The Opposition and some commentators point to what they call the ‘squeezed middle’ to back their arguments for middle-to-upper income tax cuts and when warning against Government or Reserve Bank moves that might cause a ‘housing crash’.

Actually, the ‘squeezed middle’ is quite plump and in no danger of some sort of forced rush-to-the-exits that would turn an expected 15% slide in house prices to anything more like a ‘crash’ of 30% to 50%. Middle-income households are in fine fettle, especially if they own their own homes, according to the latest statistics on income, mortgage costs, cash savings and household net worth.

National Leader Christopher Luxon has made much of what he calls the ‘squeezed middle’ in his cost-of-living attacks on the Government in recent months, arguing this group of 'hard-working average kiwis' was missing out on help from the Government in dealing with higher fuel, food and mortgage costs. These calls convinced the Government to pull a last minute ‘rabbit’ out of the hat in Budget 2022 of a one-off cash payment of $350 this winter for those who were earning less than $70,000 per year and were not receiving the winter energy payment (which cut out those on NZ Super and all households on the main benefit).

But are the ‘squeezed middle’ actually that squeezed?

It ‘sounds’ like they’re short of money because the headlines are a daily screaming drumbeat of higher prices for groceries, higher fuel prices, higher air fares and even (brace for it) tasty cheese costing nearly $20 per 1kg block. It seems ‘obvious’ to say those households earning around average incomes are going backwards and may even struggle to afford to buy food, fuel and pay for housing. Some commentators have even worried aloud about the risk of mass mortgagee sales caused by higher interest rates that causes a house price crash of 30% to 50%.

But is that actually true? Is there that much financial stress out there for homeowners that it could turn into a housing market rout, or force the Government needs to intervene with yet more ‘rabbits’ to feed the current accounts of the ‘squeezed middle’. It depends on what the Opposition means by ‘middle’ (it has never actually given a definition3), but it’s fair to assume it’s referring to those households on the average income, and who own a home. It’s perhaps not too surprising the ‘squeezed middle’ is around the median voter cohort of about 20% of voters that determine election results.

Poking around for the actual middle

Given we don’t have a clear definition from the Opposition, let’s look at the official range of measures. Firstly, the raw average gross income was $110,451 in year to June 2021, as reported by Stats NZ’s latest Household Income and Housing Cost statistics for the year to June 2021, up 4.5% from the previous year. The raw median gross household income was $89,127, up 5.4% from the previous year. But this is raw in that the very highest incomes4 will usually drag the average higher. It also doesn’t take into account the various taxes and ‘transfer payments’ (Working For Families, NZ Super, Accommodation Supplement and various benefits) that determine how much a household has to spend.

In the year ended June 2021, the average annual household disposable income (after tax and transfer payments) rose 4.5% from $84,648 in 2019/20 to $88,454. The median household disposable income rose 4.3% to $74,563.

But then there’s another measure, which is most broadly accepted among the experts. That’s ‘equivalised’ household disposable income, which removes the effect of different household sizes and compositions on estimates, and takes out the taxes and benefits. For example, if there had suddenly been an increase in the size of households with either workers or non-workers, then that would distort the ‘apples-for-apples’ measures of household incomes.

The median equivalised disposable household income before housing costs was $43,125 in the year to June 2021, up 5.1% from the previous year.

So the ‘loose’ measure would be household income of $110,451, while the most nuanced and ‘tight’ measure is $43,125.

That’s a useful starting point as a range, but it’s also out of date, given what we’ve seen with incomes and spending over the last year.

Plenty of cash and equity for the ‘squeezed middle’ of home owners

Stats NZ published national accounts data for the March quarter of this year this week, which showed what has happened to total household disposable income, savings and net worth over that period.

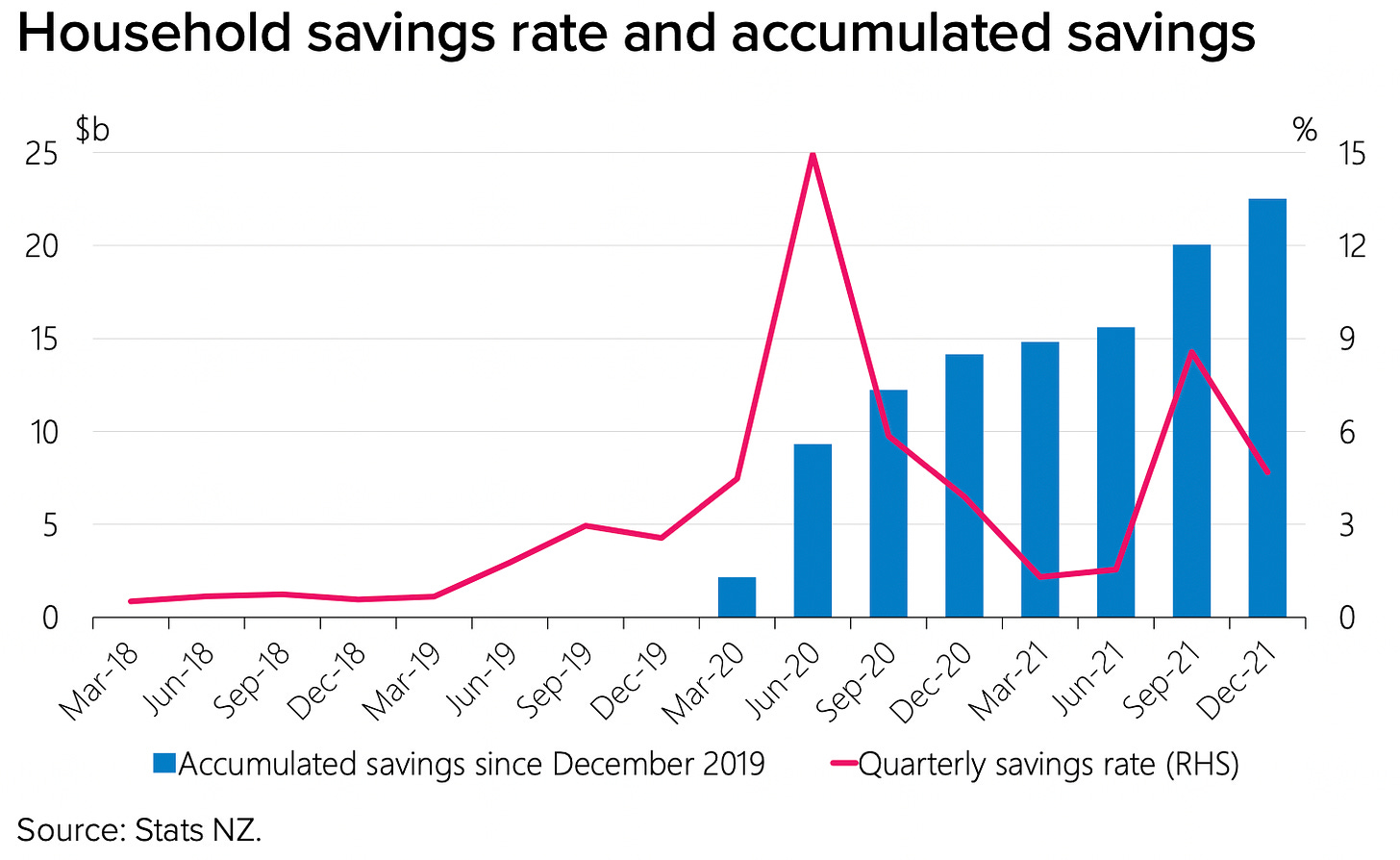

It shows total household disposable income in the year to the end of March rose 6% from the previous year to $217b, and was up 12.1% in the year just before Covid struck. Since Covid, households have collectively saved an extra $20b and increased their bank account cash and term deposit balances by $31.4b to $227b. They may well have kept some cash aside from selling some assets, including houses.

The net worth of households has risen by $621b or 34% since Covid to $2.421t at the end of the March quarter. That, of course, measures all households, but the vast majority of that is owned by home owners. Renters have not been able to save cash since Covid and they have not benefited from the rise in asset prices caused by US$9t of money printing by central banks globally since Covid.

So the bottom line here is that home-owning households have seen their incomes rise at least 12% since Covid, have socked away an extra $31.4b in cash, and have seen the net value of their assets, including property, shares, businesses and cash, rise by over $620b to $2.421t.

Higher mortgage rates not stressful at all to almost all home owners

Those households are also not stressed by a rise in mortgage and other debt of about $40b to $276b and a rise in effective (the average being paid) mortgage rates right now from around 2.75% to around 3.1%.

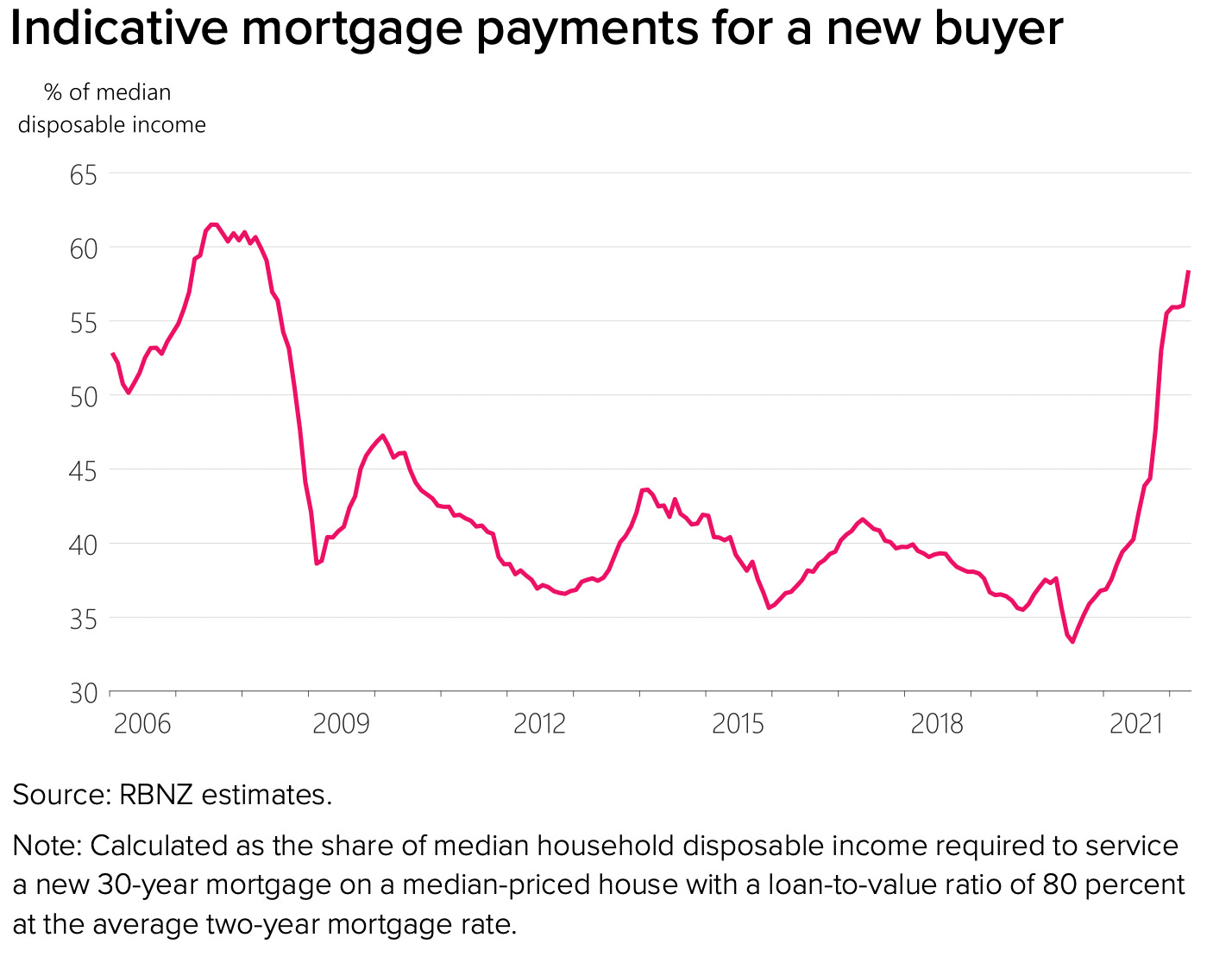

That’s because their total assets rose by $655b to $2.698t. Households have a collective loan to value ratio of 10.2% and the collective LVR on their homes is 20.4%. Their collective mortgage servicing costs are barely 6% of disposable income, well below the peak in September 2008 when mortgage rates were over 10%.

A lot of fixed mortgage borrowers have yet to roll to higher interest rates of 5.5% to 6.0% for new mortgages now, but even then, the collective cost is unlikely to touch double-digits.

Of course, those totals disguise a wide spread of situations, ranging from those with no mortgage debt to those first-home-buying couples who took out 80%-plus mortgages at debt to income multiples of over six to seven times income to buy houses late last year just before the peak.

But even they are unlikely to be in enough trouble that they couldn’t pay the mortgage or would be so far under water to make the bank nervous. That’s because the Reserve Bank has made it very difficult for first home buyers to gear up anywhere near 100% of the value of the home and the banks have used serviceability test ratios well above their actual mortgage rates. That means the bank wouldn’t have lent the money to the first home buyers unless they could pay the interest with a 6% mortgage rate.

Also, less than 10% of first home buyers were in the stretched situation of having a mortgage worth more than six times income and a loan of over 80% of the value of the home when they took out their mortgages.

The real worry for banks is if there is widespread and high unemployment and/or some sort of wage deflation. Neither is the case, with unemployment at 3.2% and any young home-buying couple more than likely to be on high and fast-growing incomes.

Even a 30% drop in house prices would not stress that many. The Reserve Bank estimated that just 1% of the banks’ mortgage books would be in trouble.

The banks are also much, much more capitalised than they were in 2008/09, which the Reserve Bank has estimated from its stress testing exercises mean they have buffers to handle even a house price slump of 40% in tandem with a 13% unemployment rate.

Only a few at the bleeding edge, but they have fast-rising incomes

It is true that prospective first home buyers will struggle to pay for a home with the current prices and interest rates, even if they have a deposit, as the Reserve Bank has pointed out.

However, those people are also in the situation of having fast-rising incomes as they’re able to leverage bigger pay increases and work more hours.

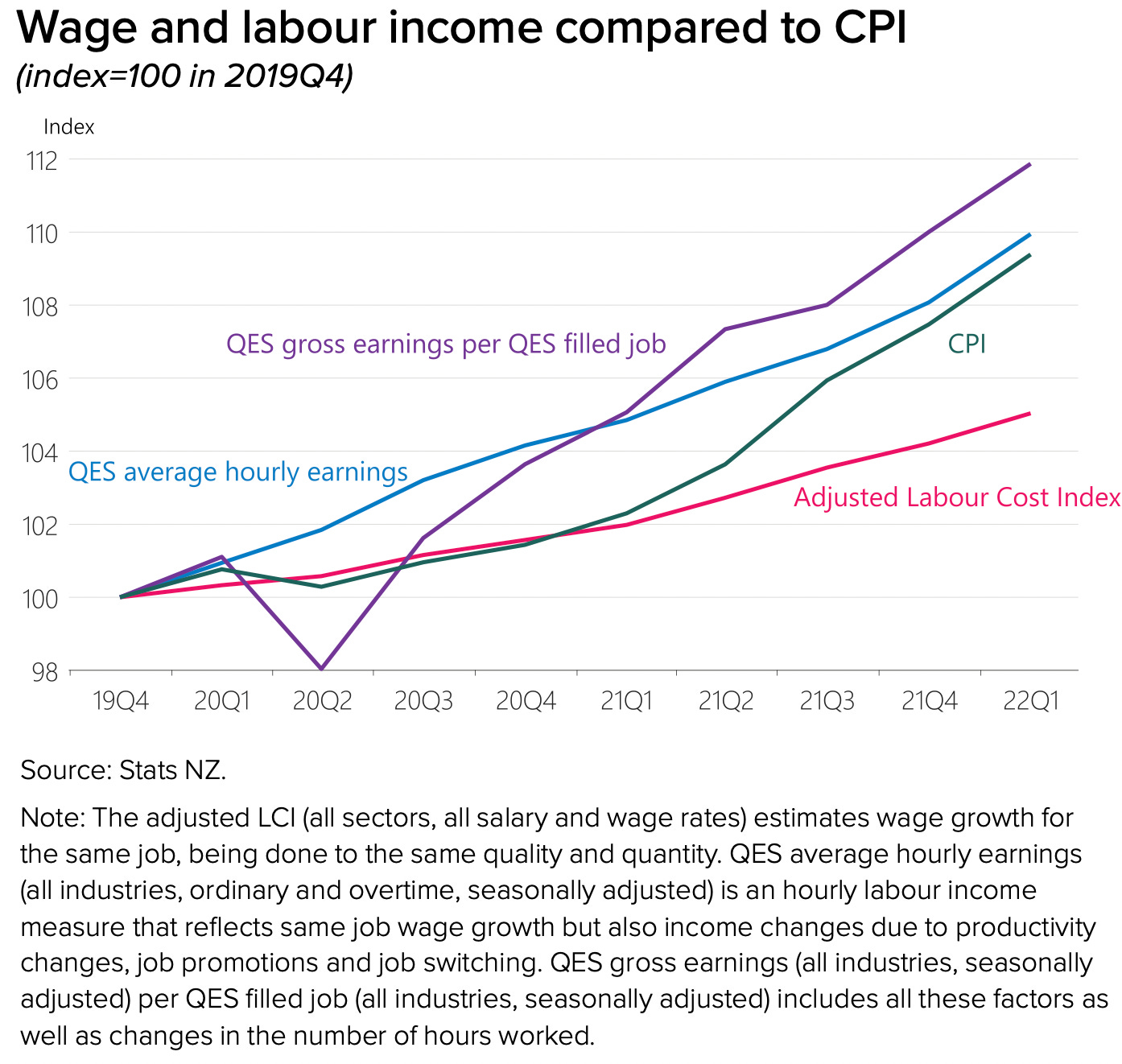

As the Reserve Bank has also pointed out, households have actually increased their total incomes faster than prices have risen over the last two years. Even though inflation is higher than hourly wage increases, total income growth is stronger.

So what?

The key, as always, is whether the ‘squeezed middle’ household is a home owner or a renter. Home owners will overwhelmingly have significant cash buffers, much lower housing costs, strong income growth, even after inflation, and plenty of equity to help them sleep at night. They don’t need any help from National’s proposed tax threshold change that would deliver most of the dollars to higher income earners, or from the Government’s one-off living costs payment.

It’s the renters who are in trouble, but they’re unlikely to be the median votes the Opposition is targeting. They’re also, by definition, not the homeowners getting into so much trouble that they bail out of housing in such a way as to stress the housing market or banks.

They’re the ones who the most stressed at the moment, but they’re much more likely to be well below the ‘not-squeezed-at-all’ middle. They’re working poor and beneficiary households who weren’t actually eligible for Budget 2022’s rabbit and wouldn’t get hardly any of National’s tax cuts.

98 Comments

Luxon's planned updating of the tax bands isn't really a tax cut, more an overdue refund on extra income tax paid since the bands were last adjusted in 2010.

Personally I think bracket creep in the tax bands is government theft by deception and the tax bands should be adjusted annually in line with inflation. Increases in inflation are mandated by government, so I think it only right that the tax bands keep pace.

Politicians need to come up with some long lasting policy changes that will improve the lot on NZ inc and stop treating the electorate as dumb by trying to buy our votes with supposed tax cuts. Most of us can see it for what it is - simple electioneering.

Recall early on as Leader of the Opposition Simon Bridges announced policy that a National government would address and adjust this factor. Wonder what happened to that then?

It got portrayed as a 'tax cut', he got dumped and National are in policy no-man's-land.

Meanwhile Robertson keeps ruling it out, which is effective a tax increase by implication each and every year, and no one ever calls that a tax hike. Why is that, I wonder?

Filed in the waste paper basket which was replaced by Robberson with a dumpster which is now full with undelivered promises.

This to me is a little bit like the "my rates went up because my property value went up" complaint.

Is the government spending the same or more money as 2010?

The answer is obviously the latter, so the "theft" you're talking of is being used to fund increased spending (via inflation or otherwise) on public services. Someone's got to pay, and people who manage to increase their incomes over time are arguably the most able to do this.

If the brackets followed inflation, the country would have less stuff.

Tax rates should follow the state of the economy- pay more during the good times and less in the bad. Bracket creep with the occasional tax cut pretty much achieves that. Otherwise it’s very hard politically for a govt to increase tax and so you end up like the US having to borrow even though the country is rich.

Tax takes usually get hurt in down economies, so that works.

Tax brackets increased annually in the UK unless specifically frozen.

If the brackets don't follow inflation it means over time you are slowing reverting from a progressive to a flat tax system, because everyone ends up in the top tax bracket.

Whether you agree with that or not, its quite a different change to simply increasing taxes.

Ah yes, the people battling on $60K a year are really now just like the people earning $180K because we neglected basic tax administration for a decade. It's all ***magic***.

This is perhaps the worst talking point I've ever seen, but what's even more ridiculous is you're using it to defend a policy that is effectively hitting the people Labour claims to care about hardest. Remember, their pay has to increase by the inflation figure + the tax Roberston wants to take on it, i.e. 8% + PAYE taken on that - if they want they just don't want to fall further behind.

How many nurses, teachers, cleaners and childcare workers are being offered 9.5% - 10% this year?

Perhaps the country could use a bit of less "stuff" as you call it.

The tax brackets in my eyes are there to tax the rich more than the poor as prices and wages go up they are no longer taxing the rich, but the average or even the poor. Do you think 70,000 makes you rich? that's $943.09 per week no kiwisaver if you are paying a student loan given the average rent is $491 https://www.interest.co.nz/property/110471/rents-have-risen-much-more-s… leaving you with $452.

Sure if we tax less the government will have less to spend, that its true of any tax, but the question is, is it fair. Its increasing the tax take by stealth a mechanism designed to tax the rich more gets turned into a mechanism to tax the poor as well.

Also if people are earning more then the tax take will be more anyway. I personally see no increase in outcomes of the increased spending, health system a mess, the 6 hour wait times are nonsense where I live even before COVID if I got properly seen by a doctor in 8 hour I counted myself lucky. My daughter couldn't even get a pillow last time she went to hospital. In the school system the results down, my children have to take a day off each week because there are no teachers. Before your university was free now you have to pay. All I see is the money being spent on more bureaucracy. More money isn't the solution to everything you need to spend it wisely. Thank god they spent money on renaming all the government departments though I am sure may lives where helped by the fact that people don't understand them.

Personally I and I think most people wouldn't be against more taxes, its just that it seems to get spent frivolous show pieces when fundamental infrastructure gets neglected.

Bracket creep only makes a difference in an inflationary environment. However in such an environment the extra cash the government receives from income tax is worth less, so these advantages and disadvantages probably cancel each other out.

Please advise years of zero inflation.

Every year, United States tax brackets are adjusted for inflation. In New Zealand, this has not been done since 2010.

Bernard has an extreme left-wing position, unable to see the issues. Sure, I own my own home. And Nelson council has raised my rates 350% in 13 years. That is almost 13 times the increase in general inflation.

The next Election is going to be a LOLLY SCRAMBLE !

Ohhhh, they're changing it up this time.

No, wait....

Where are they going to get the lollies from cupboard is bare. Print more i guess

The counter argument would be

- Interest rates fast approaching and could soon surpass those stress test rates.

- Stress test calculations did not consider inflationary pressures.

- 1/3 homes owned by mum a dad landlords. Many dependent on rental income. Rental supply and costs increasing, rents are actually decreasing.

- The odds of a recession are probably 50:50 in the next year.

- Many NZ towns supported by one industry, and highly exposed. Potential for big regional variations. Not all sectors have had increasing incomes.

Average NZ mortgage approx 460K refixing a 3% rate for today's 3 year rate cost's3% more = $13800 less disposable income - $265 a week, factor in increases in Fuel/Food/Insurance/Local authority rates all of which have increased and it easy to see discretionery incomes of the average mortgage holder reducing by $300 a week and some much more with bigger mortgages. If Bernard thinks increased wealth in the form of assets pays the bills or this reduction is minor I have a portfolio of bridges to sell him.

Actually the increase in the price of your house only really increases your expenses. All of which someone living in housing nz home does not need to worry about.

100% - also as those interest rates are going up the amount you can claim as a deduction is plummeting down - will really impact a lot of people's cashflow.

"It shows total household disposable income in the year to the end of March rose 6% from the previous year to $217b, and was up 12.1% in the year just before Covid struck. Since Covid, households have collectively saved an extra $20b and increased their bank account cash and term deposit balances by $31.4b to $227b. They may well have kept some cash aside from selling some assets, including houses."

No distressed house sellers then. FHBs are squeezed this year, with wage increases, progressively better off in future years.

Yet another economist who thinks that if your house has gone up in price you're more wealthy. That's how successive Govts & the RBNZ got us into this mess in the first place.

It's still the same house. Money is the medium of exchange. Price inflation reflects the depreciated value of money due to a range of external input factors outside the homeowners knowledge and control.

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Milton Friedman

Exactly.

Btw he’s not an economist.

Anyone know his background before journalism? (finance/econ major?)

Was managing editor on this site wherein you can see his bio. Now runs his own show where he has a spot called "ask me anything". Don't count on getting an answer though, especially if you are not PC. I mean, who the hell purports to now everything. I've been in too many careers where know alls too often result in have caused disasters including dead people. Runs a talk in with an English journalist with a lot of name dropping. Once again, don't expect answers to "difficult" questions.

Thanks for that correction ;)

Is "economist" even a protected term.

If house prices crash by 30% or more, you'll have to eat your hat.

-30% by Christmas.

We're halfway there.

I think 30% by Xmas is too soon, sure H2 23

Yep very unlikely by Xmas ‘22, I agree.

25-30% down by May 2023. Cuts to the OCR will start to stabilise the market from around then.

Housemouse, you are a smart contributor.

I challenge you to do some research into previous house crashes and see whether a falling OCR did anything to stabilize a falling property market.

For example, look at the big crashes in Ireland, USA and Japan. During those price meltdowns, interest rates roughly halved. Falling rates didn't stop the crash. Pick any country that has experienced a big crash, and it is the same story.

This is one of the (many) reasons why reading articles by Bernard Hickey makes me feel like I am repeatedly slamming my head against a brick wall. Bernard talks about how falling rates will eventually "stabilize" a falling market when there is NO EMPIRICAL EVIDENCE that this is true. In fact, all the empirical evidence points to the opposite.

Bernard's writing is full of sloppy "reckons" that fly in the face of real world evidence. I reckon that you are smarter than that HM.

The problem with Bernard's sloppy "reckons" is that they lead people astray, and give people poor information to base financial decisions upon, when very large sums of money are involved.

Falling OCR eventually helps put a base in, but def not in like a 6 month period, "Something" helped put a bottom in all those crashes, maybe better prices, yields finally work with falling rates etc etc, dawn eventually arrieves... my gut feel is that the crash will impact building and construction meaning falling prices will linger into 2024/25 maybe longer... hard to see a NEED for more million dollar shiteboxes. I think the crash needs to last 3-4 years....

The crashes in the US and Ireland were very different situations.

If we do get a “crash” here I don’t think it will take very long to get back to its previous levels.

If you’re a speculator, you will struggle. If you’re buying and holding for 7-10 years you’ll almost always come out ahead at the end of it.

Have you studied the crashes of USA and Ireland, and are you able to say how they are very different situations?

Have you really thought through the reasons why you think any NZ market recovery won't take long?

Where did you get the 7-10 year time frame for "coming out ahead"? I just get the sinking feeling that you heard it at a BBQ, or read it in some Ashley Church or OneRoof waffle somewhere.

If you own property, then large sums of money are at stake. If you base your decisions on BBQ banter, or what a mate told you, or what someone like Ashley Church or Bernard Hickey "reckons", without actually testing their "reckons" against REAL WORLD DATA and really analyzing what has happened in real crashes in the past, then you have not done sufficient due diligence.

And always remember that people like Church, and publications like OneRoof, do NOT exist to tell you the truth. They publish specifically for the purpose of bullsh/ting and manipulating the sheeple. Don't be a sheeple. Do your own research.

Far too many people publish their "reckons" about what they "think" will happen without actually back testing their ideas against historical data. It is dangerous. Like driving a car with your eyes shut. Blind leading the blind, and all that.

Their "reckons" are based on wishful thinking and blissful ignorance, dressed up as informed fact. If they're correct, they'll incessantly gloat about it, but if they're wrong no worries it was a "burner moniker" they'll sign up with a new account and start talking about how anyone could see it coming.

Real estate agent told me some areas in Auckland have already dropped 35% and Christchurch is now going negative and with more than 3000 sections being developed in Selwyn I expect to see some major liquidations of developers.

Not just Selwyn....fair old number in Christchurch as well

I made a similar comment after the last budget, when many commented there was nothing in it for them. Do you need something?, I asked.none said they did.the COVID as shutdown and supply issues showed how much spare cash many have available, and suddenly couldn't spend. Have we become a nation of spoilt brats?

Quite a poor article in my opinion with lots of questionable statements. Granted, the author is presenting the ‘typical’ or average middle income household, but notwithstanding still too many generalisations and sweeping statements.

I think some are struggling on middle incomes, particularly families with young children who get taxed to buggery on their one good wage while the other is part time. You should be able to pay tax on the family income, so if you have 2 kids and 2 adults on one wage the thresholds should be multiplied by 4.

Yes, many in that situation which the author’s sweeping generalisations based on broad aggregate data don’t account for.

Actually what about 20k of threshold relief per child, that shouldn’t be too difficult to calculate or manage.

Like a tax credit based on having children?

A threshold credit to make sure that people that aren’t rich aren’t paying the high tax rates. (Yes I know we have WFF but you have to be pretty poor to get that or have a business to hide your money in).

Great idea as it rewards the TAXPAYER not the workshy beneficiary. Time to incentivise the productive members of society.

I don't even think the author is presenting the typical household. He is has cherry picked one that owns their own home with a small mortgage. That is getting less and less typical. If you are young and middle income you are ignored by this. If you are in that category what rational choice do you have but to go somewhere else.

"The real worry for banks is if there is widespread and high unemployment and/or some sort of wage deflation. Neither is the case, with unemployment at 3.2% and any young home-buying couple more than likely to be on high and fast-growing incomes."

Just even more evidence for the RBNZ to not be worried about raising rates then to curb inflation.

NZ stats - receiving unemployment benefit 93,000 Jobseekers allowance 183,000 and unemployment is 3.2% - Tui advert and thats not counting the underemployed. Check out NZ Stats site it has much useful information.

Is it just me, or has all that time spent at the Spinoff addled Hickey's brain?

Thought it was Newsroom

All working society is feeling financially pinched by inflation and bracket creep.

Unfortunately because New Zealand Government Revenue is more heavily reliant on income and sales taxes than most OECD countries inflation is a substantial disadvantage to our working population. Increases in cost of living are being lensed.

The lie of averages.

A pyramid is supported by its base.

Exactly.

When the median household income is ~90k and the median house price in the peak of November was $900k, it’s fairly clear that a predicted correction of 15% is off the table.

What’s more interesting is that we’re happily reporting on the class based system when talking about tax. In this country earnings and wealth (or the effect) are completely different metrics. What should be the middle class is divided between haves and have nots, the have nots are the new working class simply been shut out of personal wealth generation by means of asset bubbles.

So on one hand, low earners with 2-5 assets somewhat paid of is considered middle class (boomers) and the other high earners paying rent and shut out are working class (gen z, portion of millennials).

In my opinion, class doesn’t work in current state NZ. Tax is important for our society and lowering tax would be a mistake. But we can’t tell which demographics would be better or worse off as we are a society of haves and have nots.

While the haves greatly out number the have nots.......

What statistics is this based on? Census 2018 it was a fair even split 52/48 of people who own their own home and people who do not. Would be fair to say the state of the nation is not quite as rosey as 2018 too.

So just because you don't own your own home you are automatically a have not kind of loser ? I think there are plenty even on here that would disagree with that and tell us they are renting by choice. Stats would be most interesting by age bands. People in their 40's to 50's have generally "Made it" in life and those that have not would be a very low percentage.

Yep stats by age group are a great indicator, page 34

Most notable is the drop in ownership under the age 35.

And yep, those who have a home are generally haves, those who have no home are have nots. There will always be some renting who have a lot, and some who own who have very little.

We treat home ownership as a privilege instead of a right, anybody who argues any different are scrutinised.

not really

the following stats is from 4 years ago, so all those 15 yo guys now are in voting age

I am keen to say that we also lost some of the haves in the prev 4 years

have nots are going to be the actual thing at the next elections

https://figure.nz/chart/ydWBSIDOsLatM7Ep

INDIVIDUAL HOME OWNERSHIP

% OF PEOPLE AGED 15+ WHERE INFORMATION AVAILABLE

Do not own and do not hold in a family trust 48.23966802311%

Hold in a family trust 10.91059003677%

Own or partly own 40.84974194013%

Now take the numbers to the 40 plus you don't expect anyone even close to 15 to be in there own house.

Well... you have the right to vote at 18, not >40

Many (most?) of those "have not" will hardly vote for Nat... probably not even for Lab, given what they achieved so far...

The most likely outcome (this is only my opinion) is a left govt with extreme leftist ideas/programs, highly idelogical, most probably with also TOP and Maori party on board.

Will that be a good thing? I don't know, and I am expecting anyways not much from them, but nevertheless that is my bet.

1 person, 1 vote..

Luxon is toast, next up Nicola Willis with definite shades of Ruth Richardson.

Got some bad news for you bud, Luxon is our next PM.

Got even worse for you, no, he will not. He'd be an outright embarrassment to this country, and even the Nats are waking up to it.

I'm with you PocketAces. Luxon is a smarmy ex CE with ridiculously conservative values. I could never vote for a man or woman who is anti-abortion. Never.

Years ago one of my best friends was anti-abortion - on every other subject he was liberal / left-wing. I'm all for abortion or at least as far as a man can have and express an opinion but I have to admit there are good right-minded clear-thinking people who refuse to see past 'it is murder and therefore it is wrong'. Whether Mr Luxon is clear-thinking is a separate matter.

Why can't a man express an opinion on abortion? Its not just a women only thing, there is a life of a child at stake. Why does a random woman have any more or less say over somebody else's abortion than a random man. To me when its at the point being a few cells it seems ridiculous that considered murder, but at some point it does become a human and at that point it is murder. My body my choice, seems to be the non refutable argument, well its nonsense all laws I can think of tell you what you can and can't do with your body. I can't use my body to murder you. The good laws balance my right to do what I want with my body with the harm those actions do to others. We as a society should decide together what that line should be, based on the validity of their ideas, not the type of their genitals. Suicide is a much more of a only you law than abortion but we have very strict laws on when it is legal.

Yes women have to bare the child but the vast majority of caring for a child happens after birth, as a man I believe I am both legally (up to 18) and ethically (the rest of my life) responsible for my children, and if I am I should have a say.

Luxon like so many politicians reflect their personal views forgetting they are the electors representatives and as they clearly are not acting as representatives Binding Referenda is the way to curtail their personal egos over what electors want and what is best for NZ.

I want politicians to reflect their personal views, much more than what be a hypocrite state one thing and think another. He is allow to hold an anti-abortion view and state that its his view but he will not change the law on this matter. There is absolutely no politician I agree with 100% with. If we as a society want honest politicians we need to be accepting that they may not always believe in the same things.

The way it seems to me is I like this politician => what they say seems OK. I don't like this politician => what they say is totally unacceptable. We should judge people by the whole view not just fake outrage at random beliefs.

I personally do not quite Luxon but not because of his honesty about his position on abortion but more on my feeling that he is being dishonest about other things.

I thought so a month ago, not so sure now

You guys reckon not enough people hate Cindy yet? There's still time for things to get rougher between now and the election, surely that'd seal the deal.

My feel is National could shave a Chimp and they'd probably win on their "throw Pooh through the bars" policy.

Don't be so certain. Te Paati Maori are going to come through the middle here, and they will not be going anywhere near anything that includes ACT.

National have had the wind in their sails for a bit, but people are noticing that is all it is, wind.

Maori party through the middle… what tabacco are you smoking?

And the youth vote will be very strong next election, they are engaged and want their say in their future.

How many times do you think the 'youth' will vote Labour in the hope that they'll actually follow through on rapid transit, cheaper housing and being able to get ahead before they realised that they can't or won't do it?

For some reasons I have to deal with few 20yo peps.

It might be a bias of my network, but none of them is going to vote Labour... and Nats are synonym of Nazi for most of them.

Many of the new voters are going with Green, and some of them with TOP.

Some of the old voters will go vanish in the emptiness very soon.

Again.. this can only be my experience and I don't want to make it a meaningful statistic (is not)

But that is the feeling I had, anyways

Given that the Greens will never work with National, they're.... voting Labour then?

And that's the real rub though, isn't it. The Nats could but refuse to acknowledge the need, and Labour wants to talk about it to get elected and then not be expected to actually follow through in any way, shape or form, but still pretend they're better than National.

Not arguing with that.

I don't think any of them is well intentioned and even if they were I think they don't have what it takes.

The future will be defined by the random fluctuations of the fate.

They remember me of this guy :D

https://www.shmoop.com/study-guides/literature/little-prince/king

I guess if Greens got 15% then they could govern alongside Labour, and in that scenario a vote for Green wouldn’t *totally* be a vote for Labour as the Greens would have reasonable bargaining power.

Wouldn’t it be great to see national and the greens team up though. I think many people would love to see some of nationals economic policies along side the greens climate change policies.

The farmer vote probably makes this pretty much impossible though.

The backlash from Dutch farmers now supported by German/Italian & Spanish farmers against the Greens attempt to reduce fertiliser use and sieze farms that do not comply has galvanised many into action as it is pointed out food does not come from supermarkets but from farmers as Sri Lanka has found out. I found real enjoyment seeing the Dutch farmers spray the agriculture ministers house and the ministry building with sh*t, with the message we know were you live - ditto Sri Lanka. The Dutch Poooooolice using live rounds however is a step they may live (perhaps not too long) to regret and there is a message in all this for NZ - yes Cindy I am looking at you.

They will turn out in force for the Greens.

I lived through the sixties youth rebellion and it has been severely misinterpreted. The youth vote was and is conservative - it resists change - it is for the status quo - especially the students. The young rebels are a noisy minority. Giving the vote to young people and persuading them to vote will make serious change even more difficult to attain. Admittedly the stereotypical student voter wanting radical change for unimportant matters (eg gender neutral toilets) but resistant to serious issues (eg nationalise land as per Singapore) will be voting Labour because they are the party least likely to change anything significant.

Is there an equivalent word for ‘mansplaining’ but for economic commentators?

Bernard and Tony A being the prime offenders atm…

"Cut in half" sounds more accurate rather than "squeezed".

Agreed. Many friends in the middle with million plus or there abouts mortgages are not on easy street. This refers to those who bought a house 20 plus years ago.

In general, poor from Hickey. Too much fine print to mean anything really. That's why he's on Sunday I suppose. Sad to say, some of the posts not far behind either. Tomorrow will be a better day. Perhaps.

I think the "squeezed middle" tagline is ripe picking for Labour.

What does dropping the 39% tax rate have to do with the squeezed middle? If the middle is so squeezed, why do Nationals proposals give them crumbs, while hooking up those on high/v.high incomes?

Because apparently those high income earners carry so much of the tax burden that they deserve to have more of their tax dollars back......

....instead of addressing the real issue of why we have nearly half of all income earners receiving tax subsidies.

Luxon’s squeezed middle are people owning a few rentals or the people who have over extended on that $3M bach. How do I know this? Well his tax cuts don’t give major benefits until you are significantly over $180,000 or massively in debt on your rentals.

House prices are set by what the banks are willing to lend, not what individual buyers can 'afford'. From what I've observed, almost all the activity in the last three years has been buying and selling between people who already own property, even 'bank of mum and dad' should more accurately be called 'leveraging parental paper equity'.

So banks have been very willing to lend against paper equity gains in a rising market. On the flipside, what's the new 'stress tested' rate going into new mortgage calculations going to be? Will banks be climbing over each other to extend credit against paper gains when those gains are evaporating by the month? These are the factors that will dictate whether we stop at 15% or 50% on the way back down.

Excellent points. Wonder why the mainstream media can't spell things out so clearly? You could read 100 pages of OneRoof/Herald/Stuff waffle and see less truthful information about how house prices are set.

All those interest only loans that the banks were so willing to extend to specuvestors in a rising market... watch them dry up as the market falls.

I have found a house I like. It's been on the market since August. Been to auction, come back, now it has a number, and I feel like that number has a bit of fat in it yet.

There's a point at which I'll make an insanely low offer and see what happens. But we are not there yet.

Best of luck, hope you snag a bargain! Friends just sniped one for 10% below revised listing price last week, in total probably 20% below peak. This is in a town where the REINZ index says we're down 7.6% over 3 months, 3.6% last month alone. If you're any good at spotting the ones that need to sell (vs those testing the waters) it seems anything is possible right now.

Saying that homeowners have squirreled away another $1t in increased asset prices is cheating. For most of us that number is theoretical and only good for raising debt (and who wants that?)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.