In its September 2022 survey, Statistics NZ recorded New Zealand consumer price inflation running at 7.2% over the prior 12 months. For the quarter it ran at an annualised rate of 8.8% pa in a very unexpected leap. And that was followed by fast rising inflationary expectations.

We will get the next update for the December year on Wednesday, January 25, 2023. A lot hangs on the pace and direction of this report.

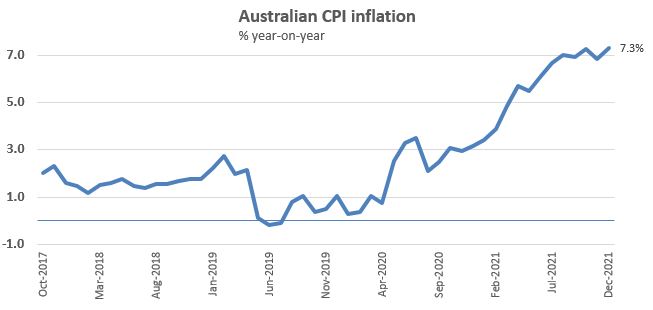

In Australia, their October 2022 CPI inflation rate was 6.9%, with the quarter-only rate running at the same 7.2% annualised rate.

However, their November 2022 rate was released today and it came in at 7.3%.

Markets had expected a 7.3% rate for the full year, and a monthly annualised rate of 7.2%.

They got their year-on-year estimate right, but the month-on-month rate zoomed up to a worrying +10.8% surge and far more than expected.

It jolted the AUD, and the NZD was hit in sympathy. Aussie bond rates rose. The chances of the RBA easing back from their inflation fighting have receded.

The are some clear culprits for this latest surge in Australian prices. First, food prices are marching higher, faster.

Australian food prices rose at a +17% annualised rate in November to be 9.4% higher than a year ago. That masks the +10% rise for bread products, the +19% rise for dairy products, and the +29% rise for fruit and vegetable prices in November at annualised rates from October.

Then there is the equivalent 12.5% rise for healthcare and the same for household furnishings, the very sharp +67% rise for petrol and fuels, which fed into travel costs rising in November at a +51% annualised rate. All these will hurt.

Ameliorating these sharp rises were low increases for housing and education, each separately up at a +1% rate, and rents at a +2.3% rate. However, if you are looking to rent in Australia, you might choke on that rent data. There are a legion of stories about how hard it is to rent and how high the rents are there.

It does make you wonder what New Zealand will record for its December 2022 inflation rate. And moving countries won't allow you to escape the pressure of inflation.

95 Comments

It's good to see the same economic model and supply chain making kaka in bed consistently everywhere.

I don't think RBA are alone among Reserve Banks in underestimating the measures required to curtail inflation.

Nor in over-estimating their ability to do anything about it.

Didn't stop Reserve Banks slashing rates last decade, unlikely to stop them raising rates this decade.

How this comes as a surprise when both Australia and NZ are adding hundreds of thousands to their population centres in a short span.

This might ease labour shortages in provision of elastic goods (takeaway meals, coffee, etc.) but will only exacerbate the supply crunch in inelastic items such as groceries and accommodation.

This might ease labour shortages in provision of elastic goods (takeaway meals, coffee, etc.) but will only exacerbate the supply crunch in inelastic items such as groceries and accommodation.

Not a great indictment on two developed economies with relatively small popns. Developing nations are fully focused on food supply.

Then we have to support those extra people as they get old an need healthcare and pension. It feels a bit like a ponzi scheme where you need to keep getting more people in and increase the population more to support them, and the extra jobs required to support an increasing popualtion

Well yeah, we have a 'pay as you go' tax and spend system which requires a continual stream of entrants to afford continuity.

The alternatives are like the films 'children of men' at one end, and 'logans run' at the other. My money is on the former, as successive generations become less and less interested in being parents. Maybe we'll turn our primary schools into cheap dorms.

Is that your understanding of migrants? Only low paying fast food jobs ?

That's my understanding based on the immigration data - the top occupations receiving work visas are chefs, cooks and cafe managers.

I really wish that weren't the case. My team is having trouble getting a single worthy applicant for the many engineering and technician roles on our website; a problem our Canadian and Australian offices aren't facing as much.

Surely for many highly skilled migrants Aus and Canada are much more appealing prospects than NZ? More developed infrastructure, better paid jobs, and lower cost of living.

NZ is really going to struggle to attract good, highly skilled talent.

If those were your largest priorities then those other two places shouldn't feature on your list either. You want to live in a city state.

Odds on NZ is not only about to follow suit but raise the ante. The data published that Xmas spending cost more for less will undoubtedly be contributive too. Thus, next time, another 0.75% OCR jump, at the very least.

Another 75 bps jump is a given, as also it is a given that the OCR peak will go higher than the predicted 5.5%. An OCR peak of 6% is very likely now.

Be more open minded, nothing is "a given" or certainty.

The NZRB - given how long it takes rates rise to flow through to borrowers - needs to be very, very careful they don't kill off a huge chunk of economic activity. Will they?

The RB has shown a tendency to vastly overreact under Orr. Firstly, by massively overstimulating the economy by not only dropping the OCR to near zero (which on its own would have done the job) but also by throwing money at the banks (who just threw it at rich people so they could buy more houses). And then by rapidly ratcheting up the OCR that caused another dash to buy on hock before the rates went up further thereby making inflation worse. (What they should have done is said was "Right, COVID wasn't as bad as we thought, back to normality, the OCR is rising from 0.25% to 3.00% and we'll adjust further when we see whether common sense returns to the market".)

This will impact NZ local interest rates too. And when the NZ CPI comes higher as expected later this month, all bets are off. An OCR peak of 6% is becoming very likely.

People are up in arms about shrinkflation but there's another phenomenon called 'skimpflation' where products are "reformulated in some way, usually with less of the expensive components and often by substituting cheaper ingredients."

https://www.businessinsider.com/smart-balance-is-undoing-formula-change…

Shrinkflation: offering smaller unit sizes at/near the same prices as the original.

Egs.

With decimalisation pints (568mls) went to 500mls

In the 1990s Lux soap went from 150g to 125g

It’s interesting what comes after shrinkflation, when companies start advertising new larger size (with increased price). Then later the process starts all over again.

We sometimes buy those Muffin Splits from the supermarket. Noticed they've shrunk the diameter considerably, didn't think too much of it.

Until I decided to buy breakfast from McDonalds. Obviously the breakfast meat patties MCD's use haven't shrunk in size, so you have a tonne of meat hanging outside the muffin.

Who remembers the sheer size of cookie times in the 90's, not the piddly little dots they sell today.

Does the Reserve bank even consider shrinkflation in the CPI figures? I remember a bag of chips used to be about 220gms. Now they are about 140-150gms a bag. They just keep decreasing in size over the years, rather than raising the price. and now they are raising the prices because they can't decrease the size much more.

Surely they consider the size. But yeah CPI is hard to measure fairly, for example should they take the most budget loaf of bread ($1.30 from new world is what we buy) or mollenbourg? There is a massive price difference and a massive inflation difference, the $1.30 loaf is quite possibly cheaper than anything you could get 20 years ago.

The cheapest loaves of bread can only loosely be termed "food". Its the sort nutrient free substance that should be in the healthcare category, as consuming it regularly means spending money there sooner, or later.

Not if you put decent toppings/fillings on it. its merely a nutrient free carrier medium. Not much point in using an expensive sourdough or premium bread when you are going to slather it in a thick layer of decent peanut butter. (Not the sugar and salt filled rubbish that passes as PB in some quarters)

It's a funny old world isn't it? The central banks are trying to slow the economy down to 'control inflation' - by increasing interest rates.

In this day and age, it seems that higher interest rates only really slow down house prices and the construction industry (unless you have a major public building programme to pick up the slack of course).

In fact, with the OCR at 4.25%, RBNZ are now pumping $4.5M of direct fiscal stimulus every bloody day into the banking sector (interest payments on settlement balances, net of interest paid back on those silly Funding for Lending Programme loans). On what planet would this level of stimulus not be considered inflationary?

Furthermore, higher interest rates are showing up all over the place when businesses explain why their prices are rising - fuel prices and shipping costs might be going down, but increases in the cost of revolving credit are up... so prices are going up sorry! It seems that increases in the cost of production do flow through into increased prices. And, it is also clear that firms take the opportunity to push up their margin when inflation is in the news. Fancy that - now who is going to re-write all of those econ 101 text books?

My personal view - and I'm not alone - is that increasing interest rates in the current environment is just as likely to be inflationary as it is disinflationary. We are literally choking the dispoable income of mortgagors and debtors to pursue a strategy that may well be making things worse.

So how would you propose to combat inflation Jfoe?

At this stage of the episode, let it play through. If prices and wages all go up by around 10% over 18 months and then stabilise, which is what is happening across the developed world, then what is the problem exactly? It effectively means that the cost of the disruption has been met by those that can most afford it (i.e. creditors).

One thing I would definitely do though to insulate us from future shocks is to introduce a mechanism to regulate the price of imported fuels and gas. Scrap the stupid Emissions Trading Scheme and publish a timetable of escalating prices for petrol, diesel, gas for the next 5 years so that households, businesses, and local Government can make informed decisions about their heating systems, choice of transport, public transport projects etc.

A 5 year Plan??? Trying to forecast energy (the fundamental commodity) prices?

Zoltan Pozsar's 'Commodity Encumbrances' piece would suggest, rather, that you may have to factor in geopolitical influences on the 4th price of Munny- the general level of prices.

Good luck...

Not suggesting a 'forecast' - just using the Govt balance sheet to carry the upside and downside risks on energy (as Germany are doing now with gas). The ultimate goal is to dramatically reduce our reliance on oil, which is, of course, one thing we can do to reduce the impact of those geopolitical risks.

I enjoy listening go Zoltan, but he has said some crazy stuff in recent months!

Using the government's balance sheet would see us paying more than our neighbours over time. Better to use the balance sheet to build a Strategic Reserve like the Yanks have and buy low and sell when required. Warehouses work for a reason. ;)

Have you really thought through your comment or the suggestion on the way you want to control inflation?

Right now only a few RAM raids, with your way of controlling inflation, it will be only RAM raids in yhe country, nothing else.

Maybe you missed the intro to my comment: 'At this stage of the episode...'

I have no idea what your point is on ram raids, sorry. I do know that violent acquisitive crime increases as inequality increases. If you put the have nots and the have a lots in close proximity, and then make life harder for the have nots, you get violence. That's why the distributional impacts of how you tackle inflation need to be taken seriously - e.g. let the benefits and minimum wage adjust to the new price level, but use taxes and other disincentives to keep a lid on the disposable income of the wealthy.

Adjustments to the new price level will create more imbalance in the society. We are moving to the new price points too frequently in the last few decades.

We need to go back to the previous price points and that too urgently and with more determination.

The socio economic platforms created when the new world order was established post world wars is not helping us anymore.

The population keeps on increasing and resources are scarce, the mindset of excess profits every quarter needs to go away. The mindset of ever increasing prices need to be extinguished if need the next generation to live happily. The greed has to be removed grin this generation.

violent acquisitive crime increases as excuses increase instead of consequences.

Fixed that for you.

You have literally taken a factual statement and turned it into a popular but wrong statement.

"If prices and wages all go up by around 10% over 18 months and then stabilise, which is what is happening across the developed world, then what is the problem exactly?"

That's a mighty big "If"? Could it be the stabilisation you speak of is beginning to occur because of central bank action?

It was only a few short years ago banks were in deflation fighting mode. Dropping interest rates aggressively to try kick some life into consumer activity. How soon the normalisation of negative interest rates and helicopter money commentary has been forgotten about huh? Seems to me the opportunity to raise rates is a godsend for central bankers, looking to stockpile ammunition for the next deflationary downturn.

Interest rates need to be high to keep a lid on energy consumption. The world is on a war footing. With Russian capacity increasingly off line, the American shale era over, there's no spare capacity to fuel global economic expansion. The party has played out. There can be no increase in energy demand, without a parallel surge in energy prices and yes, inflation!

Fair challenge - it is a big IF. But, what is the impact of going too far? We have $120 billion of mortgages coming off their fixed terms in the next 12 months. That's a massive hit to disposable incomes. Do we really want to choke the economy and put thousands of people out of work if it looks like the best cure for higher prices is stable oil prices, and, errrm, higher prices?

I'm with you on the energy consumption (we miss you PDK). The Saudis are keeping the price in the mid 70s at the moment - high enough to make their fortune, low enough to dissuade investment in new wells etc (like shale). Note also that the prices started to drop and stabilise when America gave the Saudi leader immunity from prosecution for the murder of Koshaggi. Perhaps we will get another year or so of that before the next thing kicks off. We should be using this period to move off oil quickly - Germany have shown what is possible if you go at it hard enough. Reduce use, transition to alternatives, buy all the solar panels etc.

Yvil,

Central banks have the option of tightening.

RBNZ kept up their FLP programme till Dec.

Why can't they be a bit more gentle with interest rate rises, and more active with directly restraining credit growth.

It's a funny old world isn't it? The central banks are trying to slow the economy down to 'control inflation' - by increasing interest rates.

Think you'll agree with me Jfoe that inflation is fundamentally about money supply, even though the Grand Pooh Bahs don't talk about it. Anyone with some kind of understanding knows anyway. I expect you are one of these people.

The money supply is basically total net borrowing (loans taken out minus repayments made) + net Govt investment in the economy (Govt spending - Govt taxes). So, the $600bn (ish) in non-Govt bank accounts in NZ is the sum total of net Govt spending (about $60bn) and total loans outstanding (about $540bn).

Now, does an increase in the quantum of NZ dollars in non-Govt hands - the money supply - actually drive inflation? It depends doesn't it? If the non-Govt sector puts 90% of that $600bn into term deposit accounts, then definitely not - instant price collapse and recession! If everyone decides that Bitcoin (or housing) is a sure thing, and they are prepared to cash in all of their savings to join the Ponzi, then the first order effect would be inflation in that asset price, with the second order effects depending on what the people exiting the Ponzi spent their money on (Teslas and home renos, or back into term deposits?) Note that this potentially inflationary investment frenzy would not increase the money supply - just bring lazy money into active use. Unless of course people borrowed to invest in a ponzi, which would increase the money supply (here's looking at you NZ housing boom). But is this money supply driving inflation, or is inflation driving an increase in the money supply (here's looking at you NZ business borrowing in 2022).

Anyway, I digress. My view on the current inflationary episode is that the primary cause of price increases across our economy is the increase in the price of imported oil, which is a major feed-in cost to prices across our economy. We import twice as much energy in oil as we produce across all of our electricity generation. A look at the data appears to support this view. There is no real correlation between changes in the money supply and the CPI, but the international price of oil predicts CPI changes way better than any other leading indicator that I can find.

Sorry, that's so long.

So the money supply increases let's say through the property ponzi mechanism (which is one of the main conduits in the Anglosphere). That in turn drives high cost structures through the rentier mechanism (all property bubbles are accompanied by high cost structures), which feeds into the cost of goods and services. But you're reliant on the sheeple to spend like drunken sailors and carry all the risk. Compare this to Japan where the people are relucant to borrow and party like there's no tomorrow. The CPI is relatively benign.

Japans GDP/DEBT ratio is 262.5% inflation rate 2022 - 4%, trade deficit NZ$332 Billion, Deposit interest -0.15% 10/1/2023, housing inflation 2022 +0.2%. Yen/NZ$ has hardly changed in a year so why with such different parameters does the exchange rate reamin stable against NZ$ and how to explain the vastly different ratios and rates??

Yen/NZ$ has hardly changed in a year so why with such different parameters does the exchange rate reamin stable against NZ$ and how to explain the vastly different ratios and rates??

There are fundamental differences. Japan is a net creditor nation and is the largest holder of U.S. debt. Recently watched a commentatior discuss how Japan could potentially crush U.S. equities by offloading their u.S. debt holdings. Frankly speaking, the U.S. played its part in the Japanese bubble and its bursting through the Plaza Accord.

There are major cultural differences to be fair - e.g. excess profits and greed are shameful, full employment is an expectation. Also, as noted above, they have a trade surplus, which means they amass foreign currencies (inc US bonds). However, they also have a central bank that thinks differently - they control the yields and currency with aplomb. The traders try and take them on every now and then. it never ends well for them.

Au ....."That masks the +10% rise for bread products, the +19% rise for dairy products, and the +29% rise for fruit and vegetable prices".......

Bread products=wheat=war Russia. Dairy products, little or no Russia here. 29% fruit and veg. A minor contribution from Russia, rest weather? Not sure if there is a labour issue, mainly pickers I'd think? Diesel? Lower oil prices over the last three months probably not filtered through.

Fertiliser also not sure of Au situation. Here there's a 35% duty/tax on Russian fertiliser not withstanding no sanctions on fertiliser. US no sanctions on fertiliser and revoked anti dumping tariff, not anti war on Russia in Jul22.

https://www.reuters.com/markets/commodities/us-panel-revokes-duties-fer…

Everything is going to plan. There will be no slow down, no recession and house prices are near the bottom.

The key is/are wage increases which are not only mitigating the impact of price rises on consumers, but addressing Covid budget deficits via fiscal drag.

101 macro - prices rise, wages rise, tax receipts rise, deficit inflated away.

Don't believe me, try to get a builder.

And that will work IF we restrict the amount of new Debt created. i.e. Lower LVRs on asset lending and DTI's consumer credit etc.

Inflation control has 2 basic leavers - the Price of Debt and the Amount of New Debt Issuance.

If lever one is 'counter-productive' - a higher OCR feeds into higher prices, then expect lever 2, less Debt available, to be pulled even harder.

(PS: Less Debt Available will actually pull Lever 1 again, as well, as those who must have Debt to survive compete to get it with the only defence they might have left - any ability to 'outbid' other borrowers and pay a higher % rate, to get what's available)

If lever one is 'counter-productive' - higher interest rates feeds into higher prices, then expect lever 2, less Debt available, to be pulled even harder.

Yep. Think of it like mechanics. The only thing missing is an understanding of how people make trade-offs. This is the central banks' Kryptonite.

I have no idea what you are on about.

Interest rates are significantly higher and if anything it is increasing inflation. Wages are rising because there are structural supply and skill shortages in just about any key industry you can name. None of this is going to be unwound.

You need to read up on tradeable v non-tradeable inflation. What is being unwound is 15 years of a virtuous environment of imported deflation.

How much could you pay for a builder if you couldn't borrow a cent? As an individual, you may have the cash, but collectively? - As Debt availability dries up, and borrowers can no longer borrow what they once did, regardless of the cost of interest, what happens to the builder's prices when he has no work?

I hear your logic but it’s not okaying

out that way. Wage rises mean or rowers are able to live with higher interest rates and economic activity is not slowing down - both team and nominal. That’s the point, you are applying orthodoxy to a unique situation.

I thought you were saying a month or two back that the economy would turn to custard in 2023, big change of opinion???

I dont know whether Te Kooti did or not, but HM you are well known for changing your opinion

Likewise with building materials. As housing related borrowing costs dropped enabling people to borrow more, building materials manufacturers such as Carter Holt Harvey and Winstone Wallboards would have most certainly raised their wholesale prices to match.

People claim that house prices cannot fall because it "costs so much" to build new. Ah, well, there's a lot of "head room" when you're price gouging.

Material price decreases seen in about 25 years in and around trades: 0

While I'm sure there's the odd item that's related to a commodity index (timber?) or exchange rates, I'll be pretty amazed to see any substantive price rollbacks going on, outside of maybe someone overstocked clearing inventory.

Mortgage interest rate decreases seen in about 25 years? Or average loan amounts on residential lending decreases in the last 25 years?

Or are you saying that the "cartels" that we have in building materials have ethical price models, and if you go to the source, everything is a true and fair cost with a fair and consistent GP% applied? E.g. all cost inputs (fuel, electricity, labour) are added as a 1:1 and the GP% remains the same?

No, but there's certainly been market slumps and markedly lower activity. The construction market took a decent dive in 08 for instance, and as far as I recall there weren't drops in labour and material prices. At best they stagnated for a few years.

To your second point I doubt any business constantly alters pricing to retain a 100% consistent margin. Price rises are usually periodical with likely a diminishing margin between increases.

Why don't you look up a few annual reports for some of these suppliers and see if there's a marked jump in their GP %.

Interest rates are significantly higher and if anything it is increasing inflation. Wages are rising because there are structural supply and skill shortages in just about any key industry you can name. None of this is going to be unwound.

This is true. But only part of the story. Inflation is increases the price level of goods and services + monetary inflation (M2 for ex) + increases in asset prices.

It's a cycle. As we head into recession, supply of labour will increase. The same thing happen with houses. As credit costs increased housing supply on the market has doubled. I question whether we really had any housing shortage at all, as are there any real stats on this. We can increase demand by opening up the borders and increasing the population. But many houses have been turned into airbnbs, and new houses are being purpose build as airbnbs. People don't want to have to deal with rentals, when they can potentially make the same amount of money or more from an airbnb over a weekend from visitors.

The long term trend is lower occupancy levels combined with increasing population. I dont have the actual numbers at hand, I'm sure others can confirm it

A wage to price spiral is what it is called and it is a bad thing. It is especially bad for retired people who have saving, only to have the value of their savings stolen from them. I remember when experts were saying you need ta million in savings for retirement. But in 30 years a million will be worth a fraction of what it is now if inflation isn't kept in check. They made an error in not trying to curtail it faster.

A wage to price spiral is what it is called and it is a bad thing.

You mean like in Perth during the mining boom? It was a bad thing because people believed it was going to go for 30-40 years.

But in 30 years a million will be worth a fraction of what it is now if inflation isn't kept in check.

A million dollars is chump change now.

It is so frustrating that the media and politicians have basically created this narrative that we are in a wage price spiral/fear mongering arounf a wage price spiral when the main drivers of inflation are actually energy prices, supply chain disruptions and companies increasing their profit margins. There's a mckinsey study out of the UK that even showed sectors with higher proportion of labour costs did not raise prices higher than the sectors that were not so reliant on labour. So basically every time a journalist mentions the price wage spiral they are perpetuating this innacurately as one of the main drivers of inflation and it just makes it seem like the worker is somehow to blame.

https://tera-allas.medium.com/should-we-be-worried-about-a-wage-price-s…

Thanks Te Kooti, It's refreshing to see someone being positive. I get sick and tired of the negativity displayed in this forum. I just had 2 weeks holidaying on the West Coast, South Island. The towns are pumping. record crowd (est 10,000+) at Kumara Races, great weather. Accomodation in most places booked out to end of Feb, at least. Recession-what recession? Some people need to get out in the provinces to see whats really happening.

It’s the same in the cities too. Restaurants, bars, everything is packed.

So the saddos just need to leave the house then?

This is totally anecdotal and non-scientific but I think is still instructive… I bumped in to a small group of small scale property developers that I know at an expensive Auckland restaurant prior to Xmas. There were no expenses spared in terms of their food or drink selections, putting it mildly. I asked them about their businesses and they all pretty much said things were looking pretty dire, I found out after that one of them is on the edge of bankruptcy. Yet that wasn’t stopping them living it up and putting it all on the credit card or mortgage.

my point is, I think to a certain extent the current level of business in hospo could be a bit deceiving.

Another point - I have had several groups of family or close friends visiting NZ from overseas for the first time since the pandemic struck. With all these pent up visitations, my family and I have been dining out MUCH more than we normally would. I have several friends and acquaintances who have had the same experience.

Speaking for my own household, we have blown our budget a bit on all this dining out, and will be much tighter over spending in the next few months to catch up with this.

More domestic inflation will mean higher hikes in interest rates. Higher for longer guaranteed

Alpeg - I do not doubt the west coast is doing well - but is unlikely to be reflective of NZ as a whole and one swallow does not make a summer.

That's right, chin down Alpeg.

I passed through Reefton on the 2nd day after the North Island moved back to level 2 ( Auckland 2nd lockdown, after they relaxed Inter Island travel.)

My God,that was a sad sight. Was like an end of worlds scene, like only a single car passing every 10 - 20 minutes. Was deader than Three Ways in Aussie, which i hitched out of once... . I am Glad they have visitors again.

The West Coast got absolutely butchered by covid so they need every cent.

Point taken Rumpole, I just prefer the quote from Donna Karan "Delete the negative accentuate the positive!". Now I'm feeling much better.

Yep everyone whacking it on the credit card, what could possibly go wrong ?

Fair comment but have you accounted for the lag between a decision and its implementation? I suspect actual implementation in response to inflation/interest increases etc will roll out increasingly over 2023 and the results will not be pretty.

Even with this inflation news, more and more people are saying what I have predicted for some time. Inflation, recession, tourism, house prices. ITGuy and Retired Poppy remain almost silent, too scared to take on Te Kooti. Thanks Te Kooti.

Brace - this is going to sting....

One rather suspects that the word "unexpectedly" is gonna get a workout in '23....

Next will be "Black Swan"

We need to remember monetary policy has an 18 month lag, with construction demand cratering, and energy prices down, it’s worth taking a pause to measure the cumulative effect of the actions already taken before doubling down.

Indeed, the overshoot bu central banks is massive, yet they don't realise it. In 12 mo ths from now interest rates are dropping again

Inflation firestorm equals higher interest rates, just like NZ. Aussie is in a worse position because they were allowing 95% debt loans to pump their ponzi.

-95% loans

-Grants and rebates to build or renovate when covid first hit

-Reserve bank hinting at low rates till 2024

Although they are hinted to come through the next 12-24 months more smoothly economically, so who would really know.

Hinting low rates - didn’t they almost guarantee it! Such a stupid move considering at the time other countries including us were seeing inflation.

Inflation really isn't under control is it. The Chinese takeaways just went up another $1, the breakfast at the cafe went up another $2, the Indian went up another $2 and this is all just in the last 2 weeks. Doesn't sound like much but that's 10% in one jump.

And 'inflation' is essentially a bureaucratic weighting exercise: models all the way down, as to the official figure. If the US is any guide, actual inflation is anywhere up to twice that.

It seems like it would make sense to keep raising rates at a reasonable rate but lets hope the reserve banks here and in au dont do anything to drastic because the main drivers of inflation (energy prices and supply chain disruptions and shipping costs) are all going in the right direction compared to this time last year.

I'm taking this opportunity to discover a lot more vegetarian/vegan food. Not only is it delicious, I'm easily able to feed our family (3 adult portions) on about $10-20 per day (not meal). I've also cut out alcohol at home, mostly for health reasons, but the two actions combined cut my supermarket shop by more than half.

Yep homebrewing stores will indeed have a bumper year, time for everyone to get chumly with their rural kin for cheap homekill as well.

Just got a notification on my phone re an article on stuff. Inflation has risen to 7.8% according to Massey forecasting tool. No surprises there.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.