Here's my Top 10 links from around the Internet at 6 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

Jon Stewart's riff on Obama is good.

1. The rise of the Plutonomy - Don Peck writes at The Atlantic about a research report from three Citigroup analysts that predicted in 2005 the rise of the Plutonomy, an economy where only the super rich get richer and only the super rich matter.

Some of the inherent flaws in the current model of lightly regulated multinational capitalism are coming to the surface of mainstream political debate now.

The wealth of the middle classes is being hollowed out by a shift in high wage jobs to low wage economies with the shareholders of the multinationals pocketing most of the benefits on the way through.

This hollowing out of the last 20 years or so has been disguised by increased borrowing and increased government benefits, but the unsustainability of this 'top heavy' version of capitalism is now crashing down upon itself.

The indebted middle classes aren't spending any more because they can't borrow any more and many don't have jobs. The very rich are hoarding their money into 'safe' assets such as gold and US Treasuries as either they don't need to reinvest because the corporates they own are sitting on over US$1 trillion of cash, or because they are too nervous about investing because revenue growth is not forthcoming, partly because the middle classes are not spending.

The global economy has reached this point of realisation. Most don't want to spend because they are in too much debt. Those that have the cash don't want to invest because most aren't spending. So instead the money is hoarded. Rinse and repeat. This current system isn't sustainable.

Here's Peck at The Atlantic talking about the three analysts:

They said, America was composed of two distinct groups: the rich and the rest. And for the purposes of investment decisions, the second group didn’t matter; tracking its spending habits or worrying over its savings rate was a waste of time. All the action in the American economy was at the top: the richest 1 percent of households earned as much each year as the bottom 60 percent put together; they possessed as much wealth as the bottom 90 percent; and with each passing year, a greater share of the nation’s treasure was flowing through their hands and into their pockets. It was this segment of the population, almost exclusively, that held the key to future growth and future returns. The analysts, Ajay Kapur, Niall Macleod, and Narendra Singh, had coined a term for this state of affairs: plutonomy.

In a plutonomy, Kapur and his co-authors wrote, “economic growth is powered by and largely consumed by the wealthy few.” America had been in this state twice before, they noted—during the Gilded Age and the Roaring Twenties. In each case, the concentration of wealth was the result of rapid technological change, global integration, laissez-faire government policy, and “creative financial innovation.” In 2005, the rich were nearing the heights they’d reached in those previous eras, and Citigroup saw no good reason to think that, this time around, they wouldn’t keep on climbing. “The earth is being held up by the muscular arms of its entrepreneur-plutocrats,” the report said. The “great complexity” of a global economy in rapid transformation would be “exploited best by the rich and educated” of our time.

2. The rich vote for the rich - John Sides reports at the NY Times on how US politicians are more likely to vote in the interests of the rich, because they are rich.

John Edwards’s $400 haircut. Senator John McCain’s apparently uncountable houses. President Obama’s vacation in Martha’s Vineyard. Most recently, Mitt Romney’s home renovations. These things suggest that many, if not most, politicians at the federal level come from the upper social classes. Certainly they are much wealthier than the average American. But does the social class of elected leaders actually affect how they vote?

Nicholas Carnes, a political scientist at Duke University, finds that it does. Inthis forthcoming paper, he studied the connection between the occupational backgrounds of members of Congress from 1901 to 1996 and their voting behavior. Occupational backgrounds have proven to be stronger predictors of many political attitudes than other markers of class, like education and income.

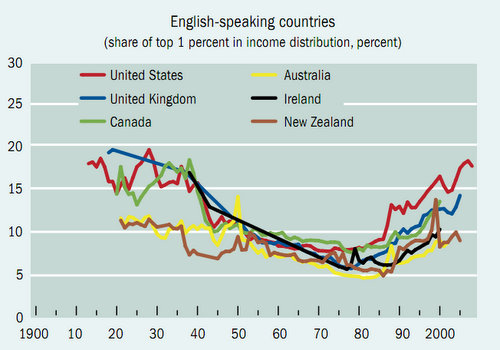

3. Inequality throws us off balance - The IMF has a special inequality issue of its regular magazine out.

It concludes we've all gotten less equal recently. This is partly to show that this issue has well and truly crossed to the mainstream. The IMF aren't renowned for being a bunch of lefties...

Here's a chart to go with it. New Zealand in brown is mentioned.

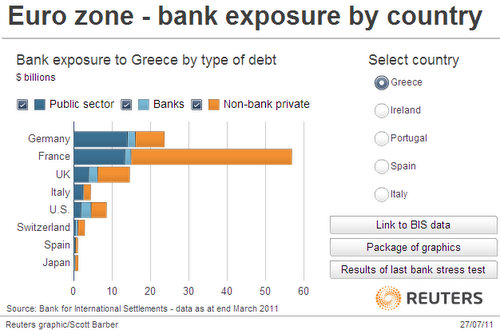

4. Play with it for fun - This Reuters graphic showing how much various countries are owed by Greece and the PIGS is fun to play with. Click on the image to get there. Click on the package of graphics link once you're there for a whole heap of fun.

5. Here's an idea - Let's get the Reserve Bank to print a bunch of money and build a couple of hundred thousand homes.

I'm sort of not kidding. It seemed to work during the Depression when John A Lee tried it. (Cue triumphal comment from Iain Parker)

Here's Stan Fitchett with an OpEd in The Press.

John A Lee was appointed director of housing. His department knew that interest on bank loans is normally the major composition of ordinary rent, so Lee demanded and got Reserve Bank credit at 1 per cent to finance the housing scheme. Lee was a man in a hurry. Within six months of his appointment, 3220 new houses were started. That provided real work for thousands of builders, plus thousands more jobs in the sawmills and factories that supplied the materials.

The vision and drive of Lee and his uneducated colleagues brought New Zealand out of the Depression faster than any other country in the world. In 1935, there were 58,000 men unemployed (and that didn't include women and youths). Just two-and-a-half years later, the number of men unemployed was 13,600 and dropping.

The state housing programme is one of New Zealand's great success stories. By 1970, 72,498 houses had been built by the State.

6. Brace for it - Former IMF economist Simon Johnson reckons we should all brace for a long recovery from the credit glut.

Can China do a better job managing the flow of credit to its hybrid state-private sector combinations than the U.S. did with its private sector and the euro zone did with its governments?

Probably not. Careless lending, backed by implicit government guarantees, has increased around the globe over the past 40 years (see “Will the Politics of Global Moral Hazard Sink Us Again?” which I wrote with Peter Boone). The Chinese learned these practices from the best in the business, that is the people and organizations that were revered for their wisdom in the 1990s and early 2000s, but ultimately systematically mispriced risk.

Economic development is often described as “catching up.” But the prospects for global growth in the short term greatly depend on whether China can avoid following in the footsteps of the U.S. and Europe. Growth based on a great deal of leverage has proved fragile, but we haven’t yet moved to a different model. For now, the transition away from high levels of private and public sector debt will most likely be prolonged. It will certainly be painful.

7. Poor dears - Reuters reports Wall St banks are only likely to make around US$100 million in profits from the Fed's likely 'Twist' strategy that many think it will announce after the September 20/21 FOMC meeting. They made much, much more from QE I and QE II.

The Fed is considering intervening in the bond market to lower long-term interest rates in a move known as "Operation Twist." According to Rick Spear, who advises Wall Street banks on strategy at consulting firm Novantas, the effort could boost Wall Street trading revenue by $100 million through the Fed's direct purchases, as well as a "ripple effect" from other bond investors' activity.

That is piddling compared with the $23 billion of quarterly trading revenue that global banks averaged from 2000 through 2010, according to Oppenheimer Research, and compared with the $1 billion of extra revenue that Spear estimates Wall Street received from the second round of quantitative easing.

For the first two rounds of quantitative easing, the Fed was expanding the money supply by buying billions of dollars of bonds. The purchases translated to new money sloshing around the bond markets, which supported overall trading activity beyond the Fed's purchases.

Both rounds of quantitative easing coincided with relatively strong trading profit for Wall Street, with the biggest benefit coming from the first round, when the Fed was buying a wider array of products.

8. Germany's Mutually Assured Destruction (MAD) strategy - Ambrose Evans Pritchard argues that Germany's threats to get Greece to toe the line may just be plain mad.

First we learn from planted leaks that Germany is activating "Plan B", telling banks and insurance companies to prepare for 50pc haircuts on Greek debt; then that Germany is “studying” options that include Greece's return to the drachma.

German finance minister Wolfgang Schauble has chosen to do this at a moment when the global economy is already flirting with double-dip recession, bank shares are crashing, and global credit strains are testing Lehman levels. The recklessness is breath-taking.

If it is a pressure tactic to force Greece to submit to EU-IMF demands of yet further austerity, it may instead bring mutual assured destruction.

"Whoever thinks that Greece is an easy scapegoat, will find that this eventually turns against them, against the hard core of the eurozone," said Greek finance minister Evangelos Venizelos. Greece can, if provoked, pull the pin on the European banking system and inflict huge damage on Germany itself, and Greece has certainly been provoked.

9. The amazing Chobani - Here's a good news story about dairy products. Chobani is an American brand of Greek yoghurt made by a Turkish immigrant, Hamdi Ulukaya. Forbes reports on how it's now worth over US$700 million after just 4 years. Could Fonterra have done this?

Ulukaya got Chobani got off the ground in 2007 with the help of an SBA loan. Between then and now, Chobani became the largest yogurt maker in America. It started with Ulukaya winning over upstate New York shops. Then came regional chains, then New England, then national coverage. Chobani became one of the primary engines in the great American discovery of Greek yogurt. Ulukaya could barely keep up with demand.

Chobani has taken no investor money, instead building on cash flow and conventional bank loans.

10. Totally Jon Stewart on Obama's Jobs speech

23 Comments

Chuckle. It seems that China helping Italy BS has had a half life of less than 24 hours:

http://www.cnbc.com/id/44497528

You know it has become bad when rumours have to be spread via the FT to try and stop the markets imploding............

Given their falls in the last hour, the FTSE, DAX and DOW (futures) appear not to have bought the BS.

True andy h....this yelp from the Japanese...http://online.wsj.com/article/SB10001424053111904353504576567811345411184.html followed by a nah not really....

http://www.businessday.com.au/business/world-business/italy-asks-china-to-buy-its-bonds-20110913-1k6jp.html I could go on but it will be acedemic by Friday.

roast italian duck..done peking style.

Hey Count : I was watching the Miss Universe competition on the telly , as one does .... to keep abreast of topical issues , and to get to the bottom of international affairs ...... and I didn't see a chick in a black tee-shirt and in gum-boots ...

....... has Miss NZ buggered off to watch the rugby ?

Nice to hear from you GBH......hope all is good.

Apparently Miss N.Z. has been withdrawn due to the sexual exploitaion of the species here down under.... under. In a comment regarding her withdrawal for Miss Universe, she was quoted as saying if she were to be successful she wouldn't want it to be for the wrong reasons.

It is understood she has opted to apply for the soon to be vacant Ambassador to Italy post in the hope of furthering her career....inside sources suggest Mr Burlusconi is looking forward to a warm relationship....not to mention Julie MacKenzie being well pissed about it.

Apparently Miss Kiwi went AWOL in Sao Paulo , she jumped a fence when she spotted a flock of sheep which needed dagging ...... atta girl !

..... all goody good here , Count ... a tadge busy , but !

A benison upon to you and the revolutionaries . ....

... . Biff the old lamingtons if all you receive is alot of hot air weezing out of the geezer at the Reverse Bank tomorrow . For $ 500 000 p.a. we want value out of AB , nothing short of a Hans Christian Anderson fairy tale will do .

Will do GBH stay well n happy...!!!! oh the joy of it all....tum te tum te...

More bad news from Europe Latest

09.35 The UK inflation figures for August are out and they show prices (using the consumer prices index) climbed 4.5pc on the previous year in August, compared with a 4.4pc increase in July.

Taking the retail price index (RPI) inflation figure, which also includes housing costs, inflation was up 5.2pc.

09.15 News from the debt markets: credit default swaps on European debt widened, indicating traders think there is a higher level of risk of default.

The Markit iTraxx SovX Western Europe Index of swaps on 15 governments climbed, as did Markit's index of corporate debt.

Gavin Nolan, director of credit research at Markit said:

Italy is scheduled to sell €7bn in debt this morning and the results, as well as the support received in the secondary market, will be closely watched.

09.10 The FTSE 100 is down 0.6pc to 5,100 points. The CACalso fell in France, losing 1.3pc, and the DAX declined in Germany after rising ine early trading.

09.07 Shares have given up their gains already

http://www.telegraph.co.uk/finance/financialcrisis/8720479/Debt-crisis-…

Re #9. The amazing Chobani:

Chobani has taken no investor money, instead building on cash flow and conventional bank loans.

Perhaps it’s time to ask the management of Fonterra as to why they keep on trying to alter the current company structure. Is it cynical of me to wonder if it’s part of a deliberate strategy to allow control of an important commodity company, and a good earner, to go overseas. Very juicy potential earnings for senior management?

Federated Farmers' new dairy spokesman Willy Leferink has stated “Fonterra would quickly succumb to foreign ownership if the world's biggest dairy exporter went public”.

www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10751451

"If Fonterra was publicly listed, within a decade it would go down the same path trod by Nufarm and Lion Nathan," Leferink said in an op-ed piece for Ideolog magazine.

What would be different about the ‘partial’ sale of SOEs? Another gift to the overseas fraction of the top 1% that are ‘hollowing out the middle class’? If Willy Leferink thinks that farmers will take the money and sell, what would be different from the Mum and Dad investors in the SOEs?

What price electricity once the SOEs are ofshore owned?

Sorry, offshore

Debt the 1st 5000 years (from RT). Interview with Dr. David Graeber, professor of anthropology at Goldsmiths College, University of London.

LBC Bank has gone bankrupt ! ....... who are they , you wonder ? ... well we wondered too , yet it seems that this low flying Philippine bank has 321 516 deposit accounts , and was given a " Superbrand " status by one government agency .....

... the bank branched out of LBC , a well respected parcel forwarding firm .

And what convinced 300 000 folk to biff their money into a start-up bank ?..... ummm , it seems the bank offered " out-of-this-world interest rates " ( Chito Cabaera , Metrobank ) .

... some of the depositors have exceeded the PDIC ( Phils. Deposit Insurance Corp ) guarantee of 500 000 pesos ...... infact , these depositors are on national TV , demanding a bail-out , because they assumed they has 100 % deposit coverage . It seems that they didn't do their homework , before entrusting their lifesavings , to a bank with no track record ....

Now , Gummy thinks that this is a salutory lesson to investors everywhere ....... what's that , oh yeah ..... NZ has already been there , done that ....

But the Philippines has so many litle banks; rural banks, agricultural banks etc. It would surprise me if many were in good shape. The Metrobank ATMs are probably the best to use.

Yes , much alike America , the Philippines has thousands of small banks , many family owned ... and why would anyone in their right sense , entrust their life-savings to one of these , rather than to a major bank ? .......

...... incredibly high interest rates ! ... So you grab a couple % points more interest , and in the process greatly increase the risk of losing 100 % of your capital .

Dumbness ain't confined to NZ investors it seems , people are getting dumberer all over the world .

I didn't know there was an LBC bank. LBC, perhaps another LBC, is a small parcel & freighting agency and a waty to send remittances.

We use the LBC often , excellent service , cheap and speedy . And it saves lugging stuff home after a holiday within the country , easy to freight it , and travel back light .

..... until the news erupted yesterday morning , we had no idea that they'd also set up a retail bank .

Sorry GBH. My error. I wrote before I thoroughly read your post. You said what LBC was. Time to watch some TV.

#3 I think that’s an interesting graph from New Zealand’s point of view. In among that cohort, we are one of the least unequal countries, and equality in NZ was improving in the first years of the decade according to it. I have no idea what the scale on the y axis refers to(???) and the title of the graph is confusing, which may lead me to interpreting it incorrectly, (I always used to slam students for doing that. If the graph wasn’t correctly and completely labelled so that the reader could instantly understand the point it was making without room for doubt – look out!) but NZ seems to have moved in a relatively tight band since the 1940s. In light of that, is this debate around inequality just another example of where New Zealand is importing the battles and concerns (often trendy) of foreign countries yet again and trying to make them its own, when really they are not and the nation should be focusing on what is happening here, and making laws and policies based solely on that?

Re: Chobani yogurt, it seems to cost about NZ$8.70/kg in the US. It would be hard to find a good quality one in NZ for that. The new "Collective Dairy" brand is popular and costs NZ$14/kg. I thought we were paying international prices for dairy? Plus the US has some dairy protection and farmer subsidies so the whole story would be hard to untangle.

NY Times on how US politicians are more likely to vote in the interests of the rich, because they are rich.

This is true in NZ too. So many of our MPs are landlords either directly or via trusts that it's no surprise that the government will not do anything that will lower property values.

Probably true Billy. I recall Alex Tarrant did some article on this and I think about 60% of MP's (involving nearly all parties) declare a direct interest in property investment activity of some sort on the pecuniary interests list and there are similar high proportion utililising trusts. Rob Stock also did some articles in the SST on the same subject. Conflict of interest when it comes to taxation of property? Maybe just a little.

#5 - great article Bernard. I like the last three paragraphs:

"If we could build all those houses back then with Reserve Bank finance at 1

per cent interest, why can't we do the same now to rebuild our city?

We still have the Reserve Bank, which could issue credit at 1 per cent as it

did when it provided the money to build houses for Key's mother and more

than 33,000 other needy families.

Perhaps we need more common-sense sheilas and blokes managing New Zealand's

economy as they did with success in the 1930s and fewer over-educated

"experts".

When I made a personal submission to CERA/CCC for the ChCh city plan it was the funding apsect I focused on only and quoted this article. No cash, no pash - simple.

Bernard, how about you get Roger Sutton in for a double-shot interview to discuss the funding, financial aspects of the ChCh rebuild, and of course this funding approach?

Cheers, Les.

Good idea Les

Amanda is travelling down to ChCh soon.

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.