2025 was a very good year for first home buyers as largely stagnant house prices and falling mortgage interest rates significantly reduced the cost of getting into a home of their own.

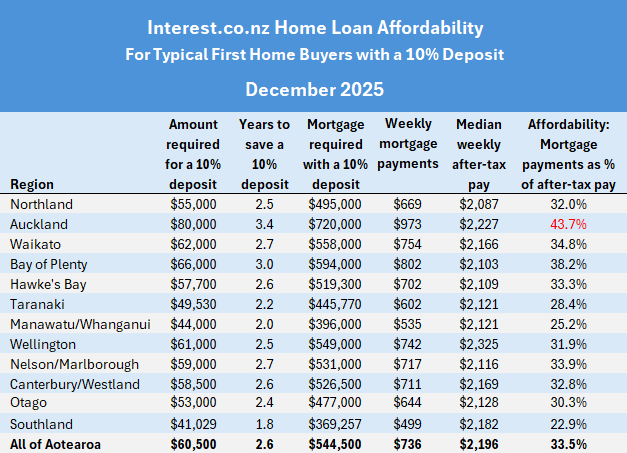

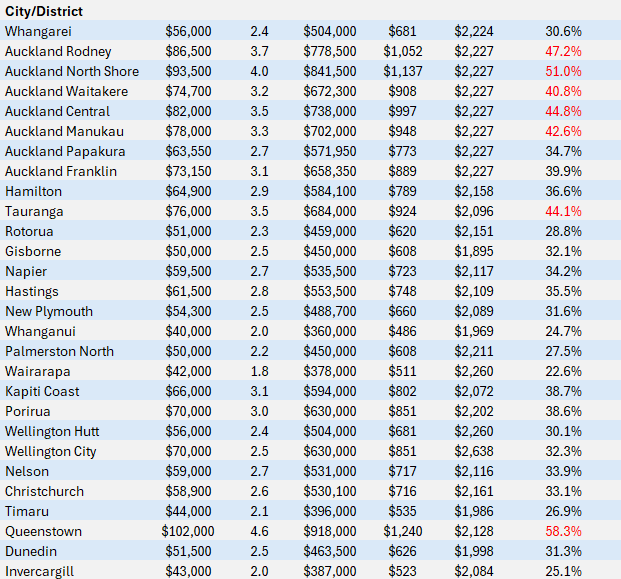

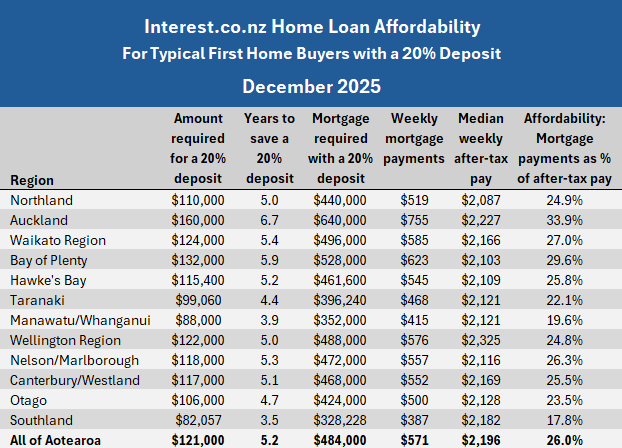

According to the Real Estate Institute of New Zealand, the national lower quartile selling price increased by a negligible 0.8% last year to $605,000 in December 2025 from $600,000 in December 2024, with most of that increase occurring in the last two months of the year.

The national lower quartile selling price is the price point at which 25% of sales are below and 75% are above, representing the most affordable part of the market.

The bigger movement was in mortgage interest rates, with the average two year fixed rate falling to 4.59% in December 2025 from 5.53% in December 2024.

That reduced the mortgage payments on a home purchased at the national lower quartile price, assuming a 30 year term, to $736 a week in December 2025 from $806 a week in December 2024. That's a saving of $70 a week for buyers with a 10% deposit, or to $571 from $631 for buyers with a 20% deposit, giving them a saving of $60 a week.

Comparing mortgage payments to the estimated median after-tax income of couples aged 25-29, assuming both work full time, the mortgage payments on a lower quartile-priced home purchased with a 10% deposit would have eaten up 37.6% of their take home pay in December 2024. That would have declined to 33.5% in December 2025.

That improvement in affordability, combined with the fact there was a lot of stock on the market last year giving buyers plenty of choice and putting them in a strong negotiating position on price, made 2025 a stand out year for first home buyers.

However, a warning bell sounded for the housing market at the very end of last year, when the interest rate outlook suddenly changed from declining to rising.

In fact mortgage rates increased slightly in December, with the average two year fixed rate rising to 4.59% in December from 4.49% in November, with further increases expected this year.

However, there is still plenty of stock on the market heading into the peak selling months, so buyers will still be in a strong negotiating position. This should give first home buyers the confidence to take the plunge when their numbers add up.

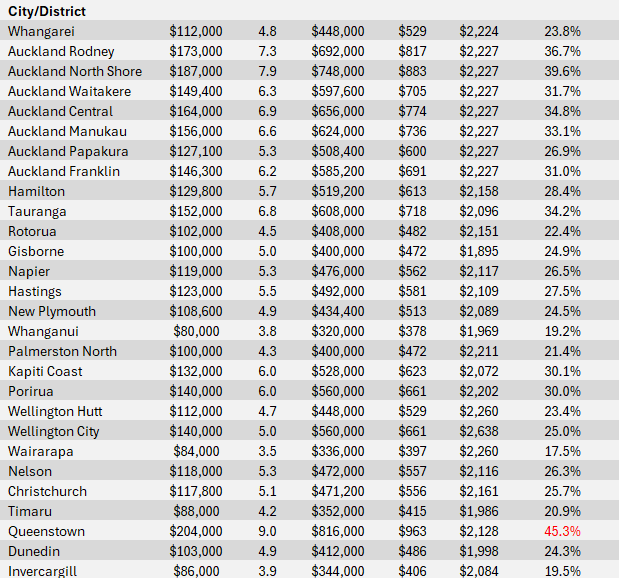

The tables below show the main affordability measures for first home buyers with either a 10% or 20% deposit in all major urban districts throughout Aotearoa at the end of last year.

- The comment stream on this story is now closed.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.