Being old is more costly than ever according to new research.

It shows people's savings when they retire will have to be higher than ever to make up for the insufficiencies of NZ Super.

The research is titled Retirement Expenditure Guidelines, and is done every year by Massey's New Zealand Financial Education and Research (Fin-Ed) Centre.

The research divides retirement lifestyles into two main groups.

One of these is called "no frills", and refers to people who endure a basic standard of living with few luxuries or even none at all.

The other category is called "choices", and involves people with a more comfortable standard of living, and enjoyments such as trips to the movies.

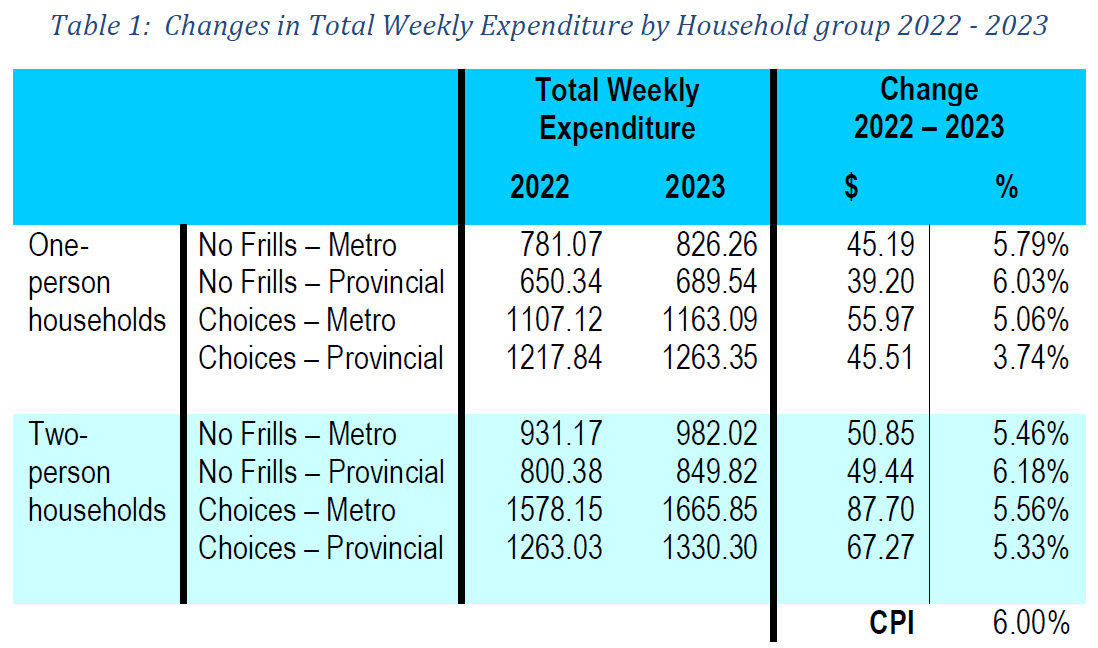

The distinctions are then broken down further into metropolitan and provincial residences, and further, into one or two-person households.

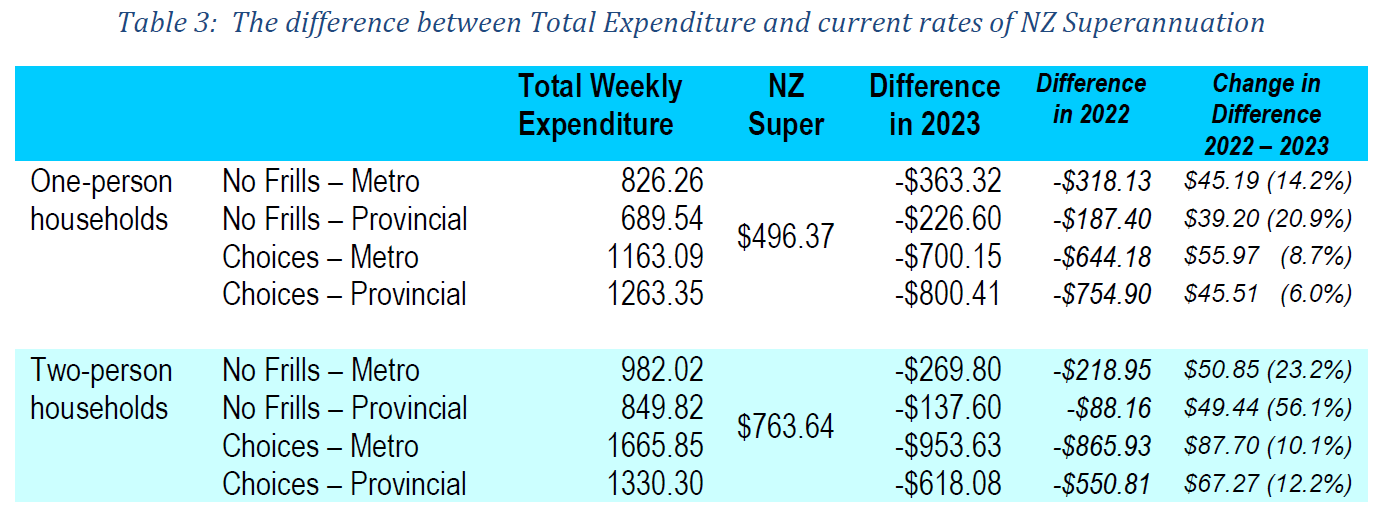

The report shows that in the past year, the gap between NZ Super payments and the cost of living is wide and getting wider across all these groups.

The report author, Associate Professor Claire Matthews, says New Zealanders need to consider the changing economic environment to determine the savings they need to achieve for their old age.

“While inflation has fallen compared to 12 months ago, it’s still higher than recent experience and cost of living remains a big issue," she says.

"Most New Zealanders aspire to a better standard of living in retirement than can be supported by NZ Super alone......so regularly reviewing retirement plans is a must.”

The figures produced by Matthews and her team show the pension is not enough in all circumstances.

Not even a single person, living "no frills" in a rural area can get by on the pension alone. This lifestyle has sometimes been described as a man living alone, eating baked beans, in Eketahuna.

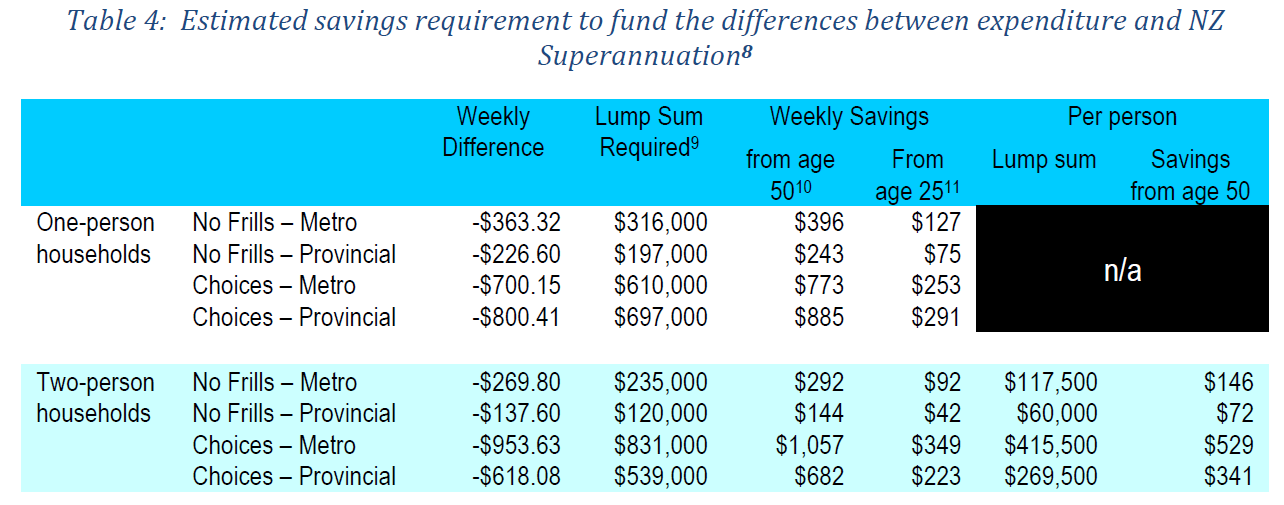

The cost of doing so would be $689.54 per week, well ahead of the single-person pension at $496.37 per week. The lump sum required at retirement to meet this cost is $197,000, assuming life expectancy of 90.

For a couple, living the "choices" lifestyle in the big city, the difference is much greater. These people are sometimes characterised as an active couple, living a full life in Ponsonby, who enjoy holidays, trips to the theatre and a daily latte.

For them, the weekly cost of living is $1665.85, far higher than the pension for a couple of $763.64 a week. The lump sum at retirement to fund this would be $831,000.

And the challenge is growing, with the difference between the pension and actual expenditure increasing from last year to this year by a margin that varies from $39.20 a week to $87.70 a week, depending on the category.

All pension rates are based on a tax code of "M".

Matthews says the figures show households forced to rely on other incomes, or on drawing down their savings and/or investments to bridge the gap.

"The key inflationary drivers for superannuitants over the last 12 months include food, recreation and culture, housing and household utilities and insurance for all household groups," she says.

Matthews adds food remains one of the largest expenditure classes for households, accounting for 12 to 22 per cent of total expenditure. The Consumers Price Index (CPI) increase for food was 12.3%, more than twice the overall CPI of 6%, and as a result, food was a notable contributor to increased expenditure, making up 35% to 43% of the total increase.

And insurance accounted for 6% to 9% of households’ total expenditure.

32 Comments

Time for my annual reminder that this report does not tell you what you 'need' to have in retirement. It tells you what current retirees - who are likely to be collectively the richest group of retirees in history - actually spend. From the report:

The No Frills Guidelines are based on the average expenditure of the second quintile of the HES for retired households, while the Choices Guidelines are based on the average expenditure of the fourth quintile of the HES for retired households.

The easiest way to see how ludicrous this is is to take out housing costs and compare. The housing costs for a single person household are between $214 and $252 (later for one person metro no frills). The 'no frills' budget overall for this one person metro no frills group is $826. So total after housing costs is $574.

I make six figures, now own my own house in a city, have rented on my own in one of the most expensive suburbs in Auckland, and I've never spent anywhere near $574 a week after housing costs. That's more than the total I spend weekly now (not including mortgage, but including the things the report counts as housing costs - rates, insurance, maintenance, energy). I travel domestically at least once a year, eat out or get takeaways 2-3 times a week, have unlimited internet and Netflix etc.

So this report doesn't tell us what you 'need to have'. It simply tells us that current pensioners - even those in the second quintile - are doing reasonably well. Given some rough calculations (assuming an average salary of 65000 a year, and rent for a 1 bedroom place in a major metro at $400 a week) the 'no frills' pensioner has pretty much the same level of disposable income after housing as the single working person.

I've been retired from full time work now for 8 years (since age 60). While I have substantial savings my target budget is NZSuper ~$500/wk (living alone). This covers basics with no extras if you own your modest home debt free. Its a lot more doable as a couple with joint Super of ~$800/wk however I've been a widower for a couple of years now.

al123,

Even if electricity/gas goes into housing costs, here's your $574:

Food & Hygiene: >$250

Phone & Internet: >$24

Car (fuel, WOF, repairs, insurance): ~$100

Health (insurance and/or bills): >$60 (more when you're older)

Basic social life: > $70

Buffer for unplanned big expenses: >$70

Some can do without a car, it depends where they live.

In your case specifically, living in an expensive part of Auckland and eating out/takeaways 2-3 times per week it's hard to see how you'd spend any less than that.

I don't live in Auckland now, but in a different city. I'm not prepared to give a line by line breakdown of my expenditures on the internet, but you've got quite a lot of assumptions in there. I don't know what you mean by 'hygiene' for example (do you mean things like shampoo etc that would ordinarily be got with the shopping?) But your number for that is double what I spend on all supermarket items + takeaways in a week. I also don't own a car. Your 'basic social life' expenses are also nearly double mine, and you can get phone and internet for way cheaper than that. That's just cut at least $260 off your $574. (So you could even add a car back in and still be quite a bit under that!).

Remember also the $574 for retirees is meant to be a 'no frills' existence - would you really count $250 on food etc as 'no frills' for one person???

I don't know what you mean by 'hygiene' for example (do you mean things like shampoo etc that would ordinarily be got with the shopping?)

Yes. Shampoo, toothpaste, cleaning products, cooking oil, etc., stuff you don't necessarily buy every week but which bump up the total spend when they are bought.

your number for that is double what I spend on all supermarket items + takeaways in a week

That's simply not credible, once you add in the non-weekly stuff averaged over the year. Maybe you can do it, but it's a poverty budget not a no-frills budget.

I keep pretty detailed records of these things because I like keeping an eye on what I spend - my current totals so far this year are an average $36.50 on takeaways per week, and an average $80.70 on groceries if you really want the details. This certainly doesn't feel like a poverty budget to me. I do make some effort though to take advantage of specials (e.g. when Countdown has Watties baked beans on special for $1 a can like they did a few weeks back, I'm buying loads). I also make yoghurt and sometimes my own bread because it is fun - but I also sometimes buy Vogels). I also don't eat meat every day - I'm not vegetarian, but I quite like things like dal makhani, which isn't hard to make. I guess we have different ideas of what counts as a 'poverty budget', but I don't consider the occasional lunch of baked beans on toast and sometimes having a homemade vege curry for tea 'poverty.' If that doesn't seem 'credible' to you, there's not much more I can say.

It's obviously significantly more difficult than it is for me who have kids and people who are way more time-pressed than me (I work from home some of the time, which definitely makes things like making bread etc easier). So I understand that there are heaps of reasons why other people might have more expensive grocery bills than this. But it seems to me that the average pensioner is not likely to be in that kind of situation (and lots of the ones I know blow me out of the water when it comes to being clever with food costs - gardening, baking, preserving etc).

This Otago Food Cost Survey report might interest you as well, as it's a bit more robust than my sample size of one. According to this, the estimated weekly food costs for a man eating a 'liberal' (which includes things like berries, steak, salmon, and specialty cheeses) is $149 a week. They don't do non-food supermarket 'hygiene' items, but they do cite some Stats NZ figures of $35 a week for these for a family of four. So even if we add that whole amount to our hypothetical man's budget, we're still only at $184 a week. Out of your $250, he'd have $66 to spend on takeaways. So I don't think it's realistic to claim that $250 on food+hygiene is a 'poverty' budget at all! (Interestingly, I'm not far off the moderate budget for someone like me with my total food spend, once I deduct $10 or so off my grocery spend for hygiene items).

This is all quite interesting. Can I ask you both, in hindsight would you do anything differently? I can live frugally, but then nature hates a vacuum and I will go nuts on big ticket items and travel, so I'm a bit of a contradiction. Still, I think I would rather go out in a fireball than budgeting for takeaways (that's not a criticism). Like keel over at Scorpios in Mykonos at 4am sort of fireball.

I'm still quite a ways off retirement - and there are heaps of things I would probably do differently if I was 20 years younger (bought a house way earlier, for one - and a partner would be nice, for more than just financial reasons). In terms of spending it would be nice to have more money - and I could spend more on stuff if I wanted to I suppose (and the moment I am massively overpaying my mortgage to try and knock it off quickly). But I don't really feel that deprived living pretty frugally - it helps that I'm not really a 'foodie' (I'd just as happily go to the local Indian place than go to a fancy restaurant). It's also a bit of a hobby of mine getting nice things for cheap off trademe etc. I'm also not into travel very much - I'd much rather spend a week visiting family in NZ than on a beach in Thailand for example. I would like to have more money to spend time with friends and family, but given I'm a millennial pretty much everyone I know is in the same boat of living pretty frugally, given the expenses of houses/kids. So right now the life stage I am at involves a lot more children's birthday parties and catch ups at home over coffee than nights out on the town and concerts, which cuts down on socializing costs. To be fair I did spend way more money on those kinds of things (nights out with mates, holidays with mates) when I was younger, and I'm glad that I did.

Edited to add: I also think it's way harder to live frugally when you have to rather than because you choose to. There were times when I was younger when I had to live off a really tight grocery budget because I just simply didn't have the money. Now my food spend is reasonably frugal because I would rather spend that money on other things that are important to me (like knocking off the mortgage), and I know that if I have a shit week and just want to go to the supermarket and buy whatever I want that week, or I'm sick and I want to get a load of nice food delivered from Countdown so I don't have to cook for a few days, I can afford it if I really want to. That turns frugal grocery shopping into 'fun game that lets me spend money on other things I want' rather than 'miserable reminder that I'm really broke and can't have nice things.'

Thanks. There is tradeoff between enjoying yourself and making sure your kids and partner are looked after. Interesting you say you would have bought a property earlier, I started buying early and forever grateful I had the forsight/discipline to do so. I have also had a couple of close acquaintances pass away in the last month, late 40's mid 50's. All they did was work 60 hours a week for 25 years. I can get a lot of enjotment out of catching dinner, hiking and mountain biking - all quite cheap.

al123, I like your style, thanks for sharing.

Most of that is pretty reasonable but $250 a week for food/hygiene seems crazy high.

Who seriously has that amount of savings.

Retirement as a concept really only came in after the world wars, and even then only in limited parts of the world.

For most it is something they will never achieve.

"I will work harder!"

Step right up folks, it can all be yours and more.

On Tuesdays, there's muffins in the break room.

I love how people are basically acknowledging the disconnect between CPI & Real world declines in purchasing power. They forgot to mention how insurance has increased 20%, $3.30 a litre of petrol. What a clown world we live in.

"The Consumers Price Index (CPI) increase for food was 12.3%, more than twice the overall CPI of 6%, and as a result, food was a notable contributor to increased expenditure, making up 35% to 43% of the total increase"

The CPI is really the RBNZ's CPI as it excludes many housing costs related to finance. And yet media quote it all the time.

Kiwis aren't that bright.

It will never cease to amaze me how people get so offended at it costing 4 hours minimum wage to fill a tank that will get you ~500kms.

Imagine if you had to figure out a way to move that vehicle yourself without imported fuel on tap. Hint: it would cost you a lot more than 4 hours of your unskilled labour.

Now think about the fact that oil is a finite non-renewable resource that is getting ever more expensive to extract.

Using fuel is remarkably cheap considering its benefits to you and its costs to future generations. How arrogant to think you deserve it even cheaper.

Let's be real here $18.90 after income tax, x4 = $75.60. Your statement means you're talking about a car that does 22km per L of fuel

Let's do it properly, average car for a minimum wage worker 13km per L (being generous), would take 38L to get 500km driving. That'll cost at $3.15 per L $121, so it's 6 hours.

$480 rent for a room per fortnight = 25.4 hours. + 6 hours of working for fuel. 250km per week is pretty average for most in a city.

31 hours for just rent and fuel out of 80 hours worked. 49 hours worth of work left for everything else plus any little savings you can do

Should we continue with insurance, food etc?

$18 billion a year on NZS is not enough then, I guess we better double it.

One more interesting comparison - who would you think has more disposable income after housing costs? A 'no frills' pensioner couple living in a metro area, or a double income no kids couple both working full time earning average salaries, contributing the minimum to kiwisaver, who just bought a lower quartile home in Wellington (based on first home grant caps) with a 20% deposit.

If you guessed the DINKs, you'd be right - but only just. They have $5 a week more. That's assuming neither of them are still paying off a student loan.

And one more, just for fun: what kind of money do you think you would need to earn to replicate the disposable income of the 'choices metro' couple? Well, imagine you're a DINK couple who has bought a lower quartile house in Wellington (Upper Hutt maybe). You'd need a household income of $176k before tax. I mean, how terrifying to find out that unless you save well over $800k for your retirement you won't be able to afford the same sort of treats as a couple who collectively make $176k, who have no kids, and are paying the mortgage on a modest house in Upper Hutt.

looks like if you own your home mortgage-free and have just shy of a million then you are fine,isnt that an argument for means testing?

The only argument against means testing is entitlement.

They however aren't entitled to Gold Card benefits as they are a more recent thing. Such as free offpeak travel (free prescriptions under National) etc. They should all be income test IMO.

No they'd argue that someone with a million in the bank is more deserving of NZ super than someone who retires with nothing, as it demonstrates in all likelihood that person with $1m paid considerably more taxes over their lifetime.

You see, Gov Super is seen as a loyalty rebate scheme by old people, not a benefit or a form of welfare.

Correct. By paying into the tax system, the government is obliged to provide it, that is part of the social contract that they have for taking taxes at the rate they do. Apparently, they have the smarts to ensure that the money is managed correctly so that then they can pay a pension in retirement. I beg to differ on that one, and the evidence is pretty clear.

Anyhoo, I understood at the age of 20 that the government could not be trusted to provide a decent retirement anyway, so put in place a retirement savings scheme, self-managed, and it has accumulated roughly 2.5x what is needed for this choices retirement. I have roughly 20 years of work to go and the house etc is paid off.

It's not hard if you start young, and of course, it is not in KiwiSaver so it cannot be means tested as easily as KiwiSaver will be should there be means testing in the future.

I know plenty of people that have saved nothing, and will obviously suffer in their retirement, and that is sad because they have good well-paying jobs. It is also very sad that what is quite a serious issue is hardly even mentioned as part of the education system and many people assume that our national Super will provide them with some sort of golden years. It won't, and that is a serious issue.

A lot would have got the money from tax free capital gains. Eg on rentals

Our large current account deficits are draining financial resources from the country and this reduces our ability to save and we also have large household debt owed to the banks and so this only leaves government budget deficits as a source of our net savings. Having the government running budget surpluses would put households in an even more perilous financial situation.

https://theconversation.com/how-government-deficits-fund-private-saving…

life expectancy of 90......average death in NZ is 82. Why use 90 is it to be more alarming in the numbers they publish

Meh. I live a very modest lifestyle and live kinda frugally, but with plenty more room to tighten my belt if necessary.

I've been on Supported Living Allowance the last 5 years nursing my mum through her final years. We split household expenses.

She ends each year with $10,000 surplus (unused) from her pension.

I roughly break even with my ~26K gross income, but that's with a long term investment taking about $9k per year out of my pocket and Kiwislaver taking another $1k, so essentially I could live on $16k, with further room to cut expenditure (booze, takeaways mostly) if necessary.

Personally I think these 'reports' are a load of manure, designed to get people to boost their savings/investments beyond where they could reasonably sit.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.