Bonds

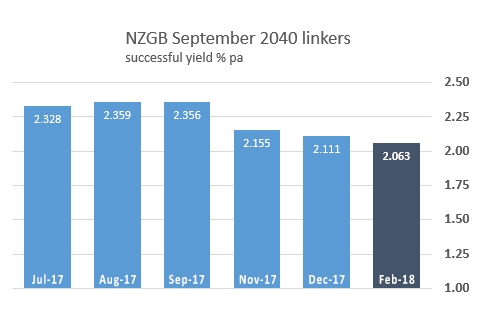

September 2040 Government inflation-linked tender #626; weighted average accepted yield down to 2.06%; coverage ratio down to 1.89x

1st Feb 18, 2:24pm

by

The results from the latest inflation-indexed bond offer by the Treasury's Debt Management Office have been released. The details are shown below.

| 2.50% - 20 September 2040 | Today #626 | Previous #622 | Previous #619 | Previous #614 | Previous #611 |

| Series offered | tender Feb 1, 2018 | tender Dec 7, 2017 |

tender Nov 10, 2017 |

tender Sep 14, 2017 |

tender Aug. 11, 2017 |

| Total Amount Offered ($mln) | 100 | 100 | 100 | 100 | 100 |

| Total Amount Allocated ($mln) | 100 | 100 | 100 | 100 | 100 |

| Total Number of Bids Received | 34 | 41 | 43 | 33 | 45 |

| Total Amount of Bids Received ($mln) | 189 | 214 | 301 | 223 | 332 |

| Total Number of Successful Bids | 21 | 28 | 4 | 13 | 16 |

| Highest Yield Accepted (%) | 2.0850 | 2.1300 | 2.1700 | 2.3700 | 2.3750 |

| Lowest Yield Accepted (%) | 2.0400 | 2.0600 | 2.1400 | 2.3400 | 2.3400 |

| Highest Yield Rejected (%) | 2.1700 | 2.2150 | 2.2900 | 2.4400 | 2.5100 |

| Lowest Yield Rejected (%) | 2.0850 | 2.1300 | 2.1800 | 2.3700 | 2.3750 |

| Weighted Average Accepted Yield (%) | 2.0627 | 2.1110 | 2.1550 | 2.3560 | 2.3586 |

| Weighted Average Rejected Yield (%) | 2.1231 | 2.1570 | 2.2163 | 2.3902 | 2.4212 |

| Amount Allotted at Highest Accepted Yield as Percentage of Amount Bid at that Yield* | 7.1 | 42.1 | 100.0 | 88.0 | 44.4 |

| Coverage Ratio | 1.8900 | 2.1400 | 3.0100 | 2.2300 | 3.3200 |

*Individual allotments may vary due to rounding.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.