Here's my Top 10 links from around the Internet at 8 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

Sorry I'm so late today. We had a couple of sovereign credit rating downgrades. Haven't had one for 13 years. Major spanner in the government's works. Go the All Blacks (but not so hard that anyone gets injured and after all it's the Canadians so actually you don't need to go that hard...please, please don't let Dan or Richie hurt themsleves...)

1. The problems in China - Mish at Global Economic Analysis points to an email from a reader in China (backed by links to local news sites in Chinese) saying that private business owners are now disappearing or jumping off buildings because they can't pay the very high interest rates being demanded by 'trusts' and other loan sharks.

This all follows the government ordered crackdown on lending from state banks to slow the economy and inflation.

So property developers and private business owners moved to the loan sharks and trusts (finance companies) to borrow more to pay the interest on the other loans...

Sound familiar?

These loans pay monthly interest rates of up to 10%.

It all appears to be unravelling in tragic fashion inside the more speculative and entrepreneurial parts of China.

Here's the reportage via Mish:

Since April this year 29 private business owners have disappeared, all of them had over 100 million RMB businesses. 11 of the 29 owned shoe manufacturing businesses.

An analyst from China Investment (China's Sovereign investment fund) pointed out that it's because they are squeezed by a rapid increase of component and labor costs. A rising RMB is also a reason why many export oriented companies are hit. In August, Zhou Dewen, President of Wenzhou Small-Medium Business Development Association said the profit margin of Small-Medium businesses in Wenzhou has dropped to under 5% and absent of policy changes, 40% of businesses in Wenzhou will go out of business by next Spring Festival (late Jan 2012)"Grey Finance" Brewing the Chinese Crisis) states that most of those owners have borrowed "private" loans (typically 70% of all loans), with MONTHLY interest rate ranging from 3% to 10%.

About 89% of families/individuals and 59% of companies in Wenzhou participated in such "private loan" schemes. In Erdos (the ghost city you blogged many times), such "private loans" are more than 200 billion RMB with annual interest rate over 60%. Now they are crashing, causing rampant unfinished real estate projects in Erdos.

2. Speaking of Ghost Cities - Here's the ghost cities documentary from Adrian Brown SBS Dateline. I may have pointed to this before, but it's well worth watching. It's from April.

3. More on the runaway bosses - Reuters also reports on the problems of Chinese entrepreneurs going into hiding or worse after using loan sharks.

Many cash-strapped firms are unable to borrow from banks amid a credit clampdown by Beijing, and some have turned to China's underground lending market - which pools money from individuals and firms - at annual interest rates as high as 100 per cent.

The staggering rates, at more than 15 times China's benchmark lending rates, have pushed some firms to the limit.

In just one day last week, Chinese media reported that nine bosses of small-sized firms in China's entrepreneurial capital of Wenzhou, in eastern Zhejiang province, had skipped town after realising they could not repay their corporate loans. 'The private lending craze has fuelled an economic bubble, and the 'runaway episode' in Wenzhou is a landmark event in the bursting of such a bubble,' the official Financial News, a paper run by China's central bank, said in a report on Wednesday.

This detail about how the informal lending sector works is fascinating. This is what happens when you suppress deposit rates in conventional banks.

An investment consultant in Beijing, who only gave his surname, Bai, told Reuters that he remits his salary back to the northern Chinese province of Hebei each month for his mother to lend to businesses.

'The money that I lent at the start of the year had annual interest rates of 10 per cent. Now rates have risen to 50 per cent,' he said. 'My 100,000 yuan of savings has grown to nearly 150,000 yuan.'

But firms cannot afford such sky-high rates, said Zhou Dewen, head of the association for small- and medium-seized enterprises in Wenzhou. Many earn profit margins of between 3-5 per cent, so loan defaults may spike if rates do not ease next year. Even Mr Bai is worried for his borrowers.

'My neighbours at home are lending at annual rates of 150 per cent,' he said. 'Which industry can enjoy such high profit margins? It's not like they are trafficking drugs.'

4. Lower growth for longer - Here's what PIMCO, the world's biggest bond fund, sees for the world over the next few years.

- Over the next 12 to 18 months, we expect the global economy to expand at a very modest real rate of 1% to 1.5%

- Global imbalances have continued to rise in the post financial crisis environment, global leaders continue to fail in their policy coordination efforts, and deleveraging and reregulation continue to be critical over the course of our cyclical horizon.

- We are transitioning into a world where we believe the incentives of policymakers and the divisiveness of politics will become the predominant drivers of investment returns and economics.

5. 'Those European idiots' - Renowned eurosceptic Peter Oborne repeatedly describes a EU spokesman as an idiot through this otherwise quite interesting BBC Newsnight panel discussion below.

I like it when Jeremy Paxman turns to the spokesman and says: "So Mr Idiot would you like to respond?"

Then the idiot walks out. After being called an idiot several more times.

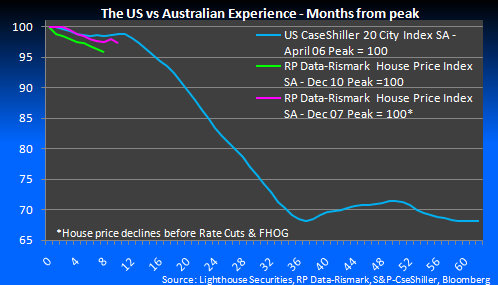

6. Australian house prices falling fast - Macrobusiness.com.au points out that Australian house prices are currently falling faster than they did in 2008 and faster than they did in America's housing market early in the housing recession there.

Australia's house price dip in 2008 was only temporary becuase the government intervened to guarantee its banks, slash interest rates and offered a first home buyer's subsidy to ensure the economy didn't tank. It's not doing the same thing this time around.

I'm not so sure Australia will see the same slump we've seen in America because Australia doesn't allow 'jingle mail' where the home owners can walk away from the debt and Australia's banks didn't outsource their credit decisions to dodgy middlemen. But still, Australia's house prices are vastly over-valued relative to incomes. Supply is also tight in some places, but not everywhere. The Melbourne apartment market and the Gold Coast apartment market is flooded.

Here's Macrobusiness:

As you can see from the chart below the current pace of house price declines in faster than that experienced in Australia during the 2008 slide, while US prices declines were even more tempered through the first 12 months, before the tsunami of selling began once people realized the Ponzi scheme of buying and flipping was done.

It seems that the fall in the appetite for, and price of, credit has been responsible for the slow melt in prices to date. Should prices fail to recover, it is likely that the selling pressure will intensify as investors can no longer justify holding on to properties that are falling in value and, with an unequivocal connection between falling house prices ad rising unemployment, we are unlikely to have seen any forced selling yet either

7. A good European summary - The Economist has an excellent summary of the bureaucratic machinery behind the eurozone and concludes thus:

European leaders such as Mr Barroso may well feel “wounded” by the patronising lectures of outsiders. But unless the euro zone’s countries listen to good advice, and quickly act on it, they will face not just humiliation but economic catastrophe.

8. Some great pictures on the Euro crisis - Thanks to Foreign Policy for the gallery. Click on the picture to go through to the gallery.

9. It wasn't just Japan - The shorthand used when talking about long periods of economic stagnation is Japan since the early 1990s.

But there are other countries and other periods of stagnation, including New Zealand from 1921 to 1927, according FTAlphaville's pickup of a Goldman note.

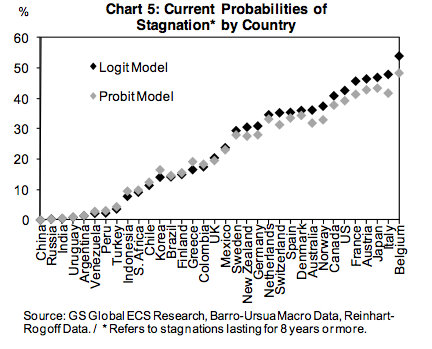

Also the Goldman note includes a chart showing the likely probabilities of stagnation for various nations.

Interestingly, New Zealand has a probability of about 30% of going into a stagnation, which is higher than Greece (!), South Africa and obviously China (on 0%), but also surprisingly below Australia, Canada and Denmark.

Belgium looks like it is toast, as does Italy, which is much more problematic for everybody because it has so much debt, much of it held by German banks...

10. Totally Clarke and Dawe on Wayne Swan's award for being the best Finance Minister in the world.

His groin muscles and hammies are fine.

48 Comments

re: 6

the OCR is quite high here in Aus, so if house prices start tanking more seriously there is a bit of room to move

I think the price falls will be mild here, although if China tanks then all bets are off

Matt - I actually think you may well have jumped out of the frying pan into the fire.

More on the problems in the Aussie house market:

http://www.whocrashedtheeconomy.com/blog/?p=1766

So Bernard ....the guilty idiots.....I see that.... yesiree thats pretty much the way I see it.

..... but they don't see it , Count ! ... that's the tragic thing ... after all the hell we've been through , not just in Europe , but worldwide ..

.. after all that , the bureaucrats and busy-bodies are still spinning the yarn , pouring out their limp stories and theories ..

... and never once thinking to look long & hard into the mirror to find the guilty idiots .

Loved his attack on the FT former editor - and the weasel way the FT man tried to get out of it - 'oh the rules werent applied properly etc' -

The FT used to be a good read in the 1980s - however sometime in the 1990s (and ever since) it switched to being a pro-Europe, centre-left (European Social Democrat) mouthpiece which was far too complicit with the Blair/Brown 'project'. The folk involved can squeal all they want about the term 'the guilty men', but that assuredly is what they are.

Yes, somewhere along the way the FT and the Economist got colonised by plonkers. How did that happen I wonder? Woosie deluded editors and know it all journalists. Very sad.

Peter Osborne is a treat isn't he? I love it. Thanks for that Bernard.

But Anyhoooooooo it's Friday Yayyyyyyyyyyyyyyyyyyy...! as you probably already know our island cousins failed to score more points than Sth Africa...but gave them a belting they'll recall for a day or two...on you lads.

Today in honour of the RWC and more to the point our Transtasman compatriots................. I offer....

Edward.......

Edward was at school this morning and the teacher asked all the children what their fathers did for a living. All the typical answers came out, Fireman, Policeman, Salesman, Chippy, Captain of Industry etc. But Edward was being uncharacteristically quiet and so the teacher asked him about his father. 'My father is an exotic dancer in a gay club and takes off all his clothes in front of other men. Sometimes if the offer is really good, he'll go out with a man, rent a cheap hotel room and let them sleep with him.' The teacher quickly set the other children some work and took little Edward aside to ask him if that was really true. 'No' said Edward, 'He plays rugby for Australia, but I was just too embarrassed to say.’

Geez I hope Edward is at high school Count, not primary school.

Edward got off lightly , Count ...... imagine the porkies you'd have to tell at school to cover up the fact that your dad was a financial journalist !

That would be nothing compared to them being a bank 'economist'.

Another nice insight into John Key

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10755698

Key at odds with Mapp on SASHowever, when asked today, Mr Key denied the troops were in a combat role.

"No, look it's a mentoring role and, you know, I've taken the liberty of checking that at length with the head of the SAS.''

The coverage New Zealand SAS received in the UK media during the three most recent firefights and the accompanying uncensored images from the Intercontinental fight to the death show Key up for the outright liar that he is.

Now he knows it is a lie, he knows we know, but he is quite prepared to say the lie. You would have to say that he is a funny guy.

The Daily Mail on the British Concil attack

This signalled the beginning of a five-hour gun battle that left a member of the New Zealand Special Forces among the dead.

Read more: http://www.dailymail.co.uk/news/article-2027749/Terror-British-women-trapped-deadly-Taliban-raid.html#ixzz1ZR6fWRKz Then also from The Daily Mail

New Zealand special forces were called in to help with Sunday night's attack, New Zealand Prime Minister John Key said in a press conference Monday.

He said the New Zealand troops began in a mentoring role but then shifted into an 'operational' combat role as the attack unfolded. Key declined to give further details of what happened.

I think when it comes to ferrets stotes n weasels Plan B.....one of the few things they fear is a wide eyed wisened owl.....

Key by behavior alone appears to subscribe to the theory most people are stupid...apathetic....indifferent...existing only on a need to know level....an elitist ,despite the so called humble beginnings......

What's always scary...............is when the people prove him right.

Forecast says double-dip recession is imminent.

http://money.cnn.com/2011/09/30/news/economy/double_dip_recession/index.htm?hpt=hp_t2

Just to back up how important that call on the start of another US recession is:

''Last year, amid the double-dip hysteria, we definitively ruled out an imminent recession based on leading indexes that began to turn up before QE2 was announced. Today, the key is that cyclical weakness is spreading widely from economic indicator to indicator in a telltale recessionary fashion.

Why should ECRI’s recession call be heeded? Perhaps because, as The Economist has noted, we’ve correctly called three recessions without any false alarms in-between. In contrast, most of those who’ve accurately predicted a recession or two have also been guilty of crying wolf – in 2010, 2005, 2003, 1998, 1995, or 1987''.

http://businesscycle.com/reports_indexes/reportsummarydetails/1091

They must have heard us - Dow slumping into the close, down 220, back down below 11000 again.

Time is changing fast !

You all should watch this video: What’s wrong with America and where are they hitting ? Has the war of the classes began - worldwide ?

http://www.washingtonsblog.com/2011/09/wall-street-protest-growing.html

In most societies today ethic and moral requirements and standards don’t prevail.

Hundreds of uniformed pilots, standing in stark contrast to the youthful Occupy Wall Street protesters, staged their own protest outside of Wall Street over the past couple of days, holding signs with the picture of the Hudson river crash asking “What’s a Pilot Worth” and others declaring “Management is Destroying Our Airline.” This comes after pilots at United asked a federal judge to halt the merger with Continental, arguing that the whole thing is proceeding too quickly……

http://www.forbes.com/sites/erikkain/2011/09/29/union-airline-pilots-occupy-wall-street/

Now, there are demonstrations in lower Manhattan and Boston specifically directed against the Wall Street banks. Another protest demonstration is scheduled for Washington, DC, starting on October 6. Good: a political challenge to Wall Street is indeed long overdue.

http://tarpley.net/2011/09/29/emergency-program-for-anti-wall-street-protestors/

Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail

They need to get re-trained.....they dont see that jetfuel above $120US is killing their industry.....cheap economy class is gone in 10 years and so are most pilots.

regards

The world is moving much faster into uncontrollable mode, then most experts are predicting. Turmoil in many western nations will be daily occurrence soon, with severe social, financial and economic consequences for all of us.

Please read on:

http://www.blacklistednews.com/Prophets_Of_Doom%3A_12_Shocking_Quotes_F…

When honest citizens get arrested in stead of greedy “Wall- street crooks”- something stinks.

FYI: https://occupywallst.org/

"...protests are sprouting in other cities, including Boston, Chicago and San Francisco" rooters

And so it begins. Wait until the New York police numbers are slashed and salaries halved and pensions stolen by the feds.

Reading “livestream” comments: Actions go globally incl. Australia

Copper prices are almost in a free fall (28% since August) – good bye world economy.

wow.........

Still I need to buy some 15mm copper pipe....

regards

I was thinking the same thing, looking to put in a woodburning stove already have the coppicing woodlot. Can i have solar water heater and a stove conected to work in tandem? The copper today looks a lot thinner than the old stuff.

Just building some wire cages for the berries. We now have an organic group in the area, its handy for me and they like having a farmer with a tractor in the group and a lot of meat.

Looking at an Esse stove, they are expensive my wife had one in the UK and loved it.

http://www.essestoves.net/wp-content/uploads/2011/07/Esse-Stoves-Woodfi…

these are the importers http://www.pivotstove.com.au/catalogue/cookers/hydronic-stoves/900-Seri…Andrew that wood stove is not that great in terms of efficiency. I don't know if you have many alternatives though.

Compare it to space heating units here.

My current work is R&D on my own invention that improved the efficiency and emissions on wood burners. Unfortunately a wood stove isn't yet on the horizon, perhaps a year two away.

when I get a wood burning stove can I fit your invention?

The configuration of the wood burning stoves I have seen would make it very difficult, I will probably have to design one from scratch.

But you never know once I turn my mind to it:)

Aprovecho, rocket stove etc. certainly worthy for outdoor cooking.

Probably lack the finish for indoors though! And where would one dry the lambs and wellies, whilst cooking the roast :) Have you seen the pyro that you hinted at? I keep looking at it and wondering how good it is.The Rocket is hard to beat for simplicity, but the TLUD's are a big step up in performance. I have thought about getting one of Tom Reeds little camp cookers, as you couldn't build on for that! Still TLUD's will never be as good as a down draft gasifier, which is essentially what my invention is.

The problem with the Pyro is that it was invented at the DSIR, but the knowledge that went into the design does not lie with the current manufacturer as far as I am aware. I have worked it out though:)

This site has some good info, the chart at the bottom is the most important one in terms of wood burners for space heating. But I have also drawn on the work of Doug at www.fluidynenz, whose has unfortunately retired and his website is now down. Another clever guy is Larry Dobson, who invented pretty efficient boilers back in the 80's.

God I hate beureacracy, but it looks like I am going to have to throw money at it to move forward. The trouble is I am having to spend considerably time working in reverse just so my device will pass the test, whereas I have asked the ministry to write a new test. Guess what my response was?

I hope someone at some stage realises the potential here. From the EPA website there are 12 million pre emission law wood stoves in the US. Modifying them is a completely untapped market that in in the big B's in terms of $. It will be a shame if I have to take it offshore.

Why not 'jump through the hoops' in the bigger market then... make it here still?

Ta for the pyro thoughts - I now understand the difference between your mods and the pyro. In our case / your mods, the 'flue' pipe would occupy a large amount of the firebox, still tempting to try though... will it take a taper? (I can see that it should).

Actually I think your Ministry approach (change the testing) is probably the best one... the device is new in its implementation to domestic appliances - maybe it needs a different classification...stressing the differences (otherwise it just becomes about pollutant levels).

Hoops. Yes bigger markets are my thoughts so you are onto it there, in fact you are onto it all round. The pyro still has one design feature that makes it suitable for passing the test, so I am still test methods to try and get a similar performance. The emissions mainly happen in the minutes after fresh wood in introduced. You wouldn't believe how hard it is to find wood for emulating the tests!

Gummy Bear will have to pay more for his Danish Tarts!

"Denmark has introduced what is believed to be the world's first fat tax - a surcharge on foods that are high in saturated fat.

Butter, milk, cheese, pizza, meat, oil and processed food are now subject to the tax if they contain more than 2.3% saturated fat."

and McD's fries are 100% fat....wonder if its cumulative....but those are exported to you so tax exempt?

regards

I thought you have a ready supply of Philippino Tarts there Gummy, or do you like a bit of variety?

This is exactly what Mark ( Tribeless ) has been warning us about . The do gooders are infringing on personal freedoms , dictating what is or isn't in your best interest .

... how soon before the world improvers within the NZ Labour party decide that a fat tax and a sugar surcharge is in the best interest of all New Zealanders .

It was not so long ago that they tried to mass medicate the entire populence by commanding bakers to dose all of the daily bread with folate . And that twit in National , our girl from the Waimak ( who has been beaten in every election against Clayton Cosgrove ) , that silly woman was gonna go along with it , and introduce the folate legislation . Idiot !

"for all the breathless headlines from the IMF/World Bank meetings in Washington, DC, Europe’s leaders are a long way from a deal on how to save the euro. The best that can be said is that they now have a plan to have a plan, probably by early November. Second, even if a catastrophe in Europe is avoided, the prospects for the world economy are darkening, as the rich world’s fiscal austerity intensifies and slowing emerging economies provide less of a cushion for global growth. Third, America’s politicians are, once again, threatening to wreck the recovery with irresponsible fiscal brinkmanship. Together, these developments point to a perilous period ahead."

http://www.economist.com/node/21530986

I wonder if the spin and BS sector will provide Bill's 170,000 new jobs. They will not emerge in the rural regions that's certain. Farmers I know are going for labour free technologies especially in the sheep sector. Fencing on flat land is now a machine activity. On the hill country it's a case of do as little as possible because good prices for Lamb cannot be promised. And how many winz 'clients' ask for farm labour work!

Meanwhile post next month expect a jolt from the fools in wgtn as they finally wake up to the real world market as outlined above. You will see the merging of departments..the closing of others....the falling state employment ceiling become a permanent feature. English will go down as a total bloody failure if he fails to throttle the govt splurge and stop the insanity.

If he doesn't get his finger out...Mr market will chop them all off.

"If more than half the voters opt to change the voting system, Parliament will decide if there will be another Referendum in 2014 to choose between MMP and the alternative voting system that gets the most support in the second question in the 2011 Referendum." google

"if"...."if".....harrrhahahaaa....Democracy not

I think the bulk of Kiwi will have had a bloody guts full of MMP and will vote for change. I think the majority will vote for FPP. 4 year terms ought to begin in 2017. The number of mps should be chopped back to 60. The Maori seats have to be terminated.

The savings from longer terms of govt and fewer bums on seats in Parliament sucking lower salaries with a reduced Parliament bureaucracy.... will amount to hundreds of millions every bloody year.

Sad comment Wolly.

The world as you knew it, is going forever. The last doubling time has gone, and there ain't another.

Exponential debt is in overshoot, and what you see in trouble now, is just the beginning.

Globally, growth is finished at this point.

And you're worried about wanting to go back to FPP?

Get real. There are bigger problems afoot.

Never PDK...we shall never give up...FPP will bring us wealth and a glorious future of full employment and no taxes.

A small thing happens somewhere every day that will change the world as you know it for the better.

When your sprogs are really old Coots...the Chinese will be freighting Helium3 back from the Moon and the age of the fusion reactor will have started. Limitless power and all electric vehicles will dominate the planet.

People will be reading historical accounts of the economic ruin and end of the usa and the emu.

Many NZder's tend to forget that 4.5 million people is about the average population of a medium size city in the rest of the world. Having 30,000 plus public servants is just the most repugnant "gravy train" per capita.

Keep your eyes on Morgan Stanley - shares fell 10% on Friday, and insurance protection against them going teets ooop is soaring..........

http://www.cnbc.com/id/44740442

Mind you most of the US banks have been caned recently.

Andrew - again time for George talking about the greedy.

Thanks Walter

Esse's the best Andrewj! I have had one for three years waiting to install in a "house/home" when I find one that is properly priced and built. Just looking this morning again on Trademe...what a load of shacks! Its a shack or a brick and tile that all look like small psychiatric units.

Anyway back to Esses . They cook beautifully, heat the water and room and now I need to find out about bedroom radiators for the winter. They are also very fuel efficient and non polluting

Thanks prosperopink, its good to hear something positive, my plumber told me Rayburn have slipped in quality and are not as good as they were. I planted 1000 Robinia in a woodlot about 8 years ago, they are getting tall and almost ready for the first crop. Hangin there with the houses, not much good news out of Europe and if its not Europe its China or the States, something will have to give soon.

And here is the weekly bullshit....

“The Fed has potent tools at its disposal and is not now, or ever, out of ammunition,” Bullard said today in a speech in San Diego. “Should further weakness develop, monetary policy will need to respond appropriately,” he said, adding that “sluggish growth” leaves the economy vulnerable to “shocks.”

Yes QE3 4 5 6 and so on are on the cards...these are the "potent tools"....they are used by fools.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.