Here's my Top 10 links from around the Internet at 7.30 pm in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

#1 is a cracker today.

1. This is today's must read - Billionaire venture capitalist Nick Hanauer has a personal luxury jet and has helped create many, many companies and jobs.

Yet even he says that the argument that taxes on the rich stop job creation is a crock.

He rightly points out in this opinion piece on Bloomberg that only spending by the middle classes creates jobs.

Hanauer argues for higher taxes on the rich.

He's right.

Here's his view.

It is unquestionably true that without entrepreneurs and investors, you can’t have a dynamic and growing capitalist economy. But it’s equally true that without consumers, you can’t have entrepreneurs and investors. And the more we have happy customers with lots of disposable income, the better our businesses will do.

That’s why our current policies are so upside down. When the American middle class defends a tax system in which the lion’s share of benefits accrues to the richest, all in the name of job creation, all that happens is that the rich get richer.

And that’s what has been happening in the U.S. for the last 30 years.

Since 1980, the share of the nation’s income for fat cats like me in the top 0.1 percent has increased a shocking 400 percent, while the share for the bottom 50 percent of Americans has declined 33 percent. At the same time, effective tax rates on the superwealthy fell to 16.6 percent in 2007, from 42 percent at the peak of U.S. productivity in the early 1960s, and about 30 percent during the expansion of the 1990s. In my case, that means that this year, I paid an 11 percent rate on an eight-figure income.

One reason this policy is so wrong-headed is that there can never be enough superrich Americans to power a great economy. The annual earnings of people like me are hundreds, if not thousands, of times greater than those of the average American, but we don’t buy hundreds or thousands of times more stuff.

It is mathematically impossible to invest enough in our economy and our country to sustain the middle class (our customers) without taxing the top 1 percent at reasonable levels again. Shifting the burden from the 99 percent to the 1 percent is the surest and best way to get our consumer-based economy rolling again.

Significant tax increases on the about $1.5 trillion in collective income of those of us in the top 1 percent could create hundreds of billions of dollars to invest in our economy, rather than letting it pile up in a few bank accounts like a huge clot in our nation’s economic circulatory system.

2. Here's the plan - Joe Wiesenthal at BusinessInsider summarises the current game plan in Europe very nicely.

Essentially, Germany and France drive through a 'fiscal stability pact' whereby countries agree not to run deficits, and then the European Central Bank intervenes to buy the toxic Southern European debt.

But will there be time?

Here's Wiesenthal:

Now at first blush a new "pact" sounds like a snooze, but those reports also said something very important, which is that if they did this, then the ECB would be expected to take a much bigger role in financing Eurozone governments.

Now Draghi -- offering up the ECB's perspective -- is saying almost the same thing, and that key line is "other elements might follow." Gee, what "other elements" might the head of the ECB be referring to? Probably ECB intervention.

And that line "the sequencing matters" also is revealing, because it gets at a core concern of the ECB. If it is going to get in the business of backstopping governments, it doesn't want to create moral hazard by funding anyone who recklessly spends and borrows like crazy. So the deal is: European leaders agree to hard, unbreakable rules about spending, and then the ECB agrees to serve as some kind of lender of last resort.

3. How bad it might get - UBS Economist Andrew Cates thinks the plan detailed above and the short term intervention this week by central banks won't fix Europe's problems.

He thinks aloud about what a euro breakup might mean. He uses the Depression word a bit. HT Zerohedge.

It is worth underscoring again that a Euro break-up scenario would generate much more macroeconomic pain for Europe and the world. It is a scenario that cannot be readily modelled. But it is now a tail risk that should be afforded a non-negligible probability. Steps toward fiscal union and a more proactive ECB, after all, will still not address the fundamental imbalances and competitiveness issues that bedevil the Euro zone.

Nor will they tackle the inadequacy of structural growth drivers and the deep-seated demographic challenges that the region faces in the period ahead. Monetary initiatives designed to shore up confidence can give politicians more time to enact the necessary policies. But absent those policies and sooner or later intense instability will resume.

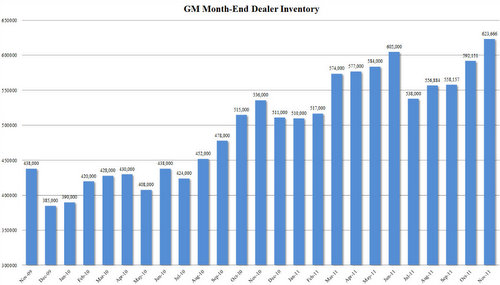

4. Ever wondered why US car production is holding up? - Zerohedge points to figures showing inventories of General Motors' cars at record highs.

It calls this 'channel stuffing'

In the past two months, everyone has been scratching their heads just how it is possible that the US manufacturing base continues to chug along at pre-recession levels even as the world all around America burns? Today, GM may have given the answer, courtesy of its monthly disclosure of car sales which at the top line is completely irrelevant as the funding for these purchases comes almost entirely from subprime loans handed out by the government to NINJAs.

What is interesting is the little blurb in every monthly report discussing the amount of dealer inventory, a topic well-known to frequent readers of Zero Hedge which has discussed GM's pervasive channel stuffing in the past, and which subsequently went quite mainstream. So how does November channel stuffing stack up? As the chart below shows, at 623,666 cars, it is an all time absolute record, and represents about 3.5 times the total GM vehicles sold in November!

5. So why are the Germans so afraid of inflation? - The world (or at least a bunch of bankers and bank shareholders/bondholders worried about their banks collapsing) are baying for the ECB to print money and buy bonds, in the process settling down the market and allowing a little bit of inflation to help reduce the real burden of Europe's debts.

Essentially, it is a way to spread the pain of losses away from bank shareholders and bond holders to the broader public at large through the gutting in real terms of term deposits and wages.

The trouble is the Germans don't want to allow the ECB to print because they fear inflation. Fair enough.

Here's the New York Times explaining why the Germans are so worried about inflation. And it's not all about the Weimar Republic.

“For the average American, inflation means the home price is increasing and the value of debt is going down,” said Peter Bofinger, a prominent economist on Mrs. Merkel’s independent council of economic advisers, “whereas the German invested in life insurance and sitting in an apartment he rented is much more vulnerable to inflation.”

Fear of inflation is a deep and broad consensus in Germany, but one that Sebastian Dullien, an economist and senior policy fellow at the European Council on Foreign Relations, said had worsened appreciably in recent years. “It is not about the 1920s,” Mr. Dullien said. “The fear of inflation went up when wages stopped going up.”

In an effort to regain lost competitiveness over the past decade, Germany went through a period of wage restraint and labor-market reforms that made the hiring and firing of workers easier and welfare benefits less generous. While countries on Europe’s southern edge, including Greece and Portugal, were enjoying the cheap money that came with membership in the euro, Germans were developing a newfound sense of economic insecurity, one that paired all too effectively with an old dread.

That has real policy consequences. Kenneth S. Rogoff, a Harvard professor and former chief economist for the International Monetary Fund, has argued that the euro zone needs higher inflation of between 4 percent and 6 percent, well above the European Central Bank’s fixed target of 2 percent. “German leaders have told me they have a lot of leeway in a lot of dimensions, but the hot-button issue they cannot touch is inflation,” Mr. Rogoff said. “Inflation is poison to them.”

6. What a waste of time and money - Stern Business School Finance Professor Thomas Philippon writes in this VoxEu opinion piece that despite all of its fast computers and credit derivatives, the current financial system is no better at transferring funds from savers to borrowers than the financial system of 1910.

The 2nd chart below shows the share of GDP consumed by the finance industry in America.

Philippon wonders whether the inefficiency can be explained by an increase in trading of financial instruments such as shares, bonds and currencies (This chart below shows equity trading relative to GDP)

He then does something clever. He compares the way retailing improved its efficiency through the 1990s and 2000s by investing in information technology with that of the finance sector, which also invested heavily.

Philppon's view:

The contrast is striking. Based on what we see in wholesale and retail trade, IT should have made finance smaller, not larger.

What happened? Why did we get the bloated finance industry of today instead of the lean and efficient Wal-Mart? Finance has obviously benefited from the IT revolution and this has certainly lowered the cost of retail finance. Yet, even accounting for all the financial assets created in the US, the cost of intermediation appears to have increased. So why is the non-financial sector transferring so much income to the financial sector?

One simple answer is that technological improvements in finance have mostly been used to increase secondary market activities, i.e., trading.

7. Cap on rents in Australia? - It seems the Australian Labor government is considering a cap on rents over there.

Landlords are beside themselves, which is sort of fun to watch. HT Houses and Holes at Macrobusiness

REIA president Pamela Bennett said capping rents would be "disastrous" for rental affordability and the property market.

Earlier this week, the Labor government said it would look at monitoring the rent costs in the private rental market and examine mechanisms to maintain affordability such as the introduction of rent capping legislation.

"To cap rents in the private rental market would be counterproductive to the objectives of improving affordability. It would reduce the supply of rental housing which would be detrimental to rental affordability," Ms Bennett said.

"If the proposal was implemented, the impact could be similar to the outcome of the Hawke government's decision in 1985 to deny investors tax deductibility of interest payments. The market response led to an undersupply of rental property and escalating rents, before the decision was reversed in less than two years.

8. Maybe the Germans think of Southern Europe like they thought of East Germany - West Germany absorbed East Germany in the early 1990s with a single currency and there was immense and wrenching pain in East Germany as it had to adjust without the ability to devalue its currency. East Germans had to go through years and years of high unemployment and many simply moved to the West.

Germans think this worked well, even if it was very painful and took a very long time.

We (West Germany) did a deal with East Germany, and the terms of that deal violated a lot of precepts of economic theory. It even included an overvalued currency for the poorer region and a long period of adjustment. Yet we insisted up front that all dealings be done on the terms of the more successful region and culture, with very little compromise. This transition, for all of its short-term flaws, will go down in the history books as a great long-run success.

In part it succeeded because it was all done on the terms of the values of the successful nations of northwestern Europe. (I am surprised that this angle is not discussed more in the press, given Merkel’s own story.)

So what eventually happened in Germany? The answer involved lots of subsidies and wrenching transfers of wealth. West Germans paid about $1.9 trillion over 20 years, partly via a “solidarity surcharge” on their income taxes, to help modernize the East. That’s roughly two-thirds of Germany’s GDP last year. The subsidies helped cover East Germany’s budget shortfalls and poured money into its pension and social security systems. At the same time, nearly 2 million East Germans — a full one-eighth of the population — moved west to seek work.

Now, as former White House economic adviser Austan Goolsbee pointed out this week, neither of those developments is likely to happen with further euro zone unification. It’s not nearly as easy for a Greek or Portuguese worker to pick up and move to more productive countries like Germany or the Netherlands—the language and cultural barriers are quite severe (See this IZA paper for more.) What’s more, none of the plans for fiscal integration in the euro zone envision the same sweeping transfers and subsidies that Germany saw after reunification.

10. Totally Clarke and Dawe - Wayne Swan thinks there will be a budget surplus.

134 Comments

Capping rents in Australia , huh ? ........ small beer , mate . Over here in Godzone we give a billion bucks every year in rental assistence to the feral underclass ....

..... wish that Jeremy Clarkson would bring his pistol sharp wit to NZ , and shoot his mouth off at some of them ........

Clever Aussie bureaucrats - quickest way to bring house prices down - scare the landlords into selling.

:-)

A dumb idea, up there with the first home buyer grant in terms of policy generating unintended consequences

It's an oxymoron...."Clever Bureaucrats" do not exists.....There are no such creatures on earth.

Over here in Godzone we give a billion bucks every year in rental assistence to the feral underclass ....

I think you already know that the money actually went to landlords on a weekly basis. So you actually do understand that the billion bucks helped prop up property prices. By subsidising rents government helped keep property prices above the level that renters could actually pay.

Once again socialism for the rich. But you know that.

In the UK they have a feral underclass as well, they have been breeding it for 1000 years. It is easy, steal the land, force the people at pain of death to submit and then sit back and let the system keep your lot on top for ever. Nothing wrong with that except of course it doesn't work in the modern world where you need a highly educated population and lost of money circulating in the economy. Eds and Meds, etc So yes why not blame the feral underclass- it is a lot easier than thinking.

Clarkson knew exactly what he was saying and why. It was a potentially offensive joke- that was the point. This morning he is on the front page of at least 3 of the major dailys. He is selling his book, thats all. He has no interest in strikes , he is interested in selling boks for Christmas. Nothing wrong with that.

Plan B,

There is something in what you say, but rises in rents in NZ, and indeed in every housing bubble market, lag rises in house prices by a wide margin. In NZ they de-linked in about 2001 and have never resumed their pre-bubble relationship. The difference was something like 80% at one time, and the gap has not closed significantly since.

So whatever was boosting house prices, it was not the potential for rental income.

In most western countries, massive democratisation of urban land ownership has occurred since "automobility" because the land owning class (rightly condenmed by Karl Marx and Henry George) could no longer maintain a stranglehold on the process of development for urban expansion, as they could when all development surrounded highly predictable rail routes (and earlier than that, the distance people could travel on foot).

Urban planning thanks to environmentalism and the global warming fraud, has let the property owning classes regain their stranglehold over the non-property-owning classes; it is just that this time, the "land owning classes" include a large proportion of the population who own their own part-of-an-acre; hence there is a sizeable political constituency against reform (unlike in the pre automobile era when the land owning classes were a despised minority).

Britain, by the way, has suffered from this racket ever since the 1947 "Town and Country Planning Act", so they never experienced the same democratisation of urban land ownership as the US and most other western countries. Their size of sections has steadily dropped for decades, while the proportion of income required to get into any home at all has steadily risen.

There is probably no single economic effect that is more powerful at transferring wealth upwards in society, preventing social mobility, and trapping an increasing proportion of society in poverty. It is massive hypocrisy on the part of politicians, activists, and the public, to claim to be against poverty and in favour of equality; yet support "urban growth containment".

Channel stuffing is a huge game in the computer business, or at least is was when the computer business was making huge sums of money. Software companies do it as well, which is odd seeing as they're not selling anything physical.

Yes but are they shipping reral cars or <a href="http://en.wikipedia.org/wiki/MiniScribe">bricks?</a>

FYI from Ambrose on the problems in Europe. He thinks they can be solved with money printing.

http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100013558/y…

The eurozone economy is in imminent danger of crashing into deflation, bringing down the whole interlocking edifice of sovereign debt and distressed lenders. And bear in mind that Europe's bank nexus — including the UK, Swiss, Scandies — is €31 trillion. Big stuff.

This crisis can be stopped very easily by monetary policy, working through the old-fashion Fisher-Hawtrey-Friedman method of open-market operations to expand the quantity of money, ideally to keep nominal GDP growth on an even keel.

This does not solve the 30pc intra-EMU currency misalignment between North and South, of course, but it quite literally "solves" the solvency crisis for Italy and Spain. They would not be insolvent if the ECB had not driven them into depression by letting their money supply implode.

The crisis can undoubtedly be halted immediately by the ECB. The bank can reflate Club Med off the reefs. It chooses not to act for political reasons because this mean higher inflation for Germany. That is the dirty secret. Everybody must be crucified to keep German internal inflation under 2pc.

It's a matter of perspective, Ambrose views the crisis as being only deflation, and QE can solve it. I don't think you can then walk away and say job done. Bernanke has been doing QE for the past few years, and markets have priced in QE3 already. Not to meantion POMO (unlimited government bond buying). Can you imagine what would happen if Bernanke was to say no more QE, and take the Permanent out to leave OMO.

Either deficits forever and printing forever, or deflation defaults, take your pick fire or ice, it's going down.

Ambrose goes on to mention the problems that printing does not fix. It's my view that the debt and interest are unrepayable, the only way to get inflation is by more government borrowing, or private sector borrowing. Debt has been growing globaly at 11% pa, the only way to keep the ponzi going is to keep increasing debt by 11% pa, which you can't do forever.

FYI from The Telegraph on the latest from Bank of England Governor Mervyn King:

http://www.telegraph.co.uk/finance/financialcrisis/8929806/Mervyn-King-…

Banks face a “systemic crisis” caused by the euro turmoil and should start hoarding cash rather than paying out bonuses or money to shareholders, the Governor of the Bank of England warned on Thursday.The Bank of England said that British banks have £15 billion of outstanding loans to vulnerable eurozone governments — but £160 billion of loans to companies and individuals in these countries. This accounts for about 80 per cent of their main reserves.

Sir Mervyn said: “An erosion of confidence, lower asset prices and tighter credit conditions are further damaging the prospects for economic activity and will affect the ability of companies, households and governments to repay their debts.

“This spiral is characteristic of a systemic crisis.”

Of the three it is generaly only households that even come close to paying off debts. Many may not even do that, governments don't, and neither do companies. They get as much debt as they can then they keep rolling it over. What is affected is the ability to rollover debts, and when you can't roll it over, and cashflow is tight, then it's time to call the Barber.

Here is an alternative analysis to Ambrose:-

http://lewrockwell.com/north/north1068.html

Yes, any financial problem can be solved by printing money, for a while. Notice how every "solution" is overtaken by another problem requiring a bigger solution.

Bernard, check this out. Written in 1992, pretty dated, but at the same time highly pertinent.

The current discussion of the Real Bills doctrine was motivated by Sargent's look, among others, at inter-war European hyperinflations, which he claimed were caused by central bank monetization of a vast amount of bad debt. The argument is that the inflations were caused not by the large increase in the money supply, per se, but rather by the fact that this additional money was backed by worthless government bonds. As the value of the central bank's asset portfolio decreased, so too the value of its liabilities decreased.

http://findarticles.com/p/articles/mi_hb5814/is_n2_v30/ai_n28614637/?ta…

Uhoh.

Yes Bernard do have a lookiesee at the link certainly sign-posting the exits in an emergency.

That is, ceterus paribus, an increase in the money supply will not, per se, be inflationary. The increase in the money supply will only be inflationary if the assets purchased with the money issue are of such low value as to reduce the average value of the assets backing the currency.

"The increase in the money supply will only be inflationary if the assets purchased with the money issue are of such low value as to reduce the average value of the assets backing the currency."

Call me simple... This doesn't make any sense to me.

Sometimes it's hard to see the forest for the trees.

Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities, as well as to growth in the money supply. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.

http://en.wikipedia.org/wiki/Inflation

Roelof,

You have to recognize that money isn't an object, but a relationship. Even banknotes (which constitute a very negligible proportion of the "money supply" have value, only in the fact that they're debt instruments taken out on part of the government. You can redeem them in exchange for Treasury Bonds that are interest bearing (income stream).

What debt represents is a claim over the income of the borrower, who is afforded the opportunity to have future goods in the present, but he must forgo goods in the future as he must pay the compounded interest cost of the loan. The loan is matched by deposits held by someone who is prepared to forgo consumption now with the knowledge that he will be able to consume more later. This is the essence of the "Banking School" of Economics, Real Bill Doctrine, but as Ludwing von Mises reveals it does have a caveat, "For this reason the Banking principle is unable to prove that no more fiduciary media can be put into circulation than an amount determined by fixed circumstances not dependent on the will of the issuer. It has therefore directed its chief attention to the proof of the assertion that any superfluous quantity of fiduciary media will be driven out of circulation back to the issuing body. Unlike money, fiduciary media do not come on to the market as payments, but as loans, Fullarton teaches; they must therefore automatically flow back to the bank when the loan is repaid.*39 This is true. But Fullarton overlooks the possibility that the debtor may procure the necessary quantity of fiduciary media for the repayment by taking up a new loan."

http://www.econlib.org/library/Mises/msT7.html

In my view this doesn't prove that the quantity theory of money's claim that growth in the money supply creates inflation, but that it merely accomodates it, essentially postponing the readjustment, which is what we saw during the housing boom with the ChinMerica dollar recycling scam, and we're seeing now with Central Banks and governments fruitlessly borrowing money from future taxpayers, in order to pretend that the bill for yesterdays excesses won't come due. Keynesians and even MMTers are that stupid. They're not even conscious of the ramifications of the self-fish and selfserving policies. Not only are we screwed, but future generations are as well.

Mist42nz, bank based money isn't fiat. Only notes (backed by Treasury Bills) and coins are fiat money. Bank money just confers time to pay to the borrower. Its zero sum. The problem comes when the borrower, borrows more money to postpone the settlement date of the original loan. Derivatives are merely securities contracts to hedge against volatility in the value of an underlying asset. Zero sum as well, because to opt out of the contract one must sell to someone whos willing to opt in.

Yes I know what legal tender means Iain, but according to the Reserve Bank, that doesn't cover bank credit. They're two seperate things. Nobody forces you to accept bank credit as your wages or for homeowners to accept it in payment of rent or of a mortgage. Its totally of your own voiltion. A transaction can be a implicit contract to accept legal tender or an explicit one where each party stipulates the means of payment., which the seller is willing to accept in return fo the good or service.

Legal tender

(1) Every bank note issued, or deemed to be issued, under

this Act shall be a legal tender for the amount expressed

in the note.

(2) A tender of payment of money, to the extent that it is

made in coins issued, or deemed to be issued, under this

Act, shall be a legal tender,-

The actual form of payment – whether it is by legal tender or some other method – is determined by the contractual context. A contractual provision may specify the form of payment as something other than legal tender. For example, it may specify that payment be made electronically or by cheque, in which case the debtor has no right to insist

on payment in legal tender....This is no doubt true in the case of small transactions where payment of legal tender would be a reasonable method of payment; it is undeniably false in the case of transactions of any size, where in the absence of a clear agreement for payment in legal tender it would be absurd to suppose that

this was the method of payment intended by the parties.‘

http://www.rbnz.govt.nz/research/bulletin/2007_2011/2007sep70_3mcbride…

"Derivatives are effectively insurance policies sold by so-called financial service sector(FSS) supposedly covering all chance of financial loss from investing in financial products. They were first created to cover the banking system which is systemically insolvent by design because it is not a zero sum game but a game of musical chairs."

The securities (CDS) you're talking about are just one form of derivatives Iain. The use of derivatives to hedge against price volitility go all the way back to the 18th Century in Japan, when they had been developed for trading in rice futures on the Dojima Rice Exchange. Its a system of music chairs, because of human behaviour. it merely amplifies the reprecussions of everyone's desire for a free lunch. You can't design a perfect system that people won't abuse, the best you can do is minimize people's exposure when the inevitable calamity happens.

The best exposition of how the economy works I've yet read is by a Social Credit theorist, but many of you monetary reformers, including Diedre Kent and yourself overlook the more subtle nuances of Major Douglas, in favour of simplistic, vehement denunciations of evil bankers.

http://social-credit.blogspot.com/2011/01/quantity-theory-of-money.html

MONEY THAT ONE BORROWER USES TO PAY INTEREST ON A LOAN HAS BEEN CREATED SOMEWHERE ELSE IN THE ECONOMY BY ANOTHER LOAN.”

- John M. Yetter Attorney-Advisor Dept. of the U. S. Treasury

So what? How else is money meant to be introduced into the economy?

Interest free money would be tremendously inflationary, because instead of a cyclical flow, it would become an ever expanding stock, as there would no longer be an incentive to save.

"Bottom line is it is the implied redeemability of electronic money into legal tender that can be used to clear debt and pay taxes that gives it its confidence. Its all about layers of confidence to support the main confidence trick."

But whose responsible for that Iain? We wouldn't be having this dialouge if it weren't for all the copiousm volume of documents produced by Central Bankers that corroborates your arguments. People would easily be able to casually dismiss you and I as raving lunatics for our claims.

As for Major Douglas, a skim is all I'm willing to give his work, as we approach monetary reform from completely different directions. For him, the monetary system constitutes a mere technical problem to be resolved by experts such as he, while I regard it as one element of our society's major dysfunctions. Its a reflection of the underlying inequality of our society,and perhaps an amplifier of it as well, not the cause itself. He deals not at all with the incredibly uneven distribution of resources within our society, nor the consequences of broken exchange markets which leads to fully apparent lack of competition and the accumulation of enormous stocks of capital by a few, which his contemporary John A. Hobson did.

Theres nothing stopping us from introducing local currencies which operate along Gessellian lines. I myself intend on developing such system at some point. But first we must inform the public and convince them of its importance and value.

http://academic.cengage.com/resource_uploads/downloads/0324321457_65787.pdf

consumption because of the failures of competition among businessmen to work

effectively toward raising wages and lowering property incomes. Because capitalists’

incomes are too high, they save too much.

Bank money isn't zero sum. This is very straight forward to show from the double book keeping accounting entries, loans create deposits. This additional bank lending has to create additional spending power in bank money, because nobody goes without their money when this occurs.

That doesn't make it a conspiracy though, it just puts private financial institutions in charge of lending. The RBNZ can't control inflation of course, because they would need much tighter control over their members lending policy. It also doesn't make the bankers culpable (I don't agree with Iain there) because they don't regulate the banking system, which is parliaments job, though some financial institutions have broken existing financial regulations and they should be prosecuted for this. It would definitely be financially imprudent for financial institutions to lend recklessly (though if they all did the bubble economy might be re-inflated) because they are likely to lose their clients money by doing this.

Not for me to call you simple Roelof....but there a couple of peers there in camp with you who did not get it either....so I guess that's ok..!

Save me the yadayada yada and read Anarkist's response as I think he's has offered a more complete explanation than I could have.

But the gist of it yes...!

I'm cancelling my trip to Keynesia....the fight plan has a bug in it.

Roelof,

its irrelevant anyway. I have realised it no longer applies in the post-Gold Standard world, with our floating currencies and credit based monetary systems. Just as well, lol.

My brain suddenly stopped after reading that quote.....

Sure this would be bad news if the analysis is correct, but I think a simpler explanation is the better one.

First of all (and contrary to popular belief) inflation prior to 2008 was primarily driven by bank lending policy (not government deficit spending). Most of the inflation showed up in housing bubbles and in many countries ran at around 6% but this is not tracked in CPI statistics (because they don't consider housing costs).

The underlying cause of the crisis is a switch from inflationary bank lending policy to deflationary bank lending policy. The banks are not solely responsible for this because the banks can only lend if there are borrowers. At present its not in either banks or borrowers interests to go further into debt. When this levels back out the deflation ends (if there are no other reforms).

This also agrees with the fact that the government has relative lack of influence. They can't combat a massive deflation in the financial system with small spending increases. This also indicates they were not responsible for most of the inflation prior to 2008.

I think hyper-inflation will be caused when both bank and government inflationary policies are followed at the same time. Especially when the government is chasing bank inflation with its own spending policies. Looking at various causes of hyper-inflation there have usually been reasons why the government kept spending when there was already high inflation. For example the famous Weimar republic was subject to reparations accounting for 1/3 of government expendature. Of course they are not going to cut expendature by 1/3 somewhere else because they will be straight out if they did.

This explanation accounts for the whole story without needing to create odd arguments about the value of things backing bonds. The reason this is a bit odd a belief to have is that most people are totally unaware of how money is created, or what a government bond is, how much debt the government carries. Why would something they know nothing about influence their price expectations? It would not. The same argument applies (and I think is equally valid) when claiming that money only has value when backed by something. Money has value because it is or appears to be national money, that should be pretty obvious. If its not a near universal belief, I don't accept it as an argument for giving value to money, because nearly everybody thinks money has some value.

Agreed Iain ..see my comment to GBH on Thursday top ten...!

But Gareth only has one aaaarrr my good man.......and his contributions should not be sullied on the basis of one comment in a panel situ......

We are all capable of understatment ...or erring on the side of caution...but liar or fool a bit rich all round....... my dear Iain.

Christov,

Gareth is actually right to some degree and Iain is wrong. Private banks do create credit, when make loans to borrowers, but in the final settlement and clearance process, loans must be matched with deposits. Banks just receive the spread between the interest demanded by their depositors and the interest rate they set for the loan. What do monetary reformers think the OCR is for and how do they explain where the interest on their balances in their savings account comes from? I have a real problem with the simplistic and polemical descriptions of the banking process you find on the 'net. They're reminiscent of the anti-Semitic publications about the evil Jewish bankers that were rife during the Great Depression. People just want to blame a highly visible target for the problems we're all suffering without actually having to own up to our complicity in it. Nobody forced people to speculate on housing, with the presumption theres always going to be a dumber smuck willing to accept an ever high price.

Sure the bankers abetted the process by recklessly giving out credit for the sake of profit, but they're no more culpable than the rest of us. Everyone thought there was always going to be a free lunch. Compliant politicians who constantly capitulated to the sense of entitlement of their electorates, demanding of ever higher spending on education and healthcare, subsidies for their pet projects, etc, Homeowners expecting ever greater capital gains as they greedily watched their "asset" appreciate, Farmers loaded greater and greater amounts of debt onto their farms balance sheets in a bid to expand and intensify their farm's size and production to meet increasing demands for milk etc etc.

Once again Anarkist your thoughful comment appreciated......I probably felt better when I thought Iain was right most of the time......but a new perspective is welcome....I like the highly visible target bit and feel it fair comment ( on my part anyway)...but that is just human nature....I think yes,,?

Burn the witch......at both ends of the spectrum we really have not come that far.

Cheers I'll read some more, think some more, maybe learn very little....about bringing down the horse.

No worries Christov,

I'm a little different to most people, because I haven't really suffered directly because of the Global Financial Crisis, though I know a few people who have lost large portions of the their life's savings due to the collapse of the finance industry in 2006 and 2007. Unfortunately New Zealand powerbrokers handed over monitoring and supervision of the fringe finance sector from the Reserve Bank o the Securities Commission into the hands of someone who made the abysmally moronic statement late in 2007.

“We are at the cusp of a new global adventure into new realms of mutual recognition and consistent standards around the world. We live in exciting times!” What a suprise, the speech no longer exists on the Securities Commission website.

http://sustento.org.nz/securities-commission-wakes-up/

What I do care about are solutions, not handwringing and the blame game. What we need to do is somehow manage the smooth and controlled depreciation of housing values, with as little turmoil as possible. I have a few ideas on that front, which I would like to air in a public forum I hope to convene at some stage. I hope to invite Hugh Pavlitch, Stephen Hulme, and Raf Manji to take part on a panel of experts, representing their respective fields of Housing Affordability, Finance, and Monetary Reform respectively.

You were doing really well until you suggested a panel of experts. Lol.

Surely history is littered with people that know better and if things were done their way then we would solve all the problems. Even my prospective profession has been in the thick of it.

One of my favourite lines is the conman who says "you can't con an honest man". That is the root cause of our problems, human behaviour, so I don't think we will see your 'orderly'. Ride it till it breaks if more likely.

Scarfie, it will be a public forum, the "experts" will be there merely to moderate discussions. I would like to employ Open Space methodology to moderate discussions. Its not simply an opportunity for "experts" to pontificate on their favored solution to the problems that ails us, but I'd like to offer people an opportunity to air their concerns and actively participate in exploring and developing solutions to our systemic crisis, using the Open Space methodology.

http://en.wikipedia.org/wiki/Open-space_technology#Guiding_principles_a…

Thank you I hadn't heard of Open Space Methodology before and it sounds alright. One of the problems I see from my study of personality types is that the best placed people to understand the faults in a system and design you a new one are unlikely to be the ones you will get the best from in a public forum. In fact you are unlikely to get much from them at all because they are not self promoting or interested in 'leadership'.

Jefferson is the best example I know of, he was the only president I know of that didn't want the job.

The nature of modern banking is such that the cash reserves at the bank available to repay demand deposits need only be a fraction of the demand deposits owed to depositors. In most legal systems, a demand deposit at a bank (e.g., a checking or savings account) is considered a loan to the bank (instead of a bailment) repayable on demand, that the bank can use to finance its investments in loans and interest bearing securities. Banks make a profit based on the difference between the interest they charge on the loans they make, and the interest they pay to their depositors (aggregately called the net interest margin (NIM)). Since a bank lends out most of the money deposited, keeping only a fraction of the total as reserves, it necessarily has less money than the account balances of its depositors.

http://en.wikipedia.org/wiki/Fractional_reserve_banking

How the OCR works

Most registered banks hold settlement accounts at the Reserve Bank, which are used to settle obligations with each other at the end of the day. For example, if you write out a cheque or make an EFT-POS payment, the money is paid by your bank to the bank of the recipient. Many hundreds of thousands of such transactions are made every day. The Bank pays interest on settlement account balances, and charges interest on overnight borrowing, at rates related to the OCR. These rates are reviewed from time to time, as is the OCR. The most crucial part of the system is the fact that the Reserve Bank sets no limit on the amount of cash it will borrow or lend at rates related to the OCR.

Confuscius say , man who think he is clever cat is basically monkey , with set of car key .

( ancient Chinese proverb , apparently )

Lol!!!

Hilarious! Made my day.

cheers

Bernard

But we had

some fun with it ....did we not....?

TLDR version, you don't need reserves, it's a ponzi.

Did not see what was posted that caused offense, Would ask that you keep on editing rather than banning. His banging on about how money is created certainly forced me to read up on the topic and try to understand it a bit.

FYI from Bloomberg:

http://www.bloomberg.com/news/2011-11-29/china-s-exports-to-europe-fall…

Slumping shipping costs show exports to Europe from China are “falling off a cliff” as the euro- region crisis chokes off consumer spending, according to RS Platou Markets AS, a unit of Norway’s biggest shipbroking group.

The CHART OF THE DAY shows how the cost of hauling goods to Europe from China is falling faster than rates for deliveries to the U.S. The price for shipments to Europe is down 39 percent to $511 per twenty-foot box since Aug. 31, according to figures from Clarkson Securities Ltd., a unit of the world’s largest shipbroker. That’s more than double the 18 percent slide in the cost to the U.S. West Coast, measured in 40-foot units.

Yes, and it's laughable how some commentators both in aus and nz see our countries as being largely immune to the problems of Europe. Clearly china will be increasingly affected and that logically will affect australasia.

#1 is good. The part about there just will never be enough uber-rich to create sustainable, long term growth/employment is bang on. But in the short term I think the middle class in a country can have very low consumption with good job creation overall. The business owners/capitalists/powers that be just need to find markets for their goods offshore. There's a country right now where this is the model and overall consumption is only around 30% of GDP. Can't remember the name but it begins with C.

Armchair,

Yep your exactly right. The current situation just reflects the fundamentally broken nature of the world's economic model. We're in a position where China, which has an agenda of ensuring the survivability of the majority of its domestic export orientated industry in the interests of social harmony, suppresses the purchasing power of its workforce, which has a side-effect of needing to find external markets to absorb its excess production. And we have American corporations who are only too eager to take advantage of the conditions favorable to price arbitrage, thanks to the wage differential between China and their own countries. I'm not quite sure whether the Chinese exchange rate manipulation strategy acts as an effect or partly a cause of suppressing Chinese workers purchasing power to keep costs low, with the virtuous side effect of suppressing Western interest rates, which have allowed us to accomodate our customary living standard with our own (in real terms) declining purchasing power, through loading up on credit.

"With a touch of British humor, Ferguson and Schularick described the bi-continental unit constituted by circular capital flows - and one-way deliveries of manufactured goods - between China and America. They correctly identified the global boom as being underwritten by the reinvestment of Chinese manufacturing profits into American treasury bonds, therefore giving the Fed the ability to maintain the artificially low interest rates that provided cheap capital for investment at home and abroad - fueling the US real-estate boom in particular... Of course, Hung Ho-Fung details the way that Chinese manufacturing profits are plowed back into American Treasuries. But the main point of the article is to show how the extremely low Chinese manufacturing wages represent a consistent and deliberate pattern of exploitation of the country's rural population by the coastal elites. The cycle of continuous industrial development for export to America and Europe and continuous investment of the profit back into America has the effect of keeping wages suppressed, internal consumption and inflation low, and export prices cheap - thus maintaining the subjugation of the rural Chinese that come to work in the coastal cities (for more details on the rural/urban relation, see my text One World One Dream)."

Ah but... I read somewhere that that particular country has 1.3 billion people who live on $2 a day and 60 million who earn $20000 a year. Sorry, I forget the link, but I thought it was an interesting alternative way to think.

Roger,

A "middle class" of 60 million people, on $20,000 is nothing in a population of 1.5 billion. Plus you have to consider the high cost of imported goods (energy, luxuries, medicines), their high savings rate due to the lack of a universal social security system, and that many of them are baby boomers who will soon retire, becoming a burden on their one or two children who will often have two sets of parents to look after. China will be far worse off than Japan in the coming years.

German Chancellor Angela Merkel has said Europe is working towards setting up a "fiscal union", in a bid to resolve the eurozone's debt crisis.

She told the Bundestag that a new EU treaty was needed to set up such a union and impose budget discipline.

In her speech, Mrs Merkel promised "concrete steps towards a fiscal union" - in effect close integration of the tax-and-spend polices of individual eurozone countries, with Brussels imposing penalties on members that break the rules.

"We have started a new phase in European integration," Mrs Merkel said.

http://www.bbc.co.uk/news/world-europe-15997784

Just as i said i suspected.

This is the only plan they have ever had. More centralised controll by a few.

#7 Increase the supply.

Tax developers holding undeveloped land, first home buyers grant only for newly built houses / apartments, Take GST of materials for new house / apartment builds, sell existing state houses to the public and use the funds to build new state houses, first home buyer 2 year special low interest mortgages.

I agree. The consequences are knocking at the door by the way, and there are a lot of them.

Very funny article in The NZ Herald bt Mark Lister

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=107…

Asset sales will be a market transformerHe states 'the electricity sector would increase significantly from about 9 per cent of the index to about 28 per cent,' and then goes onto say 'a market dominated by mining and banking stocks, New Zealand would be dominated by electricity companies. However, I don't think too many issues would arise from this'

The article is littered with Priceless nonsense like this. Brilliant. Why he thinks that having one third of the New Zealand sharemarket represented by the domestic electricity market is not a concern is amazing. It simply does not make any sense at all and will cauase all manner of problems. Of course it does make sense except in one important way.

New Zealand is witnessing its own enclosure of the commons, whereby an elite sieze control of a collective commonwealth asset via a pricing mechanism imposed without consent and then simply raise rents through force to the point at which the 'pips squeek' and they are getting away withit in 2011., not 1811

It's interesting hearing all the various so called solutions to the Sovereign Debt Crisis, the simple fact remains these debts are unrepayable. The ECB printing transfers the risk from the bondholders to the taxpayers, but does not change the risk. I have not read a single expert who is expecting any meaningful surplus before '14. Governments are unable to function without deficits, and the consensus is that we are not in a recession at the moment. So debt levels are increasing even while GDP is growing. What is the traditional for a command economy to recover from a recession? What happens when governments are unable to finance the increase in spending required during a recession, and spending required to create growth?

So much time and effort has been wasted propping up the ultimatly doomed monetary system. There is a serious lack of scientific thought among the financial elites. With simple arithmatic showing the reliance upon exponential growth to support the monetary system, and physical limits to debt levels, the system will surely fail. Will it take ten years? If so expect it to be a painful decade.

Affects are being felt in Oz. Two friends were amongst 30 who have just lost their jobs at a new mine development in WA. Many of the group were from NZ.

Prof. Roggoff is correct , a targeted inflation rate of 4-6 % may serve the Eurozone better than the hardline 2 % .

... those of us toothless old gummy wonders can recall Don Brash's mandate as Governor of the NZ Reverse Bank , a 0-2 % inflation rate ....... and by golly , 'like Volcker in the USA , he got there.....

....... crushed the economy into the dust in the process . Obliterated business activity in NZ .

....... but gee whizz he delivered to those shiney bums in parliament the outcome they desired ......

Did anyone think to ask them why they presumed 0-2 % inflation to be the magic band , rather than say , 2-5 % ..... ?

Cue some more unintended consequences please. These professors and experts have dug themselves into such a deep hole, all that is left to do is keep on digging. Who said we should do anything, sit back with popcorn and beer, lets see what the real consequences of our actions are. Lets see whos labour has real value.

(not to mention the fact that you can easily change inflation by tinkering with the metrics used to measure it, inflation measured in houses, rents, oil, gold, dairy, fish, meat etc is over 6%)

Yes, it seems to me the thing to target is the rate of world currency devaluation, ie aim to match internal inflation with external inflation. Should give a more stable currency environment so we can have exports and manufacturing rather than the present somewhat dotty scheme where we periodically cull the manufacturers. So we suffer a bit more inflation but preserve our independence.

Roger,

Governments don't control the currency. Markets do. All attempts to "devalue" have led to investor panic, capital flight, and then financial collapse. Mexico tried it in 1980 and again in 1994 and led to the Peso Crisis of 1982 and 1994and Thailand tried in 1997 which led to the Asian crisis. Any government manipulation of exchange rates, comes at a heavy price, it just depends on where your sympathies life to allow one to make judgements as to whether its worth it.

Hmmmm...if 4% - 6% is good, would not 40% - 60% be better ??

If you purchased physical assets with borrowed money 60% would be fantastic.

While we're talking illogical bailouts. Keep an eye on the free spending DCC which seems to be taking over most of the Otago Rugby Union and has not denied that it will be involved in the Highlanders' new structure. http://www.odt.co.nz/news/dunedin/189069/orfu-be-run-dvml#comment-25865

Looks like the ratepayer funded flash new stadium needs the (ratepayer heavily subsidised) tenants. There has been all sorts of creative accounting to hide the mess, shifting loans, setting up companies off balance sheet and pretending it will all work out. But it's a financial disaster and the 50,000 ratepayers are looking at an almost 12% rates increase next year alone.

Gummy Bear,

The high interest policy of Don Brash and Paul Volcker wasn't directed at the politicians, but at the workers. They know that when theres a tight labour market, workers are secure in their jobs and able to demand higher wages to accomodate escalating costs. Interest rate targetting is designed to knock the economy out of equilibrium so that business will be forced to throw people out of work. Unemployment provides employers with a buffer stock of people willing to accept lower wages just to gain entry into the workforce.

The Bank of New Zealand's head of research, Stephen Toplis, said the tightness of the labour market was the single biggest problem facing the economy. Job security left people feeling "bullet-proof" and comfortable spending up large both on housing and through the retail sector and becoming less resistant to price rises, he said.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=104…

The cyncial expedience of bankers is apalling. After all it was their willingness as proactive enablers of the housing bubble that was a large part of the problem, and we had a high exchange rate because they wished to take advantage of international liquidity flows to suppress the interest rates they had to pay domestic savers. Abosolutely disgusting.

"But he thinks it will be precisely the central banker's concern about the soaring currency that will cause him to lift the OCR.

"The only way the currency's going to come down is if the housing market gets squished," Gibbs says".

http://www.goodreturns.co.nz/article/976493091/bollard-likely-to-raise-…

As conduits of credit - standing between the savers & the borrowers - bankers have come to feel that they're an essential service to humanity , and gullible ministers of finance have swallowed this nonsense . Hence the government guarantees on deposits ..

.... which in turn , leads bankers to feel impregnable , teflon coated .......

But coming back to your other point , wages & salaries : Why do they only go up , never down ? ...... during the GFC why weren't public servants salaries clipped back , to reflect the downturn in the economy , and the tax-payers' inability to fully fund those accumulated salaries . Why can't companies cut wages when they need to , they're forced to lay off staff , rather than keep the work pool going , at decreased renumeration . Where's the flexibilty in the system , to cope with the vagarities of economic cycles ?

Exactly, my income went down significantly and automatically when some of my customers went bust. I counted myself lucky.

"But coming back to your other point , wages & salaries : Why do they only go up , never down ? ...... during the GFC why weren't public servants salaries clipped back , to reflect the downturn in the economy , and the tax-payers' inability to fully fund those accumulated salaries."

Gummy, in an ideal world, higher wages provide stimulus to employers to invest in capital equipment that makes their employees more productive, like they have in Germany, the Nordic nations, and the United States. But inflation targetting policy serves as a instrument that assists the survivability of low value, labour intensive firms, by sheltering them from the effects of wage appreciation. Too bad it has the unfortunuate effect of precipitating periodic recessions. Oh well its just the tradeoff we have to accept, lol.

"Federal Reserve Chairman Ben Bernanke and his colleagues raised short-term interest rates another quarter-percentage point Thursday for a 17th straight time, extending an unprecedented two-year campaign to keep a lid on inflation....But as the Fed has continued its campaign, it has begun to bite, sending mortgage rates to their highest level in four years, for example.... Many economists and market analysts have begun to call for the Fed to take a break for a meeting or two and assess whether further rate hikes are really needed."

http://www.msnbc.msn.com/id/13615923/ns/business-stocks_and_economy/t/f…

We don't need rent caps in NZ.

All we want is for the govt to end rent subsidies and working for families tax credits.

This will bring rents and house prices down ;or am i missing something;because this seems so simple.

"All we want is for the govt to end"

There fixed it.

Yeah N G, stuff the middle class!... what have they ever done for NZ? Why should they get the odd tax break? Losers, it's their fault they're not rich! More money for the rich is what I say!

Just had an interesting debate with a few locals about rent prices over here. In this area you pay about $1100 rent a month for a decent family home, however if you were to buy said house with a modest deposit, the repayments would be $400 a month. Something is going to give, interest rates will rise, rents and house values will fall, maybe both. Been up to the Ski fields looking for season passes with my girls but no snow and its warm 25deg C today. Anyway my girls are students and broke so I was pleased as they couldn't bail me up for the money. Next stop Sacramento.

..

But for a lack of good govt and a weak RBNZ, this could be NZ.....!

"Sweden is enjoying its lowest borrowing cost ever relative to Germany as investors reward the biggest Scandinavian economy for cutting its debt to less than half Europe’s average and enforcing discipline at its banks.

“Everybody is basically fleeing the euro area, not Europe,” said Georg Andersen, the managing director of the banking unit of Nykredit A/S in Copenhagen, Europe’s biggest issuer of mortgage-backed covered debt. “The Nordic area stands out as a safe haven.”

Almost two decades after resolving its last banking crisis, Sweden boasts the world’s best-performing bond market. The country, which opted to stay outside the euro, has paid down its debts and imposed stricter controls on its lenders. Sweden’s government made a profit on its 2008 financial rescue, will post a budget surplus this year and pays less than any other European Union member to borrow for 10 years."

yeah exactly....and their kids get school meals, free health and dental care....

We are pathetic!

Yes splineman but have you a route out of the credit bubble trap...look as close as you can and you will find the banks have sewn up the game...they own and manage this big farm...they see the govt and the RBNZ as tools to be used....

Any move to curtail their game and they point to massive depression...rioting....economic collapse....political suicide...hence Bollard's near zirp policies...and covered bond policies....all very accommodating...does what he is told does our Alan.

Its crazy comparing NZ to Sweden, we are not even remotely like the Swedes.

Sweden has a single, strong culture and sense of national identity, very low immigration rates, and a strong protestant work ethic. They also manufacture weapons and export them all over the world.

Does that sound like NZ to you?

Herald on Sunday 4.12.11

Bernard throws in the towel

(or Olly Newland = 1

Bernard H= 0)

"All aboard the property rort"

By Bernard Hickey

"There's never been a better time to borrow up to the hilt and buy property.

It's almost too good to be true - but it's true.

Interest rates are at record lows and they're about to go lower. Europe's turmoil is brilliant because it will force central banks to cut interest rates. This means we can all afford to borrow more and pay higher prices. Banks are also desperate to lend again, even offering 95 per cent loans.

National has just won a second term and Prime Minister John Key will never do anything to hurt property-owners. During the past three years, he has argued against anything that would have a drastic effect on land or property prices. He is particularly reluctant to force the banks into fire sales of houses and farms in case it drives prices down.

He's also doing very little to improve the supply of land. This has the effect of pushing up prices and creating tax-free capital gains.

National and the councils know what's good for them and the property developers who support the National Party. There's nothing better than sitting on a land bank and drip-feeding properties while making tax-free capital gains.

Did I mention the capital gains are tax-free?

Any government serious about improving housing supply would simply use government land and cheap government money to build a bunch of houses, but that's never going to happen under National. Sweet.

Check out this combo: rents up 22.5 per cent in the past four years; house prices up 16 per cent in the past year; interest rates at record lows; housing supply constrained.

There's no sign we're going to lose our jobs because China will keep bailing everyone out.

And our government will never let the banks fail. Mate. You can't lose with property. Ever."

Not wishing to rain on your parade , BigDaddy , but given Bernard's appalling track record at prognostications ( marginally ahead of Ken Ring , but no one else ) , I'd now be pooping my panties , given that he's now thrown in the towel ........

...... the concatication of events which lead him to abandon his previous conviction that residential property is overpriced in NZ may not hold up , themselves ....... nor may they lead to the magical promised land of property never falling in NZ , 'cos unlike everywhere else in the world , we're different , special , blessed by the Gods of anti-gravity .......

Hickey's giving you his blessing , BigDaddy ......... be afraid , be very afraid !

Have to agree GBH Bernard pretty much called the bottom on the housing market, has he now just called the top.

If the only people left to buy are the few sceptics like BH, then how much upside does the property market have left.

Let's make a correction to your comment BD...."our govt will never let the banks fail".....

This comment suggests that our govt makes the rules! They don't.

What you ought to have posted was something like this..: "the banks will never let the govt fail them"

Key's behaviour is a reflection of the extent to which the banks own this economy. He dances to their tune..as does Alan Bollard.

BH made the mistake of assuming the o8 elected govt would act in the best interests of the NZ public....this is not so....priority was always the National Party staying in power...and that involved not rocking the banking boat...but it allowed all manner of spin and BS to spew forth along with any amount of tinkering and tweaking wrapped up in blather.

And so today we still have price bloated property...speculation...cheap credit....etc etc

This economy is being farmed by the big banks with the little banks wanting the scraps.

As such, it will NEVER approach the quality of economy found in Sweden.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10770671

By Devil S. Advocate

Hous prices up 16% last year? I seriously question that, buy lots of houses then, double down, in a little over 4 years they will have doubled in price, in 9 years they will have quadrupled in price, and the average Kiwi home will be worth 1.4 million. 14 years 3 million, 18 years 6 million. The road to wealth right there. You are right Big Daddy we should all be buying as many houses as we can. Stupis idiots investing in productive assets and working hard to build a business, you'll never get rich with that kind of attitude.

The article is just cut and paste, written by BH with ./sarc /on

This time its different!

it is!

it is!

OK......

LOL

We've been over this so many times its not funny....you have made your bed, lie in it.

regards

Big Daddy, because you are so wrapped up in NZ residential property, have you ever considered other markets as well ?

I hear there are bargains to be had in many of the more 'go ahead' cities of the USA. Apparently you can buy property over there, as a foreigner, under what they term a "foreign national" .

I am curious, as I worked out the net returns are far greater than NZ .... and in my opinion there is room for capital growth, as they are at the bottom of their property cycle. While little ol' NZ has already recouped most of the losses over the past 2-3 years. .

just a thought and perhaps others would like to comment on the above - cue andrewj

Cheers to all

Expect a continuation of the Kiwi cancerous property splurging madness because that is what benefits the banks...yes bank bosses have benefits.

Both Bollard and Key will do what they are told to do. The spin merchants will churn out the lies and BS and the poodle media will ignore the Swedish example of good govt.

Nothing will change. OllyN knew this fact

Property is in a speculative bubble, they always burst. Kicking the can down the road, works but the question is "How long is the road?" Gross debt to GDP 220% we may still have a long road, our interest rates are higher then a lot of other countries and it's the interest cover ratio that matters.

No point in worrying skudiv...the policies will not change....the banks have control and right now the bosses are writing out the OBR rules...that will see the bosses walk away leaving the share holders and depositors to cop it in the face. The bosses and directors will move on to pillage another corporate entity. The FSA cannot touch them.

The only step to take is to avoid large deposits in any bank in NZ. It simply is not worth the risk.

Right you are Wolly, I have no love of paper. I read somewhere about sweeden or may have been switzerland, and their bank bosses are directly personally liable if the bank goes bust, so the give a sh*t factor is a lot higher over there.

Switzerland, not Sweden.

The Black Swan of Cairo.

Only 8 pages but a good read.

http://jamesshinn.net/wp-content/uploads/2011/04/The-Black-Swan-of-Cairo.pdf

How suppressing volatility makes the world less predictable and more dangerous.

Nassim Taleb and Mark Blyth

Thanks for the link.

Core Crown Revenues 40.1% GDP 81.5 Billion

Core Crown Expenses 49.9% GDP 99.9Billion

Interest expenses have increased compared to last year due to the higher levels of debt held (gross debt has increased from $53.6 billion to $72.4 billion).

If our interest rates go to 7% we can still borrow another 50 billion (about 4 years at the current rate) before we cross the point of no return. If we have interest rates at 4% we can borrow another 130 Billion so the early 2020's before we pass the point of no return. As the Euro drama unfolds I'd expect to see this get priced into our interets payments. Thats how long we have got before we end up like Greece.

I think the road is getting shorter then most people think, and even creative financial engineering will fail, as it did in Greece.

Greece has on balance sheet interest expenses of 4.5%, who would have thought they could have borrowed so cheaply for the last decade. Now they can't borrow at all.

wolly...problem is what do you do as an average worker bee? got out of shares just in time, phew! bought gold and save reasonably diligently but always in the back of one's mind is the fact that land is somehow comforting, and many of us feel it's allure....

yes I know that it's price is basically a derivative of "zirp" but still, when do you buy in?

seriously you gotta do something to provide in old age.

Same as any investment, when the cashflow is there. Buy for cashflow or buy to save purchasing power, buying in the hope of speculative capital gains is why the Dutch were spending a years wages for a couple of tulip bulbs.

It's about return OF capital not return ON capital - Kyle Bass

I honestly believe the days of sitting on youre arse and getting rich off of the back of the working man are limited. This is a Secular Bear Market, not a cyclical downturn.

Right now I'd suggest only option is buying something that protects cash value and protects against bank runs/defaults....so cash and cash like things......property is one huge bubble, 50% over what it should be, buy in there and the losss impact looks huge.....

I think I read recently that the top 1 or 0.1% took 50% plus of industries profits.....anyone who thanks thats acceptable and will continue is insane IMHO.

I cant see it lasting.....the whining might be that the rich will leave but a) if they are taking the hogs share of profits, who cares? b) this is global there is no where to go to. So 70% tax level on such ppl......pay up or leave an a CGT.....no way is it reasonable to not pax a fair share of tax on profits.......

regards

... if you tune in here too often ( as I do , ahem ! ) you will be whipsawed back & forth on a daily basis by the high brushbeater of doom , Bernard Hickey ...... and you will erroneously believe that the world and everyone on it is going to hell in a handbasket .....

And one day you'll be so afriad and depressed , that you just won't even get out of bed ..... why bother ..... it all sucks . Sucks big time ...

... but does it ? ...... have any expert's predictions come to pass , yet ? .... NZ houses fallen 30 % ....... no ? ...... oil roared up to $US 200 / barrel ...... no ? .......

Somehow we're muddling through . Innovation continues . Sharemarkets rise and fall . People go to work . Onions are bought and cooked . ....... Life goes on ....

You seem to have a enough sense to have worked out that the monetary system is fraudulent. Your first responsibility is to cease partaking of it, or you are a party to the crime. You state you have made some efforts in that department so congratulations. The debt based system must evenually fail, it is really the when and consequences of it that are in question. The longer it is allowed to continue the worse the consequences.

Think of the leverage that the banks have available to them, well it works in reverse. For every dollar you physically remove from the banking system you remove a lot more electronic ones(67:1 is the M0 to M3 ratio). It won't actually take that many people to withdraw from the banking system to bring it down. The sooner the better really so it can be replaced with something that will allow us all to move on.

Energy and water underpin everything else, so that is not a bad place to be.

M0 is notes and coins? How can you remove them? Unless you are talking about stuffing it in a mattress or burning it. The reserve bank is there and one of the reasons for it's creation is to prevent bank runs.

Crash the system. Do it now. The world is leverged at 3.5x GDP wont take much more.

How safe is Kiwisaver when NZ goes broke?

Public pensions in council workers for some EU countries like Spain and Portugal? have a huge exposure to public municipality debt apparantly..so when public services / Govn default, bye bye public worker pensions.....huge haircuts.....

Kiwisaver is a different kettle of fish, however in effect its mostly exposed to private shares and commercial property....For instance my main long term pension (30 years of contributions) lost 22% in 2008......and I expect the Cullen fund and kiwisaver to be directed into NZ more and more by pollies. I sont think NZ will go broke unless we have to cover for the banks losses...if we do like Ireland will be be screwed.....

In todays bad scene Kiwisaver is a bad idea full stop....it locks you into being controlled by morons. Since I considered unit trusts etc a rip off I was buying shares, because I was self-managed I bailed when it looked bad and took only profits....

So I think they will take huge losses myself, even if NZ doesnt go broke....hence Im paying down debt its the best and safest way to save money.........IMHO in fact I think anything else is insane.

NZ why do you think Labour wants compulsory kiwisaver? they need capital to [re-]build leaky schools etc....so its a TAX in other words.

regards

I think if you look the default Kiwisaver is into Bonds, Government Bonds. Return free risk.

.... what a dish-of-ointment , Iain ....... I tuned in hoping to see you write summit defamatory or abusive ..... and get write up Hickey's honker !

Wimped out , Iain ..... yer sold out ! .... if you truely believe the message , you gotta stomp on some softies , like the administrators here , got to be cruel to be kind you know ...

...And yes , Bernard frequently refers to President Obama as " a liar and a fool " .... OK for BH to be abusive , when it suits him .....you are correct there .......

come on , let rip ....... you know you want to .....

Its a bit more like HitchHikers Guide than that. The president of the US is a eunuch on internal policy as he doesn't even control the budget. It is only in foreign policy he is free to run amuck.

...... the " devils spawn " link that Wolly ( then called " Wally " ) put up to describe Iain was mildly amusing .......

But what was really hilarious , was Les Rudd's overreaction to Wally & the link ..... the 800 lb gorilla stomped all over Wally for several days ...... even I was bemused as to why he found it so offensive ... Iain himself took it with a grain of salt ..... ruddy Les went ballistic at Wally ..

...... ahhhh , happy days back when the devils spawn roamed free at interest.co.nz , when we were all more bold , and less bald .

Gummy...I have never called Iain the devils spawn...! Recall about that time somebody who has remained unknown was pretending to be me....and I had to stop using Wally...I lost my A and got an oh....it was a sad time Gummy...

I stand corrected , Wolly ...... I recall the link , showing some heinous looking alien critters , as a repost to one of Iain's long winded blathers about public credit and about crotchety old farts who infested the NZ Labour Party during the 1930's ........

....... God he was boring back then .....

Oh , we were all sad that you lost your " a " , Wolly .

Ever since then all I can do is fort...it's really awful Gummy.

Watch yar linguage , Wully , Barnerd's on the rumpage sonce Perky upsot hem . The big gay's nut hoppy teday .

... eny mare if thut vowel mingling ond Bornie well hive yar binned !

Baheve !

Quite right. Go for the throat Iain.

Bernard has spent too long in a cold, wet, wimpy, winey, politically correct, bedragalled socialist island far away and it shows. I think there is still hope for him though so keep trying.

"If that were true then Swaps and Forex wouldn't be near so interesting (to name 2 channels.) and we wouldn't need an International Intermediary bank, just a market."

Mist42, yes I neglected to account for international capital flows. I thought about that last night, but was too tired to bother posting a comment. Our trade and capital imbalance is such that more capital flows out to purchase goods and pay out dividends than flows in from tourism and external trade, that we have to import capital from nations who have a surplus. In the current global environment we just can't compete with China, we're too far away from international markets and we're just to small to afford the massive investment in productive infrastructure that China and to a lesser extent the North European nations have made. Plus we're too expensive to make a relative return on investment, however our Finance Minister crows that our low wages are a competitive advantage.

What you're saying is the essense of the real bills doctrine, that Antal Fakete explores in a rather suprising nuanced dissertation I will link below. I have a lot more respect for him now, as I'd earlier presumed him to be one of those deluded, simple minded Gold Bugs.

http://www.safehaven.com/article/3426/detractors-of-adam-smiths-real-bi…

Mist42nz,

Yeh the "Nationa" Surplus" of China its labour alright, stolen labour from the long suffering Chinese worker who have their purchasing power suppressed and recycled back to America, to be payed for with cheap consumer debt because even Americans lack the purchasing power to absorb China's excess industrial production.

And the derivatives are just bets, leveraged with "credit" from the exchange's margin accounts. Its gambling just like the horses at the TAB. Only bankers use M.I.T. educated physicists to calculate the odds, or nowadays computer software designed by M.I.T educated physicists and engineers.

Take the red pill and I will show you how deep the rabbit hole goes.

A decent bit of rain for the whole country, should get things growing well.