law firm also acts, are in negotiations with the banks to forgive the loans.

Haiu bought 11 Billah St in Tokoroa on December 22, 2009, for $350,000, when three weeks earlier the same property had been sold to Cooper's Greenfield Developments for just $92,500. Haiu was shown a valuation made by now bankrupt valuer Michelle Tierney for Greenfield, which did not mention the price Greenfield had bought the property for.

The Sunday Star-Times understands Haiu believed he would only own the building, which contains a number of discrete units, temporarily until each was sold on a unit title. That never happened, and the property has now sold – again at mortgagee sale – for just $107,000, leaving Haiu with a loss of $243,000.

Haiu also bought 64 Tonga St in Taupo for $395,000 on January 21, 2010. Less than a week earlier it had been bought by Greenfield for $218,000.

That property has now been sold for $185,000, leaving Haiu with a loss of $210,000.

In both cases, the Sunday Star-Times has learnt, Haiu believed Cooper would onsell the properties and he would get a profit from the deals, but that did not happen and promises to buy back the properties were never honoured.

Yes the act of. kefi now replaced with Tankards n Tubas

Umpapa..ring out a forlorne rendition of the Pain of Salvation in BBb flat minor......while Greek waiters ask ........if you'd like a little olive oil with your sauerkruat.

Bernard - are you trying for honourary membership of NZMEA? Re. #1, well said:

"Dutch Disease is where an influx of foreign currency from an oil find or mining boom boost the currency and destroy the manufacturing sector.

Yet our own politicians and central bankers seem to care little.

They care most about getting re-elected by voters getting cheap petrol...for now.

The trouble is next year they won't have jobs. The people that is. The central bankers and politicians will keep their jobs."

Simple solution - pay them in USD and watch TINA get the boot, toot sweet.

Cheers, Les.

Any solution Les that does not fit the "agenda" no matter how simple...obvious...lucid will be met with a dry .."well we really don't want to go down that track.." said without any qualification as to why......

They will tell you exports currently exceed imports on $ values while ignoring the decline in manufacturing...glad that no one asks the hard questions, and if they should ,pull out the stock answer ... that they appreciate it's a difficult time for manufacturer exporters..niche exporters offering sympathy so hollow your ears ring.....then go on to suggest ...that it is we who need to adapt to an agenda... we are not even privi to.

And forgot to mention this in 90 at 9 and here.

http://www.bbc.co.uk/news/business-14849534

Japan's economy contracted more than expected

Japan's economy contracted more severely in the second quarter than was initially estimated, revised government data has shown.

The economy shrank at an annual rate of 2.1% during the period, compared with the 1.3% drop reported previously.

To gain further insight as to why the US and indeed many western nations are mired in virtually no growth read this article by Stephen Roach. Roach is former Fed economist who then went on to work at Morgan Stanley for many years. I have followed his writings for about ten years. He predicted this mess many years ago and has consistently attacked Greenspan’s and Bernanke’s policies.

His writings from the early to mid 2000’s are still available on Morgan Stanley’s website archived.

As you will see in this article it’s not rocket science its consumer debt and consumer spending a subject which Roach has followed for 40 years.

www.project-syndicate.org/commentary/roach8/English

The Central Banks in particular the Fed are the main culprits here the fall out from which is now beginning to emerge everywhere sorry Ben & Co but no free lunches.

Nice one Colin. I've always had a lot of time for Roach - I can remember him getting lambasted for coming out with these views in the early noughties - but how right he was. He was something of a pariah for a time.

Now if he had just metioned resource depletion as well it would have been pretty much the ideal explanation of the mess that we find ourselves in.

He certainly took a lot of flack often described as the "Bearish Economist Roach" just a realist and the establishment didn't like one bit sent him off to Asia

The Aussie share market (ASX200) is now down some 40% down from the highs of Oct 2007 - thats one hell of a b*tch of a bear market eh?

Back in April 2009 it was down some 50% from its 2007 highs.

I have a feeling that low is going to be surpassed by Christmas.

Its going to get very very messy fear and loathing.

Why western economies are failing.

Here an interview with a highly successful person Nicolas Hayek:

Recommened:

http://www.youtube.com/watch?v=Z8pe4lmXZyA

Amazing link:

Should be compulsary for all of our 'elected representatives'

This is an interesting surgical exposure of the fraud the fed is running....

Yalza - Harry Dent sees Dow at 3000 in 2013 (and I thought I was bearish)

http://www.cnbc.com/id/44481286

That would make a mess of a few 401K's .........not to say almost all Kiwisaver policies.

Interesting views on the US$ being the asset to get into - I think he needs to come up with some justification for that (maybe its in the book?)

7 and 10 are related. China doesn't want to paper, so it may as well build some houses. Pity we couldn't get them to send a few over on ships to Chch.

Boy are we in for an interesting couple of weeks:

http://www.telegraph.co.uk/finance/financialcrisis/8755881/Germany-and-…

UK Independent Commission On Banking (Vickers - Final report).

http://bankingcommission.s3.amazonaws.com/wp-content/uploads/2010/07/ICB-Final-Report.pdf

Asking prices down 7 % here in Adelaide. Real estate institute president said "we have come out of 10 quite spectacular years. It's the old adage what goes up eventually comes down "

Re: Dow 3000, the Greek stock market has fallen 87% overall since Oct 2007, Ireland has fallen 76%, Japan 51%. Pretty spectacular.

The macrobusiness piece about Australian manufacturing was pretty compelling. New Zealand manufacturing has fallen from 14.5% of GDP in 2006 to 12.4% now, making Australia's 8% look dire indeed.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.