The Commerce Commission’s annual telecommunications report is out, covering the 2023-24 year. It provides a snapshot of the telco market in New Zealand for that period of time, spanning 292 pages of detail.

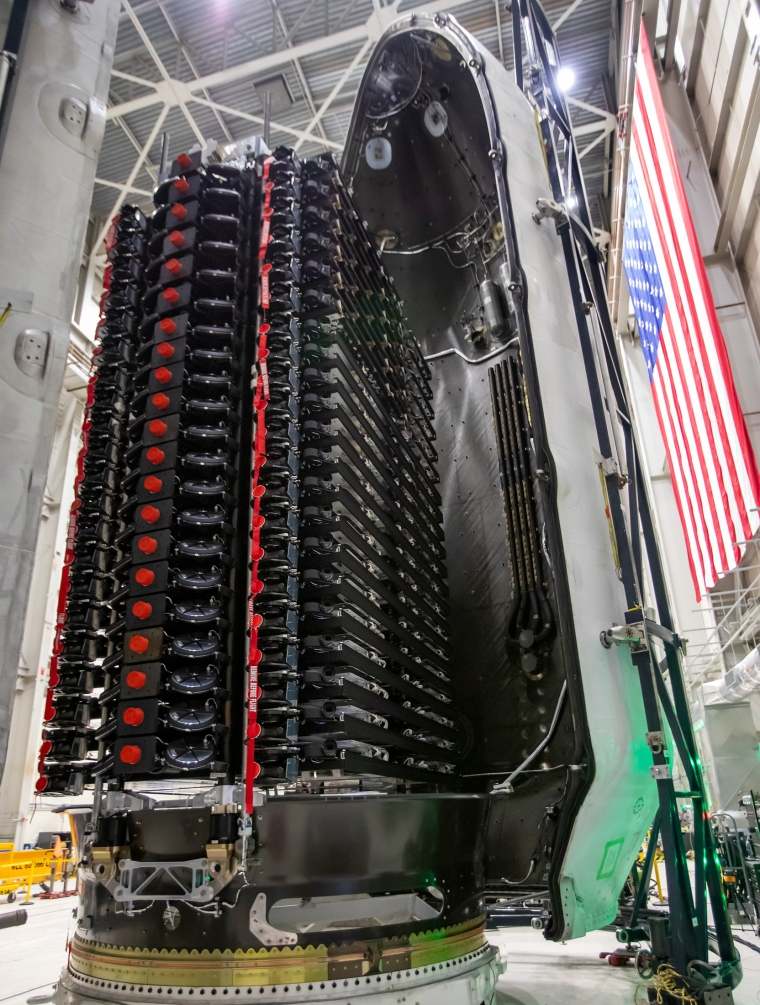

An immediate standout in the report is the growth in satellite broadband connectivity. Particularly so for Low Earth Orbit (LEO) satellite service, which in New Zealand means Starlink via Elon Musk’s SpaceX.

The Commission tallied up 58,000 satellite connections in New Zealand in the 2023-24 year, of which more than 57,000 were Starlink. That’s up from 37,000 in the preceding reporting period, a whopping 54.5% growth since then, and close to 19% of all rural connections.

This makes Starlink the third-largest rural broadband provider in New Zealand, after One NZ, Spark and 2Degrees, which have 55% of the market. Wireless internet service providers (WISPs) meanwhile have 16% of the market.

Whether or not Starlink can sustain such a rapid rate of growth over the next few years remains to be seen, but it looks like an increasingly popular option for rural and remote broadband customers.

The Commission noted that as subscribers switch away from copper service, equal numbers look to LEO satellite broadband as they do to a 4G wireless option (40%).

One reason potential customers might be tempted by Starlink is service performance. The Commission also says “24/7 download speeds for Starlink (214 Mbps) are approximately four times faster than the next best rural alternative that we measure”.

Being connected is expensive outside urban areas. On average, rural and remote users pay 29% more for broadband connections than their urban counterparts do, according to the Commission’s findings.

Mobile virtual network operators not gaining market traction

New Zealand’s mobile phone market continues to be dominated by the Three Telcos: One NZ, Spark and 2degrees. They have 97.5% of the market, a figure that’s only budged by 1.1% over five years.

There are mobile virtual network operators (MVNOs): these buy wholesale access to mobile networks, and then market their offerings to consumers. One NZ has seven MVNO customers, Spark and 2degrees two each.

The Commission noted that the MVNOs’ market share is at a high, but it’s a mere 2.5%. Compared to the rest of Organisation of Economic Cooperation and Development (OECD) economies, New Zealand is in the bottom eight of MVNO penetration.

Perhaps related is the very low rate of switching of providers by NZ customers: just 5% did so last year, down from 6% the year before. Inertia is the word to describe mobile customer behaviour, with two-thirds having been with the same provider for more than five years.

In telco jargon, customers switching providers is called “churn”. Telcos do not like churn, but it is in customers' best interest to look around for better deals; it does seem people don't do that however.

Apart from older customers being reluctant to switch providers, what is holding people back from swapping telcos then?

“We also see tactics in the market that make customers more ‘sticky’ to their provider – for example, where credit in a virtual wallet can only be used towards a new phone and where bundling services means customers are less likely to leave,” the Commission wrote.

Despite being available since December 2019 when One NZ (then called Vodafone NZ) switched on its 5G network, with Spark coming to the party the following year, the Commission said the average reported 5G geographic coverage is only 1.2%.

In fact, the landmass coverage hasn’t budged much from 2023, when it sat at 0.8%. That’s because 5G is available mainly in urban areas, and not outside. It means 40% of the population have 5G coverage.

Meanwhile, 4G sits at approximately 55% landmass, and 98% population coverage. The 3G network will be shut down this year, with radio-frequency spectrum being freed up for 4G and 5G service.

Telcos selling off their cellular towers to Connexa and Fortysouth, which have committed to building new sites over the next decade, should also help with the landmass coverage. There’s also the Rural Connectivity Group that was set up by the three telcos, which has its own tower network that Spark, One NZ and 2degrees share, and which is growing bigger.

Power companies bundle services to make inroads in ever-faster urban broadband market

Fibre broadband is where it’s at in towns, with 83% of customers using the fast and scalable fixed network access technology. The most popular fibre plan is the current 300 Mbps downloads one, but the 50 Mbps budget offerings and Fibre Max (950 Mbps) are also growing.

The above numbers will look different in the next Commerce Commission telecommunications report: Chorus, Northpower, WEL and Enable are upgrading the lower-end plans currently.

Customers on the 50 Mbps plans will shift up to 100 Mbps downloads, and 20 Mbps uploads; customers on the 300 Mbps download speed plans will get 500 Mbps down and 100 Mbps up.

The three big players in the fixed broadband market are Spark, One NZ and 2degrees which have 73% of the market. Their market share is being nibbled away by new entrants, the Commission said. In particular power companies like Contact Energy and Mercury, which now have 13% of the market, thanks to bundling services together.

Perhaps a little surprising is that despite the UFB fibre network build, fixed-wireless access options and satellite broadband, almost 10% of households (around 170,000) don’t have fixed broadband. Affordability is a big factor here, but some just don't have access to broadband, like some rural areas that never even had copper connectivity.

Students quite often stick to mobile broadband, and yes, there are people who simply like not being connected.

More competition for a slice of a smaller telco cake

The 2023-2024 year saw total telecommunications retail revenue hit $5.69 billion. That’s up a small amount from the year before, when it was $5.63 billion.

This despite increasing connection numbers, and people using telecommunications services more than in the past (with the exception of text messages, which have halved in a decade).

Nominally, the overall telco sector revenue figures for the past decade look like this:

If you adjust for inflation, the $5.17 billion 2013-14 revenue would've needed to become $6.98 billion at the end of 2024, the Reserve Bank’s consumer price index calculator suggests, to match what the telco sector brought in a decade ago.

Instead, the 2023-2024 sector revenue was $1.29 billion lower than the $6.98 billion, a decline of 18.5%.

This suggests that the regulatory environment, along with competitive pressures from new entrants might just be favouring consumers, who are getting much higher data speeds and “endless” caps now.

4 Comments

So NZ customers are inert with little churn?

And yet Starlink has picked up huge numbers quickly. That to me shows how atrociously bad rural broadband is.

Starlink provides our household of four work from home or student adults, plus two teenagers, with as much as we can eat as fast as we can eat it.

I think it's $40/ month more than we were paying at spark but then spark wasn't working at all for just two of us.

I am the same on copper VDSL but they are moving away from copper so might as well bite the bullet now, will be about $40 a month more but about 4 x the speed

It's a 'no-brainer' I would say. I wouldn't buy a property that didn't have good Internet access and Starlink provides that to rural communities. I'd go without luxuries, even food, before I went without decent Internet.

Starlink on the $79 per month is serving me well.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.