By Christian Hawkesby*

In a post-GFC environment where interest rates are eventually expected to settle at lower levels, it’s natural to ask how far away the US Federal Reserve is to the end of its interest rate cycle.

At the same time, in New Zealand, the Official Cash Rate has been on hold at record lows since the end of 2016, and the focus is on the different issue of when a hiking cycle will eventually begin.

The US rate cycle

To address the question for US interest rates, we can compare the US Fed Funds Rates with assumptions for some long run neutral level and market pricing. A simple rule of thumb is that neutral interest rates should be around the sustainable growth rate in nominal GDP (real GDP growth + inflation). Over the past 5 years, we can also use the FOMC’s own long-run assumptions from the so-called Dot Plots.

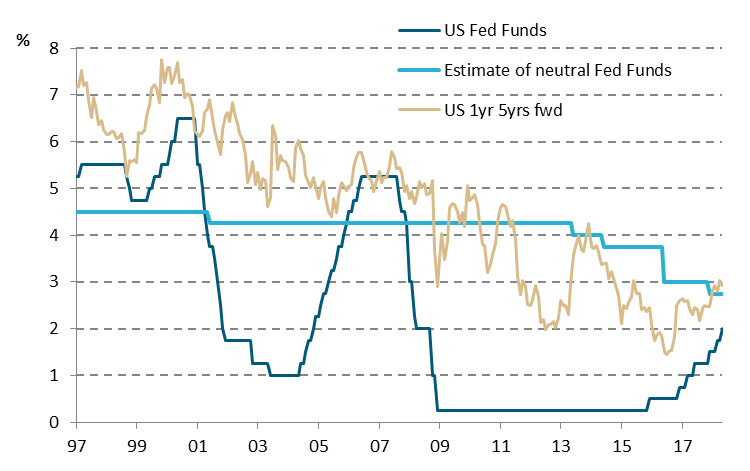

The chart below maps the US Fed Funds Rates against this estimate of neutral Fed Funds and an estimate of market pricing (proxied by the implied market 1-year rate 5 years ahead).

Chart 1. US interest rate cycle and market pricing

Source: Bloomberg, US Federal Reserve and Harbour calculations.

What it illustrates is that, for a long period since 2012, the market has tended to price-in the US Fed Funds Rate finally settling well below the FOMC’s own long-run assumption.

However, over the past year these have converged so that both the FOMC and market are picking that US Fed Funds Rate settles at around 2.75-3.00%. In practice, this means the Fed hiking another couple of times in each of 2018 and 2019, and then staying on hold for a prolonged period, perhaps as the momentum of the US economy is finally restrained by the cumulative tightening in monetary conditions from Quantitative Tightening (QT) and interest rate hikes.

There are a number of structural reasons why the FOMC has lowered its assumption for neutral interest rates over the past 5 years, including the implications of changes in demographics, lower productivity and stronger demand for safe assets. An outstanding question is whether the upcoming US fiscal stimulus is significant enough to be a factor that lifts the long-run resting place for US interest rates.

The NZ rate cycle

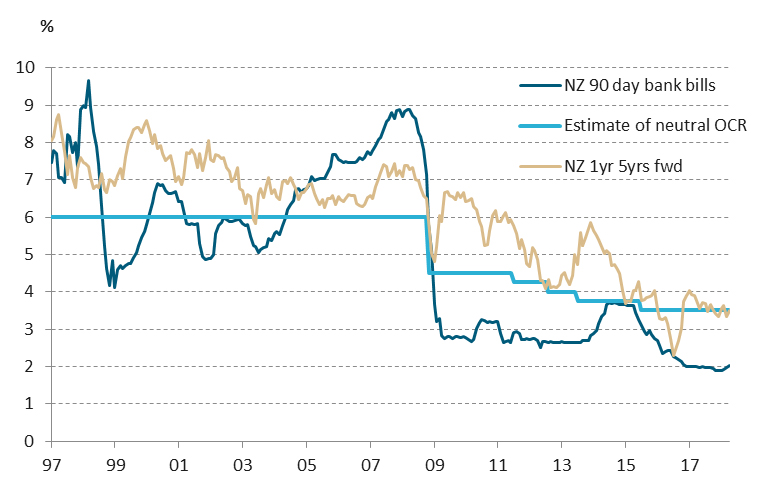

Repeating the same analysis for New Zealand draws out similarities and differences.

We know that the RBNZ modelling assumptions for the neutral OCR have also been falling, initially as a step-change lower after the GFC and then more gradually through time and sits at around 3.5-4.0%.

Since the GFC, the market’s own pricing of the long-run neutral rate (as proxied by the implied market 1-year rate 5 years ahead) has typically sat above the RBNZ neutral estimate. However, like the United States, in recent years these have converged so that the central bank and market are already factoring in a similar resting place for the OCR in around 5 years’ time.

The difference with New Zealand is that the current OCR, at 1.75%, still sits a long way south of the neutral OCR of 3.50-4.00%. For some time now, the RBNZ has used the narrative that the OCR will remain low for a considerable time and that message was reiterated by the new Governor, Adrian Orr, in his first Monetary Policy Statement in May.

Chart 1. NZ interest rate cycle and market pricing

Source: Bloomberg, and Harbour calculations.

Investment implications and what to watch

In the United States, the unemployment rate recently hit a new post-GFC low of 3.8%, and continued job growth suggests domestic inflation pressures are likely to build. In this environment, we expect the US Federal Reserve to continue its hiking cycle. Indeed, it could create a scenario where the US Fed Funds rate needs to overshoot its neutral level to contain wage and pressure pressures.

We will be monitoring whether strain in the financial system or credit markets emerge that curtail the cycle; equally we will be watching for signs of whether US fiscal stimulus and tax changes provide further legs to the economic expansion and, especially, whether it results in stronger private sector CAPEX.

In New Zealand, while the message that the RBNZ is on hold for now is loud and clear, we are looking for when enough evidence has built to move away from this narrative. In coming months, inflation may rise to 2.0% as higher oil prices and the fall in the New Zealand dollar combine to lift headline CPI inflation. Historically, the RBNZ would look through currency and oil-driven changes, but a lift in inflation towards 2% may help the process of inflation expectations lifting to become more consistent with target, which the RBNZ would likely welcome. Furthermore, the well-publicised changes in minimum wages and high-profile public sector pay claims are an added factor in the wage and price-setting dynamic to monitor.

The RBNZ will have a high threshold of evidence before they signal the commencement of a hiking cycle. But, when the facts change, so will policy stance and interest rate markets.

In our portfolios, we are modestly short duration in our fixed interest funds, and underweight bond proxies in our equity funds.

*Christian Hawkesby is executive director of Harbour Asset Management.

6 Comments

I like this little gem and, especially, whether it results in stronger private sector CAPEX.

Applied to NZ, we seem to have;

(a) settings and regulations and general societal attitude that favours low productivity endeavours (rentals, housing, tourism, local and national government)

(b) a political climate that is poisonous towards long term capital investment in anything natural resource related.

What could possibly go wrong?

Every month, every year since 2009, we have heard predictions of interest rate rises.

Hikes may need to happen very gently for the banks, given the number of dual-income households only just coping with their 850k+ mortgages in Auckland.

It doesn't make sense to me to have a preconceived idea about what "normal" central bank rates should be anymore.

This is all some mad, unprecedented experiment. Why should we assume that growth or inflation will ever behave the way it did in the 70s or 80s after a decade of "accommodation"? The world and the markets are structurally different now.

The unprecedented monetary policies have allowed for high debt levels and asset inflation. Returning to some arbitrary new "normal" is just bluffing surely, they must know the risk of pricking this debt bubble? I don't believe that any central banks have a clue what they're doing and certainly not the Unreliable Boyfriend, Mark Carney.

My best guess is that central banks will oh so gently, try to "normalise" and then each time end up undoing at least some of their movements, until eventually everybody just accepts that normal is actually much, a much lower number. That is, until some meaningful deleveraging occurs.

If there is some kind of oil crisis, then all bets are off, but excluding another oil crisis where is inflation going to come from? Trump tax cuts seem have had only a modest impact compared to the expectation a year or so ago.

We are certainly in the new millennium and I agree with above comment, I don't think anyone has any idea of where all this is heading. There are a lot of theories out there which are slowly becoming realities, but we're trailblazing folks. There does seem to me to be an inordinate amount of debt upon debt upon debt out there which suggests that someones going to get burnt sooner or later. And I don't believe that anyone will escape the horrors (if it's that bad) or indeed the effects of any (needed) correction. What I do know is that families are having to send both adults (if they have more than one) to work to pay the mortgage or the rent and it is killing the nuclear family's relationships. On that basis alone I want a substantive correction in house prices just to release the pressure on families having to send everyone available to work and then having no one to care/love for the children. And yes, you can say what you like about Day Care centres but that's not the love the kids need. It doesn't matter which end of the socio-economic ladder you're on, our relationships are struggling and there's not much goodwill out there in family Land as well as the business world.

Agree with the two above.

And can we correct the heading please? There is no such thing as sustainable growth.

Thats a very interesting looking graph, it simply screams 'unsustainable' not to worry. The new normal will be oiled with yet more cheap debt and a million or two of personal mortgage debt for every citizen and a longterm interest rate that just barely allows you to service it. Then you will be under complete control...goodbye democracy hello central bank fascism.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.