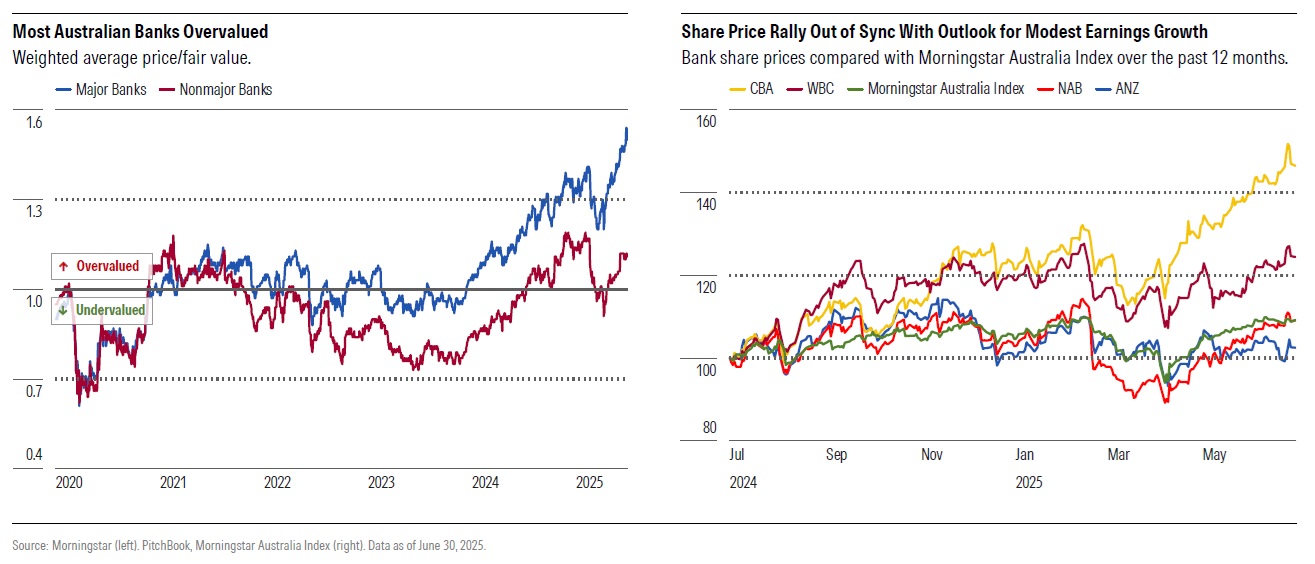

They are over there. And they are overpriced. Investment researcher Morningstar says most of the Aussie banks are running ahead of their fundamentals when it comes to share prices.

In its second quarter review of the Australian banks, Morningstar picks out especially Commonwealth Bank, "priced for much more than the mid-single-digit earnings growth we expect", as being ahead of fundamentals.

"Under new management, ANZ has integration and governance risks hanging over it, but presents the best value," the report says.

Morningstar says credit growth is healthy, with total growth on an annualised basis of 6.9% in the three months to May 2025. It is well supported by public investment, population growth, and solid house prices.

"If cash rates are lowered further in 2025, as futures markets predict, growth could accelerate as borrowing capacity increases. But the Reserve Bank of Australia’s low economic growth forecast out to 2027 underpins our expectation that credit growth slows to 4% to 5% per year in 2026," the report says.

Bank net interest margins are softening due to competition for mortgages and the lingering impact of customer switching from transaction accounts to more expensive deposit products.

"Over time, we expect competitive intensity to ease as non-major banks look to lift subpar returns on equity. Low bad debt expenses are helping soften the hit to earnings and are likely feeding into the more favorable rates for customers. Low unemployment, a tight rental market, large equity buffers, and rising house prices support low loan losses for banks.

"Banks are nearing the end of announced on-market buybacks, but still hold surplus capital, which supports the outlook for modest dividend growth."

Morningstar says the valuation divergence between Commonwealth Bank and its peers continues to widen, "and in our view, is unjustified".

"Price/book discounts could unwind, particularly for ANZ Bank if it can deliver similar earnings growth, but on a cheaper P/E. "With average dividend payout ratios of 75%, major bank dividends can grow in line with earnings. With a small surplus capital buffer, ANZ is at greatest risk of lowering dividends, but the risk is already reflected in the share price."

They say while ANZ is not as large as peers, cost advantages "support our expectation of above cost of equity returns over the long term".

"ANZ resorted to discounting and cashbacks to arrest lost home loan market share, but we expect investments in process and digital offerings to make the bank more competitive in the future.

"While this comes with added costs, it should help drive earnings growth and returns on equity. We expect the acquisition of Suncorp Bank to improve bank efficiency modestly, increasing its funding from low-cost transaction accounts and leveraging its investment in technology, but the drawn-out integration and associated costs make it unlikely to be materially value-accretive."

*This article was first published in our email for paying subscribers early Thursday morning. See here for more details and how to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.