By Gerhard Kling & Aravinda Meera Guntupalli*

Last year, the CEO of financial technology (fintech) company Revolut added a UK banking license to his 2022 Christmas wish list, telling startup news outlet Sifted: “I would love to have it as a Christmas present. A present for me personally and for the business.”

But it’s nearly Christmas 2023 and Revolut still hasn’t secured the right to take deposits from the UK customers – the main benefit to the company of getting a UK license.

Revolut has been offering e-money services such as currency exchange and transfers (which do not require a UK banking licence) in the UK since 2015. It generated £196 million in revenue from this in 2021, or nearly one-third of its business – the rest mostly comes from banking activities in 18 EU countries.

Revolut, which says it has more than 30 million retail customers worldwide, now wants to join other “challenger banks” (those attempting to break the historical dominance of the “big four” UK banks: Barclays, Lloyds, HSBC, NatWest) in becoming a fully licensed bank in the UK.

The main benefit of this would be that it could take deposits and handle more loan business instead of “outsourcing” these activities to a number of UK-licensed banks. It could also boost financial inclusion by providing people in the UK with more choice and access to products that help manage money – a key concern amid the current cost of living crisis.

Whether deposits are handled directly by Revolut or through a third-party provider is unlikely to make much difference to customers. But for Revolut, outsourcing means additional costs so this could provide the company with cheaper access to finance. So, in theory, Revolut could pass any savings on to its customers.

Getting a UK banking license involves an extensive application process but typically takes about a year. Once a bank gets one, it has to adhere to more stringent reporting and monitoring requirements.

During the nearly two years since Revolut first applied in January 2021, it has experienced IT system issues that have delayed its reporting of annual accounts. Requesting an extension is not an unusual process, but concerns were also raised by Revolut’s auditor BDO about its 2021 revenue reporting.

In March 2023, a Revolut spokesperson told Reuters the concerns were “remedied” in 2021. The company’s chief financial officer Mikko Salovaara said: “There is not any doubt over the completeness of the balance sheet, which, in turn, logically means that total revenue is also correct.”

More recently, Revolut has simplified its ownership structure – its use of different classes of shares was more common in EU countries – which could help unblock the UK banking license application process for the company.

Whether, after all of this, customers would actually benefit from lower operating costs will depend on various factors, including what the competition is charging and the need for Revolut to maintain its profitability.

Another possible (perceived) benefit for customers could be greater financial security. Deposits of up to £85,000 held with licensed banks are secured through the Financial Services Compensation Scheme (FSCS). However, the outsourcing model already offers the same protection to Revolut users if its third-party provider operates with its own UK banking license anyway.

Enhancing UK financial inclusion

More generally, fintech companies offer easier and often cheaper access to financial products than traditional banks, which means they boost financial inclusion according to research-based definitions.

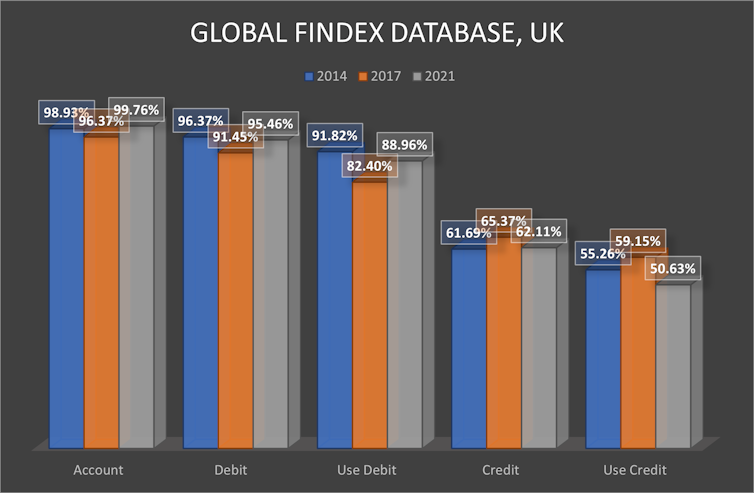

World Bank research on financial inclusion suggests the UK scores almost perfectly in this area: 99.76% of respondents to World Bank surveys have personal current accounts and 95.46% with a debit card (although only 88.91% say they use their card).

How people bank in the UK:

But the limited sample size for the UK (the World Bank’s survey relies on 128,000 adults in 123 countries) makes it difficult to truly identify the small number of “unbanked” people in the UK and their struggles. The Financial Conduct Authority’s (FCA) more comprehensive Financial Lives Survey puts the number of unbanked people in the UK at 1.1 million in 2022, down from 1.7 million in 2014 but largely unchanged since 2017.

The UK Treasury’s Financial Inclusion Report 2021-22 argues that the more basic bank accounts now offered by all banks have improved financial inclusion, but it also stresses the importance of fintechs in increasing choice and launching innovative products like mobile budgeting tools.

On the other hand, fintech’s reliance on mobile and internet banking arguably widens an existing digital divide. According to the World Bank, 92% of UK respondents had access to the internet and used mobile phones in 2021, leaving some without access to fintech products.

For those that can access them, fintech solutions could help reduce costs and provide tools to manage people’s stretched budgets. This could help mitigate the current cost of living crisis while also enhancing financial inclusion. Studies show better financial inclusion can reduce income inequality under certain conditions.

Becoming a challenger bank

Revolut has a convincing track record of obtaining banking licences in its short history. After its 2015 UK launch, Revolut obtained its first banking licence in Lithuania in 2018. It has operated as a bank in 18 EU countries since 2021. That same year, Revolut applied to become a deposit-taking institution in Australia. This is a good sign that its UK banking licence should be achievable.

However, the benefits for customers are less clear. Most customers already use e-money accounts together with traditional bank accounts. Looking at Metro Bank’s recent problems – investors were concerned that it could not meet regulatory requirements on its capital levels, although it has since secured additional financing and continues to serve customers as normal – it is not evident that one more challenger bank will benefit UK customers.

On the other hand, a more comprehensive range of different types of financial service providers tends to stabilise the financial system. In this sense, diversity could enhance financial stability.![]()

*Gerhard Kling, Chair in Finance, University of Aberdeen and Aravinda Meera Guntupalli, Senior Lecturer in Global Health, University of Aberdeen. This article is republished from The Conversation under a Creative Commons license. Read the original article.

2 Comments

I'll give it my vote as least interesting article published by Interest.co.nz and I'm embarrassed that it was written by two academics from the university where I was a struggling student.

A mildly clickbait title: Can diversity enhance financial stability? but so full of provisos such as "Studies show better financial inclusion can reduce income inequality under certain conditions."" It ends with this dramatic conclusion ""On the other hand, a more comprehensive range of different types of financial service providers tends to stabilise the financial system. In this sense, diversity could enhance financial stability.""

Outside of the Revolut advertising I would say it is rather too easy to become unbanked in NZ. Just live in a town where bank branches have been closed and in the nearest city the branch only effectively operates between 10am -4pm weekdays only for receiving JP signed documents required to open new accounts. Even signing up for a trading account with a bank is a nightmare, (there being only 2 banks offering this and one still uses manual data entry so it can take months for an application to be "processed"). So the lack of physical access to bank services is quite common across much of NZ.

Then there is the fact that all bank online services are designed to be inaccessible. All of them fail simple basic web standards. Physical branches also fail on several levels in accessibility. Most do not have any staff that know sign language.

Even given those wanting to go through the effort and travel testing account registration services and security across banks is a depressing exercise. Many do not even have 2 factor for mobile account logins. A literal nightmare may leave them able to approve payments on mobiles with little to no checks and authorisation with the users. The web interfaces are quite severely technically flawed also. So many people are confused even by their kiwisaver account information they cannot tell how much is money they contributed and how much was investment returns. Looking at the big two ANZ could not even manage the dates people joined kiwisaver to the date they joined ANZ in a literal database, & both ANZ and ASB obfuscates information like crazy. When I discovered ANZ was pocketing some of the government contribution to kiwisaver accounts instead of paying it to customers I was astounded that the information shown to customers meant they literally could not tell easily ANZ was doing that; ANZ was hiding its tracks.

Given the above being unbanked can be easier than you think and often it is not a choice but a severe lack of service provision as required by NZ laws.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.