By David Skilling*

There has been striking coherence in the Western-led response to Russia’s invasion of Ukraine. Economic sanctions on Russia and military/financial support for Ukraine have been consistent across the West (and friends); NATO is being expanded and strengthened; and there has been a collective stiffening of the Western spine with respect to China, from technology to Taiwan.

Countries have been making sharper choices on alignment. However, the emerging world will be messier than a binary framing of a Western-led bloc and a China-led bloc. A multipolar world of overlapping blocs is more likely.

Indeed, recent political developments in the US and elsewhere suggest limits on the coherence of the West. It may be that 2022 is the high water mark of the West: ‘peak West’.

America First

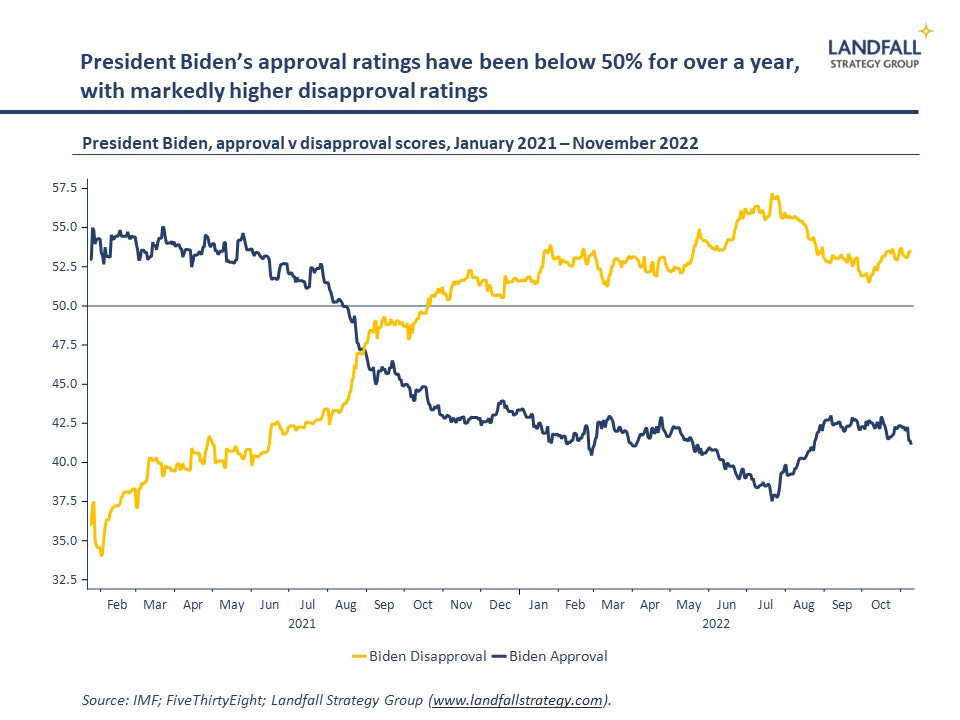

This week’s US mid-term elections saw a better than expected showing for the Democrats, and a bad night for Mr Trump’s MAGA wing of the GOP. I continue to think Mr Trump won’t run again; and certainly that he won’t secure the Republican nomination. But although two years is a very long time in politics, and the polls overstated Republican strength this week, the available polling – and Mr Biden’s low popularity – suggests that a Republican Presidential candidate is odds-on to win in 2024.

But to the rest of the world, broad continuity is likely either way. The inward turn of the US over the past several years is structural, not restricted to a particular Administration. Indeed, there has been much external and economic policy consistency between the Trump and Biden Administrations, despite the calmer behaviour and rhetoric. There is bipartisan support for a more disciplined version of the Trump Administration’s America First agenda.

Faultlines emerging

There are at least three areas in which this policy trajectory is creating stresses across the West.

First, US industrial policy activism has crossed the line into protectionism, with sweeping local content requirements (semiconductors, electric vehicles, and other green technologies). Provisions in the Inflation Reduction Act and the Chips and Science Act disadvantage non-US firms.

This is creating pushback from European countries as well as in Asia (Japan, South Korea) whose firms have built positions of competitive strength in these areas. President Macron has proposed a Buy European Act; and there are discussions underway about more aggressive European industrial policy in response. A form of trade war is increasingly possible (or perhaps a subsidy war).

High-level discussions are underway between the US and the EU, but domestic US politics makes meaningful progress unlikely.

Second, the hawkish US stance on China will continue to escalate – with gaps increasingly emerging on China policy between the US and others. For example, the US has imposed sweeping economic sanctions and restrictions on China (most recently on semiconductors), and is now pressuring other countries to move in this direction (from the Netherlands to South Korea).

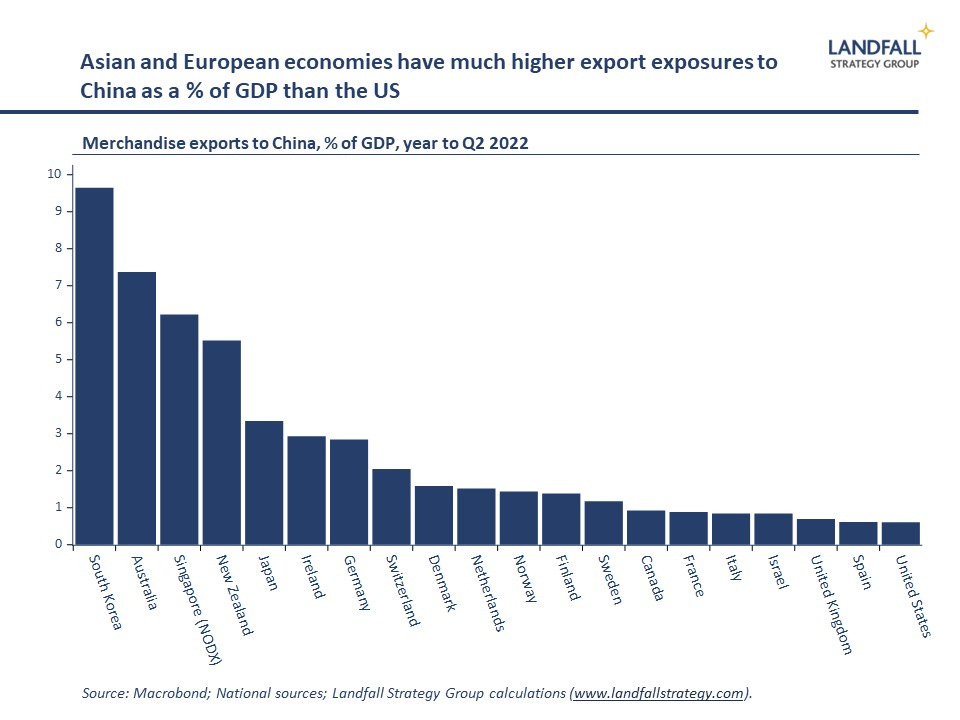

An increasingly hardline US stance on China, which requires more of its partners, will create frictions between the US and others. Although many Western-affiliated countries in Europe and Asia have toughened their policies and rhetoric on China, and public opinion is hardening, there is anxiety about full decoupling. The much higher levels of economic exposure to China in Asia and Europe explains why their hawkishness on China is less ‘full spectrum’ than the US (‘follow the money’).

Although an outlier example, Chancellor Scholz met with President Xi in Beijing last week, accompanied by a large German business delegation, having just signed off on a Chinese acquisition of a port facility in Hamburg. Mr Scholz has said that decoupling is not an option. This is essentially a continuation of Ms Merkel’s policy settings (although this week, Germany rejected a proposed Chinese acquisition of a semiconductor firm). But more broadly, there is daylight between the US and Europe on China.

And many Asian countries are cautious about signing on to US sanctions on China, particularly when the US continues to show no appetite for opening its markets to Asian firms. Indeed, Singapore signed 19 deals with China this week. And in a very interesting speech on Wednesday, Singapore’s Foreign Minister floated the idea of a ‘non-aligned movement’ in science, technology, and supply chains to avoid the ‘abyss’ of bifurcation.

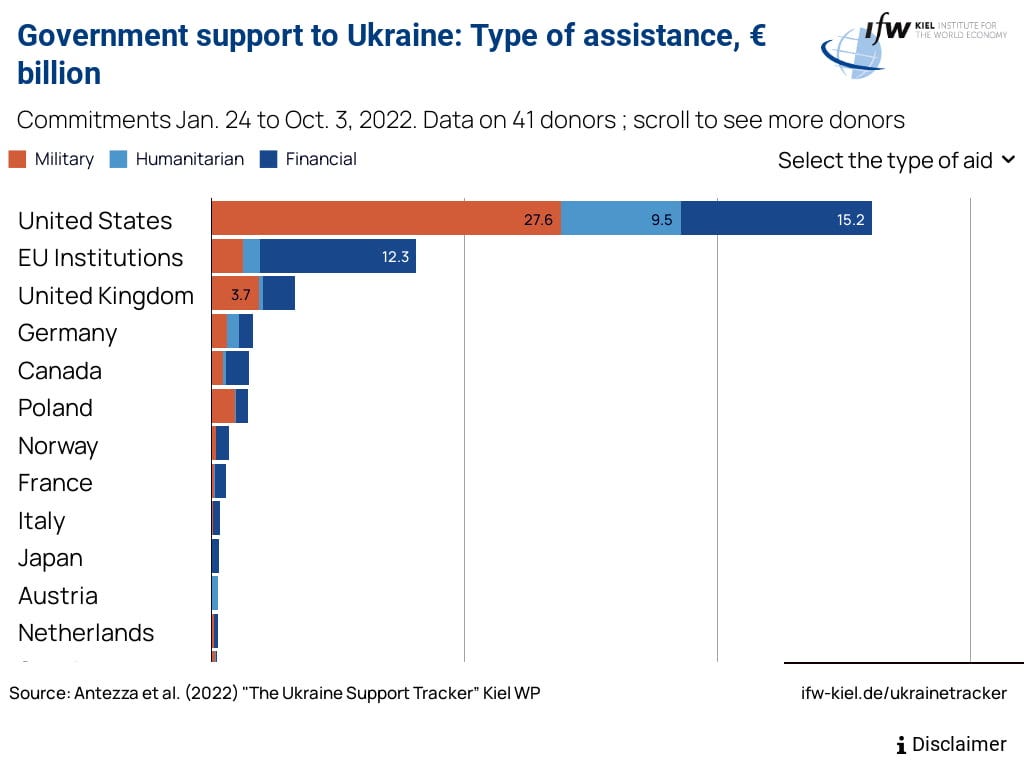

Third, there is an increasingly ‘America First’ stance, with less support for allies and partners (or ‘entangling alliances’). For example, differences on support for Ukraine are already evident across Republican leadership. I expect ongoing US support for Ukraine, but this will be more contested. This matters because the US is – by a very substantial margin – the major provider of support.

There has been sustained nervousness across Asia and Europe on the reliability of the US. The willingness of the US to commit to its allies – particularly in economic terms – has been limited: it withdrew from TPP and has not been prepared to offer market access. And this is likely to weaken further after the Biden Administration. As a result, Western-affiliated countries with large economic exposures to China are looking to keep options open where they can. Although of course, hedging in this way is not always possible (or cost free).

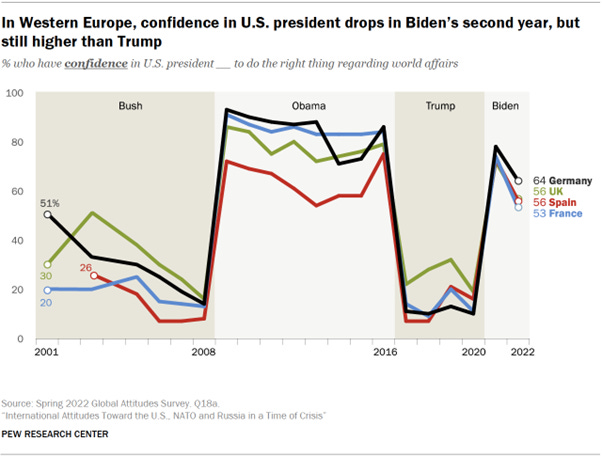

Attitudes towards US leadership across many advanced economies have recovered through the Biden Administration, but remain lower than a decade ago – and are vulnerable to another reduction.

Peak China also

However, China may not be able to take advantage of reduced Western coherence. Alongside the fractures across the West, there are increasingly evident weaknesses and contradictions in China. China’s growth potential – and its ability to project economic and geopolitical power – is running into constraints. Its ability to overtake the US as the world’s largest economy is not certain.

As I noted recently, China’s growth is slowing both in the near-term (Covid lockdowns, property markets) and structurally (capital misallocation, high debt levels, a shrinking working age population). And Western sanctions will constrain its growth potential. China is also an increasingly closed economy, and is actively reducing exposures to the West. The current leadership is focused on security and political goals rather than on economic objectives.

China will continue to be a dominant part of the Asia Pacific economy, and a key market for many economies. But its global dominance is not assured. And although its transactional diplomacy is attractive to some, its ability to develop deep and broad relationships is limited (and some of its friends, like Russia, are not in good shape).

A multipolar world

The fragmenting global economic and political system is likely to be a complicated, multipolar world with overlapping groupings – open for some purposes, closed for others. We should not take the Western coherence seen in the first half of 2022 for granted.

Of course, there are strong shared interests and values across the Western grouping – evidenced in the response to the Russian invasion of Ukraine. Another similar crisis – perhaps most obviously, a Chinese invasion of Taiwan – would also likely strengthen the Western grouping. But without such an existential crisis, the differences in posture are likely to lead to increasingly obvious fault lines.

Countries will increasingly be required to make choices on strategic positioning and alignment. But geography shapes the options and incentives facing countries, and we should expect a more regionally organised global economic and political system. In a world where geography is back, ‘vertical alignment’ (longitudes) will matter more than ‘horizontal alignment’ (latitudes).

In the real world, all politics is local. But the West – and particularly the US – needs to take care that domestic politics takes relations with its allies and partners seriously; and that it does not undermine the coalition supporting the rules-based system. Particularly for small economies, there are risks - and these dynamics require careful watching and thought.

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original is here. You can subscribe to receive David Skilling’s notes by email here.

18 Comments

Germany looked east this week. There is no euro Bloc without China. This is the fault line to watch. Defence alliance with the west and economic alliance with the east. I think Scholz has just made his choice.

And 2018 may have been ‘Peak East’.

PDK would surely say it's peak East, West, North and South.

I suspect that once again the news of the death of the West will turn out to be highly exaggerated.

... apparently the WHO are set to announce next week that the world population has cracked 8 billion ...

That news should lure the lad from his cave .....frothing & lashing out in all directions ...

... it's always " peak " something ...

Mr Scholz has said that decoupling is not an option

They might have said that about Russia a few years ago...

Russia will be highly suspicious about an alliance with Germany after what happened last time!

1945. UK, Russia, USA, China the main Allies. Germany, Italy, Japan the main Axis. Some five years later. UK,USA, Germany, Japan, Italy the allies (plus the rest of NATO pending.) Russia & China the ? Intercontinental fall out don’t take long.

Interesting David, thank you. You are one of many trying to figure this out.

It is a planet of many moving parts & picking winners & losers can be fraught, frustrating as well as financial. We've seen what China has to offer (cheap labour & scale) but that chapter is over. The new China? Who knows exactly. I'm picking the Chinese people will split from the CPC (it's already happening in places) & that things internally for Xi will become more complicated for him quicker than many expect. The Chinese people are not dummies. They know full well what's going on & they realise they are being used.

Meanwhile, back at the ranch....the West is destroying itself as the communists (within) in the media, educational facilities & the state sector itself try to wrest control from the wealth creators (the businesses). And they're doing a damn fine job of it too. This is stupidity of steroids sadly, but the regulators are stepping up & look out above (& below) as their pretty people peddle their poisons upon the rest of us. Social democracies are the new black, however, they will drown the lot of us in their own debts, before they succeed.

The small nations need the big nations, so it becomes a battle for survival when wind & tide are turning. Only the smart small nations will survive & I'm not sure New Zealand is one of them. I hope I'm wrong. The small nations should create a global club of other small nations & create a global voice of some sort. Many of us/them have something positive to add & it would act as a counter weight to listening to the big boys club all the time.

'Ten or Less' could become quite a strategic player if 30 or 40 countries of less than 10 million people were to meet regularly & at least try to (re)take some control of their own destiny. The UN doesn't do much these days, they could facilitate it? Yeah, right!

In summary, we are still in the best position, albeit whilst we are still trying to kill the best cultures on the planet. Socialism sucks, as we all know too well. Reality will have to kick back in eventually. And you can't beat freedom. Freedoms are sort out but rich & poor alike. The more freedoms we have, the better off we are, despite what Jacinda is trying to sell us. With any luck she won't be here this time next year.

Hooray!

"I'm not sure New Zealand is one of them"

it will be if it continues to screw itself. ETS and blithely following Europe to NZ's own detriment. Take fertilisers. There's a 35% duyt/levy tax on Russian fertiliser (check Customs website, The latest Regulations made under the Russia Sanctions Act 2022 impose a 35 percent tariff on all imports of goods of Russian origin. ).

There's a specific exemption on fertliser. See this document. OFAC Food Security Fact Sheet: Russia Sanctions and Agricultural Trade July 14, 2022

WJ - no. (And Nigel - fossil-originated fertilisers are as finite as guano - same problem but further now to fall).

Unfettered 'freedoms' for an unlimited number of resource-consumers, is a physical impossibility.

https://donellameadows.org/dancing-with-systems/

Put another way, unlimited growth within a Bounded System is impossible. We are up against the planetary limits now, exceeding maintainable resource-stock capacities by 1.5 -10x. In energy-stock terms, we are exceeding them by more than 20x. Hence the energy angst irrupting in the Northern Hemisphere, and the concurrent problems of global heating from just the exhaust of the burn.

I can't remember, but I'm guessing you deny the latter? It would go with the rest of your narrative.

Small nations will actually do better, but those who have least to fall (3rd World) will be better off than those with a long way to fall (NZ). Tongans, for instance, will wear the morph much better than their ex-pats in Auckland - which will border on untenable, post fossil-energy availability.

4 hours and still no sign of our leader, PDK. Curses! Oh alright, I'll do it myself:

A period of less globalisation already starting. But these oscillations are just ways for us to use up the last few years of fossil fuels with positive EROI.

:(

Sorry, I was out having fun

:)

Saw your posts above. Deep down I knew you'd come through for us.

:)

Peak West?

Yes maybe, the west seems intent on deindustrializing itself and lowering living standards through sanctions on Russia and Climate Change policies which the rest of the world especially Asia have no interesting on following and in fact are profiting from. An example is both India and China buying cheap Russian oil and reselling it to European countries at a profit.

Uhhh, it's not because of climate change that few bar the Indians and Chinese are buying more Russian fossil fuels.

didn't say that at all.

I was just using that as an example of how many countries are not following the west and taking advantage of western policies to profit.

Regarding climate change, the west is slowly shutting down it's fossil fuel industry whilst many in outside the west are doing the complete opposite.

I saw a chart recently which show that show CO2 emissions from the USA and Europe significantly decreasing whilst China now emits more CO2 than Europe and USA combined. And the increase in CO2 from China is parabolic and the trajectory is not changing. In other words we are sacraficing our economies to living standards for the earth while China and others don't care.

Good comment - but it is too late for China, energy-wise. Always was; I think I said here 15 years ago that there wasn't enough planet left for China t get as big, consumption-wise, as the USA had been. It may well become the biggest global Empire, but not at the scale the US achieved. And India was too late out of the blocks - they're in big trouble.

Those 'economic living standards' were goners anyway, lo need to lament. This wee orb spinning in space, can support perhaps 2 billion at a good-peasant level of consumption, 1 billion or less (the smart money - intended - is on 600 million) at our level. But the latter is probably an oxymoron; 600m probably cannot specialise enough to produce our variety. This was a Blip - we were lucky and timed it right.

The 'Govt Support To Ukraine' graph is misleading. Need to add all EU countries together to compare to US. Either that or split the US into its separate states.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.