By David Skilling*

‘It was the best of times, it was the worst of times, …it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair’, Charles Dickens, A Tale of Two Cities

On multiple fronts, the news flow this week has been bleak. Record-breaking droughts and heat continue to hit Europe, the US, and China (and beyond), with rivers at record lows, agricultural yields and energy production in decline, supply chains being further disrupted, as well as higher excess deaths.

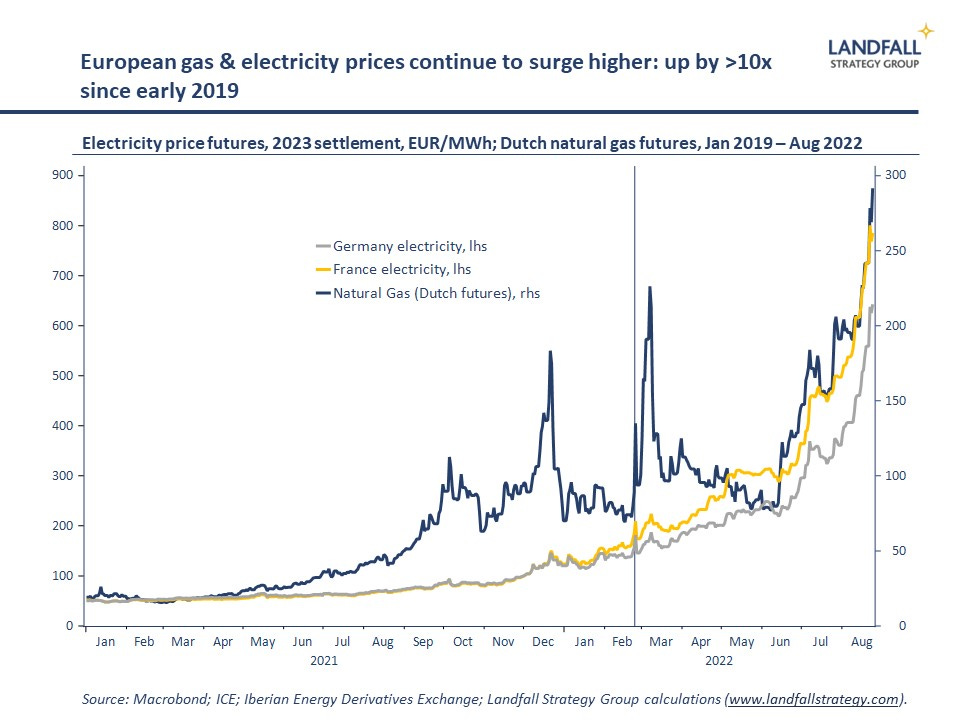

This is contributing to an already-slowing global economy. Part of this is due to surging energy prices, with gas and electricity prices in Europe hitting daily records. A recession in Europe is looking increasingly likely later this year, as industrial production is constrained and household budgets are squeezed.

And inflation is continuing to rise around the world. One striking forecast this week had inflation rising to 18% in the UK. We are likely moving into a new, higher inflation regime: see here, or as Singapore’s Ravi Menon noted this week ‘The era of cheap money, cheap labour and cheap energy is over’.

Partly in response to concerns about faltering growth, equity markets, after a more positive couple of months, weakened again this week. The Chinese economy is looking increasingly shaky. And house prices are beginning to turn in many economies.

On the geopolitical front, the war between Russia and Ukraine grinds on into its 7th month. And tensions continue in East Asia; China’s response to Western visits to Taiwan are contributing to keeping pressures high. Coming on the back of the Covid pandemic, it feels like the world is working through the four horsemen of the apocalypse: Death, Famine, War, and Conquest.

There is domestic political dysfunction in the US; political tensions in China (Covid, property); and looming political challenges in Europe (and elsewhere) as high energy prices bite. And the UK is in all sorts of economic and political trouble, for reasons that extend well beyond Brexit.

Glass half full, glass half empty?

Looking forward, I can (alarmingly) easily develop a list of material things to worry about. It is plausible to make an argument about an unravelling of the system. Mr Macron, in a speech to the first meeting of his new Cabinet this week, talked in sombre language of a ‘great upheaval’ and the ‘end of abundance’.

It is important to take these risks seriously. There has been undue complacency around risks – geopolitical, supply chain, climate, and so on. Governments and firms are now strengthening resilience and actively de-risking on multiple dimensions, having become over-exposed. There is a new economic and political regime, and new approaches are required: a greater measure of paranoia is called for.

But risks can be over-identified: we are much more sensitive to losses/negative surprises than to gains/positive surprises. And firms/countries cannot live (successfully) in a defensive crouch.

A position of excessive risk aversion, where opportunities are ignored, can be costly. Economic and political risks are real and material, but they are not the only dynamics at work. Even in times of disruption and elevated risk, there are opportunities.

‘The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function. One should, for example, be able to see that things are hopeless yet be determined to make them otherwise’, F. Scott Fitzgerald

And it is worth recalling that there have been positive surprises over the past several years as well; for example, the speed with which the world recovered from the pandemic was importantly due to the innovation breakthroughs that enabled the rapid deployment of effective vaccines. Firms and investors that were positioned for this did well.

The roaring 20s?

So let me make the case for a positive structural outlook. This is not to downplay the risks, but to emphasise that there are opportunities. Consider just a few:

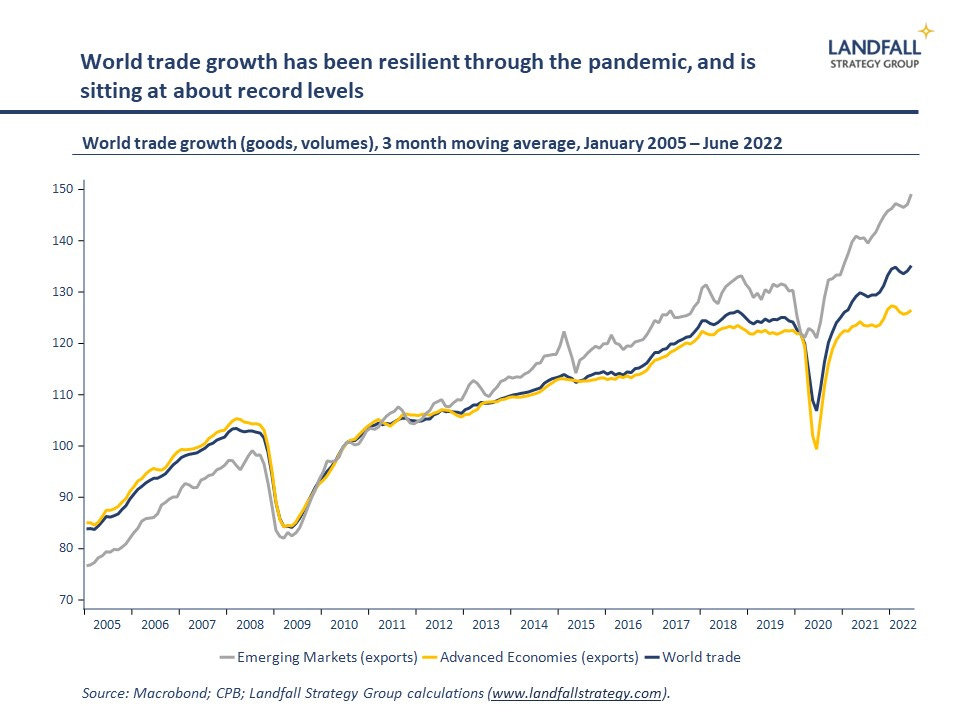

First, as I have noted before, globalisation is resilient. Although economic and political factors are generating meaningful changes to prevailing models of globalisation, in ways that make the global system more difficult to navigate, globalisation will continue (albeit in a more fragmented, political, regional manner). Countries and firms can continue to prosper through externally oriented growth models. Indeed, global trade flows have been resilient through the pandemic despite initial concerns.

Economic and geopolitical factors will reshape trade and investment flows, the design of supply chains, and so on. But there are also opportunities here: Vietnam is becoming home to more of Apple’s production that is shifting out of China; Singapore is receiving flows of people, firms, and capital from Hong Kong, China, and elsewhere; and there are growing opportunities for economies (from Africa to eastern Europe) that are proximate to large consumer markets. And there are some new pockets of strong growth, notably around digital trade.

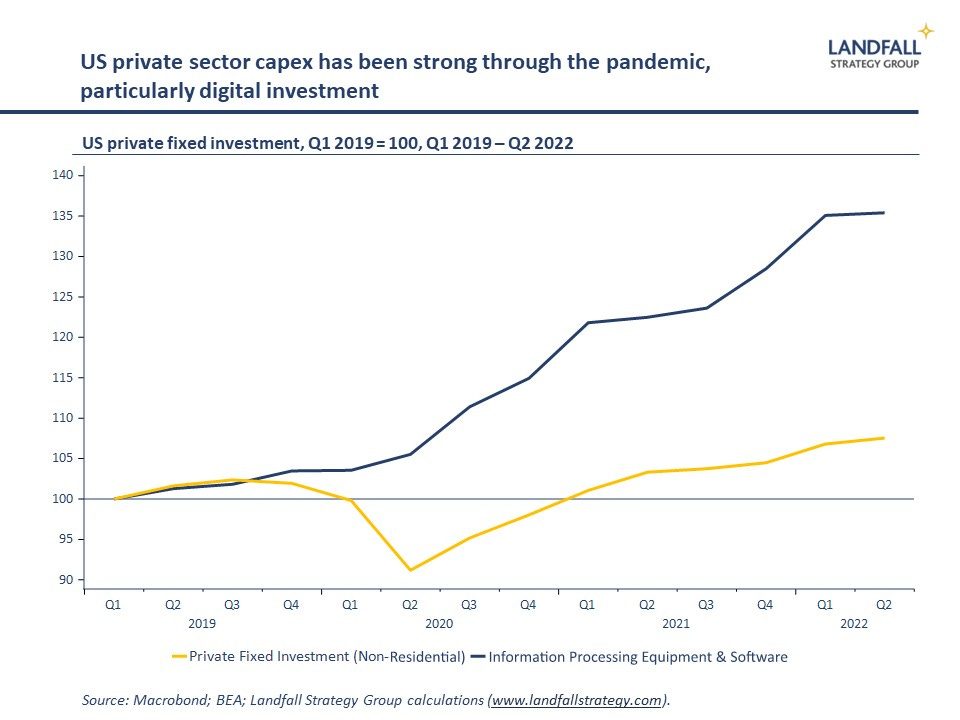

Second, firms are investing behind new business models (automation, digital transformation) as well as in new areas of technology. Capex by US-listed companies continues to be strong, with healthy investment intentions – particularly in technology sectors. Some of this investment behind innovation and technology was accelerated by the pandemic.

And across advanced economies, as well as China, industrial policy around key areas of technology is picking up markedly – notably semiconductors, but extending into a broad range of other areas. Public sector R&D is being increased in the US and elsewhere (note the recently-passed CHIPS and Science Act). The OECD report resilient and strengthening private sector R&D spending growth. And the pace of innovation in areas from quantum computing to AI is accelerating.

This innovation, and the associated investment, creates the potential for sustained higher rates of productivity growth – a productivity renaissance. The tight labour markets in the post-Covid economies may strengthen these incentives further.

And third, there are opportunities in the net zero transition – which will involve fundamental changes in energy, transport, and industrial systems. The deployment of renewables is picking up pace. From the US to Europe and China, substantial investments are being made in reducing emissions. The EU Recovery Package had a strong emphasis on green initiatives, and recent US legislation has put more public funding behind the transition. The speed of this transition is likely to be further accelerated by the current energy crisis, as well as the growing evidence of rapid climate change.

The Netherlands is a good example, with last year’s coalition agreement committing the government to allocate €35 billion to the net zero transition: from investment in renewables to retrofitting parts of the domestic gas network for hydrogen. And there is rapid private sector innovation in food and agriculture, transport, and other sectors.

Walking and chewing gum at the same time

Periods of disruptive change often lead to innovation. The 1970s led to new institutions, new technologies, new growth firms. There were new risks to be managed, but also opportunities to invest behind.

Small advanced economies are deeply exposed to these global economic and political dynamics, and face strong competitive pressures to respond. As is often the case, Singapore provides a useful illustration. PM Lee’s National Rally Day speech this week struck a balance between risk and opportunity – acknowledging the many economic and political risks facing Singapore, while pushing ahead with the massive Terminal 5 at Changi Airport, the world’s largest fully automated port at Tuas, and various other initiatives to position Singapore for new opportunities.

Risks do need to be managed in ways that they have not been, but there is also a case for investing in opportunities with strategic intent.

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original is here. You can subscribe to receive David Skilling’s notes by email here.

42 Comments

How much of a lag is there between high energy prices and the prices of food and end products? Surely some of that will take months to filter through, so even if energy prices fall back a bit, inflation is likely to stay high for quite some time yet..?

When it comes to baking a loaf of bread I suspect like price rises in 24hrs ? 80% rise in energy cost over there can you imagine the real rate of inflation come October ?

Yep, but I would expect it to take a while to filter through for some crops in some parts of the world due to planting dates and when fert goes on.

I think I and many others would be protesting in the streets if I was told that my energy bill would go up by 80% on October 1st in NZ. I am a bit surprised this has not occurred already in England. What would it take to get the people out in the streets? How are they tolerating the lack of leadership and direction from their government? Beggars belief.

It would be very interesting for me to go back to the UK. When I lived there 15 years ago food and utilities were super cheap. They seem to have had a lot of inflation since and a falling currency, I wonder if it’s almost as expensive as here now.

Let me help you with that - with the October shift in the energy price cap the average household in the UK will be spending in excess of NZ$7,000/year on household energy, with the forecast that this rises to over $9,000/year by next April. One of the major finance houses predicted 18% annual inflation in Q2 of next year. Meanwhile human sh+t literally floods the beaches as a privatised water industry which has extracted NZ$140 billion plus in dividends in the last 20 odd years has slashed investment in yet another triumph for free marketeers, whilst Truss stands on the verge of wresting BloJo's crown as worst PM ever from his quivering hands. All this while Brexit continues to crush the life out of British exporters. You sure would find it interesting to go back........the UK is a basket case which is going to suffer substantial civil strife this winter on a scale not seen since the Poll Tax riots.

https://www.nzherald.co.nz/world/britain-to-see-80-per-cent-spike-in-en…

Meanwhile, a grassroots movement called "Don't Pay" is campaigning to gather 1 million people who will commit to not paying their energy bills on October 1 if the price hike goes ahead.

But can you still get a pint for £1.29 from Witherspoon?

I saw that in one London pub prices had hit an all time high of 8 quid a pint............

£2.99 for a full pint of Heiny at my old pub in London. Prob half the price of here. https://www.google.com/amp/s/restaurantguru.com/amp/The-plough-and-harr…

That is one cheap London pub considering the average price per pint now across the entire country is 4 quid. https://www.cnbc.com/2022/08/05/why-the-price-of-a-pint-of-beer-in-the-…

That place must get drunk dry every night, LOL.

King of the whiners,

I lived in Scotland for some 57 years before coming here in retirement 20 years ago and sadly, i have to agree with you. I still have a number of good contacts and find little optimism. I am a little surprised that there does not seem to be a growing momentum for Independence there despite everything. Polls just do not show any big swing in Scotland in favour of it, though that may yet happen.

The selling off of everything was pure Thatcherism and quite rightly from early on, most Scots despised her.

I feel sorry for my friends and family in the UK. People are struggling with the cost of living, yet Truss wants lower taxes for the wealthy. Does this sound familiar?

What does sound familiar is that NZ is the worst place on the planet according to M Hosking

The more a person listens to Mike, the stupider they get. Great for giving the knees a workout with jerking exercises though.

Even conservative voters now support some re-nationalisation. Free markets are failing the majority of people and the trickle down effect is a fallacy.

I went to the UK a few months ago. The supermarkets are still mind blowingly cheap compared to here.

I know, have you seen the price of peaches and grapes in NZ at the moment? Outrageous.

ever heard of the seasons?

Sure if you want to live on bread and noodles but real food is horrendous. Also the cost of dining out isn't even an option for many now. Fish and chips is twice the price of NZ. Try putting the same quality items in the food basket and then look at the cost.

“ we are much more sensitive to losses/negative surprises”

”A position of excessive risk aversion, where opportunities are ignored, can be costly”

If you truly appreciate these two quotes from the above article, you will most likely prosper.

The most exciting opportunities usually exist when most are too fearful to see them.

... sent me Daniel Larison's piece at his blog Eunomia where he contemplates economic sanctions. He refers to The Economist piece titled: Are sanctions on Russia working? My friend correctly states and I quote him:"Sanctions are another example of the intellectual bankruptcy of the Western ruling elite. Like a child with a hammer in a room full of glasses and dishware. As you never cease to point out, almost no one in Western top circles has a well-trained mind. Way too many law and business degrees (or worse, in political voodoo science!), with very poor background in math, physics, chemistry and such. They do not understand the energy-material world -- thermodynamics and the importance of those 92 elements." And Larison's piece, while concluding correctly that:

The flaws of broad sanctions have been well-known for a long time, so it wasn’t as if it took imposing them on Russia to recognize their limitations and ineffectiveness. It was entirely foreseeable (and foreseen) that waging economic war on a country as large and powerful as Russia would have adverse consequences for the senders of the sanctions and for the entire world. We know from experience that targets of the harshest sanctions regimes also tend to be the most intransigent, and broad sanctions often backfire and produce more of what they are supposed to discourage. We also know that sanctions usually do not really “work” at all in the sense of changing the target’s behavior in the way that the senders want it to change. Given all that, it should not come as news that the “sanctions weapons has flaws.” The question should be why we continue to use a weapon as blunt and crude as sanctions at all. Link

Sanctions are a long term game. The west will find alternatives to Russian gas, the Russian economy will shrink into nothing. At some stage they will realise how much better off they would be if they could trade with the rest of the world.

'Experts interviewed by TASS believe that gas prices could rise to a record-breaking $5,000 per 1,000 cubic meters in winter..' In the good old times of Merkel - before Biden came in with NATO & spoiled the party for Europe- Germany was paying Russia $280! https://tass.com/economy/1498683

Audaxes,

Ok. How would you have dealt with Russia?

Good question? I imagine it would involve a lot of bending exercises?

I have a flagpole at home. Raising the NZ flag this morning it occurred to me traitorously that we should replace the Union Jack with the Stars and Stripes. Being that Britain seems to be a failed state that cares not for our part of the globe and we could become the 51st State of the USA. With all the accruent advantages that come with it. In turn they get a pretty good rugby team.

Crap TV though.

We'd be hooking our wagon to a $30T public debt.

No, no, no. Do not go there.

Great article David.

But the DGM in me thought the demographic cliff was worth a mention. Actually, I remember when David was one of our analysts in Treasury who was considering inter-generational equity. Maybe that particular epic fail on the part of the govt is too painful to recall.

It's pretty good. But still only B+ territory.

The only NZ commentator capable of superb analysis is Chris Trotter, although he writes as much dross as superb stuff.

Chris Trotter is blinded by partisanship, where David at least seems to stick to playing the facts and not the messenger.

David is a bit beige, though, and I don’t get any deep insights from his writing, really.

Trotter can be awful, but also brilliant.

Bernard Hickey does righteous indignation better than anyone.

I wonder if drought in China will expedite energy transition?

https://i.stuff.co.nz/business/129705290/how-investors-monthly-loan-rep…

How investor's monthly loan repayments went from $2000 to $8700

ouch.

We saw this recently. The banks are VERY reluctant to extend interest only when loans are renewed. Its potentially more an issue than the OCR rise itself.

I imagine a few are using revolving credit facilities to pay the principal component of the repayments. Investors have had a fair bit of warning about things getting tighter. Interest only is generally not forever and the government was steadily implementing changes that would increase costs and reduce income for investors. There was plenty of time for investors to get things in order. In retrospect the COVID boost was a great opportunity to do this. Very clear in hindsight.

Jesus, we can’t even play rugby well anymore. Total shambles of a team. Surely the worst All Blacks team of all time.

The NZRFU - another example of useless governance in this country.

We are much better at cricket these days though, a good swap IMO

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.