Here's my Top 10 items from around the Internet over the last week or so at 10 am. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #10 on the problems inside the "Credit equals Gold #1" Shadow bank in China, which may default next Friday. Credit equals gold...sigh.

1. Secular stagnation and bubbles - It is the paradox of our age.

Developed economies are struggling to grow at 'normal' rates for a bunch of reasons. Populations are ageing. Globalisation and a rising profit share are dragging on middle and lower incomes. New technology is failing to deliver much productivity growth.

So why are asset prices taking off? Is it just because there's lots of cheap, freshly printed money spewing out of central banks in America, China, Britain and Japan?

And does this risk creating fresh bubbles just like the one that caused the bust of 2008 that almost wiped out the global banking system?

How do we avoid such stagnation turning into another financial crisis?

Larry Summers' meme about secular stagnation delivered before Christmas has got lots of people thinking over the break.

Summers himself suggested a few alternatives, including using these near nil interest rates to pay for debt-funded public investment in infrastructure.

But the 'Voldemort' of solutions is also now being whispered: deliberately target higher inflation closer to 5% to engineer the financial repression needed to repay the debt and get growth going. Don't laugh or sneer. That's what America did in the 1950s.

Here's the Economist with a chat about that:

(IMF Chief Economist) Olivier Blanchard responded to Mr Summers' take on secular stagnation by arguing that policymakers should target higher inflation to generate adequate demand and then use macroprudential policies to rein in financial instability. Mr Summers tossed that idea aside, saying that the two policies—higher inflation and macroprudential regulation—push in exactly opposite directions and would cancel each other out. But that's seems to wildly oversimplify matters.

As Mr Summers himself notes, there are many sources of excess saving. Macroprudential policies might very effectively filter out some of them (like inward capital flows from reserve-accumulating foreign governments) while leaving other savings perfectly free to scale up investment and boost the economy.

2. ADHD and politics - This (ironically) longish piece from Douglas Rushkoff at Politico Magazine about the speed of communications and political reaction in the Facebook and Twitter age poses some interesting ideas.

Welcome to the world of “present shock,” where everything is happening so fast that it may as well be simultaneous. One big now. The result for institutions—especially political ones—has been profound. This transformation has dramatically degraded the ability of political operatives to set long-term plans. Thrown off course, they’re now often left simply to react to the incoming barrage of events as they unfold.

Gone, suddenly, is the quaint notion of “controlling the narrative”—the flood of information is often far too unruly. There’s no time for context, only for crisis management.

3. China's dangerous credit addiction - The FT has written a good editorial on the near doubling of China's debt (almost all internal) to 215% of GDP in five years to 2012 and the need for market-led reforms of China's credit system. It rightly calls for a tightening of monetary policy to rein in the leverage.

Rates are significantly higher today than they were in the first half of 2013. But the central bank is discovering just how difficult it is to tighten monetary policy without creating a market panic. Last year, on two separate occasions – one in June, the other in December – a spike in the interbank lending market forced the monetary authorities to inject liquidity in order to ease the crunch.

4. Inside the Chinese printing presses - Former Peoples Bank of China official Joe Zhang has written a useful Op-Ed at FT.com on just how China's credit system works and why higher interest rates are needed.

I participated in the banks’ bargaining, not just in the loan quota-setting sessions that took place at the beginning of each year but also in ad hoc negotiations that unfolded in smoky boardrooms. It was a common scene in the dark and narrow corridors of the People’s Bank: a mayor or a governor from some province would sit patiently, sometimes for hours, waiting for an opportunity to lobby my senior colleagues for a bigger loan ration for banks in his province or city. Even junior officers such as me found ourselves on the receiving end of their entreaties – and freebies.

Instead of lending out 60 or 70 per cent of their deposits, the banks would lend out more than 100 per cent. The extra money came from the central bank’s printing press.

China’s shadow banking sector has helped fuel an alarming run-up in the debt owed by local governments, which have established off balance sheet vehicles to borrow money for development projects. A recent report by China’s National Audit Office estimated that local government debts had reached almost $3tn by June last year, rising 70 per cent from the previous audit conducted at the end of 2010.

7. A Bitcoin ATM? - Here's a useful WSJ video explaining how Bitcoin works in tandem with an ATM. One is planned for Hong Kong.

8. A Sydney property bust? - Robert Gottliebsen at BusinessSpectator is hopeful that an inner city building boom in central Sydney might burst or at least deflate the Sydney property bubble. It seems Chinese-funded apartment developers are about to go on a building spree and that planners may ease the rules. Wish they'd (both developers and planners) do the same in Auckland.

New ingredients are emerging that look set to generate a surplus of apartments in Sydney in two or three years – the first time that has happened for a long time.

The two new ingredients are the emergence of Chinese developers and a looming change of attitude by local councils and planning authorities.

In Sydney and Melbourne not only are the Chinese buying apartments from Australian developers like Harry Triguboff’s Meriton, but Chinese developers are now entering the market. Unlike smaller Australian developers the Chinese do not need to use Australian banks and are using their own banks to fund the developments. Accordingly, funding is now plentiful and the two pillars of supply constraint are crumbling.

In Melbourne there is no developer of the power of Triguboff/Meriton. Most of the new developments have been concentrated around the Docklands and Southbank area where permission has been relatively easy to get. But in other areas of the city the Sydney-style supply constraints exist leading to too many apartments being concentrated in the one geographical area (Southbank/Docklands). This is also changing. And the Chinese developers are entering the Melbourne market with a vengeance, out bidding many locals for key sites. Like Sydney the supply blockages are breaking down.

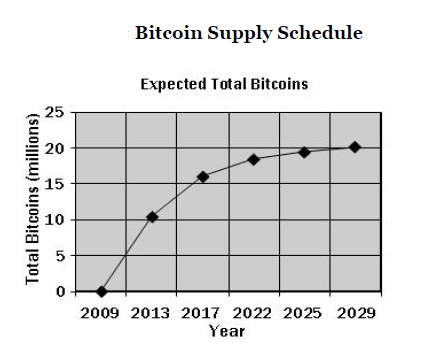

If the virtual currencies develop simply into a better medium of exchange, then the economy as a whole will gain, and less efficient alternatives (Paypal, the banks) may lose out. But the potential economic consequences go further than that. The success of a new global currency, created by the private sector, would clearly undermine the monopoly of governments in monetary creation, which is why it is such an attractive concept to Hayekians and other libertarians.…and a store of value

One early consequence has been that the first “miners” of the new currency have already gained “seigniorage” for creating a valuable asset with very low marginal costs, a process conceptually identical to that which the central bank printing presses have monopolised until now.

China’s largest bank may be forced to repay investors, most of whom were Beijing-based ICBC’s own private banking clients, Guangzhou Daily reported yesterday.A default on the investment product, which comes due Jan. 31, may shake investors’ faith in the implicit guarantees offered by trust companies to lure funds from wealthy people. Assets managed byChina’s 67 trusts soared 60 percent to $1.67 trillion in the 12 months ended September even as policy makers sought to curb money flow outside the formal banking system.

“Nobody wants this default to become a trigger for a financial crisis,” Xue Huiru, a Shanghai-based analyst at SWS Research Co., said of China Credit Trust’s product. “Breaking the implicit guarantee may help the long-term development of China’s financial system, but the short-term pain would be too much for the economy to take.”

15 Comments

#7 on ATMS, the 95% of ATMs in the world running on Windows XP at risk as Microsoft finally stops support XP

http://www.theverge.com/2014/1/20/5326772/windows-xp-powers-95-percent-…

#1 - secular stagnation.

It's at least possible to view this as a sign of cultural stagnation as does Victor Davis Hanson, (a West Coast classicist) in bearish mode.

Which cannot be regulated away, changed by voting differently (or, as has happened, announcing election results the day before the event), or applying yet another economic theory-du-jour.

It has to happen by Acting differently: an altogether more daunting possibility....

If we are part of the 99% of struggler’s, and out there are the 1% with all the wealth, then let us look at some sums.

If the world population is 7 billion, then the 1% with most of the wealth = 70 million people or 1 in 100

If the 1% with the wealth, hired the 99% with no wealth, that is each wealthy person hired 99 people then that would eliminate global unemployment, global poverty and so on.

But what would this cost a wealthy person? especially if they had to pay each person an anual salary of $50,000 US.

Well 99 people at $50,000US each = just under $5 million - why the wealthy would spend that on one painting or the like, they would never miss it.

But it gets even better for them.

Out of the 99% there are babies who cannot work, then there are the school children and the teachers needed to educate them, then there are the sick and the elderly and all the health care workers needed, then we need a military and a police force and justice system and a fire service and a government and on and on.

So the 1% probably only need to hire say 20 people, max, at $50,000 US at a cost of $1 million.

Well we could go on and on but you get the picture - All this financial crisis can be cured along with world poverty and so on - we just need the will to do it.

MikeB, the 1% already do employ the other 99%, we are the entrepreneurs, businessmen, investors and customers that create those businesses that magically make money appear in employees bank accounts each month. We are the customers buying the things that your business sells, we invest/own the companies that you work for. This “attack the 1%" is rather confusing, have you heard the expression “don’t bite the hand that feeds you”.

And good point about economic collapse, buildings and infrastructure. Gives you an idea why so many invest in houses in Auckland.

Hi Happy123,

Thank you for your response to my comment. Unfortunately i cannot make sense of it to make a reasonable reply.

1) You say the 1% already employ the 99%.

1% + 99% = 100% in my arithmetic = full employment

2) You say "we are the entrepreneurs, businessmen, investors..................."

I take it you are refering to yourself as being one of the 1% meaning you are a billionair - well done

3) I did not attack the 1% i just pointed out a little arithmetic.

Thank you

Bitcoin

An article in Wired the other week mentioned a Tech guy in California claiming that the Bitcoin would climb to $100,000 US.

Everyone should get one and put it away, but i think you should read my comment http://www.interest.co.nz/opinion/68069/fridays-top-10-difference-between-houses-and-chickens-banana-lobby-europes-debt-crisis

to understand why it will keep increasing

Bitcoin is thought to be a revolutionary technology by the chap who founded Netscape, ie the web browser. This is a thought provoking piece by someone with enormous credibility - he saw the potential of the internet when Bill Gates did not.

http://dealbook.nytimes.com/2014/01/21/why-bitcoin-matters/?_php=true&_…

A mysterious new technology emerges, seemingly out of nowhere, but actually the result of two decades of intense research and development by nearly anonymous researchers.

Political idealists project visions of liberation and revolution onto it; establishment elites heap contempt and scorn on it.

On the other hand, technologists – nerds – are transfixed by it. They see within it enormous potential and spend their nights and weekends tinkering with it.

Eventually mainstream products, companies and industries emerge to commercialize it; its effects become profound; and later, many people wonder why its powerful promise wasn’t more obvious from the start.

What technology am I talking about? Personal computers in 1975, the Internet in 1993, and – I believe – Bitcoin in 2014.

When an economy crashes it is not the wealth that is destroyed but the artificial wealth that money allowed to be created.

PS We sill have all the buildings and infrastructure. We have no shortage of money because that can be created. As i said it is the Artificial wealth that was created, and now destroyed, so prices fall to their real wealth value. The natural economy, like nature, sorting out the mess that money caused.

Read about early American history and the banks.

Waymad, that's a lighweight bit of propaganda, and you're better than that.

We 've long pointed out here, that money isn't the right measure - indeed, it isn't any measure in reality terms.

We are going to cook the planet, extract all the available resources, polute all we can get away with, and fool ourselves by denial, propaganda, and dumbing-down. We could all be very, very rich - but that won't save us.

It is physical realities that have to be addressed, not the making of the most money. You should be there by now. You ain't as stupid as some.

Well, flattery, as the actress said to the bishop, will get you Places.

But I Am surprised at the 'lightweight' tag applied to core articles from the 'Economist'.

Especially as one of the physical realities being pointed to in said articles is the Inadvertent Outcome, that Germany, bless its green little socks, is now producing more excitable electrons from burning lignite and other coolth-fighting minerals, than has been the case for a quarter of a century.

I'm reasonably sure that's not what Die Grünen actually intended......

So you and I could be said to be on the Same Page: emphasizing the importance of physical quantities and their basis in real-world outcomes, over Hopium....

Ain't as stupid as some = as stupid as some others. Talk about a back handed compliment.

Which of course, keeps a very watchful eye out that it does not morph into corporatism, eh, Hugh?

Doesn't matter how, matters that it does.

Just had a look at that one and something stuck out like the proverbials, here is the comment I left

"are the wealthy rich because they looted everybody else, as was inevitably the case in feudal, pre-commercial societies, or are they prosperous because they profited from serving the needs of others in a competitive market?"

Well you will probably be prosperous by serving the needs of others in a competitive market but to become one of the wealthy rich you have to do a bit more than that. In their own way, they indeed do loot others. How about if one person is born of more cunning and guile than another that he can take advantage of another less so and thus accumulate, then we make it a truly competitive society so that those who are blessed with more brawn are free to accumulate via the means they have to hand.

Don't like that one?

Thought you wouldn't, but do you get it, even just a wee bit now?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.