Augusta Funds Management is syndicating Countdown's South Island distribution centre and is forecasting the scheme to provide investors with a pre-tax cash return of 8%.

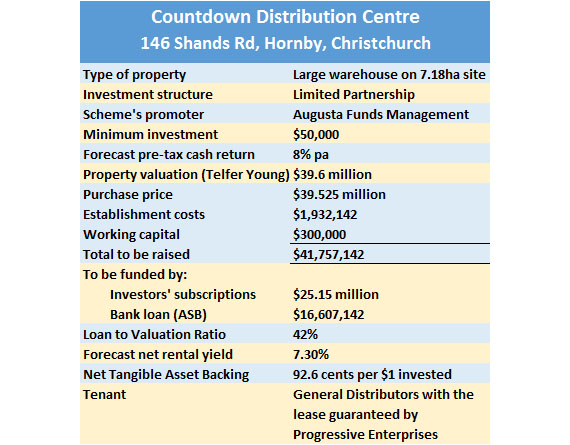

The scheme is being structured as a Limited Partnership in which the minimum investment is $50,000 and its cash distributions will be paid monthly, which means it is likely to appeal to retired folk or other investors seeking a regular income stream (see the fact box below for the scheme's key financials)..

The property being acquired is a huge warehouse building on a 7.18 hectare site at Hornby in Christchurch, which is leased to General Distributors, with the lease guaranteed by General Distributors' parent company Progressive Enterprises, which operates the Countdown chain and is the New Zealand arm of Australian supermarket giant Woolworths.

The building was constructed in 2000 and extended in 2012 and General Distributors' lease has nine years to run, with three subsequent rights of renewal of 10 years each.

Although the scheme has the hallmarks of a quality industrial property with a blue chip tenant on a long term lease, its also has some unusual features which potential investors should consider.

The property's vendor, privately owned South Island company Virgo Group, will continue to be involved once the sale is concluded by leaving money in the property and by topping up the rent.

The scheme is offering 503 investor interests at $50,000 each and Virgo Group will take up 120 of those, which means it will be leaving $6m in the property and effectively retain a 23.9% ownership stake, giving it considerable voting sway if important decisions need to made by investors.

General Distributors' rent is currently $2,753,908 plus GST a year and that is due to be reviewed by August next year.

Virgo has agreed to top up the rent to $2.85m until August 2019 if necessary, although how much of a top up, if any, it will be required to contribute after August next year will depend on the outcome of the rent review.

The lease also allows General Distributors to require the landlord (which will become the Limited Partnership scheme once the sale is settled) to undertake capital improvements to the property.

The new part of the building that was completed in 2012 has a seismic rating of 100% of New Building Standard (NBS), but the original building completed in 2000 has a seismic rating of 73% of NBS.

General Distributors has indicated it wants the entire building brought up to 100% of NBS, and in return its rent will be increased by 11% of the cost of this work, for at least the following six years.

The property is being purchased with a $16.6 million mortgage from ASB, and Augusta has arranged for this to be increased by an extra $2m to fund the cost of strengthening the building.

The property also has some vacant land around the building and General Distributors could also require the building to be extended.

Augusta's forecasts suggest the scheme would be able to borrow an additional $10 million to build a new extension and remain within its current loan to valuation limits.

Both the seismic strengthening work and the possible extension have the potential to improve the overall performance of the scheme by increasing the value of the property and lifting its rental income.

However, the work also carries a degree of development risk, particularly the larger extension, because the timing of any such work is uncertain and there is no way of knowing what the costs will be if or when it proceeds, what the funding costs will be, or even whether the scheme will be able to borrow all of the necessary money to fund the construction or whether they will have to ask its investors to provide additional capital.

The property is being purchased for $39.525 million, so potentially spending an additional $12 million on the property could have a significant impact on the scheme.

As well as looking at the income stream the scheme is likely to provide, potential investors will need to weigh up how comfortable they are putting money into a property that carries some development risk.

The scheme is being sold down by Bayleys Real Estate.

Here's a link to a general guide on how property syndicates work.

Click on the link below to read the Countdown Shands Rd Investment Statement:

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.