A sharp improvement in home loan affordability over the last 15 months may mark a return to the more affordable housing conditions prevalent prior to 2021.

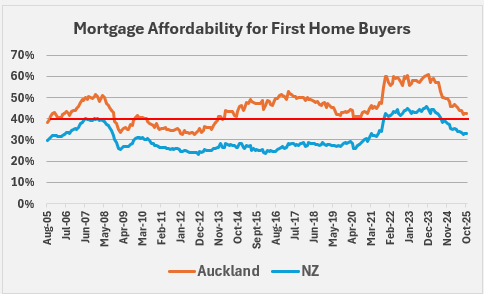

Interest.co.nz has been tracking the monthly movements in mortgage interest rates, lower quartile selling prices, and the median after-tax pay for couples aged 25-29, to measure changes in home loan affordability since 2004.

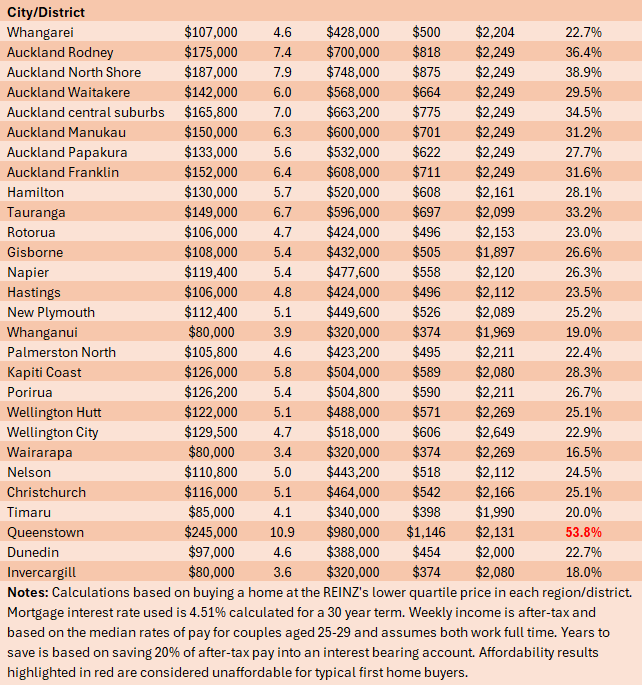

Mortgage payments are considered unaffordable when they take up more than 40% of a couple's after-tax pay.

The graph below shows what has happened to that affordability measure between August 2005 and October this year, nationally and in the Auckland region

The red line at the 40% mark is the point at which mortgage payments go from affordable to unaffordable for typical first home buyers with a 10% deposit.

Anything under the red line is affordable while above the red line is unaffordable.

What this shows us is at the national level, housing has been well within affordable limits for first home buyers apart from a brief period during the Covid pandemic. That's when the Reserve Bank pushed interest rates down sharply while reducing mortgage lending restrictions at the same time, leading to an immediate and unsustainable surge in house price inflation, from which the market is still recovering.

However, that brief period of unaffordability was quickly followed by an almost as steep improvement in affordability, as interest rates were normalised and house prices declined.

At the national level, housing returned to affordable levels for first home buyers in August last year and is continuing to improve.

The Auckland exception

However, as the graph shows, it's a different story in Auckland.

Housing in Auckland has been in unaffordable territory for typical first home buyers since November 2013, with the Reserve Bank's exuberant slashing of interest rates and lending restrictions during the pandemic supercharging the problem.

But even in Auckland, affordability has shown a dramatic improvement since the middle of last year as house prices and interest rates fell in tandem.

Although Auckland remains in unaffordable territory at the regional level, house prices and their corresponding mortgage payments at the lower quartile end of the market are already at affordable levels in Waitakere and Papakura, and are on the cusp of becoming affordable in Manukau and Franklin.

So the home ownership dream is getting back within reach in most parts of the country, even in Auckland.

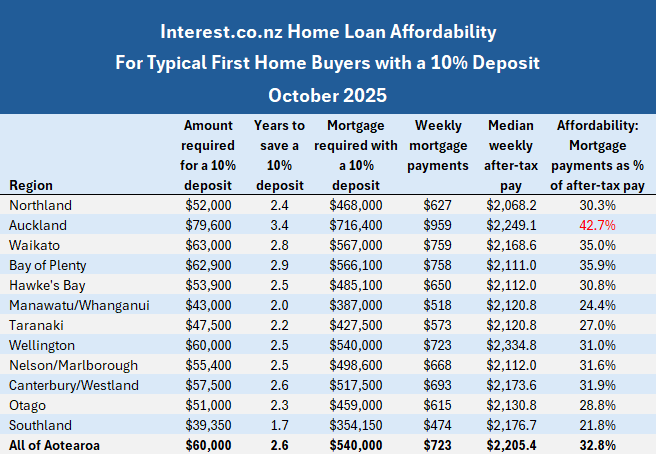

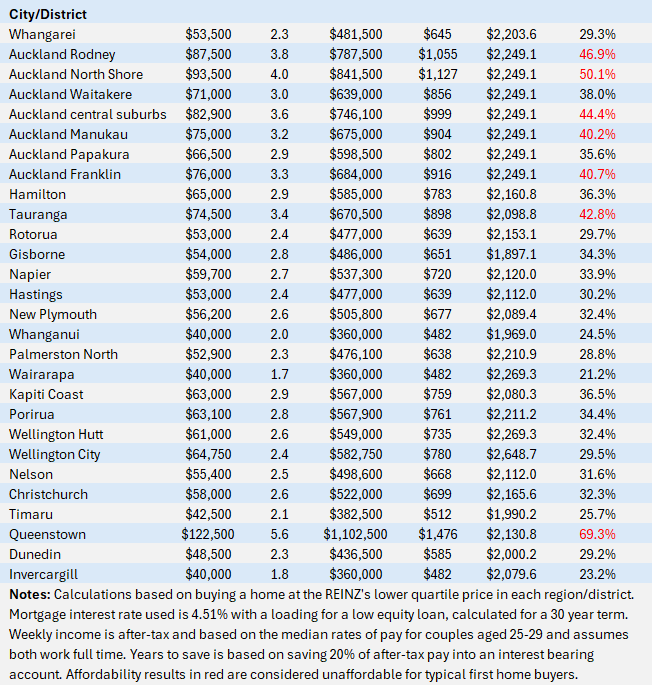

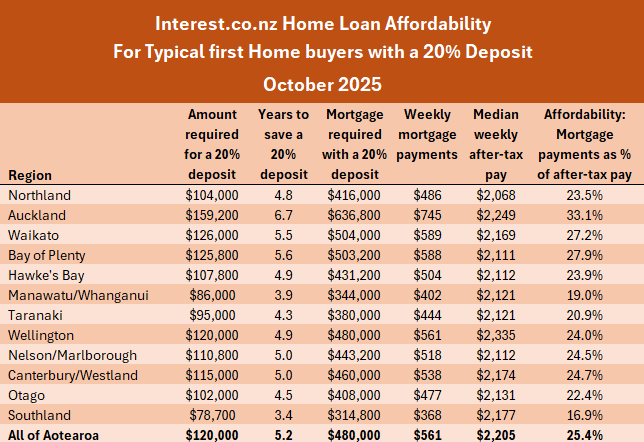

The tables below give the main affordability measures for typical first home buyers with either a 10% or 20% deposit in all main urban areas throughout the country.

The comment stream on this story is now closed.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

32 Comments

Time to reduce investor DTI ratio then. Make them have real equity.

Imagine if you thought housing affordability rested on investors shoulders.

Imagine pretending that investors bidding FHB out of the market in the 2010's had no impact on housing affordability for new buyers (what I witnessed first hand on many occasions at auctions I attended in Auckland)

There's quite a difference between "no impact" and being the prime cause.

Almost all developed countries have got housing wrong. Investor levels varying greatly between them.

Averageman never made the claim that they were the prime cause - but you jumped to that conclusion in your response for whatever reason - almost as if you have a need to protect the interests of those who have been gambling with debt and capital gains.

But what are the unintended outcomes to his solution? Less housing investors may fix things a little for FHBs, what does it do for renters?

There's a very common misconception on this site that our housing affordability woes rest on investors. That's pretty much the sum total of every averageman perspective, and where he thinks solutions lie - except they're shown to not work wherever they've been applied.

I'm arguing that's not the case, because I'd like to see the problem actually solved.

Supply is the solution, and that has been solved to an extent (although it could have been done a lot better).

It's not solved though - it's why all housing is so expensive.

25% of after tax income. I can't see it getting cheaper unless we have population decline.

bingo - you do not have to die to want to sell, just getting OLD, may mean you cannot live at home alone anymore, its called hidden supply but can be easily modelled by any actuary. Most of these will not be shit boxes, so price fall pressure from the top of the market not the bottom.

Hard to know where demand and property prices go from here.

This is for dual income I assume as I can't imagine the average wage allows for over $2k after tax income per week.

25% of after tax income. I can't see it getting cheaper unless we have population decline.

That's just an arbitrary metric.

I know new houses can be half the price they currently are. If you can go buy a new house for say, $450k, hard to see someone paying way more for an old shitter.

When we were in a situation where housing supply was inadequate and could not respond quickly enough to growing demand, I suspect the large investor demand did help to push up prices. Remember they were buying more than FHBs for quite a while, from memory they were taking up 30-40% of mortgage demand.

In an ideal world we'd deal with the root cause of supply being inadequate and slow to respond, and all the NIMBY restrictions that prevent us building houses where they are needed. But when we were trapped in that framework, turning the taps off a little for investors, or overseas buyers, probably helped.

Imagine if investors actually invested in businesses or heaven forbid, their own business making and selling a good service, employing people to do so. But alas, the only picture they can paint is to fuel ever higher rents and inflation in order to bail out their leverage.

Damn everyone else.

25% of after tax income (on average) if you have a 20% deposit. Sounds pretty reasonable to me.

I think if you're a FHBer you can make some purchases with as little as 5%. That is fairly doable.

I still think we should upend supply in as many ways as possible. If we can make radical changes in the face of a health emergency, surely we can make some radical changes around our housing supply.

2 years net income up front as deposit and 25% of your income every year for the next 30?

Assuming your income doesn't go up in 30 years.

Wrong. It’s only very temporarily 25% because we currently have unsustainably low interest rates (again…). So anyone buying thinking cool, only 25% of income is needed to service debt, will be disappointed next year. And the year after, etc. Surely some people have learnt from the painful experience of the last 5 years….

It's hard to predict the future, but unless the RBNZ publicly abandon 2% inflation targeting then it's more likely rates stay around where they are.

The last 5 years should tell anyone to not push all their debt/expenses to the point there's no room to move though, because sometimes things go wibbly wobbly

Not really relevant, but a thought I felt the need to put out there.. can something be done about empty nesters staying on in their large family houses and in the most convenient spots around schools? What's the point of zoning if no kids are living in the area? What's the point of family homes with 3 empty rooms? How do we encourage better use of property in school zones? Seems silly to have so many families driving to school

Great comment

Yip as I've commented on here before. Current street I'm living on is around 70-80% widows living in 3-4 bedroom family sized homes (and people may think I'm making this up...I am not...). All of which are in their 70's - 80's and whom struggle with the property maintenance and will need to sell in the next 5-10 years into either a small granny flat or retirement village.

I don't think we have a supply issue - we just have a lot of old people living beyond their means and a lot of investors who think its their given right to own 10 homes if they want to (imagine all the supply of houses available for FHB to buy if 50% of investors sold their rentals? and how much lower house prices would become and how much less debt FHBs would need to take on to buy and how much better that would be for the economy)

I guess if you just killed everyone that wasn't a FHB then houses would be super cheap.

"I guess if you just killed everyone that wasn't a FHB then houses would be super cheap"

This is a pretty bizarre comment and line of thought. Hope everything is ok.

If your interpretation and conclusion of my comment was that we should kill people so that FHB's could have cheaper houses, then it might be time to go and have a checkup (or take a holiday).

The people occupying the houses in mention - ie those 70+ will be dead in 5-20 years of natural causes and on my street, that opens up 80% of the street as new supply of houses that are more suited to young families than a single 80 year old woman. If its similar across large parts of the country - I really don't think we have a supply issue with housing - more just a terrible misallocation of resources that will in time correct itself.

But I have no intention of taking things into my own hands to fix this misallocation - even though that appears to be the direction your mind appears to prefer to head down. Besides, the neighbours make great muffins and have excellent gardening advice...

The smart ones downsize before it is forced upon them from lack of mobility, and enjoy more of their life as such. My house was previously owned by a widow before me and she lived in the downstairs as she didn't have the mobility to get up and down the stairs as often anymore. The last thing I;d want myself is to be dragged kicking and screaming to rest home by necessity but then again, I appreciate the older generations had crap housing to start with, with bugger all insulation and likely put a lot of work into their own homes to make them as comfortable as they are now. Attachment supersedes logic in so many scenarios. As I've said before, humans are silly

Feeds out of zone enrollment I guess. If you want the retired out of zoned schools, vote the land tax next year. Those without income will be incented to move/downsize.

That'll teach them for buying a house in an area that became gentrified!

Noise. The real issue is said widower occupying an 90% empty house with no concern about the school log jam they contribute to. Probably complaining about the rates to boot.

Perhaps they could take in borders, who could actually do the property maintenance and pay the rates.

As I've commented before, a lot of people have financial vested/self interest in never resolving our housing problems. The more they laugh at or ridicule valid suggestions, the more you know their interest. That is their own net worth is greater than the problems that our society face. That is individual greed is better (or more important to them) than an improved collective financial and social outcome.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.