It’s with quite a bit of fanfare and excitement that the Government announced that teaching kids about money was going to be part of the curriculum. It is certainly needed and well overdue.

Over the years there has been a lot of debate about who should be teaching kids about money. Is it a parental responsibility? The school? Or some other external providers like banks and other organisations? It seems the government has taken the approach that it’s a combination of school and external providers.

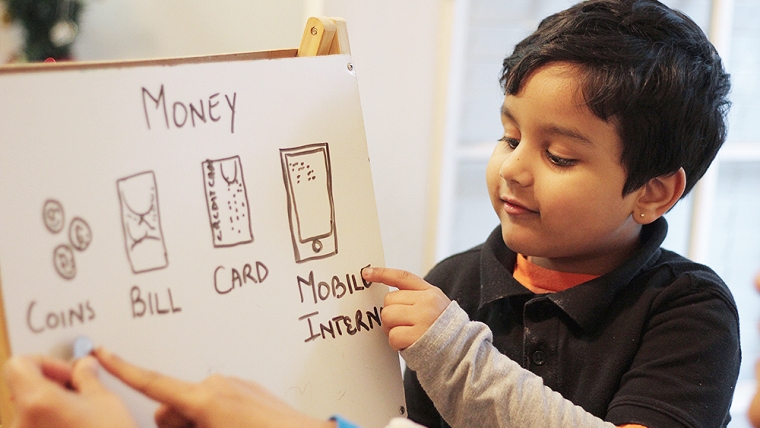

From what I have read so far, it is going to be very practically based. How to save, spend, have a bank account and for the older kids, investing, budgeting and tax.

It’s a great start, and I am certainly not knocking it. But, what about the parents? Where is their role in all of this?

I certainly agree that teaching children about money at a young age is necessary. If you want to make change, that’s how you do it. Just as planting gardens and teaching kids how to grow things and eat healthy food can lead change in the family’s diet too. So too, can teaching youngsters about money.

But when it comes to money, that might be a bit harder than planting a vege garden. I’m sure there are some parents who are sighing with relief that this money stuff is going to be handled at school, so they don’t have to worry about it. That is if they have even given it any thought at all.

I am going to throw it out there, that there might also be some parents terrified at the thought of their little cherubs learning all this money stuff and then coming home and asking some difficult questions that they either don’t know how, or don’t want to answer because they aren’t financially healthy themselves.

I don’t believe that parents can simply abdicate their responsibility to engage in money education just because it is going to be part of the school curriculum.

If you want to raise financially healthy children, then you must talk to them about money - warts and all.

Whether money is taught in schools or not they will get curious and they will ask questions. How you answer them is very important.

The schools aren’t going to dive into your family values, your beliefs about money. That part is still up to you, and to be frank, that is the hardest part of the money education to pass on. Our children also learn by watching us, they will see the good, bad and ugly in our money behaviours, and try and figure out how that is going to fit with what they are being taught in school.

For many parents talking about money with their children is difficult. Often, we don’t know where to start, or we’re concerned what our children will tell others about our financial situation. If you and your partner don’t talk about money or if your parents didn’t talk to you about money, then it is even more difficult for you to talk to your children about money.

Silence around money is also something that many of us learned from our parents.

We also know that children’s questions can be straight to the point and candid, and questions around money are no exception. The playground is often a typical source for many curly questions, for example, little ‘Johnnie’ may say to your little ‘Suzie’, “my family is rich.” So, your little Suzie may come home and say, “are we as rich as Johnnie’s family?”

When your child does ask a question about money, you want to be honest. Before we launch into your answer, simply say in an encouraging and not suspicious tone, “Why do you ask?”

By asking your child, “why do you ask?” gives you some time to determine where the question is coming from, so you know the context, this also gives us time to think about our answer.

Another source of these seemingly awkward money questions arises from fear or anxiety. These are likely to have come from an overheard argument between parents, or a fragment of a conversation.

Here are a few questions you may be asked:

“Are we poor?” This question may come up when children have been told ‘No’, and they see a friend with whatever it was you said No to. A good answer to this one is, “people who are poor don’t have everything they need, like food clothing and medicine, we have all that, so we aren’t poor.”

“Are we rich?” A group of children may have come to the conclusion that a friend is rich because they have lots of toys, a big room and nice clothes. Once you know why they are asking (why do you ask?), try and define the term, and include other non-monetary words.

“Why can’t I have it if I’m going to pay for it with my own money?” It’s your house, so your rules. If you didn’t want to be quite so authoritarian, you can give a more detailed reason which they may or may not agree with.

When talking to you children about money, you need to be age appropriate, you aren’t going to go through your household expenditure with your 4-year-old, but you might with your 16-year-old. The main thing is to be honest, and don’t make money scary.

The American journalist, Ron Lieber, has written a best seller called The Opposite of Spoiled. The book is all about how, when and why to talk to kids about money, whether they are 3 years old or teenagers. Written in a warm, accessible voice, grounded in real-world experience and stories from families with a range of incomes, The Opposite of Spoiled is both a practical guidebook and a values-based philosophy. I highly recommend it to all parents wanting to partner with their children on their money journey.

Maybe it’s time to dust off the Monopoly board and make learning about money with our kids fun.

*Lynda Moore is a Money Mentalist coach and New Zealand’s only certified New Money Story® mentor. Lynda helps you understand why you do the things you do with your money, when we all know we should spend less than we earn. You can contact her here.

6 Comments

My children started with Karl Marx. Later they learned Keynes. My grandchildren are starting with Modern Monetary Theory - Warren Mosler, Stephanie Kelton and Steve Keene.

That’s fantastic! It’s great to see financial education evolving across generations – such a solid foundation for your grandchildren.

First lesson. Purchases on a credit card are not owned until the amount of it is repaid to the credit card. Credit card use in NZ at least, didn’t really get underway until the 1980s. Up until then it was extremely difficult to borrow money for personal use. For instance much of society resorted to lay by or similar when needing such as household goods, furniture etc. Today much of society cannot differentiate their spending being from money earned or money borrowed. Teach the children either you save for it beforehand or else be fully aware that it will required to be paid for afterwards with a likely increase in price due to interest charges.

Appreciate your thoughts. Such an important point – understanding the difference between earned and borrowed money is key. Credit has changed so much over the years, and those lessons are more relevant than ever for the next generation.

Actually, the first lesson should be that money is not a store of wealth

The second should be that there are too many forward bets compared to remaining physical underwrite.

The third should be that 'saving', therefore, is nuts.

Abd the final one should be that people trained in finance, are no better than tea-leaf-readers because they are energy/resource blind.

Then tell them to go out and play.

Thanks for sharing your perspective – definitely a thought-provoking take on how we think about money and value. There's always more to the conversation than just dollars and cents!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.