By Ian Robertson*

Recent months have seen a trend in the NZ retail bond market towards longer dated bonds with coupon resets (known as “Reset Bonds”). Infratil, Chorus, and Trustpower have issued 10-year bonds with coupons that reset after five years, and most recently Wellington Airport issued an 11-year bond with a coupon reset after six years.

Ten years is a long time when investing and there are myriad factors that can arise over such a horizon to change the risk profile of the borrower – for better or worse. These can include credit risks associated with potentially multiple economic cycles, as well as structural changes to markets and companies such as changes in competitive landscape, regulation, technology, and ownership.

When considering such longer dated investments, investors need to ensure they receive a premium for taking on longer term risk and to ensure robust protections are offered by bond documentation to mitigate unforeseen outcomes.

Investors should require a premium for longer dated risks

Bond interest rates comprise two parts: i) the wholesale interest rate aligned to the bond’s maturity, and ii) a margin to address the specific risks associated with the issuer. For Reset Bonds, the margin is set when the bond is issued and does not change throughout the term of the bond – only the wholesale rate is reset.

For example, the recent 10-year Chorus bond was issued in December at a coupon of 4.35%, comprising a 1.80% margin above the five-year wholesale interest rate (then 2.55%). Upon reset in December 2023 the coupon will be reset at the same 1.80% margin but above the then prevailing five-year wholesale rates.

Only time will tell whether a Reset Bond’s margin is appropriate compensation through the term of the bond. Generally, the longer the bond, the greater the premium required to compensate for the longer-term risks.

Changing risk profiles can be seen in bond prices

While some investors will not mark-to-market their bonds – instead assuming a bond will not default and will repay in full at maturity, many investors should consider the value of a bond prior to maturity.

Once the interest rate is set, bond prices fluctuate through their life to reflect ongoing changes in the two interest rate components. All else being equal, these are typically:

- A fall in market wholesale (swap) rates will increase the price of a bond (and vice versa)

- An event that increases issuer risk will increase the required margin and reduce the price of a bond (and vice versa).

By resetting the wholesale rate part way through the life of a bond, Reset Bonds somewhat protect against rising wholesale rates. However, as Reset Bonds maintain the same margin for the life of the bond, investors are still exposed to adverse changes in the risk profile of the issuer.

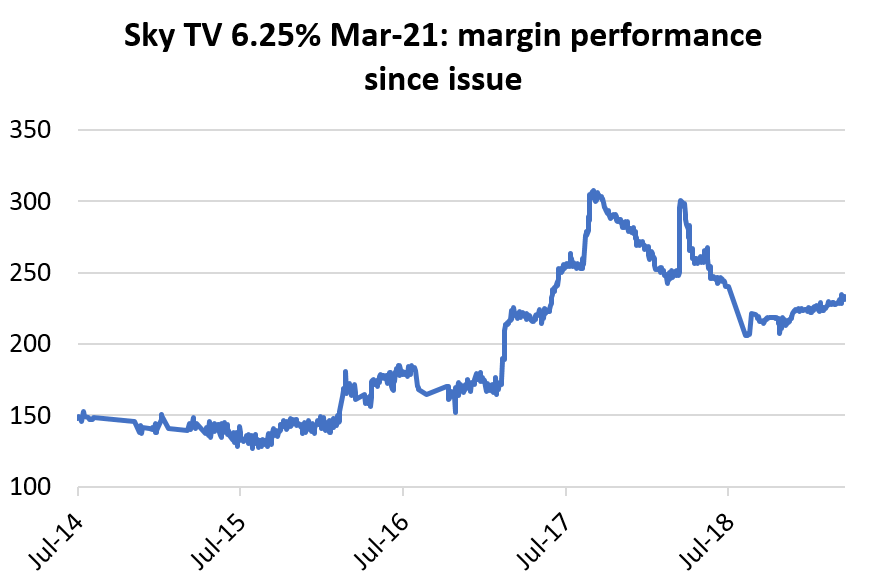

A changing risk profile can be clearly seen in Sky Network Television Limited’s 6.25% unsecured, unsubordinated bond due in 2021. The bond was issued at a 6.25% coupon in 2014, or a margin of 1.50% over the then 7-year wholesale interest rate. The chart below shows that since issuance, the margin implied by the market price of the bond has ranged up to ~3.10% in late 2017 to ~2.33% currently. Even with only two years to maturity, investors would require approximately 50% greater margin than they did in 2014 to compensate for the perceived additional risk.

Source: Bloomberg.

Investors should be focusing on robust bond terms

To help mitigate the risk of unanticipated events investors should note what protection is afforded in the bond’s documentation.

We have previously touched on the importance and bespoke nature of bond documentation here. For New Zealand senior, unsubordinated bonds there is no standard set of terms. There should be a balance between the issuer’s desire for flexibility and investors’ need for protection.

A search for some common bond protections highlights the variance between documents. None of the bonds mentioned have explicit Change of Control provisions which can help to protect bond holders from changes in ownership that could bring a change in business direction and financial profile (e.g. additional debt via private equity ownership). Wellington Airport does not have cross acceleration provisions. Cross acceleration provisions mean that if any other debt of the company (usually above a certain threshold) becomes due and payable via a breach of those terms, then the bonds also become due and payable. This offers bond holders an indirect benefit from potentially stricter provisions in other debt instruments such as bank loans.

The brief examples above will be more applicable to some companies than others, and there are other terms that help mitigate certain risks – for example the Chorus bond has a mechanism to increase the coupon if credit ratings fall below investment grade. But are the protections broad enough to capture unforeseen eventualities?

In Australia, we recently saw a borrower add a Change of Control provision to its latest bond to address heightened market concerns that the company could be taken private. Such concerns were not considered relevant in earlier bond issues – which now have comparatively weaker terms and therefore less value.

Summary

A lot can change over weeks and months to impact an investment, let alone 10 years. To compensate and mitigate the inherent risks associated with long term bonds, investors need to ensure they receive an appropriate risk premium and that the bond terms are robust and extensive enough to contemplate events that may seem remote today.

*Ian Robertson is a senior analyst at Milford Asset Management. This article first appeared here and is used with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.