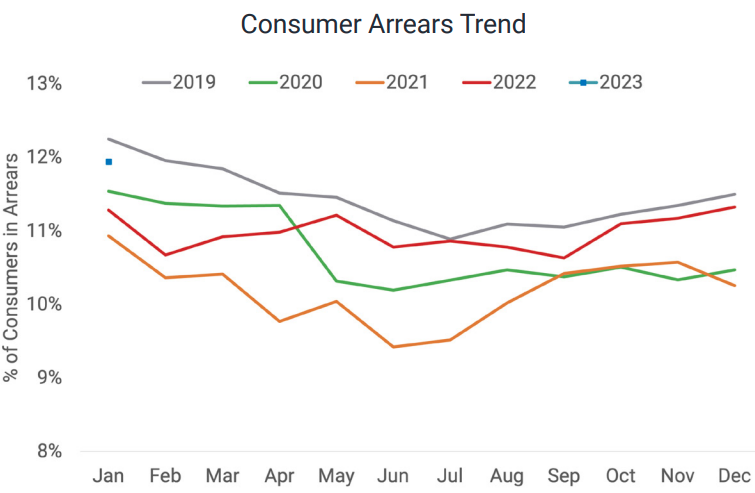

Consumer lending arrears have hit their highest level since 2019, according to credit bureau Centrix.

In its latest monthly update, the bureau's managing director Keith McLaughlin says the current economic climate "appears to be putting pressure on households across New Zealand". Consumer arrears rose to 11.9% of the active credit population in January 2023.

McLaughlin says there are approximately 430,000 Kiwis behind on their repayments, a 20,000 increase from December 2022, with 4.8% of credit active consumers currently 30+ days past due (up from 4.4% in January 2022).

"Coupled with the recent devastation of Cyclone Gabrielle, many Kiwis across New Zealand will be feeling the pinch following the Christmas and summer holiday period.

"While the arrears cycle tends to peak post-Christmas, the current arrears level is 6% higher compared to the same time last year, as economic conditions continue to deteriorate," McLaughlin said.

He went on to say, however, that although the increasing arrears rates are concerning and something to keep a close eye one, "it is important to point out that we are still below pre-pandemic levels".

The number of households behind on mortgage repayments in January 2023 has risen to the largest number since April 2020, with approximately 18,400 mortgage accounts past due. That does, however, represent just 1.26% of the total.

Centrix said unsecured personal loan arrears rose to 9.2% in January 2023 – the highest percentage on record since 2017. Vehicle arrears continued to climb to 5.5% in January 2023 (up from 4.9% year-on-year).

Credit card arrears have climbed to 5% of active accounts in January 2023, the highest level recorded since January 2021.

Buy now pay later arrears have also climbed to the highest level recorded (9.3%), which is similar to arrears rates seen in unsecured personal loans.

The number of households behind on telco/broadband bills also increased in January 2023 (9%), the highest level recorded since October 2020.

In terms of business credit trends, Centrix says overall demand is down 13% year-on-year in February 2023.

"Unsurprisingly, this is driven by a downturn in the retail and hospitality sector as discretionary spending slows and consumer confidence falls."

McLaughlin says for anyone who is struggling with their finances and meeting their repayments, it’s important to raise this with creditors as soon as possible.

"It’s better to come to a repayment agreement than to slip into arrears and further financial strife."

23 Comments

Finally! I've been feeling the mood tighten for months around the BBQ (or this summer, indoor dining room) table.

I did my annual clothes check. Own enough that are good enough for another year. Donated a few bags of things. Total "new thing" expenditure planned for 2023 is a tennis racquet.

We are a one car family and want to get a second but have been delaying it because I have a couple of other projects on first and have a hunch that a) borrowing to get a car feels silly b) there will be some firesale deals soon.

Haha yes I can relate to that. I had a big clothing buy up during lock downs, I am also all good for one or two years, although might get a few basic staples in Uniqlo when i am in Japan later in the year. Really wish Uniqlo was in NZ.

The only debt I have apart from the mortgage is a zero interest loan on our car. Looking forward to getting rid of that in November.

Funny I was also thinking of upgrading the racquet!

I can't fit Uniqlo stuff unfortunately. Too broad shoulders. When I lived in Japan I would buy up clothes on my annual NZ trip. Which is a shame because the price and quality is great. My kid wears mostly uniqlo and a T-shirt he thrashed upon us moving here is now on it's third hand me down and looks like new.

Good plan you two....

Some of the other rackets :-) are on a downgrade path in 23!

It's real. Starting to become a badge of pride amongst friends how long we can string things like phones and other items past their supposedly best-before dates. Things like replacing video cards, tablets, a BQQ for our next house and so on just have to wait.

You guys are amateurs. I still wear shirts I had in the late 70s.

It should be a badge of pride, not only from a financial perspective, but from an environmental one as well. There's a concept called "buy it for life", where consumers base their purchasing decisions primarily on things like how long something is going to last, or how easy it is to repair when it breaks.

Great initiative IMO, and more difficult than you'd imagine in this age of engineered obsolescence.

NK - US car loans now in significant arrears and NZ debt arrears trending down - could be a pre cursor to another Lehman moment.

When I see numbers like this I am always intrigued.

10% of Kiwis are behind on their personal loans?

You can bet another 10% are just keeping their heads above the water, and then another how many percent actually have consumer debt?

If and when this crashes, it is going to be ugly.

A lot of companies that sell retail goods are essentially finance companies masquerading as retail companies. Car companies are probably the worst offenders. The salesman almost looks upset when you want to pay cash. With the squeeze on the middle and lower classes brought about by the cost of living crisis personal debt defaults could be a blood bath in the next 12-18 months. A trickle can quickly become a flood.

The worst part is the government is powerless to do anything about it. What are they going to do? Lower interest rates? This will just lower the dollar and exacerbate the cost of living crisis. Which is a key cause of the issue in the first place.

Oh, the govt will "do stuff" fer sure. When the screaming is loud enough they will spray money around in 10 ways to be kind and save debtors. They are in endless deficits but not yet broke, so they can still borrow and spend our grandkids money. Won't work of course - NZ's lack of productivity means we can't underwrite the handouts forever, but Natbor will kick that can and fizz it up real good.

donny - I admire your optimisin and hope your are right but my money is on something much worse.

I guess the one positive thing to come from all this is that debt defaults are extremely deflationary...

The "KIND" ECONOMY under Ardern, has proven to be a disaster for the poor and great for the rich.

Queenstown going great

Maori elite having a ball

Motorhome sales awesome,!

Joe and Jo Average.. Pain!

Recession ?... Game on!

Labour governments are usually good for asset owners and investors because if you're financially sensible then lolly scrambles are a good time.

18,400 behind on payments. If those become sales, that'll be a 50% increase in available stock. Prices will tumble.

Yes its playing out like most property crashes do , its moving faster as its interest rate rise driven. late 2023 will be pretty ugly

Probably half that number, most people will have multiple accounts associated with a mortgage. But yes, very interesting. Usually takes at least 6 months of workout before mortgagee sale.

So just in time for the election?

Govt announces mortgage flood relief scheme payment, available to anyone with a mortgage who lived where it rained.

No questions asked - high trust model.

And a levy on those few "lucky" enough to be net tax payers to cover it.

I know how easy it was to get the subsidy in covid, no effing way should they use it again in response to climate events because those are going to be regular as clockwork going forward

.

When we start to see mortgage stress I think things will get really interesting.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.