Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must-read today is the speech at #3 from Mark Carney social contracts, banking and the need for change.

1, China's muscle flexing - The clashes between China and Vietnam and China and the Philippines in recent weeks hasn't got much attention here in New Zealand.

But in Asia everyone is watching a tad nervously.

China appears to be pushing the boundaries on oil and gas exploration and claiming various godforsaken rocks in the sea as Chinese territory.

America's apparently weakness and uncertainty over its 'pivot' to Asia is feeding into the tension.

New Zealand, of course, needs to be watching closely. So far we've managed to avoid having to take sides, unlike the Australians who have come over all hairy chested when supporting Japan late last year in its stoush with China.

The ugliness in the waters between Vietnam and China is not a good sign.

Here's Rory Medcalf at The National Interest with his analysis of China's muscle flexing and a recent diplomatic stoush at a conference last week:

Chinese diplomacy seems comfortable only on a stage it manages. This reading is borne out by the extraordinary outburst of China’s senior representative at the 2014 Shangri-La Dialogue, an inclusive and structured regional forum run by a UK-based think tank, in Singapore. On June 1, General Wang Guanzhong publicly accused U.S. Defense Secretary Chuck Hagel of using his address to the same gathering for issuing ‘threats’, ‘intimidation’ and ‘provocation’.

He attacked an earlier speech by Japanese Prime Minister Abe in similar terms. Abe had, in fact, barely mentioned China by name, although his carefully worded remarks made clear Japan’s newfound willingness to help other countries build capacity and coalitions to protect their and Japan’s interests in opposing coercion and maintaining freedom of navigation. Apparently, for this transgression, General Wang went so far as to describe Abe’s address as ‘unacceptable’ and ‘unimaginable’—as if a foreign prime minister’s words are for a military man to circumscribe.

2. 'It's the middle class stupid' - Edward Luce at the FT makes the good point that when more of the fruits of economic growth go to the very top very little of that income recirculates as spending on goods and services.

When most of the gains of growth go to a small slice of high earners at the top, little of it is spent. Aggregate growth is perennially vulnerable. There is nothing mystical about the forces at work. Take the US housing recovery, which has once again stalled in the past few months (a negative trend that both predates and postdates the terrible winter).

During the first four months of this year, the sales of the 1 per cent most expensive US homes – those worth $1.67m or more – have increased by 21 per cent, according to Redfin, the real estate group. It followed a gain of 35 per cent in 2013 – led by the gilded San Francisco Bay area, where the priciest homes start at $5.35m.

Sales of the bottom 99 per cent of homes in the US, meantime, have fallen by 7.6 per cent so far this year. Here, in a nutshell, you have the US economy. The total value of home sales has risen. But most people are not seeing it.

The same is true of other forms of consumption. The high end is booming. And so are parts of the bottom end. Most things in between are struggling.

3. Telling it like it is - The Bank of England's new Governor Mark Carney gave an extraordinary speech last week in London that must have struck the dinner-suited bankers it was directed at as truly radical. I'd recommend you read it in full. The speech is also available in video form below...for fun.

Here's a sample of his speech to an inclusive capitalism conference:

This gathering and similar ones in recent years have been prompted by a sense that this basic social contract is breaking down. That unease is backed up by hard data. At a global level, there has been convergence of opportunities and outcomes, but this is only because the gap between advanced and emerging economies has narrowed.

Within societies, virtually without exception, inequality of outcomes both within and across generations has demonstrably increased. The big drivers of globalisation and technology are magnifying market distributions.

Moreover, returns in a globalised world are amplifying the rewards of the superstar and, though few of them would be inclined to admit it, the lucky. Now is the time to be famous or fortunate. There is also disturbing evidence that equality of opportunity has fallen, with the potential to reinforce cultural and economic divides. For example, social mobility has declined in the US undercutting the sense of fairness at the heart of American society.

4. 'An astonishing record of complete failure' - Tim Harford writes at the FT about a new study of economic forecasts that found they were all hopeless in 2008. None forecast a recession in 2009.

Economists – as reflected in the averages published in a report called Consensus Forecasts – had not called a single one of these recessions by April 2008.

This is extraordinary. Bear in mind that this is not the famous complaint from the Queen that nobody saw the financial crisis coming. The crisis was firmly established when these forecasts were made. The Financial Times had been writing exhaustively about the “credit crunch” since the previous summer. Northern Rock had been nationalised in the UK and Bear Stearns had collapsed in the US. It did not take a genius to see that trouble was on the way for the wider economy.

This is extraordinary. Bear in mind that this is not the famous complaint from the Queen that nobody saw the financial crisis coming. The crisis was firmly established when these forecasts were made. The Financial Times had been writing exhaustively about the “credit crunch” since the previous summer. Northern Rock had been nationalised in the UK and Bear Stearns had collapsed in the US. It did not take a genius to see that trouble was on the way for the wider economy.

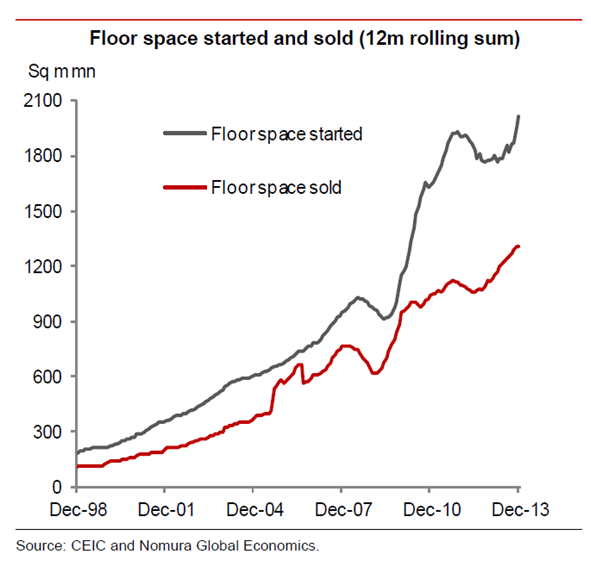

5. If only we had this problem - Former Goldman Sachs economist Gavyn Davies writes in this FT blog about the problems growing within China's property market. The chart below is a cracker.

Until 2011, construction struggled to keep pace with the demand for new housing caused by China’s rapid urbanisation. House prices rose rapidly, providing households with the best performing asset available to them. This encouraged speculative purchases, increasingly financed by the shadow banking sector. China’s infamous ghost cities were the result. Goldman Sachs estimates that there is now significant over-supply of housing in 30 of the largest 200 cities in China.

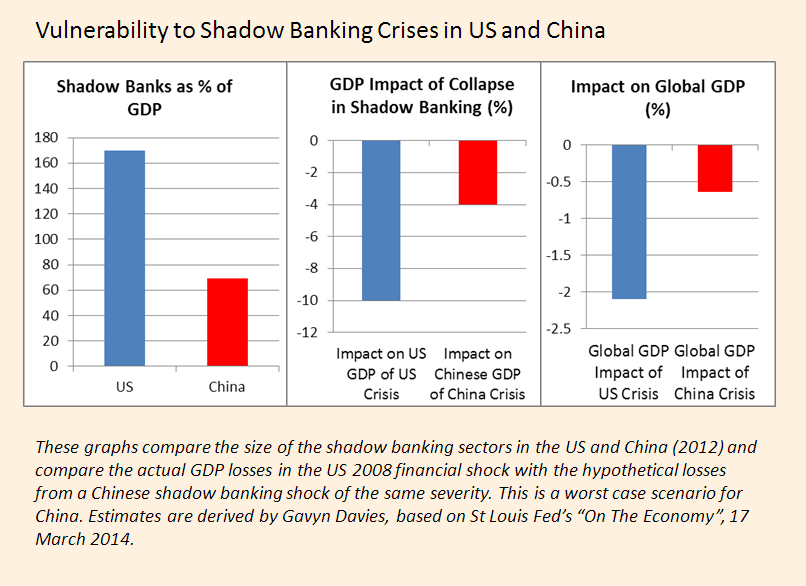

6. It's not so bad - Gavyn Davies then looks at research into how much of an impact a collapse of China's shadow banking system would have.

It turns out it wouldn't be as bad as the collapse of America's sub-prime market.

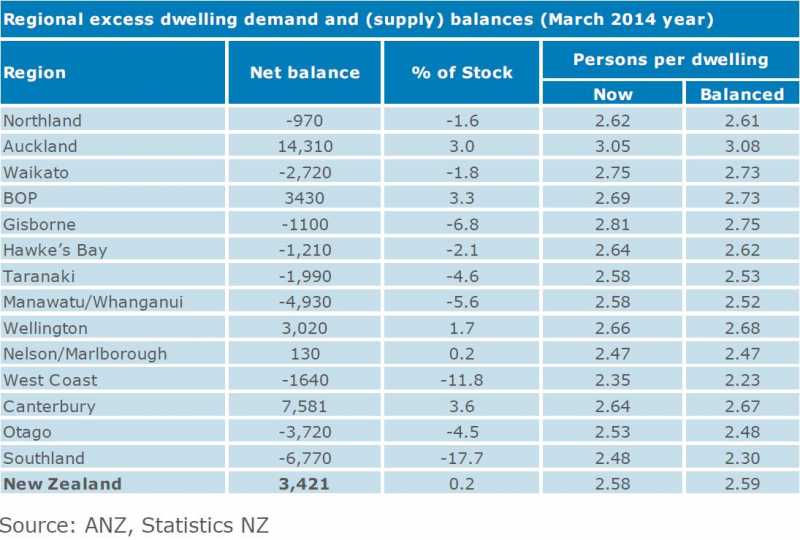

7. Mass house transportation the solution? - ANZ has put together a useful housing supply and demand table across the various regions.

It suggests we should lifting a bunch of homes off their foundations in places like Huntly, Gisborne, Whangarei and Invercargill and transporting them to Auckland and Christchurch.

I'm kidding. Sort of.

8. Does not compute - It turns out US companies earn US$51 billion in the Cayman Islands, even though the nation has GDP of about US$3 billion....

The IRS may be investigating...

9. Homes for 'self-use' - That's the term the biggest Chinese developer uses now to describe houses bought by owner-occupiers, rather than buy and hold (empty) investors.

The “golden era” for China’s property market has passed, according to China Vanke Co. (000002), the nation’s biggest developer, which is shifting its focus to homes for owner occupiers rather than investors.

“The period in which everybody makes money out of property is gone,” President Yu Liang told reporters May 26 in Dongguan, a southern city in Guangdong province. “Vanke will take a cautiously optimistic approach to face the slowdown and target those buyers who need homes for self-use.”

10. Totally Clarke and Dawe on selling the Australian Budget.

9 Comments

I see China is trying to secure more 'black gold'. It all comes down to energy in the end.

Indeed it does.

"Thanks in large part to Germany’s decision to phase out nuclear power and push into green energy, companies there now pay some of the highest prices in the world for power. On average, German industrial companies with large power appetites paid about 0.15 euros ($0.21) per kilowatt hour (kWh) of electricity last year, according to Eurostat, the European Union's statistics agency.

In the United States, electricity prices are falling thanks to natural gas derived from fracking - the hydraulic fracturing of rock. Louisiana now boasts industrial electricity prices of just $0.055 per kWh, according to U.S. Energy Information Administration data."

"This facility can export product around the world to the backyard of our competitors and still the product would be cheaper, even with shipping,"

http://www.reuters.com/article/2014/06/02/us-usa-germany-power-specialr…

Your claim that US electricity prices are falling is pure nonsense and can easily be refuted by simply referring to the EIA:

http://www.eia.gov/forecasts/steo/report/electricity.cfm

Please study the 3rd graph down the page entitled 'US Redsidential Electricity Prices' and come back and tell us again how US electricity prices are falling as a result of fracking.....

As for commercial prices - these have jumped steeply in the past 12 months:

''Year-over-year increases in commercial sector electricity prices were highest in the Middle Atlantic (11%) and Pacific (8%) regions, while industrial prices increased the most in Middle Atlantic (19%) and South Atlantic (9%) regions''.

Consensus Forecasts

It is quite possible the problem is how these so called consensus forecasts are constructed rather than the accusation "no one" saw it coming. Perhaps those who saw it coming were marginalised from the process.

Now is the time to be famous or fortunate.

Yet fame is a curse and luck favours the brave.

#7 - Transportable - Excellent idea!

#6 - And how do you measure the perception people have which leads to their behaviour? I don't actually believe graphs like those - no one really knows the impact and the sooner we stop pretending we do the more fun we will all have!!

Russia-Japan Gas pipeline proposal.

http://www.globalresearch.ca/is-a-russia-japan-natural-gas-pipeline-nex…

What is worrying is what China tends to do when it runs out of a resource.

No "god forsaken rocks".... no-one to take fake paper IOU's...

the people of China have rights to live, take resource from neighbours. Reduction in population from the project has always historically been seen as a public good. (only slowed by the one child policy).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.