Two thirds of the interests in Oyster Group's latest property syndicate were taken up by investors within a week of it being launched.

Oyster launched its latest syndicate, the Home Straight Business Park, at the beginning of last week and on Friday Oyster chief executive Mark Schiele said 67% of the capital being sought by the syndicate had already been raised.

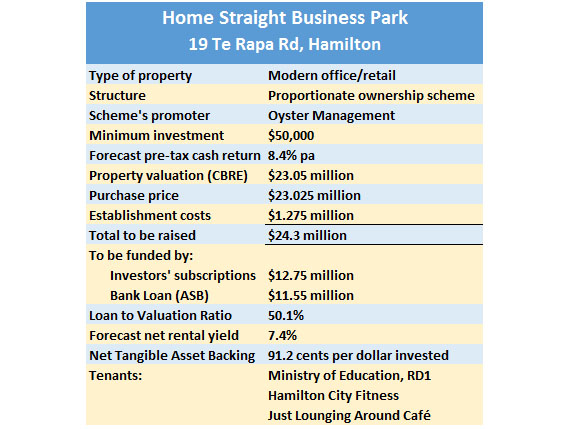

Home Straight is being structured as a proportionate ownership scheme and is forecast to provide investors with a pre-tax cash return of 8.4% a year and the cash distributions will be paid to investors monthly, so for investors such a retired folk seeking a relatively reliable income stream, scheme's such as this have an obvious attraction compared to term deposits and even shares.

The scheme will acquire two adjacent, modern office buildings at Te Rapa on the outskirts of Hamilton for just over $23 million, with investors able to buy into the scheme with a minimum investment of $50,000 (see the fact box below for the scheme's key financials).

It's a modern complex completed in 2012 and its tenants are the Ministry of Education, RD1 - which is Fonterra's rural supplies company, plus a gymnasium and a cafe.

Like most property syndicates the scheme does not have a termination date and will be wound up by special resolution of investors (requiring a 75% majority vote) so investors should be prepared to have their money tied up in the scheme for the long term (perhaps 5-10 years).

An unusual feature of the scheme is that one of the property's tenants, RD1, has an option in its lease which allows it to require an extra 500 square metres of office space to be built onto the space it already rents.

If RD1 exercises that option, the property's vendor, who was also its developer, is contractually obliged to undertake the work and then sell the extra space to the syndicate at a price which has already been agreed.

That means the vendor carries the development risk rather than the syndicate.

The total cost to the syndicate of the new extension would be $1,255,230 (or $4922 per investor interest of $50,000). Schiele said it was intended to fund this through a mix of additional bank debt and issuing new investor interests, which would be offered to existing investors first.

A formula had already been agreed with RD1 for calculating the rent on the additional space if it is built and that meant the distributions to existing investors should not be affected, even if they did not take up any additional interest they were offered.

The scheme is being marketed directly by Oyster and through Tim Lichtenstein of Colliers International.

Here's a link to a general guide to how property syndicates work.

Click on the links below for the Home Straight scheme's investment statement and valuation :

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.