There’s no end of commentary in Australia about the cost of buying houses. There’s always much less focus on the cost of renting them.

But the rental market is increasingly grabbing headlines as vacancy rates reach new lows throughout much of Australia and rents continue to rise.

This matters because more than 30% of Australians are now renters, approximately a quarter from private landlords. And the numbers are increasing.

As in many developed countries, the level of home ownership is falling, particularly among young people. According to a recent Productivity Commission report, the percentage of households under 35 who own their home dropped from around 44% in 1997-98 to 36% in 2019-20 – “more Australians are renting, for more of their lives”.

The latest data from SQM Research shows that the national vacancy rate for residential rental accommodation was just 0.9% in September. That’s the lowest vacancy rate since 2006.

According to CoreLogic, the total supply of advertised rental accommodation is currently more than a third below the five-year average. This is partly attributable to a drop-off in investors purchasing rental properties between 2017 and 2020.

Low supply is inevitably flowing through to higher prices. SQM Research data reveals that asking rents in Australia’s capital cities rose by 1.4% in the 30 days to 12 October. The rise for the year was a remarkable 21.8%. Unsurprisingly, the capital cities are outpacing the regions.

Domain says that “Australian tenants are suffering through the longest stretch of continuous rental price growth on record … the highest growth ever, both annually and quarterly”.

Low supply of rental accommodation is not the only cause of rapidly rising rents. Escalating demand is also a factor. Much of that is the result of a dramatic turnaround in both immigration and foreign students enrolling in Australian universities.

Because of extreme labour shortages post the Covid-19 pandemic, the government has made a priority of bringing back migrants and students. It has raised the permanent migration program by 35,000 places in the current year and invested heavily in clearing the visa backlog that existed when it took office in May. In the last four months alone, the Department of Home Affairs has ruled on more than two million temporary and permanent visa applications, including for students and skilled workers.

Permanent arrivals have recovered from the depths of the 2020-21 period and are now running near pre-pandemic levels.

Foreign students are also returning in significant numbers. This reflects monthly student visa applications in the first half of 2022 that exceeded pre-pandemic levels.

Clearing the backlog of student visa applications is just part of a concerted effort to revitalise the education sector. Education was a major export market worth more than A$40 billion in 2019 but slumped to less than half that amount during the pandemic.

According to the latest Times Higher Education Index of World University Rankings 2023, seven Australian universities are now in the world’s top 100 universities. However, the competition for lucrative international students is intense and both the government and universities recognise the need to reconnect quickly with that market.

While the recovery in immigration and foreign student enrolments is good for the economy, it spells trouble for the residential rental market, particularly in the capital cities which attract most of the students and new migrants.

There’s only one practical solution – increasing the supply of rental accommodation. As Louis Christopher, Managing Director of SQM Research, puts it, “there remains a structural issue with the rental market which increases in construction of new dwellings will only resolve”.

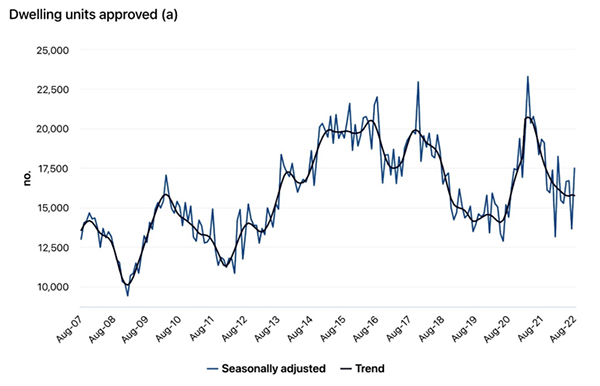

Unfortunately, the prospects for construction solving the accommodation shortage in the short term are not encouraging. Data from the Australian Bureau of Statistics shows a sharp drop off in the approval of new dwellings over the last two years.

Source: Australian Bureau of Statistics

Even if approval numbers pick up again, the long lead time for construction means that a significant increase in supply will be delayed.

And approvals do not equate with actual construction. The current environment is far from ideal for developers – economic uncertainty, frequent failures among building companies, rising interest rates, and building costs increasing at the highest rate in more than two decades.

Charter Keck Cramer’s analysis of apartment construction in Sydney highlights the current shortage. In the financial year to 30 June 2022, construction commenced on just 7,700 apartments. According to CKC, “this is the lowest number of apartment commencements recorded over the past decade and represents a decrease of 75% from the peak of 31,000 apartments in FY 2017”.

It’s no wonder that residential rental growth is so strong in Sydney.

And yet the price of both houses and apartments continues to fall. For the moment at least, the rising yield on residential property is more than negated by the rise in interest rates.

Many renters have no prospect of ever buying a house, so their concern is with house rents rather than house prices. For some, those rents are becoming increasingly challenging.

The Productivity Commission says that Australia has a housing affordability problem – “Australians, particularly those on low incomes, are spending more on housing than they used to. Many low-income private renter households spend a large share of their income on rent.”

Brendan Coates of the Grattan Institute provides an in-depth analysis of this problem in his sobering paper ‘The Great Australian Nightmare’.

More than half of low-income Australians in the private rental market suffer rental stress, especially those in the capital cities. … One in five working-aged households who rent are in financial stress, defined as skipping a meal, using charity, pawning something, or not heating the home.

The federal government faces a painful dilemma. It needs immigrants and foreign students to solve a chronic labour shortage and to stimulate the economy.

But those same arrivals are exacerbating an emerging rental crisis, never a good look for any government, let alone a newly elected Labor one.

Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

17 Comments

ABC 4 Corners did a sobering documentary on this recently. It's available on YouTube. We give the homeless a motel room on Fenton St, in Aussie they get given a tent. Adding to the population thru immigration when there is already a dire shortage of accommodation is just cruel. Unless you are a landlord jacking up the rents over 30% a year.

We own a property on 1100 in the Eastern suburbs of Melbourne. We can't build a second dwelling on it due to subdivision size environmental overlays. We no longer have any canopy trees on the property, the ones we did have were non indigenous and fit the rules for removal(they were so close they were doing damage to the structure/brickwork as their roots were sucking moisture from the ground around and under the building). We have left only one old fruit tree towards the back of the property. If we tried to gain approval to build a low profile duplex, something that blended with the environment, took up not a significantly larger footprint of the property and added future canopy trees, we would still likely spend a fortune on designs and application fees but get knocked back by planning. We will just continue to hold as long as we can, until they are eventually forced to adjust the planning rules or a councillor forces through a planning change for their own benefit(we all know they do that to benefit themselves or their mates eventually). If I could afford it, the best investment would be to buy the neighbouring properties and sit until that happened.

I have relatives looking for a place in Brisbane, apparently 50 people can turn up to see a single house. The lucky country?

It was exactly the same here last year.

Compared to NZ, it definitely is.

Lower cost of living, much better opportunities, better healthcare, significantly higher salaries, and no Jacinda with her woke racist agenda. Moreover, while Brisbane and Auckland have more or less comparable population size, you can buy a much better house there than in Auckland for the same money.

NZ will follow this trend. Home ownership falling. Developers facing similar problems with building costs increasing while sales are slowing and prices are dropping. Costs for landlords increasing, particularly for leveraged investors of older homes who may no longer be able to claim mortgage interest as an expense. Government looking at increasing immigration.

They need to get the liberalisation of zoning through, in the face of council NIMBYs' resistance. It'll be critical to free people up to be able to build on their own land.

It'll be interesting though to see how much of New Zealand resembles the Hutt Valley, where rents (as well as prices) have been falling as speculators have been caught holding properties they'd bought for capital gains but are now needing to hold and are seeking to rent out to cover costs.

I'd say more than we think and I'd hazard a chance at a prediction that the same pattern will emerge across the ditch. Empty properties spilling onto the market once the real investor desperation hits. Bit of water under the bridge between now and then though methinks.

Wayne Brown doesn’t want intensification (apparently Auckland doesn’t want it, maybe he has done a survey or something). Maybe he owns a few motels or something.

Yes, rather authoritarian of Wayne Brown, that sense of entitlement to rule over what others can build on their own freehold land.

May be some of those wanting to come to Auckland can go elsewhere? Personally, I preferred Auckland in the late 90's/early 2000s. Infrastructure was coping, housing affordable and a good mix of ethnic restaurants. Now it's a crime ridden cluster Fk.

Well, we've inflated housing costs and devalued wages. No surprises we're getting poor results.

When you introduce multiple middle men(shippers and distributors etc) to have to deal with supplies that have been offshored, you are going to get multiple step ups in the cost to build. Those costs and supply fluctuations will be amplified, especially in times of global, geopolitical upheaval.

The solution is to onshore supplies and the jobs required to do that, which will replace job losses that might be suffered in the loss of international shipping and distribution needs. Prices will still be high due to onshore wage requirements, profit margins for manufactures and distributors etc but there will be far less dramatic fluctuations of supply and prices.

Another way to stabilise prices is to eliminate multinational traded corporations who offshore their jobs and profits from the local market. Those whose only mandate is to benefit their shareholders(including their share remunerated management). They have minimal ties to the local economy, and do not feel a need to deal well in the international markets they populate.

One thing is for sure, the Labour Govt is about to panic at the inflation number and will bend over backwards to get more immigrants into the country as soon as possible. I wouldnt be surprised if they start handing out free airfares or "get settled" grants to get people here. Only then will wages start to fall, and supply challenges ease. Of course, the unintended consequence of that is that rents will sky rocket due to accommodation shortages, and demand for all other goods and services will increase as hundreds of thousands of new consumers flood the country. Ahh, good times ahead lol.

Are you sure those consequences are unintended?

Exactly. One group never suffers, the elite rentiers who manipulate the economy/markets to fit them making money no matter what the circumstances.

This Labour Government is possibly the worst government in the history of NZ, hands down.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.