Here's my Top 10 links from around the Internet at 10 pm in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

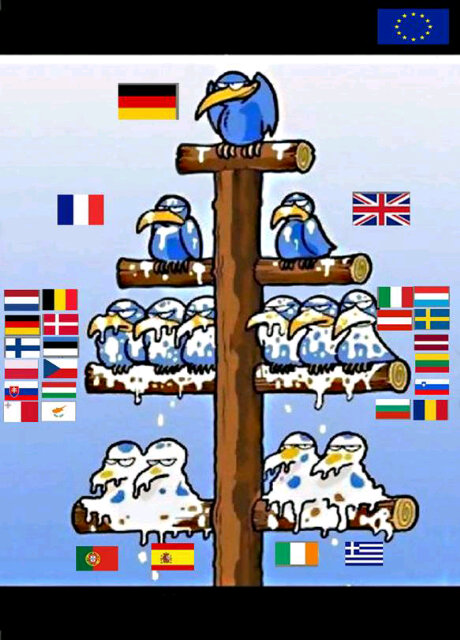

Number 8 is today's must read, particularly if you a supporter of an FTA with America. My favourite cartoon is Euro Angry Birds.

1. Is China about to ease? - Bloomberg reports Chinese lending jumped in October.

It suggests the Chinese may be about to use similar tactics to the ones they used in late 2008 to switch the activity in its economy from exporting to infrastructure and housing construction.

We'll see if China is really serious about money printing and building fast railways to nowhere to try to keep its economy going. It's not in the current 5 year plan..

There's still plenty of inflation in the Chinese economy, but it has come off the boil in the last month or so.

The other major macroeconomic factor to watch is whether the European Central Bank starts printing money as everyone except the Germans (and the Finns and Dutch) want.

It's all part of the extend and pretend strategy.

It didn't work in 2008.

We'll see whether it works three years later.

Local-currency lending was 586.8 billion yuan ($92.5 billion), the People’s Bank of China said in a statement on its website yesterday. That was the most since June, exceeding the previous month’s 470 billion yuan and all 18 estimates in a Bloomberg News survey. M2, the broad measure of money supply, rose 12.9 percent.

Chinese officials aim to sustain the nation’s expansion as the property market cools and Europe’s slowdown hits exports. Daiwa Capital Markets sees a rebound in lending through this quarter after Premier Wen Jiabao said economic policies may be “fine-tuned” and pledged support for smaller companies. In China, the government guides lending levels.

“This is a meaningful pickup in new loans which suggests selective easing has already started,” said Qu Hongbin, a Hong Kong-based economist with HSBC Holdings Plc. “This should help stabilize growth with small and medium-sized enterprises and increase credit support for ongoing infrastructure projects. China has no risk of a hard landing.”

2. Euromess - The Telegraph reports the big (1 trillion euro) bazooka fund set up the Europeans to stop contagion spreading from Greece failed to raise enough money for Ireland's next bailout tranche of 3 billion euros last week. Instead it had to resort to buying its own debt.

Just nuts.

Here's The Telegraph's Harry Wilson and Kamal Ahmed:

The European Financial Stability Facility (EFSF) last week announced it had successfully sold a €3bn 10-year bond in support of Ireland. However, The Sunday Telegraph can reveal that target was only met after the EFSF resorted to buying up several hundred million euros worth of the bonds.

Sources said the EFSF had spent more than € 100m buying up its own bonds to help it achieve its funding target after the banks leading the deal were only able to find about €2.7bn of outside demand for the debt.

The revelation will be seen as a major failure and a worrying sign of future buyers strike after EFSF officials and their bankers had spent recent weeks travelling the world attempting to persuade key investors, including China's national wealth fund and Japanese government funds, to buy its bonds.

3. 'You're fine until you're not fine' - Economic historian Niall Ferguson tells CTV in this interview that the Euro may live longer than the European Union and public debt over 100% of GDP is a dangerous thing. He makes a good point about interest rates being low until they are not. And then your frog is boiled.

"It's actually easy to leave the European Union, whereas it's hard to leave the single currency. So one possibility is that the euro may survive, but the European Union, the project of something that actually had a political as well as an economic character, that that might start to disintegrate."

Rising economic problems in the eurozone have created massive political turbulence, forcing the resignation of Italy's Prime Minister Silvio Berlusconi and, before that, the ouster of the Greek prime minister in favour of former European Central Bank vice president Lucas Papademos. Ferguson said those countries essentially ran into trouble because they choose to hold off on addressing their debt problems.

"What you're seeing in Europe, particularly Italy, is a warning for North America countries -- it's a warning that if you just let your deficit grow, if you allow your public debt to rise about 100 per cent of gross domestic product, at some point there will be a reckoning," Ferguson said.

"My argument is not that things happen gradually, but that they happen very, very fast. You're fine until you're not fine. You're paying 3 per cent on a 10-year bond, and then suddenly you're paying seven-and-a-half per cent."

4. Gold demand doubles - The Telegraph's Ian Cowie reports demand for physical gold has doubled in the last year.

Fears about the global credit crisis, the euro, inflation and the falling real value of paper money of all descriptions helped more than double demand for physical gold held by BullionVault last year; pushing up profits by 48pc it reports today.

The dealing facility, which was set up just five years ago, now holds gold and silver worth more than £1bn on behalf of 33,000 investors. It’s an ill wind that blows no good and rotten returns from bank and building society deposits have boosted demand for valuable metals. Paul Tustain, founder and chief executive, said: "The major driver of growth has been the steady realisation among private savers that low interest rates are here to stay.

5. The capitalist network that runs the world - The New Scientist reports on research about the linkages between 43,000 multinational corporations and the linkages between the companies that own. It finds a 'super entity' of 147 companies controls 40% of the wealth in the network (pictured below) HT John via twitter

The work, to be published in PLoS One, revealed a core of 1318 companies with interlocking ownerships (see image). Each of the 1318 had ties to two or more other companies, and on average they were connected to 20. What's more, although they represented 20 per cent of global operating revenues, the 1318 appeared to collectively own through their shares the majority of the world's large blue chip and manufacturing firms - the "real" economy - representing a further 60 per cent of global revenues.

When the team further untangled the web of ownership, it found much of it tracked back to a "super-entity" of 147 even more tightly knit companies - all of their ownership was held by other members of the super-entity - that controlled 40 per cent of the total wealth in the network. "In effect, less than 1 per cent of the companies were able to control 40 per cent of the entire network," says Glattfelder. Most were financial institutions. The top 20 included Barclays Bank, JPMorgan Chase & Co, and The Goldman Sachs Group.

6. So what happens now? - Reuters analyses the possibilities for Europe in the wake of the Italian bond market meltdown last week.

Efforts to construct a financial firewall to protect Italy, Spain and potentially France are running behind the curve, shackled by legal and political obstacles to using the European Central Bank or issuing joint euro zone bonds.

"This summer, I thought the "muddling through" scenario had a 50 percent chance of success. Now it's clearly less," said Jean Pisani-Ferry, director of the Brussels-based Bruegel economic think-tank and an adviser to the French government and the European Commission.

"Leaders everywhere are now aware of the very high risk if they let things run out of control, that it can lead to a financial catastrophe for Europe," he said in an interview.

7. Only weeks away from collapse - The FT's Wolfgang Munchau reckons the euro is only weeks away from a catastrophic collapse. He writes persuasively that the European bond market is cactused and that the only thing that will save it is a Eurobond backed by Germans.

The Germans won't allow it. Ergo. Cactused euro.

Yikes.

Here's Wolfgang:

The cause of the panic attack was the European Council’s decision on October 26 to renegotiate the private sector participation of Greek sovereign debt holders. With that decision European leaders destroyed what was left of a functioning eurozone government bond market. Investors interpreted it – correctly in my view – as a precedent. They then dumped their Portuguese, Spanish, Italian and even French government bonds. As of now, there is only one significant risk-free asset in the eurozone – German government bonds.

The eurozone’s refusal to capitalise the EFSF properly contributed to the panic. A leveraged EFSF would have the worst kind of Eurobond: a tranche in a toxic debt security. I really hope EU leaders will come to their senses and stop pussyfooting with dubious financial instruments. The eurozone needs a risk-free asset class, and this means something boring and simple.

8. America's rotten politics - I won't attempt to paraphrase this history lesson from George Packer at Foreign Policy on how corporate money infected America's public. Just read it and reconsider any support you may have had for the US Free Trade Agreement.

The final rant is well worth it.

Inequality will continue to mock the American promise of opportunity for all. Inequality creates a lopsided economy, which leaves the rich with so much money that they can binge on speculation, and leaves the middle class without enough money to buy the things they think they deserve, which leads them to borrow and go into debt. These were among the long-term causes of the financial crisis and the Great Recession. Inequality hardens society into a class system, imprisoning people in the circumstances of their birth — a rebuke to the very idea of the American dream. Inequality divides us from one another in schools, in neighborhoods, at work, on airplanes, in hospitals, in what we eat, in the condition of our bodies, in what we think, in our children’s futures, in how we die.

Inequality makes it harder to imagine the lives of others — which is one reason why the fate of over 14 million more or less permanently unemployed Americans leaves so little impression in the country’s political and media capitals. Inequality corrodes trust among fellow citizens, making it seem as if the game is rigged. Inequality provokes a generalized anger that finds targets where it can — immigrants, foreign countries, American elites, government in all forms — and it rewards demagogues while discrediting reformers. Inequality saps the will to conceive of ambitious solutions to large collective problems, because those problems no longer seem very collective. Inequality undermines democracy.

9. This will happen one day in New Zealand - In my dreams at least. A national newspaper in Italy last week lead its front page with the size of the Italian 10 year government bond spread above German bund yields.

I kid you not.

Can you imagine the NZ Herald having on its front page the size of the NZ Credit Default Swap spread to US Treasuries. One day... One day...

“Spread a 500” (spread at 500 basis points) was a front- page headline of Corriere della Sera, Italy’s top-selling daily newspaper, on Nov. 9. That evening’s television talk shows featured charts of the 10-year spread as Italian economists and politicians discussed Italy’s crisis.

In downtown Milan, adjacent to the city’s landmark Il Duomo cathedral, a group of Italians gather frequently to gaze at market prices on a giant TV screen displaying Bloomberg data.

“What’s the spread? It’s the difference that a country pays on interest rates compared with another,” said a 76-year- old retiree who would only identify himself as Peppino. “How can we pay 6 percent interest rates in Italy and Germany 2 percent?” Peppino said. “It shows that Italy is sick. When a country is strong, the spread falls.”

10. Totally Jon Stewart on the Rick Perry meltdown. Fun times.

47 Comments

Totally irrelevant link to streaming Greatest Hits from Flying Nun.

http://www.nzherald.co.nz/entertainment/news/article.cfm?c_id=1501119&o…

Straitjacket Fits - She Speeds my current favourite

cheers

Bernard

She's dreaming, but here's Merkel calling for a United States of Europe

In her interview, Merkel said that the next step to bolster investor confidence means what was begun by the euro’s founders must be completed with “a fiscal union, and then turn it step by step into a political union.”

http://www.bloomberg.com/news/2011-11-13/merkel-says-eu-must-forge-clos…

. ...of course she's dreaming , Bernard ... only one country has truely benefited from the establishment of the Euro as a currency , Germany . And they're as unlikely to want the Eurozone unravel , as the Chinese are to un-peg their currency from the American dollar ....

Dreamer , you're nothing but a dreamer ......

.... un-Merkelise Europe , say I ....... !

If thats her only / best idea I think its pretty clear that the EU is buggered....so how many months (weeks?) does it have left is the only Q.

regards

And Obama tells China to act like a 'grown up' economy. Like America's. Or Europe's. This guy is a comedian.

http://www.reuters.com/article/2011/11/14/us-apec-idUSTRE7AB12920111114

Obama insisted that China allow its currency to rise faster in value, saying it was being kept artificially low and was hurting American companies and jobs. He said China, which often presents itself as a developing country, is now "grown up" and should act that way in global economic affairs.

About as funny as some kiwi from down under having a moan about all the US$ printing a while back ay :)

Nouriel Roubini is excellent here at Reuters on the Eurozone crisis

http://blogs.reuters.com/amplifications/2011/11/11/down-with-the-eurozo…

Germany and the ECB have less power than they seem to believe. Unless they abandon asymmetric adjustment (recessionary deflation), which concentrates all of the pain in the periphery, in favor of a more symmetrical approach (austerity and structural reforms on the periphery, combined with eurozone-wide reflation), the monetary union’s slow-developing train wreck will accelerate as peripheral countries default and exit.

The recent chaos in Greece and Italy may be the first step in this process. Clearly, the eurozone’s muddle-through approach no longer works. Unless the eurozone moves toward greater economic, fiscal, and political integration (on a path consistent with short-term restoration of growth, competitiveness, and debt sustainability, which are needed to resolve unsustainable debt and reduce chronic fiscal and external deficits), recessionary deflation will certainly lead to a disorderly break-up.

With Italy too big to fail, too big to save, and now at the point of no return, the endgame for the eurozone has begun. Sequential, coercive restructurings of debt will come first, and then exits from the monetary union that will eventually lead to the eurozone’s disintegration.

Personally I think he's spot on.....from my lowly knowledge it has struck me for 3+ years that this wasnt going to end well....he's writtn it up well...right now I think he's on the money with the outcome....the only Q is will it be a fairly peaceful 3 to 6 years as this happens.....sadly I expect some loss of life as this occurs....and certianly loss of freedom......the long emergency is beginning.....

Another piece in here talks about having a core EU, but when you look at it the only solid core is germany and maybe finland (so the iece said) at that point having a union between 2 countries a fair distance apart makes no sense.....so its bye bye the EU.

regards

I used to play Tennis interclub with these UBS/ CS banksters – they are often so twisted and corrupt over there - they can’t even play a straight ball over the net - on the weekends.

..and because of their twisted soul – hardly one of them make it to a 12 handicap – although they play 5 times a week.

These two short films, you gotta see:

http://dailybail.com/home/the-fed-under-fire-the-federal-reserve-is-the-black-hole-in.html

and

http://dailybail.com/home/max-keiser-short-film-on-greece-heres-what-happens-when-your.html

The 2nd is especially interesting since it states quite clearly that the original (designed to fail) Greek bailout was illegal. Better still, the Greek entry into the Euro was a fraud. Why aren't the bankstas being rounded up and jailed?

Part two of Kaiser's report.

http://www.youtube.com/watch?v=LnsWEXqhd7M

What a mess.

http://claimgreece.com/ is outraging Greeks

Two days ago here in HK I came back from Stanley by bus. There was a group of very loud Italians. They must have heard me say to my wife " They're spending their last Euros before they turn to dust" Not a sound from them after that. These people are going to bring us all down.

Then there's this as oil stocks continue their relentless depletion.

Our pollies are asleep at the wheel planning asset sales and spending a massive amount of the proceeds on schools. How many of us here learnt quite happily in an old prefab?.

GS played a big part in this.....but Im sure its legal.....

;]

Up until the point they hang from a lampost I suspect....

If nothing else the mandarins / Pollies in Brussels turned blind eyes because they wanted the EU to expand......

regards

Bernard,

With regard to the rather hyperventilating article on inequality above, while the US and many countries have problems with inequality, the problems are overstated because as the article linked to below shows, people erronously think that income strata are fixed, that people stay in one income strata, be it the top or bottom, for their entire lives and that is that. This type of analysis, so prevalent at the moment with the OWS movement 1% v the 99% construct, is false. This analysis ignores completely the reality of mobility, people move up and down the income strata during the course of their careers and lives. Sure some people like Bill Gates and Warren Buffet are always at the top, but many people may make an appearance in the 1% as they recognise the efforts of a lifetime and sell a business, or they are at the peak of their career and income earning years, and then they go back down the strata. Just about everyone makes an appearance in the bottom strata as they take their first student or holiday job, but this is a necessary step on the ladder to success.

http://mises.org/daily/5799/The-Rich-Arent-Dispossessing-the-Rest

In fact not only is inequality not inherently bad, some degree of inequality is a precondition for a successful, merit based society. Does the fact that Sam Morgan and Mark Zuckerberg have made a bundle make me or anyone else worse off? No of course it doesn't, in fact the achievements of these 2 guys made my and everyone elses lives better off, and of course increased overall inequality at the same time.

The society in the world with the lowest inequality would have to be North Korea. Do we want to emulate that society's "success" with inequality?

We need to think much more intelligently about inequality and the economic challenges we currently face. All this hot air and hyperventilating tends to cloud our thinking and does us more harm than good.

Ppl used to believe they could move up that was the American dream....the reality is its almost impossible....this is the second gilded age, the first ended with the Great Depression....so will this one end.

mises is crap frankly....its not economics its political dogma...and we can see where 30 years of that has taken us.

You are cherry picking......

"think" thats what has been lacking for a decade or more.....thinking is what many ppl will be forced to do in the next 5 years or so as the reality of peak oil making the debt un-payable sink in.....

regards

Warning!! The above comment contains economic propaganda and disinformation.

James,

Many thanks. Social mobility is crucial.

That's why this piece in Time is so interesting. It cites academic studies showing that social mobility is now higher in Europe (the old country) than it is now in the United States.

Here's the link with more detail.

The most comprehensive comparative study, done last year by the Organization for Economic Cooperation and Development, found that “upward mobility from the bottom” — Daniels’ definition — was significantly lower in the United States than in most major European countries, including Germany, Sweden, the Netherlands and Denmark.

A 2010 Economic Mobility Project study found that in almost every respect, the United States has a more rigid socioeconomic class structure than does Canada. More than a quarter of U.S. sons of top-earning fathers remain in the top tenth of earners as adults, compared to 18 percent of similarly situated Canadian sons. U.S. sons of fathers in the bottom tenth of earners are more likely to remain in the bottom tenth of earners as adults than are Canadian sons (22 percent vs. 16 percent). And U.S. sons of fathers in the bottom third of earnings distribution are less likely to make it into the top half as adults than are sons of low-earning Canadian fathers.

cheers

Bernard

Whats gone wrong? oh, its OK just Spain biting the dust.

James I guess your comment would carry more weight if in the article Bernard wrote, was not mention of 14 million more or less Americans permanently unemployed. Still the best and most stable, high on happiness scale countries do have an equitable system. Of course I am thinking primnarily of Scandinavian countries. I will also add that that descrepancies we are concerned about now is between the few who are filthy rich and the many who are now dirt poor. Are you really ok with that

Totally agree......but when I see someone quoting mises I know Im looking at an extremist ie libertarian (of which there are about 1000 in NZ, based on their vote in 2008).....When you look at such a small minority with such extreme fundimentalist views, well its like the loopy fundi christians (who at least are 4000~20000 in number), there is no negoitiation with such ppl IMHO...its black or white for them. To parapharse some of them they are quite happy to see our society collapse and watch mayhem and death ensue in the hope their way will rise from the ashes....

So yes I think the likes of James really think like that....

regards

I thought the comment on 'Merit' was the most telling point of his post. Measured on what basis?

Do you have a definition of, or way of measuring, "merit" under which it is not the case that

"some degree of inequality is a precondition for a successful, merit based society"?

Inequality of wealth is not proof of inequality of opportunity.

Inequality of opportunity may, depending on the nature of the inequality, result in inequality or equality of wealth.

Equality of opportunity, on the other hand, will result in inequality of wealth; for the fact is that some people are more intelligent and/or industrious, and/or take wiser decisions and/or better advantages of their opportunities, and/or are more interested in making money, than others.

That's why inequality of wealth per se is the wrong thing to be complaining about.

My issue is the linking of merit with monetary wealth. Surely wealth can be measured in other terms than money, just as merit can be measured in other ways than wealth.

IMO opinion it makes for a pretty sad society when wealth is the preeminent measurement. Without having given the matter lots of thought, you could extend this to say that the measurement itself is the cause of the uneven distribution of wealth.

I don't think we are disagreeing, we are just having different conversations.

It is the OWS protestors who are making wealth, in terms of money, "the preeminent measurement".

By focusing on the fact that some people have a lot more money than others, they are ignoring the fact that there are be very good reasons for that. Those reasons, as previously noted, include the fact that some people have more talent than others, and the fact that at any one time different members of society are at different stages of their careers.

But the reasons for inequality of monetary wealth also include the very fact that you identify - some people assess merit in other ways than wealth, and wealth in other terms than money.

That is their right, and it is not a bad thing. It's a good thing. And it is something that you would have to suppress if you wanted to deliver a society in which money was more equally distributed.

Yes I think we are on the same page. Interesting point the OWS focus & I do worry about it being a bit grey in that department. My take on Russian communism is that it wasn't, the Bolsheviks got control from the Communists simply because they were better organised.

There was a cracking video here linked to by Wolly elsewhere in this thread, where Max Kaiser says the OWS movement should be buying silver while it is artificially suppressed in an effort to collapse the monetary system. Could work, then you could redefine the focus.

I think my personal focus is actually pretty good:) Yes some fine tuning for sure, but why stress about that.

I wonder whether wild bill and wonkey understood the boiled frog parable! Just a few more days of BS and then what.....the real budget plans will be whipped from wild bill's holster and the killing of the scared cows will begin in earnest, where ever that is.

Pity the folks living in earnest. It's not around here is it?....oh thank goodness for that...cos wild bill has a belt full of ammo. But can he hit a barn door you ask!

Spain on the way to join the 7% club....Italians unaware that Monti has to cut their incomes in half since most of them work for the state anyway...pensions chopped too...all those villa owners about to face a stone tax...heaps of work on offer for plasterers I'd say. Best of all will be the high heel tax!....Monti is not one for the ladies....

Obama telling the Chinese how to run an economy....funniest funny so far this year....

How long do we have before Bollard's OBR scam kicks into high gear freezing deposits far and near!

The building sector dying by the day....gst theft sent it on its way.

But the good news is the X and Y lot are starting to display a capacity to learn how to separate the BS in the media from reality of the piigs farce....X&Y have started to give the bank credit the big finger....this is a positive....

How do we know this?.....just watch as the media run the banking BS advertising back to back every BS break on the goggle box.

As a relatively young gen X person it has been great reading interest.co.nz. The comments and advice on this site have "opened my eyes" to what is going on financially in the world and especially NZ. Being informed has saved me about $ 300,000 so far by making sound financial decisions that I would not have otherwise made. I have had some "austerity" and saved myself from a lifetime of debt, and found that you can be quite happy without spending money all the time. Only now are some gen Xand Y's starting to listen to the advice I have been offering, now they listen intently, previously they just weren't interested. More of them see now why I bought a lower priced house and only replced my car when it had done 400,000km!

Thankyou to interest.co.nz

That's a bit wasteful CM...400K Km....only just run in!

For a Toyota Diesel most definitely. I finally got rid of my Corolla at 700K, mind you I did rebuild the engine once.

Good for a million Ks if you do the oil and filters regular....400,000 is a pretty poor effort.

2L petrol engine car, bought for $5,500, when had done 150,000km, I got another 250,000km out of it, I'm quite happy with that.

hehehehe.....My 4wd has 170k on the clock but I reckon its either heavily clocked or been round the dial.....but the engine's been re-built and its solid....so it will be running for a long time if i get my way....assuming I can get fuel....:/

regards

Steven...if you get up real close to your readout on the dash behind the plastic...you might just see a tiny tiny number showing up right down on the bottom left of the whole pack of guff...it's really small..it should read "2" if your heap has gone round the clock...or "3" if it was a taxi...!....You will need pretty young eyes though...good luck...!

Oh I know my Corolla was clocked, because I bought of a mate that had unplugged the odometer:) Easy to do as it is simply an electrical connection to the gearbox, not like cables of old. Might of even got a bit more of that treatment after I bought it.

Actually the rebuild wasn't because it was worn out, but because the water pump failed and has a little bypass that exits right onto the cambelt. Bugger I should have got onto that one sooner.

But did you find the number?

I never knew to look for that one Wolly, but I don't think it had been around the clock. I had a few minor issues over the seven years I owned it, but nothing I couldn't fix myself:)

Most people don't know about it!

"The first problem facing Europe is the glaring sore thumb: there is simply too much sovereign debt in Greece, Ireland, Spain, Italy, Portugal, and Belgium. That is not news. What has yet to be absorbed by the markets is that the cost of bailouts, present and potential, is likely to be in the €3 trillion range, talking an average of the estimates I have seen (with the Boston Consulting Group suggesting €6 trillion). €3 trillion is not pocket change. Indeed, it is a number that is inconceivable in scope."....E$3,000,000,000,000.oo

2. European regulators allowed their banks to leverage up to 450 to 1 on their capital, on the theory that sovereign nations in an enlightened Europe could not default, and therefore no reserves need to be kept for “investing” in government debt

3. the third problem, which has two parts: (1) the massive trade imbalances in Europe, where Germany and a few others export and the rest of Europe buys, And (2) the fact that German labor is far cheaper on a relative basis than Greek or Portugal labor (or that of most of the rest of the Eurozone). German workers have seen very little rise in their incomes, while Southern Europe labor costs have risen to over 30% higher.

http://www.marketoracle.co.uk/Article31521.html

Meanwhile wild bill and wonkey are borrowing how much each year from whom, to splurge on what did you say.......half million dollar salaries are par for the course in Sir Humphrey's club!

No need to plan on a trip to Spain or Italy taking in the Greek islands and a stop in Portugal as you head for Ireland and some black grog....it's all coming down here for a visit very soon....we will be in the piigs club....now isn't that something to look forward to...

Wolly, 3Tr Euro is six rugger fields of pallets loaded to two mts high with 100 Euro notes. Now you can order them by the size of a field, it is easier and you avoid the zeroes.

Thanks....nice to know....wonder if the company printing the euros knows they will be paid with the very same euros...Maybe all that toilet paper will make good insulation stuffed under the floor.

This essentially means default or the printing press before the end of the year I would say.

"The ONLY reason that Italian yields have dropped below 7% is that the European Central Bank has been buying Italian debt “in size.” Any retreat by the ECB from buying Italian debt and Italian yields shoot to the moon. Italy will need to raise close to €350 this year, including new debt and rollover debt. The higher rates will put even more pressure on the deficit."

And have you realized that the size of the notes tends to be smaller. Maybe next trend is notes the size of a credit card. Very telling. so that it would be no more than a single field per Trillion... very convenient. Those brains are thinking fast.

but I dont think its as little as 3trillion.....

regards

"The Christchurch City Council was playing "Russian roulette with its citizens" through its policy on earthquake-prone buildings, architect Sir Miles Warren warned five years ago."

http://tvnz.co.nz/national-news/council-warned-building-danger-4536602

So much for public safety....why have no prosecutions been laid...not one...nada...zip...!!!!

EU puppet governments installed in Greece and Italy. Should get even more interesting when the Greeks and Italians figure that one out.

I guess the bureaucrats in Brussels and Frankfurt feel they are far enough away to be safe.

It's time we all gave wild bill and wonkey a hand...the pair of them are having trouble identifying the waste in the state sector...

We can start by pointing wild bill at what the Sir Humphreys take home after paye each year...that's CUT number one......anyone stab at what the saving would be on say a 10% CUT.

Fellow peasants take note: If we don't force those fools to reduce the splurge as do it NOW...we will be joining the piigs in the hole....and when that happens.....and it is highly likely to happen....the IMF will dangle you over a hot flame by your short ones.

No Wonkey will not be joining you over the flames....he will be in Hawaii....wave to Sir Wonkey.

Bernard,

As to No.5

You may like to read more at Global Research

"According to company 10K filings to the SEC, the Four Horsemen of Banking are among the top ten stock holders of virtually every Fortune 500 corporation.[1]

So who then are the stockholders in these money center banks?

This information is guarded much more closely. My queries to bank regulatory agencies regarding stock ownership in the top 25 US bank holding companies were given Freedom of Information Act status, before being denied on “national security” grounds. This is rather ironic, since many of the bank’s stockholders reside in Europe."

by Dean Henderson

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.