By Alex Tarrant

The government's 'leaky homes' bill should refer to a possible agreement between banks and the government to share any losses under a joint venture between the two to provide assistance for the nationwide problem, the New Zealand Bankers Association says.

Banks and the government are still in talks over the Weathertight Homes Resolution Service (Financial Assistance Package) Amendment Bill with the main sticking point being who takes the hit of any losses arising from any financial assistance package. Currently central government will pay 25% of repair costs for homes affected, with local authorities to pay another 25% if it signed a consent for the building work.

Government is then expecting home owners to borrow the other 50% of repair costs from a bank. However, many borrowers don't have enough equity or income to borrow more and the banks want the government to agree to share in any losses from such loans.

The Bankers Association made its comment in a written submission to Parliament's Local Government and Environment Select Committee, which is looking at the bill after it passed its first reading in the house last year. The select committee is due to report back to Parliament in April.

The NZBA said it supported the objectives of the Bill to improve, for owners of leaky homes, access to finance to repair their homes.

"Banks are supportive of the Government’s efforts to address this important issue and to help owners of leaky homes in a positive way," it said.

However it said that, "for the purpose of clarity and given that negotiations between the Government and banks have not yet been completed, the Bill should explicitly recognize the options being discussed".

"In the Explanatory Note, the definition of financial assistance measures and Clause 125G, the reference to “guarantee or indemnity” should be replaced with a reference to “guarantee or indemnity or loss sharing agreement”. Currently, the Bill does not appear to contemplate a loss sharing agreement," the NZBA said.

Furthermore, the NZBA said a line in the Explanatory Note should be replaced with the words:

“the Crown will provide credit support (by way of a guarantee or indemnity or loss sharing agreement) to banks who agree to provide loans, to eligible owners who meet the banks' lending criteria, to assist with meeting the remaining agreed repair costs."

"The Government has strongly indicated in negotiations that the existence of a loss sharing agreement should not influence banks’ decisions about whether to lend, that banks should not lend more or lend in circumstances where perhaps they otherwise would not, and that the agreement is not intended to provide banks with increased confidence to lend the required amounts," the NZBA said.

A report in 2008 by PricewaterhouseCoopers estimated between 22,000 and 89,000 homes were leaky with the consensus forecast of 42,000. PwC estimated the total cost of fixing 42,000 leaky homes, including repair and transaction costs, at NZ$11.3 billion in 2008 dollar terms. The Government is currently incurring costs of about NZ$19 million a year running dispute resolution and related services. See the Government's Regulatory Impact Statement on the leaky home financial assistance package here.

See more on the potential costs of leaky homes in Gareth Vaughan's February 17 article here.

50 Comments

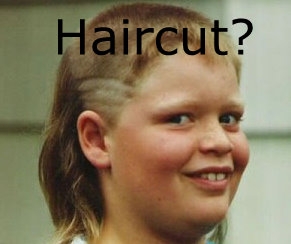

Sick mullet! Is that you Alex as a chubby 10 yr old in 1989? Where was your fluro zinc?

Na mate I was never that chubby. Raised on carrots and beans and made to run 19 Ks every day to school ;)

Bernard found that photo...somewhere...he had the old family album out last time I was in Auck, and I'm pretty sure coloured photos had been invented when he was that age...

Really. [quote] A report in 2008 by PricewaterhouseCoopers estimated between 22,000 and 89,000 homes were leaky with the consensus forecast of 42,000 [endquote]

The 2008 quote from PWC in an article now published here in the year 2011 (3 years later) suggests that is the best information available? Surely they can do better than that. How can anyone sit down and negotiate when they don't even know the absolute quantum. Surely every leaky building has been identified and assessed and costs valued? Are you serious? It hasn't been done? Get away. If that is so then someone somewhere deserves a kick up the backside.

Really good point iconoclast.

I suspect the banks know the real number and that's why they're pushing so hard for the taxpayer to help the banks ... ahem....pay the bill.

Interesting question. Should taxpayers effectively help Australian-owned banks (who are increasing their profits) to get out of loans made years ago (without much checking) to people who bought dodgy houses?

Maybe the banks should be forced to fess up and take their losses on the chin?

Or maybe the losses are too big for that?

Someone has to take a haircut. The owners of the leaky homes? The governnment (s)? Or the banks?

Or a combination of all three?

That's what is being fought over now. The relative shares of the bailout.

I wonder if taxpayers know their money is going to be used to soften the blow to bank profits from this leaky building disaster.

cheers

Bernard

Exactly Bernard, it looks like responsibility has gone out the window now, just go to the government cap in hand when things go wrong and get paid out for it.

It's time the banks started getting serious about what they are lending money for, and not just throw it at anyone that walks in the door, because if they want to have a policy like what they have done, they should expect to take some of the losses too.

The same goes for the insurance companies, when there is no pressure at all from them on owners of earthquake prone buildings to do anything at all about them, nothing gets done.

In other parts of the world like the west coast of the US, insurance companies won't touch buildings unless they have been brought up to a reasonable earthquake standard.

The need for non main-stream-media is to have access to and obtain opinions from experts in several fields, particularly Law and Finance and Banking. Building and construction is not my field of expertise but what I do know is this. When building any residence there are a number of "contractual" arrangements in train. Local-Body-Councils are responsible for assessing then issuing final authorisation for the owner to occupy the dwelling by issuing a "certificate-of-occupancy" and the owner is entitled to rely on that. What I would do is get some input from either the Law Society to search the archives and law records for any precedent court case involving these issues. If there are no precedents then one looks to either Australian Law and English Law for precedents. If there are still no precedents then look to Canadian Law and USA law. I would be surprised if there are no precedent case-law available either in New Zealand or Overseas that deal with this issue. Fairly simple. Why has this not been done? Either way, the need to know is important. Knowledge is power. Waiting ten years is ridiculous. Then publish it, and pursue it.

Well I'm no fan of banks but can you really blame them for arguing for "loss sharing".

Quite simply - they did not write the building regulations, nor did they approve the untreated timber and other materials/methods. Nor were they responsible for inspections.

These causes of the potential losses all lie squarely with government.

We elected them - they cocked up - we pay.

I disagree. The lion’s share of the loss sits with the homeowner. And ultimately the bank if they cannot recoup the potential loss. This issue has been around for 20 years now. The banks were aware of this as much as the next person. They were aware of the risks the potential fallout and possible implications with respect to the mountain of liability. They were chasing easy money, trying to pick up market share, thus stoking demand. They could have reduced exposure to this excess with a stroke of the pen and they didn't. They thought that they could use their dominance to influence government. They didn't foresee that central government would be bought to its knees by the GFC. .

"Or maybe the losses are too big for that?"

Yeah, how about this shocking new idea:

The bank invested (strike sthrough) gambled. THEY cocked up. If the losses are too big, the bank fails. Shareholders lose, bondholders lose, the board kan walk (good riddance). A new bank, with better practices, takes over. New shareholders and bondholder look twice before throwing money in. The world doesn't end.

We already paid.

@Iconoclast , good point about the extent of the problem and numbers .Someone should ask their local elected MP to ask the Minister responsible for Housing for precise leaky house numbers, in Parliament

This is an election year , and they cant afford to fudge the numbers , or lie to Parlaiment .

As to whether we should pay for this , well if that is introduced by way of a tax or whatever , I will take my wife , kids , dog , skills and capital and move to Australia until I retire

The inclusion of the banker's suggested language into the Bill will effectively mean the taxpayers will foot the bill for 100% of the bailout. The kicker is the banks get to charge fees for moving the money from them, to homeowner as they move through the default process, and back to the government. Municipalities (Auckland Super City) will have to increase rates enormously to factor in their 25% liability, which effectively taxes those prudent homeowners who did proper due dilligence before purchasing.

For a government entity borrowing $300m a week to maintain the status quo. Add in the borrowing needed to pay for this programme: say $3b. And then there is the cost of the earthquake damage: say $16b. (Since when did government ever give us the true cost of any programme?) I say round it all off to $20b. All of a sudden it looks like we are at government borrowing double (am I even close?) what they are currently having to shoulder.

Even if the global economy manages to remain static over the next year; (a scenario that is highly unlikely given rising oil prices and currency devaluation) we are in for an austerity scenario that rivals Ireland's.

It doesn't take a tinfoil hat to see that this year is going to end in tears and that next year will see a revised debt schedule that can only result in a credit downgrade. This is the point where the turd picks up speed before it disappears into the porcelain vortex. God help us all. (Oops, forgot Key doesn't believe in God.)

Why would your 'God' help you Doug....seems maybe your 'God' has been sitting back and enjoying the mayhem or causing it....don't you think!

Neither do most sane ppl believe in a figment fo someone elses imagination...

regards

steven - yes !

regards - always looks good.

Why is the govt so keen to save the banks from losses they will cop in the face on each property left abandoned by homeowners. If it be a dump that once sold for $500ooo to a fool using $450ooo of bank created credit...and it's now worth just the $100ooo for the section value if that....the bank cops a $350ooo loss on its balance sheet...the fool has lost $50ooo plus all mortgage payments since day one....

Tarting up the place to look good will not return it to being worth more than $450ooo anyway...so the fool is still out of pocket. The only winner is the bank....which has a govt guarantee against future loss.

I say bugger the bank....let them cop the $350ooo loss. They can sell the section for some return or fund a new build and maybe make some profit on it...in the end they will lose stuff all.

That leaves it open for the govt to help out the fool.....some of the fools will deserve help...other will not.

The law can be changed to allow home owners to walk away from designated 'rotten home mortgages'. Then if the banks want to go after the councils or builders or architects...so be it.

If a home owner cant sue a builder or an architect today how can the bank? Anyway this is a classic case of laissez faire building regulation or lack of it....The so called professionals wanted the opportunity to deisgn and save money by "innovating" what we have is a natioanl disaster.

Sure the law can be changed but the reaility is it wont be, it hasnt been and it could have been by now, however the developers and architects company just goes "bankrupt" and tahts the end of the story anyway. Also to many archticets and builders/developers etc vote National.......

um, has the Govn actually fixed the regs or is it the same crap?

Throw in the expected decline in house values over the next 2 or 3 decades and the cost cant be inflated away as JK thinks. In fact its a danger for the mortgage holder ie the bank...if we see year on year say 5% drops once the leaky home is worth less than the mortgage the householder can "simply" walk away....and by that I mean emergrate if need be....I would suspect the ppl with the newer, larger leaking homes are also the skilled/professionals, I cant see the Bank following someone to say Canada? and Canada would love to have them.

regards

Wolly,

If Banks can't rely on the quaility of its securities (quaility of build) it will do one of two things:

Not lend against them (hence most banks are fairly strict on apartments etc)

or

Require every thing from engineers reports / structural reports / moisture readings etc for every mortgage it will add thousands of $$$ to the cost of getting a mortgage.

Bugger the Banks you say but want you a really saying also in bugger the depositers and borrowers as well as they Banks will need to charge higher mortgage rates or lower deposit rates to fund the losses you are suggesting. We the fiquures being totted about in could run into Billions of $$.

Wolly, I would really like to understand why you are out to get Banks like they are the root of all evil and no doubt it will be their fault as well that we won't win RWC?

This I love "Central Govt" = Taxpayer, "Local Council" = Taxpayer, "Bank" = Customer ie Taxpayer, All we are arguing here is who will organise the flogging of the innocent.

Meanwhile CHH, Fletchers and Hardies and some nameless incompetant bureacrats (the real criminals) are laughing

Neven

Neven - You've hit the nail on the head. All the problems in this respect are caused by big Gov't both at the Central and Local level. Get the bureaucracy out of our lives and let the people make and stand by their own deisions and make Caveat Emptor the priority. Because people believe the Gov't will bail them out of any self imposed future problems they don't do any of their own research into any of the areas necessary. As soon as NZ'ers realise that Big Gov't is the problem then we will be on our way to ensuring that large scale cock up like the leaky homes don't happen again in the future.

However I don't think this has any chance of happening as we have over 50% of people in this country dependent on a Bg Gov't system.

Not really "incompetant bureacrats"

I used to be in the Building industry as a building services engineer....mostly its the Pollies of the day's fault...ie they wouldnt pay for the regs to be written, so instead got the industry "professionals" to write them for them for "free"...and guess what the payback was the ability to do anything they wanted with no come back....

I also dont especially blame the suppliers like Fletchers etc....they mostly supplied materials...

A lot of the blame can be put on the shoulders of architects for designing in-appropriatly for the NZ climate (like FFS who's stupid enough to want a mexican bungalow in a place that rains heavily? or internal roof gutters caused by fancy roof shapes? or internal balconies?) and then sure the maximise the savings ie make it as cheap as possible developers who actually usually clear 100% NET profit, and finished with poor building techniques and shoddy workmanship can fill up quite a bit of the rest.

We can aldo throw some of the blame onto the customer who wanted that afore mentioned mexican bungalow and wanted the cost minimalised...

So really its one huge screw up from top to bottom....and sure I feel sorry for the ppl who bought a leaky home....sometimes.....I also note from what they have said that they didnt do their homework and didnt pay for professional opinions in many cases (not to mention a lot of the so called "pros" opinions are/were worth jack sh*te IMHO)....and are paying the price for it....

I did my homework and I have a sound 1960s house.........sure that needs a refresh but its purely due to its age...

regards

If this leaky home problem can't be reconciled, and I am thankful none of my properties are leaky buildings, there are going to be some houses where people will just have to abandon them- then that's great for your neighbouhood if you have an abandoned place or more in your street. Becomes more than just the house owner's problem then. Doesn't do anything for an emerging house shortage situation as well. And the government has a leaky school building problem to deal with of at least $1.5 billion.

"emerging housing shortage"....really....sure it's not just hyped up spin Muzza!

Seems more likely the exodus across the ditch will lead to a surplus...indeed is that not why the regions are seeing a price collapse....a sea of unsold sections and ex rentals....

Yeah mate there is that 'house shortage' myth again. The property investors stick to it like poo on a blanket because what else can they cling to??? The bubble went pop and property looks to be the crappiest so called investment around today.

The poor saps around Christchurch must be wondering what they were thinking to get themselves into property debt. But they are not much worse off than any other property investment sucker elsewheres in that particular respect!

Facts are that our existing housing will be down (outside of where there is an over-supply in coastal beach areas and places going backwards like Marlborough and the Coromandel) due to new construction at the lowest rate since 1965, plus the ravages in Chch, plus this leaky homes nightmare. Sure Australia could act as a safety valve.

Add the finance company disaster to the earthquake loses and the leaky homes, and New Zealanders have billion upon billions less to spend on anything, property most certainly, than they did one or two years ago. Those estate agenst in Nelson that I read about that are 'rubbing their hands together' at the though of Christchurch resident flocking to them should concider what those people are - refugees. And they don't have the money to buy what the Nelsonians have to sell - or anyone else in the country has to sell. Thta's a general lowering of the money that New Zealanders can pay for homes; lower property prices nationwide.

So much for the regs offering savings...........it seems never ending.....

I dont think it will be reconciled myself.....the ppl left with the "houses" are/will be the ones left carrying the cost....

regards

Steven

The reason your '60s house is sound is H1 Piine framing timber (or OB Rimu), Fletcher and CHH pertioned the gov't to drop the treatment requirement o framing (because they didn't control the treatment industry), the justification was that borer didn't live in timber with a low mosture content, At the same time Hardies altered the composition of their substrate from mineral to wood based, WANZ (window association of NZ) also allowed the reduction of the overlap in their aluminium profiles. All this was overseen by Gov't bureaucrats.

Where is the 'test house' for all these changes in a sub-tropical climate? It doesn't exist. What you have given above is the spin.

Houses have always 'leaked', monolithic styles existed NZ since 1945, fancy rooflines, were you alive in the 70's?. The point is these houses haven't rotted and fallen down.

I'm not saying that poor workmanship or poor deisgn don't contribute to a building leaking, obvoiusly they do, only that they have always occurred but the consequeneces were mitigated by resilient materials

Neven

Neven911...the OB Rimu you speak of is riddled with borer....only heart Rimu is safe. They ran out of that and used the crap...then came the Pinus Rhubarb era.....the DF is better than pine for stuff kept dry and above ground...far stronger timber.

Yes you are right there Wolly, my place is heart rimu and [earthquakes or volcanoes not withstanding] it will be around for many years yet. The other is not sort is not much good.

Wolly

I agree that OB Rimu was subject to borer, but a lot of that was stopped when they relined houses with Gib, What is 'DF'?

Douglas Fir. The old Corsacan pine is a great timber and there are plenty of old trees on farms. Id recommend it ahead of a lot of other timbers once its treated.

Pine is fine....it just needs to be old enough, H1 treated and of adequate section....a House in 4 x 2 pine is pretty sound and cost effective.

Most of the reason pine has a bad rep is the suppliers started using it 2 or 3 years before the wood / tree had reached maturity when it toughens up the most....so usually the wood pine problem is in newer houses and not 1960s....

regards

Again you shoot yourself in the foot regarding no being the suppliers fault, pine used to be graded #1 or #2 visually, but now its done mechanically, the benefit of visual grading was that a wonky piece if timber ended up #2, now if it passes a deflection test its #1 why was this done? obviously because it allowed more timber to be graded #1

Hi,

Actually, wrong....and you appear to be talking from complete or at least magor ignorance and political bias...its quite simple most of this can be laid squarely on private enterprise because they were allowed to run riot and not the Govn as such....beyond they didnt want to take ownership and standup to the cowboys.

a) H1 is anti-borer, H3 is anti-rot and anti-borer............My framing is pine and HTH treated....seems borer proof so far, mainly because its staying dry, borer dont like dry wood...

b) The move away from H1 was the health and safety concern of builders sawing treated timber....hence the moove to UT.

c) My house is sound/dry because its have eves, ie it has a proper "umbrella" covering the wall tops....

d) My house has no internal roof lines or gutters, huge points of failure, leak and damage...sure houses that have these have not fallen down, but this is a misnomer, few houses ever fall down, they usually get fixed long before at considerable expense, such "spin" usually comes from a typical Real Estate Agent. Its simple.....Ive seen this enough and had to do the repairs often enough to actually know something about this. So the fact my house has none of these features was one reason why I bought it...And actually I just had to fix a "leak", the copper vent pipe and the roof iron it touched needed replacing, no biggee...a latent defect that took a decade or two to appear.

e) They dont need to control the treament industry...I know ppl with their own timber yard, they do their own treatment and comply with all the regs....its easy enough.....but refer to to point b)

f) Gov't bureaucrats admin the system not write technical documents...the Pollies were bought pure and simple.

g) Test house...pretty much exactly that, so called architects went wild with no real world experience to back up what they wanted to do....now we have that experience the hard way. More than a few traditional builders with decades of experience and the council inspectors I talked to about these pretty much agreed they were naff....

You dont mitigate damage with resilient materials as such....you mitigate with proper and suitable design for the NZ climate....stucco etc and flat roofs is not suitable for NZ.

Also putting in H3 floor/wall plates so they dont rot while the water leaks in is plain loopy and not needed....

regards

a) thats the spec not the actuallity, H1 repels rot pretty well, UT timber doesn't...unintended consequence

b) utter BS, Greens and industry in chorus (Bootlegger Prohibitionist syndrome), how many builder ever died of inhaling H1 sawdust

c) straw man

d) see c

e) They comply now..because its required, the point it why was treatment removed? your crap argument c) is pseudo green crystal wearing spin, no-one in the world has fingered boron as a health risk

f) utter BS, Bill Porteous was the archetypeal bureaucrat, box ticking f&*(wit

g) see f, the test was live

And your comments re mitigate clearly show no or incompetent engineerring training, do you understand the concept of "fail safe"?

a) No H1 does not resist rot in any meaningful and consistant manner.

b) H&S assesses risk to ill-health and then looks to remove that, One of their targets is to make sure any chemical exposure is reduced or if possible eliminated. see your stupid comment on risk.

c) H1 should be the minimum level for anti-borer IMHO....proper sound design and construction finish this off....so far houses like mine are showing over time their relative low maintenance cost....

LOL.........my training was very good and I understand risk very well it is a balancing act....yours is clearly zilch....

regards

Steven

Clearly you are going to read and not comprehend, So effectively we have removed the risk of dealing with H1 timber by replacing it with H1.1 and in my practical experiance I've seen H1 timber exposed to water, that doesn't rot and more importantly supresses toxic mould.

Therev never was a quantified risk from Boron salts as far as I can determine, I'd be interested on any info you can provide

And re my training its far from zilch, I the sort of prick that designs the systems that keep dogmatic fellows like you from killing yourselves.

Neven

B.E. E & E

steven

some reading for you

http://pc.blogspot.com/2009/11/leaky-homes-part-1-myth-of-deregulated.h…

Strangely a lot of 1900, double gable villas have internal gutters and they haven't fallen down

Neven

Good link. Compulsory reading. Exactly what is needed. And it names names.

No houses dont usually fall down....funny that but the owner usually coughs up long before that stage....this is just spin and its worthless twaddle in the real world.

Ive seen houses of all ages with internal gutters some that have needed repairs, not all of them do, sure but its a risk....So your choice is buy a house with one and risk a repair or eliminate the risk, dont buy a house with one...that's your choice.

Ive read this piece before,,,its much right wing politically biased drivel....it takes some elements of truth and are justified but it over states them while ignoring many others. So called "good" architects..LOL just about all of the ones ive met and had the mis-fortune to work with were clueless, so this piece is rubbish...IMHO. As he says a good journalist should have investigated....maybe they did and just didnt re-print his drivel.

Its certainly correct that there are many facets to this problem which all came together....the poor new regulations did play a part if you did stop at the regs and not look behind them and who wanted freedom from them....or if you wanted to follow the regs blindly and not think.....or even ask.

"You know which houses I mean, don’t you: they’re usually the Mediterranean looking things around the place now covered with tarpaulins and scaffolding."

mexican/mediterranean, yeah whatever...."usually".......

The same can be said for the sinking of the titanic....if it hadnt been winter, no problem, no fog, no problem, going slower no problem, full height bulkheads probably no problem....all these came together and caused mayhem....

You can take a reasonable material, even a good material and use it the wrong way and well, it fails..........such a surprise......

regards

CHAPTER 1. The lobby group

Politicians do not run the country. Lobbyists do. In the US the lobby industry is a $50 billion a year industry with 50,000 lobbyists in Washington. In Australia the lobby industry is a $1 billion per year industry employing 1,000 registered lobbyists. Yes, lobbyists are required to register. Dont know how much it is In NZ. But what is unique to NZ is the 4 Austalian owned banks are the most powerful lobby group in New Zealand. They have the NZ government in a classic "christmas hold" and they're not going to loosen the grip any time soon. The 4 banks call the shots. The one contributor here who is aware of their power and hammers the point almost daily is Wolly. I have also backed it up with the ocasional comment. The subject never gets any traction. Why not? Well in time Wolly will be able to say "I told you so" and I'm not trying to piss in his pocket here. Yet, interest.co.nz whose "statement of purpose" and "mission statement" and corporate name is founded on banking finance and banking interest rates, doesn't take up the cudgels. When bank customers deposit money in a bank account, the banks have what is known as a "float" at the end of each day. That float is used by the banks to trade the currency markets overnight. Any proceeds are not passed back to the customer. It goes into the banks coffers.

Settle down, i ! "The float" has nothing to do with FX trading; see my repost to your earlier writing. Wolly has a point ,but it's nothing but an, his, opinion. We all have one; you; me and Wolly. And theres' a bit of merit in all our posts :), even Bernard's!

I am not sure of your understanding of the Banking system but each Bank has a settlement account at the RBNZ and its aim is to have this as close to Zero at the end of each days after all of its transactions are processed with all other banks etc.

In effect if it is in credit then its paid the ORC rate for overnight cash balances. It by mis calulation its settlement account it is overdrawn then its charged interest by the RBNZ in excess of the OCR.

This is where the impact of the ORC is as it sets what the RBNZ will pay or charge Banks on its overnight position.

Banks don't want to have too much of its funds in its RBNZ settlement account as it can earn more by lending it out to clients (or other Banks thus term Bank Bill) and on the other side it doesn't want to overdraw its RBNZ settlement account as this is more expensive than get funds in from depositors.

Yes Banks do do FX transactions as well as Billions of other transactions each day, both domestically and Internationally, most of these being on behalf of its clients.

Managing the Banks position is no easy task, its needs to know what loans may be being drawn down on any one day, what term deposits are maturing and may be lost, etc as well as the impact of FX transactions which will impact on Banks position as well.

CHAPTER 2. The power of the un-elected

The power of the Lobby Group. The Minerals Resource Council of Australia is NOT the most powerful lobby group but this is what they achieved in less than one month last year. The AU Federal government proposed a Resource Rent Tax on non-renewable resources. The 3 largest and dominant players, RIO, BHP and XTRATA are foreign owned and controlled. They objected violently to the tax. Threatened to take their business elsewhere to more friendly countries. The 3 CEOs (who are unelected) flew into Canberra, got a seat at the table in private discussions with the PM. Flew out. The proposed tax was canned.

CHAPTER 3: How to Fix the Banks and the Deficit and the Foreign Debt problem.

I wrote this about 4 weeks ago, prior to Gillards visit to New Zealand, thinking primarily of PowerDownKiwi and Kunst. The Foreign Debt issue was the hot topic at the time. I submitted it to BH asking if it could be published as an article on it's own, but it was a bit tongue in cheek.

A little bit of history about New Zealand and Dunedin and Auckland

The 10 July 1985 is the day the French bombed the Rainbow Warrior. I was 100 metres away in Quay Street, just passing the Ferry Buildings at the bottom of Queen Street the night it happened, out celebrating my birthday, so it's a vivid memory that lives with me today.

In the mists of time leading up to this event the French were conducting regular atomic bomb tests at Mururoa Atoll not too far north of New Zealand. In the weeks after each French atomic bomb test the local press would advise us that Strontium-90 levels in NZ milk would rise from 16% to something in the order of 60% and remain at those heightened levels for approximately 2 weeks. The worst affected area was Dunedin. That's all history now. But if you search the archives you will find it to be fact. If you lived in NZ at the time you won't need to research it. Anyway that is some of the background to Lange's and NZ's vigorous opposition to anything atomic, and the powerlessness of the small and insignificant, and the imperviousness of the powerful, using our backyard as their dumping ground.

In a round about way it is happening again. Tangential to this is Australia's long time refusal to allow the importation of NZ apples, and the increasing droughts in New Zealand and impact of those on the economy.

In Australia nearly 90% of all electricity generation infrastructure is located on the eastern seaboard, just on the left hand side of New Zealand. It is coal fired base load power stations which produce large amounts of pollutants. In Victoria 100% of the coal-fired stations burn brown-coal which poduces mainly CO2, while in NSW they burn black coal which produces toxic atmospheric pollutants in addition to CO2. It just so happens if you look at a weather map you will find the prevailing weather sytems here in Australasia is from west to east, so all these pollutants produced right on the eastern seaboard blow straight out over the Pacific Ocean and the Tasman Sea. Because Christchurch and Dunedin are on the same latitude at Victoria, the population has to learn to breathe a bit faster to get the same amount of oxygen, while those in parts north of ChCh have a toxicity problem that isn't overcome by breathing faster.

Over the coming decade Australia will be building more and more coal-fired power stations. And New Zealand will cop more imported pollution. And more droughts.

Now Julia Gillard is visiting Auckland and Wellington in the next few weeks. Perhaps now might be the time to get down to some serious discussions about apples. Even better still John Key could charge an air-space fee of $10 billion per year for Australian produced pollution as it passes over New Zealand. That would help fix both the deficit and the Foreign Debt problem. And charge the AU banks a temporary levy or license fee of $1 billion pa to operate their stalls.

Maybe after hell freezes over a bank will call me saying:

'would you like to have some of our embarassingly large profits?'

Until that day there is no way I would assist them in anything.

You could get some of their embrassingly large profits by purchasing some shares in them (on Aussie share market) then you could sit back and wait for the huge dividend cheques.

If you think the profits as excessive then get a slice of it.

The reality is that so much of that profit doesn't hit shareholders by way of dividend as profits have to be used to funds any growth in its balance sheet (to met capital adequency rules as required by RBNZ) as well as the huge costs in IT and systems.

Ignorance again... Who insured these houses, or was it not sensible/possible to do so?

Money man's point above:

"Require every thing from engineers reports / structural reports / moisture readings etc for every mortgage it will add thousands of $$$ to the cost of getting a mortgage."

Isn't this exactly what a prudent lender would do? It's their security isn't it? Why lend on something dodgy in the first place. Maybe they bill the customer, but isn't that the sensible thing to do. An insurer would also want to know that the thing wasn't going to cost them loads before insuring it. Seems neglectful. Did all the purchasers just pay cash?

This whole lark smells embarassingly dishonest in so many ways.

When banks could rely on the the integrity of its securityt hen only for lending in excess of 80% did it require registered valautions and if there were any issues the Banks would ask for Engineers reports etc.

If Banks can't trust the integrity of its securitesand be required to carry the financial risk of substandard properties, it might end up requiring all properties build from say 1990 onweads to have these full structural and moisture reports, adding additional costs for borrowers which will flow to lower prices for vendors.

The other option may be for indeminty insurance will be required to cover Banks for these properties, again at the cost of the borrower, like mortgage indemnity insurance / fees are charged for loans over 80%.

This 25/25/50 deal will never happen. We're paying the pollies to sit in meetings, dictate letters, dream that they could ever negotiate with banks, sit in more meetings, write more reports, etc, etc. And the result will be zilch. The whole thing is one of the biggest farces any of us will ever see in politics. And you and me are paying for it. That stinks really.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.