Here's my Top 10 items from around the Internet over the last week or so at 10 am. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must watch today is #10 because it made me laugh out loud several times. The news coming out of Australia's hot property markets is startling too.

1. Chinese money flooding into Sydney - The drums are beating loudly across the Tasman about the flood of money coming out of China and into Sydney's property market, inflating prices.

Australia bans non-residents from buying existing houses, but non-residents are allowed to buy houses and apartments off the plan, or if they've just been built. And there's plenty of residents with good connections to money from China who are buying existing homes too.

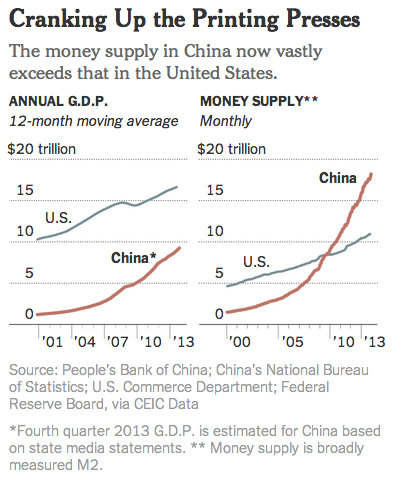

China's money supply has quadrupled in the last six years as state-owned banks and shadow banks there ramped up lending even faster than economic growth. See the chart below. China's money supply is now about 60% bigger than America's, even though China's economy is about 60% of the size of America's. The money is desparate to get out of China in some way and get parked in real asset.

China is awash in cheap money.

Now it's trying to find a home in assets that can't be, ahem, taken back by the Chinese Government.

Families all around the Asia Pacific and Europe are buying property as fast as they can.

Sydney is near the top of the hit parade. Auckland is lower.

Here's the FT with coverage of an A$100 million mansion sale in Sydney.

“Foreign buyers, particularly in China, are buying into Sydney as a secure long-term investment,” says Howard Tanner, a prominent architect who worked with the Fairfax family, the media company founders who own the property, on proposals for renovating it.

Indeed, the near-legendary Chinese and other foreign buyers are credited with fuelling property hotspots across the globe, from London to the Algarve to Miami Beach.

And in Australia too, foreign buyers, together with cheap money and supply constraints, have helped push up house prices, prompting some commentators to warn of an emerging housing bubble in some of the country’s bigger cities.

2. Charlene Chu and China's debt - Former Fitch analyst Charlene Chu has become a rockstar of the economics and debt analysis world with her tireless and fearless analysis of the credit growth going on in China and the risks now apparent there.

She is now watching closely a rapid expansion in foreign currency borrowing by Chinese banks and others inside China. Remember, the main defence of the China bulls until now is that the debt is China is purely internal and therefore no problem. Maybe not for much longer.

Here's more from her in this excellent Telegraph piece:

“Without a doubt, that has been on the rise [foreign currency borrowing] and was really starting to grow fast in the latter half of last year and it’s only going to continue. For the time being, it is only a fraction compared to the massive size of the financial sector, but still we’re talking about a growing amount of funding coming from offshore sources,” she said.

“You look at the exposure numbers from the BIS and the Hong Kong banks . .. you’re going to encounter a few [foreign] institutions that are going to have a sizeable exposure to China.”

George Magnus, senior independent economist at UBS, said the Chinese banking system resembled that of Japan during the 1980s in the years leading up to the country’s financial crash.

“If the dollar were to appreciate it could cause problems for those banks that have borrowed in dollars. Anywhere you have a banking system that uses a non-domestic currency, there is a possibility of a mismatch that could cause issues when the value of your liabilities runs away from you,” said Mr Magnus.

3. Show us the land - Further to the article above about Chinese money flooding into Sydney, here's Florence Chong from Business Spectator on the frenzied bidding going on these days for land and buildings in Australia.

Forget about off-the-plan apartments. What cashed-up overseas Chinese buyers really want is a house in Australia, and more precisely, the land on which the house sits.

For the right house in the right suburb, they are outbidding Australian buyers by $100,000 to $200,000 – and sometimes more – to secure the property. They are importing inflation to their country of choice.

"Many people say, erroneously, that Chinese investors are only buying new-built – I can say categorically that that is not true," says Andrew Taylor, co-founder of juwai.com, a property website visited by 1.5 million potential Chinese investors each month.

"To most Chinese buyers, re-sales (existing properties) are far more appealing," says Taylor.

Taylor estimates that Chinese investors spent $5.3 billion buying Australian residential real estate in 2013 – but this is a mere drop compared to the estimated $38 billion to $50 billion they spent buying houses overseas last year.

"The bulk of our enquiries are for established homes, priced at $600,000 to $1.1 million in Australia – the sort of price range most Australians are also targeting."

4. Beyond the Shadow Banks - Reuters has a useful piece here on China's surprisingly large loan shark sector, which is where the truly desperate go after they've exhausted their credit lines with the shadow banks and the real banks.

At 8 percent of China's $9.4 trillion economy, according to IMF estimates, it is a surprisingly large niche.

As China intensifies its efforts to discipline risky lenders and calm exuberant credit growth, financial stress is building in the country and underground debt is becoming one of the biggest banking risks.

Analysts say the underground market is most vulnerable to worrying spikes in unpaid loans, especially since its borrowers are often small-time exporters hardest hit when the economystutters.

"You may see a high frequency of defaults," said Qiang Liao, an analyst at Standard & Poor's in Beijing. "The borrowers are more vulnerable to an adverse economic environment."

The risk is that a major default of an underground loan could trigger a domino effect threatening the wider financial system.

5. TPP in trouble - This hasn't gotten much coverage here, but late last week Democratic Senator Harry Reid essentially killed off Barack Obama's (and John Key's) hopes of getting a Trans Pacific Partnership trade deal done anytime this year.

Edward Luce at FT.com has the story.

If Mr Reid does not want TPA to pass, it will go nowhere. That would badly undermine Mr Obama’s most important two global initiatives that do not involve the Middle East.

In particular, the Trans-Pacific Partnership is the cornerstone of Mr Obama’s rebalancing to Asia. Although China is not part of TPP, the US aims to set up a new set of trade, investment and intellectual property protections that will bind its future behaviour. If Mr Obama cannot persuade his own party in Congress to support the talks, then China’s neighbours will take their cue. They are already riddled with doubts about Washington’s readiness to take on its own vested interests – textiles and sugar among them.

6. America's eroding middle class - The New York Times has an excellent piece here on one of America's biggest problems. The strong and income-rich middle class that powered its growth through the 50s, 60s and 70s has withered in the last two decades for all sorts of reasons, including the gutting of high paid manufacturing jobs by globalisation and new technology, and the rising share of income going to capital in the form of profit.

This is a problem for these same profitable companies because the middle class was the main buyer of their products. Up until 2008 the middle class just borrowed to keep spending at their previous rate. That has ended.

So what now? Companies are focusing their marketing efforts on the top 20% in the hope the trickle down will be enough.

If there is any doubt, the speed at which companies are adapting to the new consumer landscape serves as very convincing evidence. Within top consulting firms and among Wall Street analysts, the shift is being described with a frankness more often associated with left-wing academics than business experts.

“Those consumers who have capital like real estate and stocks and are in the top 20 percent are feeling pretty good,” said John G. Maxwell, head of the global retail and consumer practice at PricewaterhouseCoopers.

In response to the upward shift in spending, PricewaterhouseCoopers clients like big stores and restaurants are chasing richer customers with a wider offering of high-end goods and services, or focusing on rock-bottom prices to attract the expanding ranks of penny-pinching consumers.

This factoid is startling.

The current recovery has been driven almost entirely by the upper crust, according to Mr. Fazzari and Mr. Cynamon. Since 2009, the year the recession ended, inflation-adjusted spending by this top echelon has risen 17 percent, compared with just 1 percent among the bottom 95 percent.

Public servant Tina Ford said she could hardly believe it when her three-bedroom Chatswood apartment sold this month for $1 million at an auction in which all 16 registered bidders were ethnic Chinese.

“I’m over the moon, I’m gobsmacked,” said Ford, 53, adding that she “would have been ecstatic with $940,000” and didn’t expect to double what she had paid 14 years ago for her third-floor unit with a balcony 11km from Sydney’s CBD. “I suspect that overseas investment, Chinese or otherwise, is certainly pushing prices up, but from a vendor’s perspective, I’m ecstatic.”

Such buying by locally resident Chinese and those from mainland China is inflating housing bubbles in and around Sydney, where prices in some suburbs have surged as much as 27 per cent in the past year. That’s almost three times faster than the overall market.

Many of the neighbourhoods with the biggest price gains “are areas that are popular with Chinese buyers,” said Andrew Wilson, senior economist at real estate data firm Australian Property Monitors. “Some of these suburbs are seeing price growth that we haven’t seen in Sydney since the early 2000s.”

8. So just how powerful and competent is China's military? - The Diplomat says not very, but that makes it more dangerous.

It is precisely China’s military weakness that makes it so dangerous. Take the PLA’s lack of combat experience, for example. A few minor border scraps aside, the PLA hasn’t seen real combat since the Korean War. This appears to be a major factor leading it to act so brazenly in the East and South China Seas. Indeed, China’s navy now appears to be itching for a fight anywhere it can find one.

Experienced combat veterans almost never act this way. Indeed, history shows that military commanders that have gone to war are significantly less hawkish than their inexperienced counterparts. Lacking the somber wisdom that comes from combat experience, today’s PLA is all hawk and no dove.

9. The birth lottery - There's been a lot of talk and research into income inequality in America in recent years, but now there's some research out on inter-generational mobility.

How easy (or hard) is it for someone who is born poor to become rich? Harvard Professor Carl Sunstein writes at Bloomberg that the research shows mobility has been stable for about 50 years with around 8-9% of those born into the bottom fifth being able to rise up through the ranks to the top fifth.

He explains why rising inequality combined with static mobility is a bad thing.

Chetty, Saez, and their co-authors also emphasize that over the last four decades, the U.S. has seen a significant increase in income inequality as well. This increase has important implications for intergenerational mobility.

As the rungs of the economic ladder move further apart, a stable level of mobility becomes a more serious problem, because it matters a lot more whether your parents are rich or poor. The “birth lottery,” as the authors call it, ends up having bigger consequences.

It’s one thing if children have an 8 percent chance to get into the top 20 percent, when the top 20 percent isn’t so far ahead of the rest of the pack. It’s quite different if children have that same 8 percent chance, but the top 20 percent is way ahead of the rest. In the latter case, a child’s ultimate prospects depend far more on the wealth of his or her parents. To put it another way, it is much worse for a child to have only a small chance to escape the bottom if the bottom is very low and the top is very high.

22 Comments

The ranks of those who still don't believe that China's credit system will eventually implode must surely be dwindling by the day.

#1 excess credit from country A being exported to Country B results in increases in property prices? I thought it was all the local council's fault.

PeakEverything, your asking the wrong question, what you should be asking yourself is where will they buy when the set their sights on Auckland? With no restrictions on buying existing houses… If Auckland follows Sydney and the market is going to go up 25%+ a year regardless you might as well join the party…

and when the credit gets chopped in A the market goes pop in B

No thanks that's one party I'll try and avoid...

regards

Not following your logic:

First... Chinese pour money into the Auckland market as a safe haven from the Chinese tax man

then... Credit growth gets constrained in China

How does that then effect the Auckland market? The houses are already bought... it might effect further price rises but don't see why the same Chinese would start selling and hence force prices lower. To the contrary, the more problems you see in China the more money is likely to flow out of there and into here.

Surprising loan sharks?

I would suggest any system that marries a centrally controlled economy to a cronyism form of government must naturally pay the price of a large 'loan shark' overhead, shadow or otherwise.

I'll play, why is the factoid in #6 "startling"? From 2009 to 2012 the top 1% incomes grew 31.4% while the bottom 99% grew 0.4% (and most of the lower 70% was negative income growth). You would expect that to be reflected in sales figures.

Not one, not one single one, of these articles is about New Zealand. Neither does Bernard make the slightest attempt to comment on what relevance they might have for New Zealand, or how far the same trends are or are not apparent here.

Could'nt agree more. You've got my vote.

... maybe because NZ has a " rock-and-roll " economy .... nothing wrong here , nothing to see .... all goody good .... ahem !

You're describing the difference between Repeating and Reporting....

#6

Corporates are just waiting for the middle classes in China to replace the American middle class. They could'nt care less who they make profits from.

Great Top 10 Bernard!

The Chinese debt saga is intriguing as they borrow from the "shadow" banking sector and buy up overseas property including NZ and the impact it has on our inflated property.

#6. I wouldn't be surprised if our own stats mirrored the American middle classes reliance on debt to fund their lifestyles. dh - your stats above say it all.

Ms de Meanour - I believe you have a point in terms of relevance; however, I would be intrigued as to whether such data exists in NZ since the current government does it's utmost best to cut funding to Statistics NZ.

There is a lot of data that exists alright, it's just not made available. It's suppressed. The populace is kept in the dark.

One example would be

Statistics NZ publishes Quarterly GDP numbers that are questionable at best

A simple sensitivity test of GDP and business activity in new zealand would be quarterly publication of the amount of GST collected by the IRD. Not hard. But they dont. Treasury gets it for sure.

Yet, the very same IRD will collect data on US cistizens and US Corporates located in new zealand and pass it on to the IRS

Freedom of information request....

there are some early summaries out from the 2013 census. Not a huge amount of detail yet, but:

In the 2006 census the median income was $24400. If it had kept pace with inflation (CPI), it would be at about $29500 (depending on time of year of the census). The actual 2013 figure is $28500, which suggests that, like the U.S., the majority of people are the same or slightly worse off in real terms than 2006.

Re No. 1 - the Chinese (and others) might be setting themselves up for a fall (and just Australia?)

US demographer predicts hit to Aussie home prices

And even Bill Gross can't work China out:

http://www.bloomberg.com/news/2014-02-04/gross-says-risk-assets-vulnera…

worse

China's economy grew 7.7 percent in 2013, the same rate as in 2012. Expansion is forecast to be 7.4 percent this year, the weakest pace since 1990

Just rhink, 7.4% will be the lowest growth rate in 23 years

If you understand the video on the exponential function that scarfie has posted here a couple of times you will understand that China's economy more than doubled in the 7 years to 1997, then more than doubled again in the 7 years to 2004, then again in the following 7 years to 2011

http://www.youtube.com/watch?v=F-QA2rkpBSY

Now look at the growth rate of China over the last 5 years

world bank growth rates - its worse than that

http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG

It's either imaginary pixie dust or it is going to come down with a thump one day

The correct link for no. 5. http://www.ft.com/intl/cms/s/0/4f1ed8ca-89e9-11e3-abc4-00144feab7de.html?siteedition=intl

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.