New Zealand’s uber rich appear more secretive than those in Australia, the United Kingdom, the United States, China and Russia, according to new research, which suggests they’re more likely to use blacklisted offshore financial centres and conceal their identities.

In a new research paper, Ho-Chun Herbert Chang, Brooke Harrington and Daniel Rockmore from Dartmouth College in the United States, analysed two publicly-available datasets: The Offshore Leaks database from the International Consortium of Investigative Journalists, and the World Justice Project Rule of Law Index.

The Offshore Leaks database includes information from documents like the 2016 Panama Papers, the 2017 Paradise Papers and the 2021 Pandora Papers.

By also looking at the World Justice Project Rule of Law Index, the researchers were able to analyse data on countries and their levels of civil and criminal justice, corruption, government transparency and regulatory enforcement.

The researchers found there are distinct patterns for elites to achieve offshore secrecy across 65 countries.

“Our analysis examines the institutional conditions that motivate elites’ use of the offshore system, with emphasis on the roles of corruption and rule of law in their home countries,” the researchers say in Secrecy strategies: Global patterns in elites’ quest for confidentiality in offshore finance.

When it came to measuring secrecy, they looked at three things: diversification in the use of offshore financial centres, the use of identity concealment strategies, and the use of blacklisted offshore jurisdictions - including the diversification in the use of blacklisted jurisdictions.

The results

The researchers found “elites from countries in Europe and the Middle East make little use of blacklisted offshore financial centres - except when their overall offshore diversification increases”.

“In contrast, elites from the rest of the world (Americas, Asia, Eurasia and Africa) show the opposite pattern: the more use they make of blacklisted jurisdictions, the lower their overall offshore diversification.

“This means elites from those four regions tend to concentrate their assets in just a small number of blacklisted offshore centres.”

When it came to allocating offshore assets to blacklisted jurisdictions, elites from Peru, Thailand, Indonesia and Malaysia allocate 70% to 90%. Elites from Mexico, Brazil, Russia, India and China allocate about 30% of their offshore assets to blacklisted offshore centres.

Meanwhile, elites from Europe and the Middle East rarely put their assets in those jurisdictions.

In the research, the British Virgin Islands was pointed out as an offshore destination.

When it came to identity concealment strategies, the researchers say it is “equally surprising in that we find the highest uptake among an unlikely assortment of countries: Sweden, Iran, Poland, Belarus, Kazakhstan and Germany”.

Chang says "what stood out to me the most was that it wasn't just bad governance that produced offshore use - such as due to fear of confiscation - but also good governance".

"In countries in Northern Europe, where taxes are high and transparency is high, such as public access of tax returns, these are also factors that could push people toward offshore use."

What about New Zealand?

The researchers had a sample size of around 2000 elites from New Zealand.

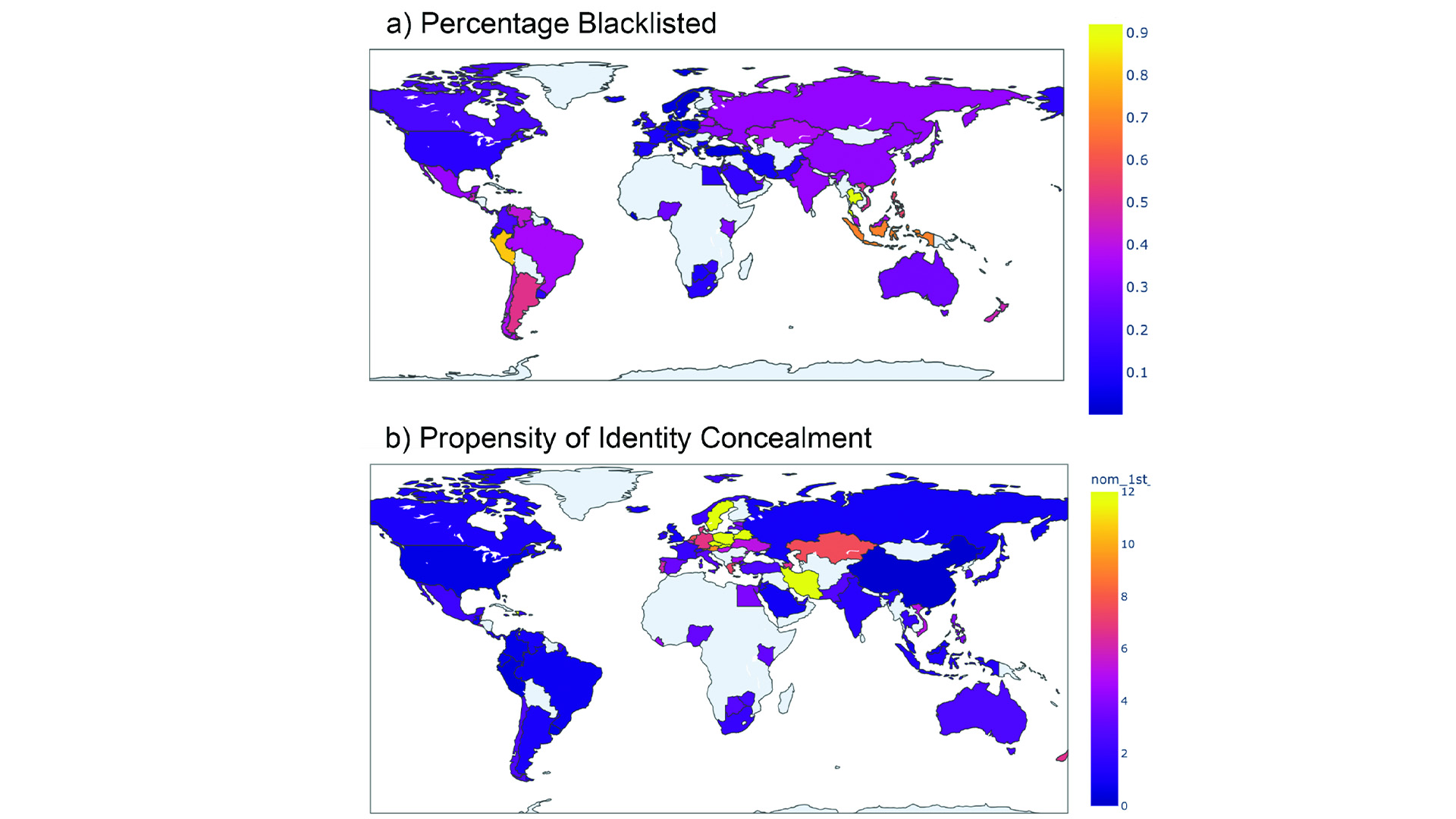

Figures in the paper show where New Zealand sits in comparison to other countries when it comes to showing the percentage of blacklisted jurisdiction use and propensity of identity concealment.

Looking at the figures, New Zealand is ranked higher than countries like Australia, the United Kingdom, the United States, China and Russia for both identity concealment and percentage blacklisted.

Chang says one possibility is due to New Zealand's proximity with access to known tax havens, given its location in the global south.

"This could also be more about these larger countries - for instance, there are well-known domestic tax loopholes in places like USA and the UK already."

In terms of top three jurisdictions that New Zealand elites appear to favour, Chang says it's Samoa, Bermuda and the British Virgin Islands.

Another possibility as to why New Zealand scores high for identity concealment and blacklisted jurisdictions could be a combination of New Zealand having a strong rule of law and proximity with Samoa as an offshore financial centre, Chang says.

Overall

The researchers say their analysis has three main results:

- When elites come from countries high in institutional corruption, they are more likely to spread their assets across multiple offshore financial centres, the researchers say.

“They diversify, in what might be called a ‘don’t put all your eggs in one basket’ strategy'.”

- In countries where the risk of government confiscation of assets is high (because of a lack of civil rights or strict law enforcement), elites make “heavy use of secrecy strategies” that conceal their identities as asset owners.

“This includes the use of anonymous bearer instruments, as well as the employment of nominees to shield elites’ names from discovery in public records.”

- Elites from both types of countries make frequent use of blacklisted offshore financial centres.

“Blacklisted jurisdictions are countries sanctioned by international bodies like the OECD or European Union for their high levels of secrecy—refusing to share information—and for facilitating tax avoidance and evasion.

“Using them to hold assets entails considerable reputational risks and increased transaction costs for elites,” the researchers say.

Their most “counter-intuitive finding” is that elites’ use of offshore finance can be driven not only by poor governance in their home countries, but also by good governance conditions as well.

'One dimension of an evolving shadow financial system'

Chang says the issue of tax evasion is one of the most critical ones for democracies today.

More research is needed to confirm any cause-and-effect relationships between home-country politics and offshore strategies.

In a media release, Daniel Rockmore, one of the authors and a professor of maths and computer science, says the overarching goal of this work is to better understand the patterns of “secrecy” implicit in offshore investment.

“We see this as just one dimension of an evolving shadow financial system that serves the elites, often at the expense of average taxpayers."

“We hope that our results will be useful to policymakers concerned about this kind of financial drainage," Rockmore says.

*This article was first published in our email for paying subscribers early on Monday morning. See here for more details and how to subscribe.

3 Comments

With the release of the Panama papers et al, and the links to NZ residents, I have not seen any prosecutions. Perhaps we no longer have the skills @ IRD to run a successful prosecution?

I am always intrigued by the apparently successful people who would rather gamble on the chancers in Samoa or elsewhere than pay 28% in NZ with the related security/ POM. Of course, proceeds of crime is another matter. If the latter, how has the NZ banking system AML allowed this? Interesting.

And how about including some jail time for the lawyers and accountants who make this all possible?

Lawyers run the show in NZ. Self regulating and self serving.

New Zealand has a culture of secrecy, particularly around money: when was the last time you heard a candid conversation about how much a person earns?

Such secrecy is empowering for groups who control capital and supports the idea of financial high priests.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.