Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must-read today is #5 on China's 'kleptocracy'. An eye-opening read from Minxin Pei. #8 on 'hedge cities' is a cracker too.

1. Chart du jour - Congratulations to the crew at NZIER for putting together this fantastic heatmap of house prices throughout New Zealand since 2007 in its quarterly predictions release. See below.

It makes interesting reading for someone who rashly made predictions about house prices falling 30% in 2008 before the Goverment and Reserve Bank chose to intervene to support our banks.

The rebound in prices in Canterbury and Auckland since 2011 has been extraordinary.

But the contrast with the rest of the country couldn't be clearer in this map.

It's a cold blue sea of 0-30% falls in house prices outside of the hot red spots in Canterbury and Auckland.

I don't get quite so many 'told you so's' when I travel outside of Auckland.

It all reinforces the vulnerability of the Government to a campaign from Winston and others to say to people outside of Auckland (in particular) that they are paying the price through higher interest rates and LVR limits for the migration and supply-fed house price inflation in Auckland.

Peruse away and thanks again to NZIER:

2. A housing market with bits tacked on - This chart, also from the NZIER, also makes clear just how dependent the New Zealand economy appears to be on the appearance of household wealth created by surges in house prices and house sales. The correlation between house sales and GDP is mighty closely. You could debate chickens and eggs, but the correlation is clear.

3. Piketty's data errors - The FT caused a bit of a counter-sensation over the weekend with its accusation that Thomas Piketty made errors with his inequality data and appears to have been cherry picking.

That's a serious charge.

Here's a few looks at the issue, firstly from Slate, and then from Vox.

It seems Piketty may be most wrong about Britain.

For the US, Giles raises an objection to how Piketty deals with a data lapse between 1870 and 1910, but doesn't really say Piketty's data points are mistaken. Piketty's own response here seems a little half-baked and it will be interesting to see what he comes up with when he has more time. For the moment, the FT's strongest claims don't seem all that clearly supported by their analysis. But the disagreement about UK trends is large and interesting.

4. Further to Piketty - This AP report looks at how pay for the average CEO in the S&P 500 rose 9% last year, while pay rose 1.3% for US workers overall. It gives 5 reasons why the gap is widening.

That CEO now earns 257 times the national average, up from a multiple of 181 in 2009, according to an analysis by The Associated Press and Equilar.

Those figures help reveal a widening gap between the ultra-wealthy and ordinary workers around the world. That gap has fed concerns about economic security — everywhere from large cities where rents are high to small towns where jobs are scarce.

5. A post-1989 Kleptocracy - Minxin Pei writes very aggressively in the FT about the kleptocracy that has developed in China over the last 20 years or so and how it undermines the legitimacy of the leadership.

Organisationally, members of this kleptocracy have privatised the power of the party-state, forming patronage networks based on personal loyalty and exchange of favours. Again, according to accounts in the media, such networks now permeate the Chinese political system and the country’s economy. In the economic realm, powerful politicians, their family members and business cronies – known as “families” – dominate lucrative sectors such as property, energy, telecommunications and natural resources.

State-owned enterprises have degenerated into conduits through which assets nominally owned by the Chinese people can be cheaply, if not freely, acquired by such families.

This post-1989 kleptocracy has harmed the Chinese people. But the CCP has suffered from its depredations as well. Privatisation of state power and usurpation of the party’s authority by patronage networks have gravely undermined its organisational integrity. Its elites have become so thoroughly cynical and self-serving that they are only motivated by private gain, not the party’s corporate interests or long-term wellbeing.

6. Another way to look at inequality trends - The dominant narrative around inequality is that the rich in the developed and developing world are getting much richer while the middle to lower classes are getting poorer.

But that's not true when you look at it in a global sense. The poor in many parts of the emerging world are getting richer. This chart below showing real income growth by global percentile is a clever way to look at it. It shows the middle classes in developed economies are struggling, but they're only a smallish part of the global story (although not much fun if you're one of them...)

7. Price to income multiples - Robert Peston writes here at the BBC about the Bank of England's growing mood to increase capital requirements for banks lending mortgages wth high multiples to incomes. It's another version of NZ's own high LVR speed limit.

It's amazing this is happening while the British Government is still offering 'help-to-buy' subsidies to home buyers in Britain in the hope asset price inflation will boost the economy. Sigh.

Here's Peston. The average house price to income multiple in London is now 11...

The Bank of England has some ability to take some of the heat out of the market, even without putting up interest rates - in that it now has a Financial Policy Committee, that sits alongside the Monetary Policy Committee, which has the power to rein in banks when they are perceived to be lending in a way that could be dangerous and destabilising.

So at next month's FPC meeting, it would not be a great surprise if the FPC announced that it would make it more expensive for banks to provide loans that are a relatively high multiple of earnings, by increasing the capital charge for such mortgages.That would mean banks would have to hold more capital relative to such loans, and that would be costly for them, so such loans would become scarcer and pricier for customers.

8. Hedge cities - James Suroweicki writes at the New Yorker about the heavy capital flows going out of developing markets such as Asia and the Middle East and into developed country property markets.

Our Government may be in denial that it's happening. The rest of the world is not. Vancouver is one of these 'super-star' or hedge cities. Will Auckland become one? Or has it already happened?

When price-to-income or price-to-rent ratios get out of whack, it’s often a sign of a housing bubble. But the story in Vancouver is more interesting. Almost by chance, the city has found itself at the heart of one of the biggest trends of the past two decades—the rise of a truly global market in real estate.

We’re all familiar with the stories of Russian oligarchs buying up mansions in London, but this is a much broader phenomenon. A torrent of capital from wealthy people in emerging markets—from China, above all, but also from Latin America, Russia, and the Middle East—has flowed into the real-estate markets of big cities in other countries, driving up prices and causing a luxury-construction boom. A recent report by Sotheby’s International Realty Canada examined more than twelve hundred luxury-home sales in Vancouver in the first half of 2013 and found that foreign buyers accounted for nearly half of sales.

Vancouver’s appeal consists of comfort and security, making it what Andy Yan calls a “hedge city.” “What hedge cities offer is social and political stability, and, in the case of Vancouver, it also offers long-term protection against climate change,” he said. “There are now rich people around the world who are looking for places where they can park some of their cash and feel safe about it.” A recent paper by two Oxford economists bears this out, showing a tight correlation between London house prices and turmoil in southern and Eastern Europe. The real-estate boom in Miami has been magnified by political unrest in Venezuela. And Vancouver, which has a large Chinese population, easy access to the Pacific Rim, and nice weather, has become a magnet for Chinese investors looking for insurance against uncertainty. A Conference Board of Canada report found that Vancouver’s real-estate market is tightly connected to what happens in the Chinese economy.

9. Where is the growth coming from? - This Australian Treasury chart (courtesy of Business Spectator) seemed to have galvanised Tony Abbott's cabinet to really hammer Australia's budget.

It shows that the only way Australia can keep its growth rate up is to somehow engineer major growth in productivity. The forecast bar is the interesting bit.

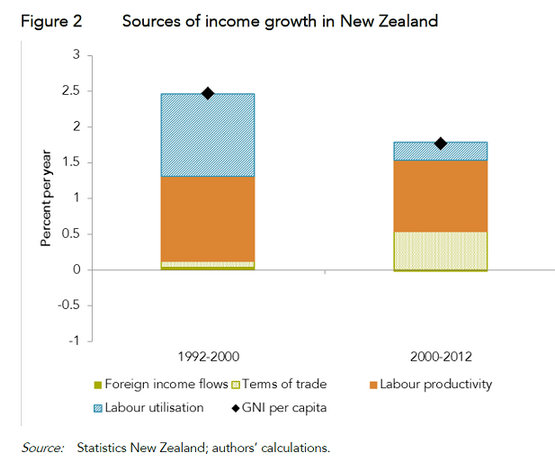

And here's the New Zealand version, albeit without the forecast, via the Productivity Commission. HT The Treasury.

5 Comments

Figure 2 - I haven't done or seen the analysis but it doesn't quite look right to me - I expected to see more red.

Bernard, So does Fig 2 actually mean there are lots and lots of people with -ve equity out there??

Ad.2. Interesting chart is house price vs. migration:

http://www.treasury.govt.nz/publications/research-policy/wp/2014/14-10/twp14-10.pdf

page 31. by NZ Treasury

re No 8 Vancouver. There is a disconnect between house price and income because there are people with the funds who can purchase regardless. Overseas buyers with cash can outbid locals.

The interesting thing is that the Right 1% generally rubbish global warming whilst privately they are positioning themselves to make money out of it. Beware you aren't sucked in whilst being shafted.

Saving the Aussi economy by productivity boom (because they're obviously slacking on productivity normally)... doesn't that kinda require custoemrs who will purchase the goods and services produced...WITHOUT depressing your own market ... O_o

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.