This article first appeared in Russell Investments' Communiqué. It is reposted here with permission.

This short article explores this notion and concludes that this isn’t necessarily the case, as the relevant metric is real (inflation-adjusted) returns rather than headline, nominal numbers.

Further, it demonstrates that lower returns might even be preferable after you factor in tax.

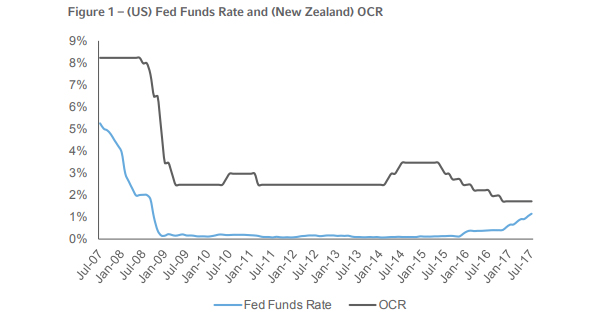

Across the world, as central banks sought to stimulate their economies, cash yields fell dramatically in response to the global financial crisis (GFC) and have remained at or near their lows ever since. In the United States, for example, the Federal Funds Rate (the interest rate at which depository organisations lend to each other overnight) fell sharply from approximately 5.25% in the third quarter of 2007 to close to zero in the following 18 months. The rate has reversed slightly in the last two years, to currently sit at approximately 1.25%.

Meanwhile, the Reserve Bank of New Zealand’s Official Cash Rate (OCR) was reduced even more dramatically – from just over 8.25% in mid-2008 to 2.5% in the space of less than 12 months.

While the OCR (the rate the RBNZ charges on overnight loans to banks) was then increased over 2014, it has since retraced and currently sits at just 1.75%. These moves are shown in figure 1.

So what does this mean for those depending on cash returns for their income in retirement? Surely getting, say, 5% is better than, say, 3%? In fact – it depends!

In a neutral state (that is where the central bank is trying to neither stimulate nor dampen economic growth), cash rates broadly comprise compensation for inflation and a margin for credit (and depending on the tenure of the deposit) term risk . That is, inflation is a core component of cash rates. At the same time, inflation also reduces our purchasing power. That is, inflation simultaneously “giveth” and “taketh away”.

It is therefore not nominal, but real cash returns investors should be concerned with. If cash returns are 5% and inflation is, say, 3% this results in an entirely different outcome to the situation where inflation was 1%.

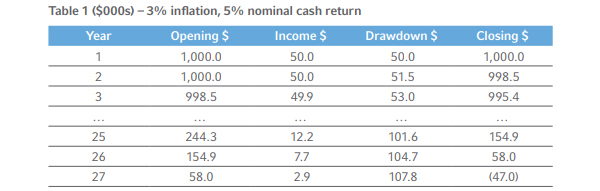

Consider the case of an investor requiring an annual, inflation-adjusted drawdown of $50,000 on their capital of $1,000,000. If inflation is 3% and nominal cash returns are 5% (i.e., 2% real), the investor’s position at the end of each year is as shown in Table 1:

As is evident, in the first year the income is sufficient to meet the drawdown (which, for simplicity only, we have assumed occurs at the end of each year). However, in the second year, the impact of inflation starts to bite and the income is less than the drawdown, meaning that the closing capital is slightly reduced.

The rate of decline in capital accelerates over time, such that it is nearly exhausted by the end of year 26.

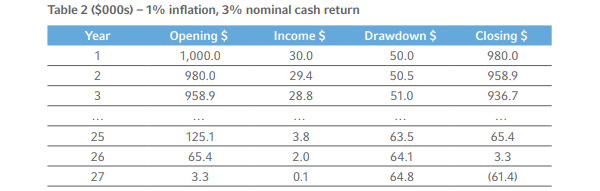

What if inflation had been 1% and, retaining the same margin as above, nominal cash returns were 3%. The investor’s position at the end of each year is as shown in Table 2:

As is evident, in the first year the income is insufficient to meet the drawdown and the closing capital has reduced quite markedly. The reduction in capital from year 2 is further impacted by inflation. However, relative to the earlier example, inflation has a much smaller part to play.

Moving forward, we see that capital is, once again, all but exhausted at the end of year 26. While the investor’s remaining capital at that point is lower than in the earlier example, the difference is not that material – in both cases his capital lasts just over 26 years.

The above examples show that despite materially different nominal cash returns, the investor would be more or less indifferent if we assume that the real cash returns are the same in both cases.

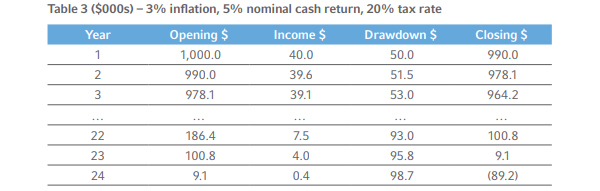

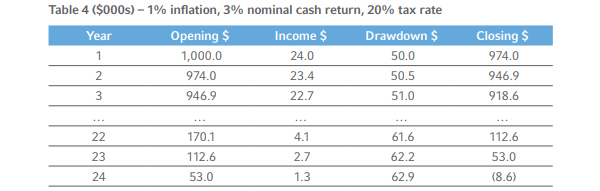

Further, there’s a twist – tax! It is nominal, rather than real, cash returns that are taxed. That is, both the inflation and margin components of cash returns are taxed. As inflation increases, so does the amount of tax payable. Let’s look again at the above examples after allowing for a tax rate of, say, 20%.

Unsurprisingly, tax has worsened the investor’s position, with her capital now all but exhausted at the end of year 23 (rather than year 26).

While the investor’s position is understandably less favourable than was the case when we ignored tax, she is now slightly better off than in the 3% inflation example. That is, if we assume the same real cash rates in both cases, the investor is actually better off in the low return environment after allowing for tax! In our first example, tax accounted for 1% (20% of 5%) of the return. The effective real return was therefore 1% (2% margin less 1% tax). In the second example, tax accounted for only 0.6% (20% of 3%) of the return. The effective real return was a healthier 1.4% (2% margin less 0.6% tax).

Summary

This short paper has demonstrated that low cash yields do not necessarily spell potential disaster for retirees depending on bank (and similar) deposits for their income. Real, rather than nominal, cash returns are what is key. Assuming the same real yield, investors should be largely indifferent to changing nominal cash rates. Further, when we take tax into account, low nominal cash rates might actually be preferable.

Andrew Johnson is a senior portfolio manager for Russell Investments based in Wellington. This article first appeared in Russell Investments' Communiqué. It is reposted here with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.