Here's my Top 10 links from around the Internet at 2 pm today in association with NZ Mint.

We welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #2 on the tragedy of the commons in Europe's banking system. Read it and realise Europe is so, so stuffed.

1. McWages - We've all heard of The Economist's Big Mac index to try to get a measure of real exchange rates and just how 'over priced' or 'under priced' an economy is.

Now there's a way to work out how 'over paid' or 'under paid' workers at McDonalds are relative to their colleagues in various countries, and relative to the cost to eat of what they produce.

US economist Timothy Taylor points on his blog to this research by Orley Ashenfelter on real wage rates that use the wages of McDonalds workers and converts them into Big Macs Per hour worked -- ie how many Big Macs could a worker buy with one hour's wages making Big Macs.

It's a fascinating idea.

The research shows that third world workers are paid much less in Big Macs per hour than their developed world colleagues.

Interestingly, the research then tracked the productivity of workers in different countries generally to see how 'fair' the over payment and undepayment might be.

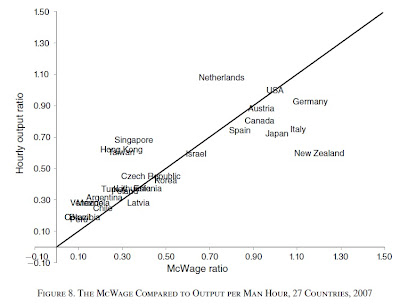

The chart shows it's generally fair, although there are a few outliers, including New Zealand.

McDonalds workers are paid slightly more than their US counterparts per hour, but New Zealand workers generally are about half as productive.

Taylor makes some good points here about productivity, but somehow we have to make sure that productivity has been turned into wages for the masses. That hasn't happened in America.

The key lesson of the figure is that the differences in McWages across countries line up with the overall productivity differences across countries. The main exceptions, in the upper right-hand part of the diagram, are countries where the McWage is above U.S. levels but output-per-hour for the economy as a whole is below U.S. levels: New Zealand, Japan, Italy, Germany. These are countries with minimum wage laws that push up the McWage.

Ashenfelter emphasizes in his remarks how real wages can be used to assess and compare the living standards of workers. I would add that these measures show that the most important factor determining wages for most of us is not our personal skills and human capital, or our effort and initiative, but whether we are using those skills and human capital in the context of a a high-productivity or a low-productivity economy.

2. The tragedy of the commons - Economists Aaron Tornell and Frank Westermann write at VoxEu about the expansion of credit in Southern Europe in recent years as central banks and others there discover the opportunity and tragedy of using a common resource (central bank credit) where the costs are shared. It is today's must read in full.

The chart belows shows central bank loans to banks in peripheral Europe of GIIPS (Greece, Ireland, Italy, Portugal and Spain) vs loans to banks in the core Euro-zone area of GNFL (Greece, Netherlands, France and Luxembourg).

Despite the recently-announced €100 billion European Financial Stability Facility loan to Spain and the recent Greek elections, this column argues that Eurozone periphery may soon need another large-scale rescue operation. But it fears that without reform at the ECB, the rescue package will be just yet another temporary plaster over the cracks.

The late, great scholar of crises, Rudi Dornbusch, put it aptly: “In a very rich country you can afford to do very bad things for very, very long.” The Eurozone is in the process of finding out just how long “very, very long” means.

Despite the recently-announced €100 billion European Financial Stability Facility (EFSF) loan to Spain and the recent Greek elections, the Eurozone periphery may soon need a new large-scale rescue operation. Two likely events may force such rescue operation to avoid a panic: Deposit flight, and The need to rollover government debt.

Without institutional reform, however, the next rescue package will simply be another link in a continuous process of backstop measures undertaken since 2007.

According to some commentators, the Eurozone has been saddled in a bad equilibrium because the ECB waited too long before using its Big Bazooka and has refused to act as a lender of last resort. They believe that if the next rescue operation were only big enough, the Eurozone drama would come to a happy end. We disagree. What ails the Eurozone is neither the ECB’s lack of monetary expansion nor the multiple equilibria syndrome, but rather the tragedy-of-the-commons.

3. The Great Abdication - Paul Krugman asks at The New York Times if 2012 is turning into the new 1931.

Suddenly normally calm economists are talking about 1931, the year everything fell apart.

It started with a banking crisis in a small European country (Austria). Austria tried to step in with a bank rescue — but the spiraling cost of the rescue put the government’s own solvency in doubt. Austria’s troubles shouldn’t have been big enough to have large effects on the world economy, but in practice they created a panic that spread around the world. Sound familiar?

The really crucial lesson of 1931, however, was about the dangers of policy abdication. Stronger European governments could have helped Austria manage its problems. Central banks, notably the Bank of France and the Federal Reserve, could have done much more to limit the damage. But nobody with the power to contain the crisis stepped up to the plate; everyone who could and should have acted declared that it was someone else’s responsibility. And it’s happening again, both in Europe and in America.

4. September is a dangerous month - The Economist points to research from Luc Laeven and Fabian Valencia on how September is the worst month for banking crises...

But why?

The Economist has a few ideas.

I recall reading that historically the fall was a popular time for crises because farmers needed to borrow to bring in the harvest, which strained fractional-reserve banking systems. I can't think why that pattern would persist into the post-industrial era. One theory blames the October 30th fiscal year-end of American mutual funds; managers trying to avoid losses or hold onto gains for the year were more likely to succumb to herd behavior as that date approached. But that wouldn't explain why the pattern holds in other countries which, I assume, have different year-ends. Maybe it's because policy makers and bankers don't confront their problems until they get back from vacation, the macro equivalent of doctors scheduling c-sections during office hours.

No matter the explanation, this gives more reason, as if you needed more, to sweat as the fall approaches. Just to elevate the anxiety further: another calendar pattern to which Mr Rogoff first alerted me is the tendency for crises to happen in election years; think Mexico, 1982 and 1994, Korea, 1998, America, 2008, Greece, 2009. The intuition behind this was that crises are the result of imbalances that accumulate over a long time. Politicians have a strong incentive to delay dealing with them until after an election, and often, as was the case with Greece, to actually hide the truth until the polls close. This means imbalances often reach their breaking point right around the election.

5. Colin Meads still 10th most trusted New Zealander - The All Black legend who promoted Provincial Finance to Mum and Dad investors has been named the 10th most trusted New Zealander in the latest Readers Digest poll.

Though to be fair to Pinetree, Provincial Finance receivers returned 92.2% of money to investors. See our Deep Freeze list here.

Richard Long, who promoted Hanover Finance, doesn't make the list...

6. Deleveraging and the Depression Gang - Krugman also has an excellent critique of the Bank for International Settlements report saying central banks can't and shouldn't do much more to solve the world's economic problems.

It's a useful summary that touches on the problems of a global balance sheet recession:

the deleveraging shock has been so large that we’re hard up against the zero lower bound; interest rates can’t go low enough. And so we have a persistent excess of desired saving over desired investment, which is to say persistently inadequate demand, which is to say a depression.

By the way, this is in a fundamental sense a market failure: there is a price mechanism, the real interest rate, that because of the zero lower bound can’t do its job under certain circumstances, namely the circumstances we face now.

What to do? One answer is fiscal policy: let governments temporarily run big enough deficits to maintain more or less full employment, while the private sector repairs its balance sheets. The other answer is unconventional monetary policy to get around the problem of the zero lower bound: maybe unconventional asset purchases, but the obvious answer is to try to create expected inflation, so as to reduce real rates.

Now look at what the serious people say: we must have fiscal austerity, not stimulus, because debt is bad; we must not have unconventional monetary policy, because that would endanger “credibility” (where it’s not at all clear what that means). So basically, we must do nothing to fix this horrific market failure, and allow unemployment to fester instead.

8. Another point of view - A Harvard University study of global oil fields predicts oil production could grow 20% by 2020 and trigger a collapse in prices.

No worries then.... Still can't work out why production hasn't increased much over the last 5 years or so when prices more than doubled, but hey, it's coming right?

The findings by Leonardo Maugeri, a former oil industry executive who is now a fellow in the Geopolitics of Energy Project in the Kennedy School’s Belfer Center for Science and International Affairs, are based on an original field-by-field analysis of the world’s major oil formations and exploration projects.

Contrary to some predictions that world oil production has peaked or will soon do so, Maugeri projects that output should grow from the current 93 million barrels per day to 110 million barrels per day by 2020, the biggest jump in any decade since the 1980s. What’s more, this increase represents less than 40 percent of the new oil production under development globally: more than 60 percent of the new production will likely reach the market after 2020.

His study attributes the expected growth in oil output largely to a combination of high oil prices and new technologies such as hydraulic fracturing that are opening up vast new areas and allowing extraction of “unconventional” oil such as tight oil, oil shale, tar sands and ultra-heavy oil. These increases are projected to be greatest in the United States, Canada, Venezuela and Brazil. Maugeri also predicts a major increase in Iraq’s oil output as it regains stability, which will add new production in the Persian Gulf region -- potentially destabilizing OPEC’s ability to manage output and prices.

9. Another another point of view - Vivek Wadhwa writes at Forbes that, contrary to some views, the world is about to embark on its most innovative decade to solve its growth problems.

Many people believe that we’ve run out of ideas and that the future will be one of bleak shortages of food, energy, and water. Billionaire Peter Thiel, for example, argues that despite spectacular advances in computer-related fields, technological progress has actually stalled because the internal combustion engine still rules our highways, the cancer death rate has barely changed since 1971, and the top speed at which people can travel has ceased to improve.

Thiel is right about engines, speed, and cancer death rates. But he and the pessimists are completely wrong about what lies ahead. I don’t believe that the future holds shortages and stagnation; it is more likely to be one in which we debate how we can distribute the abundance and prosperity that we’ve created.

Why am I so optimistic? Because of the wide assortment of technologies that are advancing at exponential rates and converging. They are enabling small teams to do what was once only possible for governments and large corporations. These exponential technologies will help us solve many of humanity’s grand challenges, including energy, education, water, food, and health.

10. Totally Stephen Colbert talking to Paul Krugman

The Colbert Report

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive

35 Comments

OMG - Soros is a damn clever fella and he must be extremely frustrated at what is happening in the Eurozone. He has been continually providing the solutions to the problems. You can lead a horse to water but you can't make it drink.

8. In perspective we have,

http://www.energybulletin.net/stories/2012-06-25/commentary-america%E2%…

"Using the RRC data for Texas crude oil production suggests that annual US crude oil production in 2011 was only back to the 2004 production rate. In other words, it appears that the cumulative expenditures by the US oil industry for 2005 to 2011 inclusive only served to bring us back up to the pre-hurricane production level that we saw in 2004.

Our analysis suggests that at best we may only see a slow increase in US oil and gas production--especially if we use actual production data in lieu of EIA estimates."

Easy really, we should see an increase in production.....so lets see it.

regards

I didn't read the whole article, but with all the talk about new production coming online, one could conclude that production would increase. I wonder though if he has taken into account the decline we're seeing in current fields. I remember a statistic from somewhere that 2/3 of all fields are now in decline. Combine that with new production coming online and we might be able to maintain current production rates, for a little while longer, until we can't any more.

No 2:

in the core Euro-zone area of GNFL (Greece, Netherlands, France and Luxembourg)

Maybe that is not supposed to be Greece?

Colin you are correct it is not Greece. GNFL or GFNL depending on where you are, the "G" is for Germany.

I tried to vote your comment up - but for some reason an error pops up.

Thanks. Germany does make a difference.

Re 8

You have linked to articles previously that highlighted the decoupling of oil prices from real world supply and demand as speculative bank money has poored into the market. Money that never has any real oil nor ever wants any real oil- above what is required to fill the car.

A mate of mine now living in New Jersey writes software for oil refineries that helps them determine what to make based on market price singnals and the make up of the actual crude oil- the biggest customers for the software are now- you guessed it - bankers and hedge funds in New York.

Regarding #9, "I don’t believe that the future holds shortages and stagnation; it is more likely to be one in which we debate how we can distribute the abundance and prosperity that we’ve created."

Spoken like a true member of the 1%.

Also regarding #9

Forbes has a long history of such idiotic statements.

Coincidently, I've just been watching Professor Albert Bartlett's video “The most important video you’ll ever see” which explains that the biggest problem facing the human race is the inability to understand the exponential function.

He mentions that:

"Malcolm Forbes, Jr. Editor of Forbes Magazine had a similar response to the reports of global problems resulting from overpopulation in both the developed and underdeveloped parts of the world. "It's all nonsense." ( Forbes 1992 )"

It's a fascinating watch. So far 4.4 million people have watched part 1 of an old geezer like myself talking about arithmetic.

See it here, it's interesting, honest!

http://www.justwondering.co.nz/the-consequences-of-growth/

Brilliant video that indeed sums up our issues. Sadly I think it is indeed too technical for many to understand, and that itself is very sad.

Not too technical for most visitors to this site. I've started a series of letters to my mokos to keep them abreast of the economic and ecological brick wall we're careering toward. So I ran Dr Bartlett's video past my mathsphobic wife as a test subject.

She enjoyed it and followed it no problem. Trust me she's a technophobe without parallel.

http://www.justwondering.co.nz/letters-to-my-grandchildren-introduction/

A truly brillaint, and worrying, video.

http://www.justwondering.co.nz/the-consequences-of-growth/

Sadly I cant see the people that need to watch it; doing so.

It does remind me of:

11 barrels of oil, 10 customers and 10 ships... all is well.

9 barrels of oild, 10 customers and 10 ships, ALL HELL BRAKES LOSE!

When it happens; it happens big and fast.

Yes - it's an oldie but it's the truth.

The below poster, though, won't look. That way he doesn't have to know. Not knowing, he can project himself as an expert.

Just like EVERY teacher/professor/lecturer in economics in NZ. (I stand to be corrected????????????).

Very few economists will mention Peak oil, the few like Jeff Rubin and Robert Hirsh that do, say pretty dire things that ppl refuse to listen to...even deride. The good thing though is those that do probably wont be the canon fodder....they will however have to figure out how to lose the parasites which threaten to overwelm them when the fodder is gone and tahts my worry....

regards

Hence the US military will help ensure those most deserving of the oil get it first.

regards

Thank you for the link to Sebastian's video Hugh. When he described the reaction of the young student who faced monumental problems in her life but was inspired to battle on I had a tear in my maudlin eye.

Another educator whom we should be paying attention to is Ken Robinson, particularly in this clever, funny, and inspirational video:

http://www.justwondering.co.nz/changing-education-paradigms/

He points out that our system is mired in the 19th century and is destroying our children's creativity.

I think Sebastian Thrun's been listening to him. :)

re 8 - this guy makes the classic mistakes. Like Brownlee re coal, he quotes a total, the current per-year figure, then states "this would give 40 years supply". You can stop giving any cred to anyone who talks like that, straight away, because in the next breath, they inevitably claim that we can 'grow'.

You cann'ae have both.

He also fails to adress the falling quality of each barrel - despite mentioning sources far below the EROEI of 100 that Drake got from Spindletop. Wringing 'oil' from shale using vast quantities of water (already allocated and depleting) at an EROEI of less than 8, doesn't support BAU. It's that simple.

Then there's the export-available quantity - for instance SA will use all her production internally by 2030, projecting current rates.

Interesting to note the backing of BP..............

Exactly what Dr Bartlett bangs on about in the video I linked to above. People in positions of power and influence with not a bloody clue about exponential growth. Planners who swear that growth can and should continue forever.

The clincher: he quotes an educated idiot who said "we'll never run out of copper because we can make it from other metals."

Roll on Armaggedon. We need a clearout.

yes Alan.

My old Dad used to say that half the people you meet must be below average, but he thought it was worse than that.

I think more know, than let on. Denial, clutching at straws, it's interesting to guess what drives which one. Jim Mora addresses Powerdown not by getting in a physics expert, but two economists (I hassled him in between). I know of a business reporter who said "I don't want to know, I've got a young family and a mortgage". Radio NZ News report Bill English advocating "sustainable growth". There's no such thing - it's a lie, to be blunt.

The sad thing is that I suspect the clearout will end with the thugs in control, the rest of us dead.

"My old Dad used to say that half the people you meet must be below average, but he thought it was worse than that."

I love that. I've regularly pointed out the first bit, but the second is hilarious.

From experience you'd swear it was true, and on reflection, it could actually be true. We're talking average, not median.

Certainly applies to cabinet ministers.

AH - seriously, folk in my circles wonder if the majority of brains are wired for linearity, and for optimism to override reality. Perhaps that was a successful gene-type in the early days.

It is quite likely that recognition of exponential numbers wasn't needed, and therefore the percentage :) of folk who can see the perils, is not a majority by a large margin.

You can see the stupidity re the energy-co sales - the profit goes to the customers - a zero-sum game. Now it will go to a select section of the customers - which is a change of individual wealth held, but still in that zero-sum game. Even if the narrower cohort screw the dispossessed, it's still an internal zero-sum game. That can only get worse, the more shares go offshore.

Meantime nobody - neither the media nor the runners of this site - have overlaid the energy supply globally with the local supply, ascertained the future desirability of same, nor noted (it's 100% of the media have failed here) that no fiscal activity is underpinned without said energy.

Great thing about being a soverign nation is of course when globalisation goes away we simply posses the assets and stop payments.....ownership by foreigners is tenious at best.....votes will win.

regards

My old Dad used to say that half the people you meet must be below average, but he thought it was worse than that.

Actually that quote does not stand up. As an optimist I like to think that half the people you meet might be above average.

N the N - your attitude suggests you are one of the 'below' cohort.

Optimism and pessimism are emotions, not an intelligence rating..

:)

His writings suggest the opposite.....

regards

I was actually calling bullshit on your little saying, its simply untrue.

http://www.chessbase.com/newsdetail.asp?newsid=3527

Notice more than half the players scored below the average score.

http://www.chessbase.com/newsdetail.asp?newsid=7238

Of course more than half the players could also score above the average score.

You are right optimism has nothing to do with it.

That 'little saying' came from a man with an intellect well into Mensa territory, who lived from inventing and producing those inventions. He happened to have a sense of humour - it was a joke.

That makes you the straight man?

If its a joke you will need to condescend to explain it to me. Unsurprisingly to you it goes well over my head. I don't see any reason that your scale of intelligence needs to constrain the mean above or below the median.

Sorry Nic, you're confusing average with median.

:)

he could ask a medium.

Is there anybody out there?

I like the saying, "I'd like to like ppl but they are so f'ing stupid"

regards

Greeks want more time....

http://www.bloomberg.com/news/2012-06-23/greek-government-to-seek-at-le…

regards

.png)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.