Supplied by the OECD

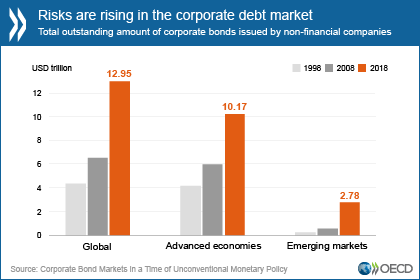

Global outstanding debt in the form of corporate bonds issued by non-financial companies has hit record levels, reaching almost US$13 trillion at the end of 2018. This is double the amount outstanding in real terms before the 2008 financial crisis, according to a new OECD paper.

Corporate Bond Markets in a Time of Unconventional Monetary Policy says that non-financial companies have dramatically increased their borrowing in the form of corporate bonds. Between 2008-2018, global corporate bond issuance averaged USD 1.7 trillion per year, compared to an annual average of USD 864 billion during the years leading up to the crisis.

Companies from advanced economies, which hold 79% of the total global outstanding amount as of 2018, have seen their corporate bond volume grow by 70%, from US$5.97 tln in 2008 to US$10.17 tln in 2018.

The corporate bond market in emerging markets, mainly driven by growth in China, reached a total outstanding amount of US$2.78 tln in 2018, up 395% compared to a decade ago. China has moved from a negligible level of issuance prior to the 2008 crisis to a record issuance amount of US$590 bln in 2016, ranking second highest in the world.

The risks and vulnerabilities in the corporate debt market are also significantly different from that of the previous pre-crisis cycle. The share of lowest quality investment grade bonds stands at 54%, a historical high, and there has been a marked decrease in bondholder rights that could amplify negative effects in the event of market stress. At the same time, in the case of a financial shock similar to 2008, US$500 bln worth of corporate bonds would migrate to the non-investment grade market within a year, forcing sales that are hard to absorb by non-investment grade investors.

Against this background, the paper cites concerns around global economic growth. In the case of a downturn, highly leveraged companies would face difficulties in servicing their debt, which in turn, through lower investment and higher default rates, could amplify the effects of a downturn.

While major central banks have modified their use of extraordinary measures recently, the future direction of monetary policy will continue to affect the dynamics on corporate bond markets. Gross borrowings by governments from the bond markets are also set to reach a new record level in 2019, according to the recent OECD Sovereign Borrowing Outlook 2019.

Any developments in these areas will come at a time when non-financial companies in the next three years will have to pay back or refinance about US$4 tln worth of corporate bonds, close to the total balance sheet of the US Federal Reserve.

The full report is here Corporate Bond Markets in a Time of Unconventional Monetary Policy.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.