Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must-watch today is #10 from John Oliver on FIFA. An epic and righteous rant. The best kind. ;)

1. An ethics free zone - London's financial markets are an extraordinary place.

I worked as a financial reporter in London for five years and dealt with all sorts of bankers, executives, PR people and analysts. There was a strangely feverish and disconnected feel to the place.

The amounts of money flying around and the intense focus on the bonus for the year never failed to shock me. City bankers worked insane hours and appeared completely disinterested in the real world of workers and products and services and welfare.

Everything was always, always about the deal and money. It was never about the good any business was doing for people in particular or general.

I left in 2003 before the worst of the excesses, but I'm not surprised about what we're finding out now about the culture of London's banking scene.

Here's the Financial Times' John Plender with a timely look at how the crisis showed London's moral capital was in decline. Ditto, of course, for New York.

And still the revelations come. Leading banks pay yet more record fines for egregious behaviour ranging from sanctions-busting to facilitating tax evasion. Their involvement in rigging markets now extends beyond Libor, the rate at which banks lend to each other, to foreign exchange and the gold market. It appears to be a pervasive rather than occasional phenomenon. Even when they have been shopped, they do not give up. UK banks, we discover, have been underpaying compensation for mis-sold payment protection insurance.

All this corporate wrongdoing is combined with immense personal enrichment and a paucity of prosecutions of people at the top. How are we to make sense of this bizarre concatenation of events, in which the financial system appears to have become an ethics-free zone?

2. Companies not people? - One of the stunning trends in the last two or three years is that authorities have agreed not to prosecute the people involved in all the dodgy behaviour and to instead levy big fines on the companies rather than the people. No one goes to prison. The bonuses earned in the mad years are retained. The only losers are the pension fund savers who put their money into these banks.

It's as if a moral vacuum has taken hold.

In the corporate sector, and especially in banking, there has been an adverse step change in ethical values. One reason is the ineptly named “shareholder value revolution”, whereby a paternalistic corporate capitalism was replaced by a capital market pressure cooker in which senior executives were required to deliver progressive rises in short-term earnings. A second change was the move to performance-related pay and incentives tied to equity values.

In banking this bred a more transactional culture in which profits and personal rewards came increasingly from gaming the system. The globalisation of capital flows in the absence of an international regulator provided banks with ample opportunity for regulatory arbitrage, whereby questionable business could always be diverted to weaker jurisdictions.

3. A painful debate - Vancouver is having a very similar debate about migration and house prices as the one going on in Auckland at the moment.

It's all very reminiscent. Many would prefer the debate not happen. The R and X words get thrown into the debate very early.

Here's the Vancouver Observer:

“The fact these millionaires (buying real estate in Vancouver) are mainly Chinese is not relevant to the debate, and that is why I am a bit distressed that this is being characterized as a racist discussion,” says Ian Young, the Vancouver correspondent for the South China Morning Post.

Stating his opinion in The Vancouver Sun last week, former real estate developer Bob Ransford says any talk of who is buying what, where they are from and whether or not anyone is living in these homes is “innuendo” and “arm chair estimates”. Ransford says talk of restrictions on foreign ownership “begin to tread very close to past policies for which we are today apologizing. The head tax on Chinese immigrants is one that comes to mind.” Ransford says what’s really needed is reliable data.

But Young disagrees. He says that the fact that the issue is sensitive doesn't mean it shouldn't be openly debated. “It’s a very sensitive discussion, and for that reason I am perturbed that this discussion has been appropriated by people who profit from the industry. I think it’s ridiculous. Of all the people to leap to the defence of the huddled masses of Chinese millionaires, surprise, surprise: it’s rich property developers.”

4. Buying in San Francisco - Mingtiandi reports on strong demand for apartments in San Francisco from buyers from China.

“I think we’re seeing three different phenomena,” he said in the television interview. “One is asset diversification, people trying to move money out of China. Two would be education for their families. And three would be lifestyle, this is a beautiful place to live.”

In general, both wealthy Chinese individuals and corporate interests have so far shown a preference thus far for buying property in “gateway cities,” whether in the US or other foreign countries. Echoing the experience of developers in Vancouver and Sydney, San Francisco property sellers are finding that a big backyard may not be a major attraction for Chinese buyers.

To McLaughlin, Chinese buyers are looking for high-rise homes similar to what they know back home. “What Pacific Union is seeing is the condo is very attractive because it’s low maintenance,” he remarked. “There’s no yard to clean.” And for California property owners, demand from Chinese buyers means that many of them may have an opportunity to make a tidy profit.

5. A productivity puzzle - Martin Wolf writes at FT.com about the strange experience of Mexico over the last 20 years or so. Its trade with America has boomed because of NAFTA, but its productivity and per-capital income growth has been very weak.

For those who believe that opening up to trade is a guarantee of rapid growth, this is a sobering tale: the ratio of trade to GDP jumped from 39 per cent in 1990 to 65 per cent in 2011. Exports to the US rose sixfold under Nafta. Yet the economy underperformed.

Mexico suffers from a “productivity puzzle”. The contrast with other emerging economies is remarkable. McKinsey’s explanation is that, while productivity rose at a compound rate of 5.8 per cent a year between 1999 and 2009 in companies employing more than 500 people, it rose at just 1 per cent a year in companies employing between 10 and 500 people, and fell at a rate of 6.5 per cent in companies employing fewer than 10. The share of the latter in employment also rose in the same period from 39 per cent to 42 per cent, while the share of big companies stayed at 20 per cent and those in between fell from 41 per cent to 38 per cent

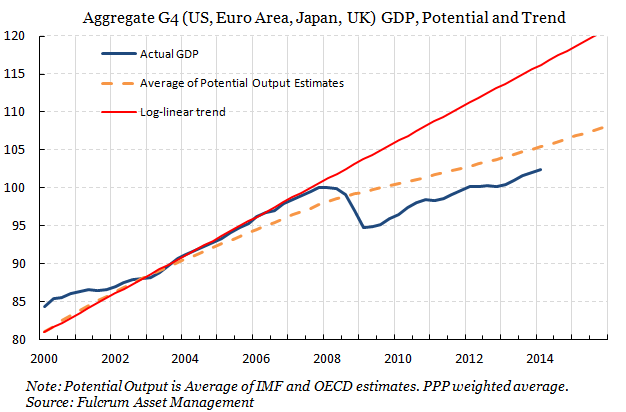

6. Down 12% - Gavyn Davies writes in his FT blog about the enormous loss in output that has happened over the last 6 years around the developed world as their economies have failed to return to their trend growth rates. He, like many, is puzzled as to why the growth seems to have slowed so dramatically and, it appears, permanently, as the loss of output seems also to have damaged the potential output of the economies involved.

If the damage is permanent, the implications are profound, not least for asset prices. Try telling that to the bond, stock and property markets though...

The chart below is a cracker. Here's Davies:

While several economies have now returned to their previous peak levels of output, very few have approached the previous long term trendlines which had been established for decades before that. For the developed economies as a whole, output remains about 12 per cent below these trendlines.

Because this level of output has never actually been attained in the real world, there is little sense of tangible loss about this, notably in the political sphere. Nevertheless, the opportunity cost could still be enormous.

The case for believing that the trendlines can indeed be re-attained is that this has always happened after recessions in the past, at least in the US, though it has sometimes taken many years, especially in the wake of financial crashes. The optimists say that none of the growth fundamentals in the system – the state of technological knowledge, the available labour force, and the amount of fixed investment that is profitable to deploy – has been permanently destroyed by the Great Recession. Therefore, they say, it is incumbent upon policy makers to try to re-attain the trendlines, rather than simply accepting the loss. Many central bankers, especially in the US and the UK, strongly believe this.

A more pessimistic view is that the Great Recession has resulted in a permanent (or at least very long lasting) loss of economic capacity, in which case it would be inflationary to attempt to re-attain previous trendlines. On this view, the global economy has now locked on to a different path, with its effective capacity being much lower than previous trends might imply. The latest estimates of capacity published by the IMF and OECD, who should be able to do this sort of work better than most, clearly imply this.

7. 'Just abolish paper money' - Kenneth Rogoff suggests getting rid of paper money in this FT Op-ed, or at least phasing out large denomination notes.

Has the time come to consider phasing out anonymous paper currency, starting with large-denomination notes? Getting rid of physical currency and replacing it with electronic money would kill two birds with one stone.

First, it would eliminate the zero bound on policy interest rates that has handcuffed central banks since the financial crisis. At present, if central banks try setting rates too far below zero, people will start bailing out into cash.

Second, phasing out currency would address the concern that a significant fraction, particularly of large-denomination notes, appears to be used to facilitate tax evasion and illegal activity.

8. 'Machines don't need pay rises' - Alan Kohler at Australia's Business Spectator has written a interesting piece casting the problem of low inflation and massive central bank stimulation as a case of the central banks' race against the machines.'

The reason we are in a “new normal” of super-low interest rates is not because of weak demand, which is what central bankers are used to manipulating, but because of the impact technology on supply -- specifically the replacement of humans with machines.

Automation is suppressing employment, wages and inflation and will do so for a decade or more to come. Machines don't need pay rises, they don't get bored at work and go on Facebook, and they turn up every day.

It is wonderful for the owners of capital because 10 years ago there was an historic and permanent disconnect between wages and productivity: they used to move in tandem but for a decade wages have flatlined while productivity continues to rise.

The result has been rising profits and corporate cash flows, and declining real wages, in turn resulting in growing inequality.

9. Blatter must go - I'm looking forward to the start of the World Cup and have picked Uruguay in the office pool. I don't have a good reason, other than Brazil was already chosen and I figure the last World Cup winner in Brazil was Uruguay (1950) so why not pick 'em again. I've also been watching the Sepp Blatter debacle from a distance. Now even Bloomberg is opining that Blatter must not seek re-election. The numbers are interesting.

So what has Blatter done with that fire so far? For one, he has increased spending on personnel, management and the FIFA ruling bodies, to about 21 percent of all expenses in 2013 from about 17 percent in the years 1999 to 2002. That's more than the 14 percent of revenue that FIFA spends on what it calls "development": aid programs for national soccer associations, women's soccer, charity and education projects.

It's as if FIFA were a country where the central bureaucracy absorbs more money than health, education and subsidies to poorer regions put together.

10. Totally John Oliver roasting FIFA big time. Hilarious and outraging at the same time.

6 Comments

#9

A good example of governments funding and fueling inequality.

Billions of taxpayers dollars are spent on building stadiums, for soccer players who are paid in the millions and play for clubs owned by billionairs.

Stop the crony capitalism. Let the billionairs fund their own stadiums

Re:No 6 and the ' below trend' growth. The 'mystery' is easy to decipher, if you appreciate that the era of cheap energy has gone:

http://www.theguardian.com/environment/earth-insight/2014/jun/10/inevit…

No 2.....".the authorities agreed not to prosecute"........and who keeps an eye on the Authorities? Best not to have any Authorities and be your own.......it's such a shame this big Socialist regime that works the world didn't fall over and sink into a pit.......system error...malfunction....system error....malfunction....system error.....malfunction....should be screaming in the ear drums of all.......but know.....it's more regulation......more authorities......there is nothing like more of the same when it doesn't it work in the first place!

#7, get rid of money? Any government doing this would quickly find the people switching to alternatives. The currency of other countries and/or precious metals would be favoured and that is what has happened when paper money is removed or inflated out of control.

A one ounce silver coin and half and one ounce gold coin are nice handy amounts - about $25, $750 and $1500 in our money.

The control freaks would just love it. I can just see our government being drawn to the idea as they are no longer the slightest bit interested in personel freedom. 24 hour spying, absurd nannying policy and cradle to grave welfare all "for your own good" of course. You are born to serve the almighty state; end of story.

5

How many countries have got any meaningful benefit from an FTA deal with the USA. Few if any. Take note NZ

6

How realistic is it to expect the post crash growth rate to bounce back to pre crash levels?

The pre crash rate is what you would expect with bubble conditions; reflectling unrealistic enthusiasm and eurphoria. Ie not a realistic or sustainable long term rate. Some people never learn

7

Yes abolish cash. I regularly see evidence of cash transactions being used to avoid tax and possibly other criminal endevours

6 - "The optimists say that none of the growth fundamentals in the system – the state of technological knowledge, the available labour force, and the amount of fixed investment that is profitable to deploy – has been permanently destroyed by the Great Recession"

Sure, if you completely ignore any kind of demand side trends then I guess it would be a mystery to you.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.