Here's my Top 10 links from around the Internet at 10.30 am in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

Check out the Chinese shadow banking stuff at #6. A little unsettling.

1. 'Seven lean years' - GMO Fund Manager Jeremy Grantham's quarterly letter is always worth reading. This quarter is no different.

He points to the growing problems in the developed world.

Income inequality.

Ageing populations.

Depleting resources.

Poor infrastructure.

All produce lower asset values over the long run and extreme volatility over the short run.

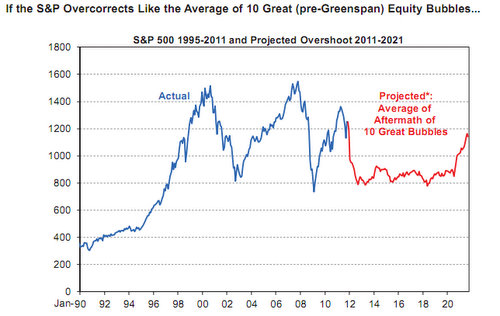

His chart below shows where he thinks the S&P 500 will go. Here's Grantham:

Sadly, I feel increasingly vindicated by my “seven lean years” forecast of 2½ years ago. The U.S., and to some extent the world, will not easily recover from the current level of debt overhang, the loss of perceived asset values, and the gross fi nancial incompetence on a scale hitherto undreamed of. Separate from the “seven lean years” syndrome, the U.S. and the developed world have permanently slowed in their GDP growth.

This is mostly the result of slowing population growth, an aging profi le, and an overcommitment to the old, which leaves inadequate resources for growth. Also contributing to the slowdown, particularly in the U.S. and the U.K., is inadequate long-term savings Meriting a separate, special point are the drastic declines in both U.S. income equality – the U.S. has become quite quickly one of the least equal societies – and in the stickiness of economic position from one generation to another. We have gone from having been notably upwardly mobile during the Eisenhower era to having fallen behind other developed countries today, even the U.K.!

The net result of these factors is a growing feeling of social injustice, a weakening of social cohesiveness, and, possibly, a decrease in work ethic. A healthy growth rate becomes more diffi cult. I also believe that having an economy in which the average worker makes little or no economic progress slowly erodes economic balance, leaving us (as mentioned last quarter) with strong sales of BMWs and other premium goods, and weak and erratic sales of what might be called ordinary goods, resulting in weaker and more unstable growth. Sales are erratic because, with little or no income progress, buying surges by the “middle class” depend increasingly on shifts in confi dence and a willingness to go into debt.

2. Brace for it - George Soros says the Global Financial System is on the brink of collapse.

He must be very short in something.

The current global financial system is in a “self-reinforcing process of disintegration,” Mr. Soros warned, and “the consequences could be quite disastrous. You have to do what you can to stop it developing in that direction.”

3. China headed for stagflation ? - Panos Mourdoukoutas writes at Forbes that China appears to be headed for stagflation where inflation is high but growth is low.

Economic growth is slowing down, while inflation remains high. Last Saturday, The China Federation of Logistics and Purchasing (CFLP) announced that nonmanufacturing sector slowed down sharply, with the non-service Purchasing Manager’s Index (PMI) dropped from 57.7 in October to 49.7 in November.

The slow-down in the non-manufacturing sector follows a similar slow-down in the manufacturing sector, as announced last Thursday; the manufacturing PMI dropped to 49 in November from 50.4 in October– a contraction that comes at time inflation is still running above 5.5 percent.

China’s stagflation complicates economic policy, posing dilemmas to policy makers. An effort to stimulate economic growth by raising bank reserves and by boosting infrastructure spending will worsen inflation (as it is currently underway), while an effort to curtail inflation will lead to slower growth.

4. 'It's all a plot' - Missouri University Economics Professor Michael Hudson has written a broad sweep through history (via Naked Capitalism) about the relationship between kings, democracies and bankers.

It's worth a read.

The financial sector has gained sufficient influence to use such emergencies as an opportunity to convince governments that that the economy will collapse they it do not “save the banks.” In practice this means consolidating their control over policy, which they use in ways that further polarize economies. The basic model is what occurred in ancient Rome, moving from democracy to oligarchy. In fact, giving priority to bankers and leaving economic planning to be dictated by the EU, ECB and IMF threatens to strip the nation-state of the power to coin or print money and levy taxes.

The resulting conflict is pitting financial interests against national self-determination. The idea of an independent central bank being “the hallmark of democracy” is a euphemism for relinquishing the most important policy decision – the ability to create money and credit – to the financial sector. Rather than leaving the policy choice to popular referendums, the rescue of banks organized by the EU and ECB now represents the largest category of rising national debt. The private bank debts taken onto government balance sheets in Ireland and Greece have been turned into taxpayer obligations. The same is true for America’s $13 trillion added since September 2008 (including $5.3 trillion in Fannie Mae and Freddie Mac bad mortgages taken onto the government’s balance sheet, and $2 trillion of Federal Reserve “cash-for-trash” swaps).

This is being dictated by financial proxies euphemized as technocrats. Designated by creditor lobbyists, their role is to calculate just how much unemployment and depression is needed to squeeze out a surplus to pay creditors for debts now on the books. What makes this calculation self-defeating is the fact that economic shrinkage – debt deflation – makes the debt burden even more unpayable.

His conclusion:

Re-regulation of banking and providing a public option for credit and banking services would renew the social democratic program that seemed well underway a century ago.

Iceland and Argentina are most recent examples, but one may look back to the moratorium on Inter-Ally arms debts and German reparations in 1931.A basic mathematical as well as political principle is at work: Debts that can’t be paid, won’t be.

5. Hard landing possible - CNBC reports Marc Faber has warned of a hard landing in China.

"I think growth will be much lower and it is possible that we could have a hard landing with no growth at all."

Faber, who correctly predicted the 1987 stock market crash and more recentlyforecast the stock market correction in August, says China's economy depends largely on capital spending, which tends to be volatile and has a strong multiplier effect on the economy.

While a recession in Europe could mean a gross domestic production contraction of 1-2 percent, he expects a shrinking Chinese economy to have a more widespread impact globally.

The commodities market, in particular, will bear the brunt of a China economic deceleration, said Faber. "If the Chinese economy grows at 10 percent, or 5 percent or no growth, it has a huge impact on iron ore, copper, nickel, anything. “

"It will have on the global economy a devastating impact via the resource producers of the world, whether it's Brazil or Australia or the Middle East or Africa," Faber added.

6. China's shadow banking risks - Cindy Tse writes at China Briefing about the risks in China's shadow banking system, which makes up about 20% of China's financial sector.

She makes an excellent point about how many commodity traders are using trade finance as a back door into property speculation. It creates a double whammy if commodity prices fall and the Chinese property market slumps.

The growth of informal lending channels can be traced back to the government’s response to the recent Global Financial Crisis, in which the country’s main banks were ordered to handout massive loans to state-owned enterprises (SOEs). The resulting inflation led to a subsequent and swift clampdown on lending with harsh quotas that have made credit available only to those SOEs least likely to default, and for the most part shutting out private sector enterprises.

China’s small and medium –sized enterprises (SMEs) account for 60 percent of China’s GDP and 80 percent of urban employment, according to Zheng Xin, deputy director of the SMEs division of China’s Ministry of Industry and Information Technology. Therefore, such preferential loan policies have rendered a massive chunk of the economy strapped for cash with little choice but to turn to informal channels in the shadow financing market.

Of particular concern since June of this year has been the involvement of commodity traders in this unregulated market. The state-led credit squeeze beginning in early 2010 forced SMEs and SOEs alike to turn to trade financing as a loophole. Trade loans fell outside the central bank’s restrictions, thus banks were able to offer them for commodities purchases such as copper, steel and soy beans.

The situation would start off harmlessly enough – with a letter of credit from a bank issued on behalf of an established borrower to a steel manufacturer for a given stock of steel. The borrower, perhaps a commodities trader, would then have a short period of time to repay the bank, but the time periods can vary depending on the bank and commodity. In the case of copper, the borrower may have three months to a year, with fees and commissions to the bank that may add up to only about 3.5 to 10 percent of the value of the cargo.

The risky business begins when these borrowers sell their cargo – be it at a loss or profit – and quickly funnel the cash into other investments or to other borrowers at exorbitant interest rates, sometimes upwards of 70 percent. One of the biggest recipients of this cash is China’s ever inflating property market; the very market state regulators have been trying to reign in. And what worries many analysts is the possibility that a fall in commodity prices might coincide with a sharp drop in property prices and demand, triggering a wave of defaults.

7. Printing Greenbacks - Washington College History Professor Richard Striner looks back through history via The American Scholar to find a time when America printed money to buy stuff, as opposed to just bailing out banks.

If the Federal Reserve can create new money, couldn’t Congress do the very same thing? The answer is yes, and here’s the precedent: the Legal Tender Act of 1862, in which the Republican-controlled Congress authorized creation of “United States Notes,” known as greenbacks, that were printed up and spent into use.

The U.S. Constitution has no provision for this practice, but it does authorize the minting of coins.

Why shouldn’t the American people have additional funds to be used for such impeccable purposes as national security, infrastructure maintenance, public safety, environmental protection, and research to counteract global climate change—funds created by the government without more taxes or debt? Does the principle seem too good to be true—a mere mirage, something for nothing? Think it over, for the system that we have right now is an exercise of mind over matter. The system I propose would give the people and their leaders an equal share in money creation with the bankers who are seeking private profit. It’s a profitable game, the creation of money, and we need more players at the table.

8. Diddums - An Wall St Hedge fund manager is worried about a change in the tone of the rhetoric likely to be adopted by Barack Obama in a speech this morning about them (the 1%) vs 'us' (the 99%).

So the NYTimes' Dealbook reports he wrote a letter to Obama that seems to have captured the mood (of the 1%), which is they don't like people saying nasty things about them.

Last week, in a widely circulated “open letter” to President Obama that whizzed around e-mail inboxes of Wall Street and corporate America, Mr. Cooperman argued that “the divisive, polarizing tone of your rhetoric is cleaving a widening gulf, at this point as much visceral as philosophical, between the downtrodden and those best positioned to help them.”

He went on to say, “To frame the debate as one of rich-and-entitled versus poor-and-dispossessed is to both miss the point and further inflame an already incendiary environment.”

9. Low interest rates not helping - The US Federal Reserve has been buying government bonds and toxic mortgage bonds to push down the long term interest rates that people use to borrow to buy houses in America. The theory is it will boost the economy.

The trouble is it's not working, as Tyler Durden points out at Zerohedge with this chart below:

What appears very clearly on this chart is that despite ever declining mortgage rates, there is simply no interest in home turnover, and sales are at record low levels due to lack of demand, and lack of desire to sell into a bidless market, in essence causing the entire housing market to halt.

And this makes intuitive sense: the bulk of home owners who can take advantage of cheap credit are those who already have a mortgage and at best will refi into a cheaper one. For everyone else, either the bank's admissions criteria are too stringent, or the potential borrower is simply convinced that a year from today, the 30 Year mortgage rate will be another 1% lower (most likely with 100% justification). As such there is absolutely no drive to naturally restart the housing market

Totally on the mark video of Daniel Hannan speech on the problems with debt globally

43 Comments

re #4, I know its counter to current orthodox thinking, but does the govt have a plan for defaulting, should the sh1t hit the fan?

i dont believe that there is NO situation where its the smart thing to do, and seeing as WLG is full of bureaucrats doing planning for all sorts of crap, do they have a plan for this?

re #7, printing greenbacks to buy stuff, i've raised this here before.....if you're going to print money why not give it to, say, a company who build bridges, or broadband, or powerlines?

if the job of banks is to price risk and allocate capital, they have failed miserably. why give them another penny? personally i'd rather have a corrupt and inflated infrastucture building industry than banks.

edit: ps where's wolly?

Yes of course they do VL....their plan is to always claim it is De Fault of the Labour govt....

Theres is little likelihood for a government to default when it has its own Central Bank and a free floating currency regime. Cases when its happened historically were when governments were constrained by their currencies being underpinned by a gold standard (at the first sign of trouble gold floods offshore, leaving governments unable to make good their obligations) or when their made dire mistakes in currency management, like trying to maintain a fixed peg against another currency, whilst seeking to wade against the tide of market sentiment (Mexico in 1982, Argentina 2001). The wider economy would have to collapse before our public finances became a problem and at that stage we'd have greater problems to deal with than worrying about the public debt.

Anarkist is right with the key lesson from the last couple of years is that having your own central bank/currency is key, as is making sure you borrow in your own currency. Worst comes to worst you just print to repay say a bond maturity or similar large cashflow obligation. If you had to do this because of a temporary liquidity squeeze, rather than a long term solvency problem, then you've just bought some time (for "free") to start repairing the balance sheet or source some cash from somewhere. If you have to continue printing money then it's the inflation scenario, and the NZ govt would likely be shut out of funding markets but at least the NZD would fall and we'd begin to repay our way through hard-graft exporting. Wouldn't be easy but essentially this is what Argentina is doing right now, (although that place looks to be still a basketcase - the government there price-controls Big Macs so that international PPP comparisons (e.g. from Economist mag) make Argentina look good).

Careful what you wish for. Backhanders to councillors who approve construction deals, backhanders to ministers who buy miltary equipment, to doctors who prescribe certain drugs?

NZ is not Greece.

yeah i'm aware of that risk roger, but at the moment its being funnelled to a the parasitic banking industry. i would rather have a corrupt insutry that makes stuff than a corrupt industry that deals in misery and magic

edit: i know nz doesnt really do QE the way the yanks do, and there is lots about banking I don't know, but surely if the govt is going to inflate any industry it should be infrastructure, rather than banking.

The book I read earlier in the year "False Economy" stated that corruption is no impediment to an economy as long as it is mild and predictable.

The govn doesnt have a plan for anything, except re-election in 2014.....

regards

4. and 7. both advocating what amounts to a system of public credit. The neoliberal claim that such a notion is folly is beginning to crack.

Hey Bernard...you missed the fun news...Contact Energy just bought a brand new power gen plant for todays debased $30mill...that they were paid 03 $150mill to build by that fathead Labour mob under Clark and Cullen...and Parker was the Minister at the time...ha de ha de ha...

and Contact can shift the plant to a location near Auckland...and make lotsa money running it to feed the big stink...

As a shareholder in Contact..thankyou Labour.....well done....

The plan is to covert it from diesel to natural gas ... a nice little earner for Contact ...

.. ..why did Labour commission a diesel generation plant , .. a knee-jerk reaction to a bad year or two , when the southern hydro-lakes ran low ?

..... big companies must prefer a Labour government , 'cos Labour are bigger fat-heads when it comes to wasting munny ..... so much easier to rip off the taxpayers of the country ....

Shall we call it Parker's Power Palace....!

I consider it payback for the way Cullen and Clark rorted the aia shareprice to win votes off the marxists in the big stink....now those suckers gotta pay me back for their bit of marx....funny as a F......

Perhaps they had been listening to powerdownkiwi and Steven, Gummy, and thought they'd better get in quick before all the diesel ran out?

speaking of which, where is PDK? Do we need to send out an SAR party?

.... in the Southern Ocean helping Japanese sashimi chefs locate minke whales for scientific research ? ..........

Probably with our belated Walter in that he can't be bothered with Bernard's censorship or lack of balls on certain matters.

ha

PDK's a good man Vanderlei, his leanings aside....a clever man indeed.

I think it had more balance when he was here.....and it's a shame he's not.

Cest la vie.

As an ex-Contact share holder, good luck with the value of your shares....

LOL

regards

Oh thanks steven...I only worry about value when I sell...it's the divs that concern me...and knowing the directors are taken care of...especially the directors.

I can’t understand why anyone in the MSM (New Zealand included) isn’t covering this:

The US government is very close to imposing Martial Law.

And congress has the numbers for a veto override, so don’t think Obama can do anything about this. The economic implications on the world economy will be devastating…

Troy,

Its not on the news because the PTB don't want it in the news. They want to spring it on the completely unprepared, unwitting sheepie, who will find they wake up in a totally different world one morning, with armed troops in the streets and agents of the government free to kick in your door without due process. Including for reasons such as consuming unapproved foodstuffs (Food Bill).

Its been on the cards since the 1978, with Operation Garden Plot, when elites in the United States were afraid they would have to cave into the demands of the ungovernable masses. See Samuel Huntingtons Crisis of Democracy and Post Industrial Politics.

Having a plan is very different then the US Senate voting 97-3 to expunge the constitution. The US military has all types of plans. They even have a plan to invade Canada, besides the rot goes back even further than the 70’s.

EDIT: BTW that vote was the very reason I left the US for NZ 6 years ago today

They voted to expunge the Constitution? Are you talking about the Patriot Acts? Yeh, I would do the same too.

Not that our Bill of Rights is worth the proverbial paper its written on if you find yourself on the wrong side of agents of the judicidal system.

In the 86 page ruling in Attorney General v Chapman, a majority of the Supreme Court last month declared acts by judicial officers are exempt from New Zealand Bill of Rights Act 1990 enforcement or remedies.

http://kiwisfirst.com/

Haha, it is filthy to the core. Stupid of the judges really, because it only leaves one avenue available for redress.

Re the Constitution issue, perhaps there is something in all those FEMA camps I keep getting told about.

Always enjoy Daniel Hannan. Why are the seats always empty?

Looks like the Beehive on a slow day. Wish we had a few smart, articulate politicians.

I just twigged. Why bother turning up when its all being decided by unelected technocrats

behind closed doors.

Why bother with the one true barbarous relic - democracy - when good ole' fascism will suffice. As The Telegraph's Bruno Waterfield reports, "EU to avoid any votes - parliamentary or popular on treaty change - via obscure Lisbon Treaty 'passerelle' clause, Art. 126 (14) via protocol 12. "This decision does not require ratification at national level. This procedure could therefore lead to rapid and significant changes," says confidential Van Rompuy text

On behalf of my fellow shareholders in Port of Tauranga , a heart-felt thankyou to the striking employees of the Port of Auckland , a big Chrisco hamper coming to your union rep's office , and lest we forget , thankyou to Miss Management of the Port of Auckland Authority ....

.. $ 92 000 p.a. is simply not enough for the sterling stevedoring work you do , men , hang out for more , much much more ...... we're rooting for your rights and entitlements .....

.... can't hang around guys , we're gonna be all hands to the decks in Tauranga , with the extra 22 000 containers we need to unload for Maersk ...

Cheers !

Gummy has Union backing...what a xmas present....lucky you.....

I see lots of stuff on today's Top 10 about the 99% and 1% .

Whats going on with the Hobo's occupying the Square in downtown Auckland ? I went past there during the Santa parade and it looks like downtown Lagos , frankly is a disgrace . The buggers should be arrested , they are achieivng nothing , clearly unemplyed or unemployable,

What makes you think you can just go dicking around at Santa parades? Get a job FFS.

yeah - Prosser for Police Minister ,he would have it sorted by lunchtime

Actually Police have been starved of resources for years and don't have the capacity to deal with an serious civil disorder. They know this and so won't back up the councils pitiful and baseless attempts to use the trespass act.

Not only that but the Police are dumb as an organisation and they would be very prone to co-ordinated action.

You had better pray the OWS crowd stay peaceful.

Power...so much POWER....it's a Weidmann thing....

"Most economists indicated that they were convinced that the position of Weidmann will be crucial in deciding whether the ECB more than at present to save the euro is taking. "The attitude of the Bundesbank to the program for the purchase of government bonds is more important than their normal attitude to monetary policy, since the program moved to the edge of the contractual mandate," said Torge Middendorf from WestLB(sic)

http://globaleconomicanalysis.blogspot.com/

Now who will be phoning Mr Weidmann today I wonder....and what will be on the table....!!!

http://www.johnmauldin.com/images/uploads/pdf/mwo120511.pdf

Fascinating discussion (if a bit above my head) eg

The initial judgment was that Merkel did not understand economics, or was too beholden to longstanding monetary traditions, or was simply incompetent. But while the crisis has intensified, Merkel has become ever more stubborn in her refusal to do what was obviously needed to save the Euro, as David Cameron discovered last week. So a different interpretation of her inconsistencies must now be considered. Is it possible that Germany, far from trying to save the Euro, actually wants to break it up? A clear historical precedent is the sabotage of the European exchange-rate mechanism (ERM) in 1992. And the institution that now seems to be working to destroy the Euro is the same one that organised the ERM breakup—the Bundesbank.

"Milk powder is the latest foodstuff to be affected by radioactivity in Japan after shipments of beef were banned in August and rice in September, also for caesium contamination."

http://www.bbc.co.uk/news/business-16047697

Explains the rise in Mpowder price lately!

Nuclear and cover up do seem to go hand in hand.

I read a report by a guy at a conference when the tsunami hit. There were a lot of nuclear guys there and he was party to the discussions they had. They were white faced to a man. The potential was for a much bigger accident than Chernobyl due to the vast amounts of radioactive material stored on site.

T^a S.L. good read.

This is just the best piece to watch...will take you 1hr 11mins....

http://www.youtube.com/watch?v=8WBiTnBwSWc&feature=player_embedded#!

regards

Yep, but you need anti=depressants afterwards.

Hey Sore loser,

Nice post!

Living in a defationary world is actually great ! Japan right now and radiation etc aside, life here is good. Your money actually goes somewhere, you can actually count on your wages to cover your cost of living and not be constantly gobbled up by rising prices.

Each year I am slightly better off and it's quite agood feeling.

I am of the opinion that inflation is mostly a manfactured concept. Manufactured by Govt to erode the size of their debt so that they may borrow ever increasing amounts to cover the previous borrowing repayments - ponzi scheme anyone? It will be of great interest now for the US govt to ramp up inflation to help pay the national debt and is exactly why they are so afraid of deflation.

Of the two inflation or deflation I much prefer deflation or (no-flation).

Cheers

Hey....a hole in the wall...look what I see....

"Chinese New Zealand businesses, including one formerly owned by the businessman spearheading Shanghai Pengxin's bid for the Crafar dairy farms, have boosted the National Party's coffers by more than $100,000 in recent days.

Recent filings to the Electoral Commission show National received $50,000 on November 22 from Citi Financial Group, a Queen St foreign exchange and financial planning firm owned by Yan Yang and Qiang Wei.

The same day, the party got a $1600 donation from Oravida NZ, which also gave $55,000 on November 30.

Oravida's directors are Jing Huang, Julia Jiyan Xu and wealthy but reclusive businessman Deyi Shi." herald

..........it's porn....it is isn't it.....the really nasty stuff.....

.....the really nasty stuff.....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.