It has been gloomy out there and, well, it still is - but there are signs of the clouds lifting.

Credit bureau Centrix says it's now seeing overall improvement in credit demand, arrears, and business defaults.

In Centrix's latest monthly credit indicator report, managing director Keith McLaughlin says although the challenging economic environment persists, "credit trends show some hopeful signs of recovery emerging".

"The continued decline in the Official Cash Rate (OCR) is beginning to reshape New Zealand’s credit landscape, providing a much-needed boost to both households and businesses," McLaughlin said.

The Reserve Bank (RBNZ) has been cutting the OCR since August 2024 and it has so far dropped from a peak of 5.5% to 2.5%, with another 25 basis point cut widely expected in the last review for the year on November 26.

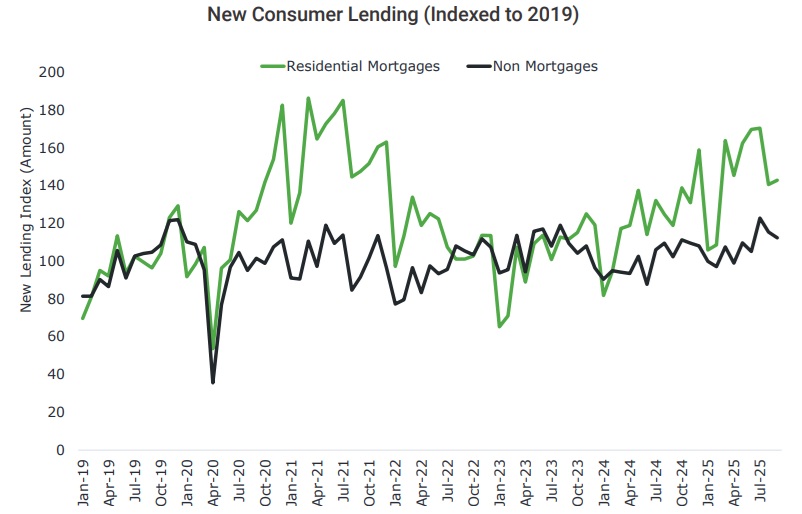

McLaughlin said new residential mortgage lending is up 21.1% year-on-year. This reflects increased market activity and a growing number of borrowers refinancing for lower rates following the recent OCR cuts. New non-mortgage lending - including credit cards, vehicle and personal loans, Buy Now Pay Later, and overdrafts - rose 10.3% year-on-year, driven largely by stronger growth in unsecured personal loans and BNPL in recent months.

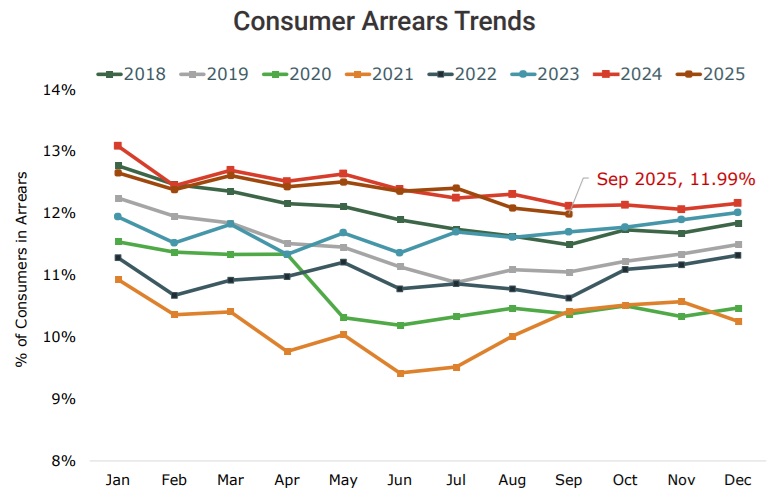

The flip side to this is that consumers reported in arrears fell to 11.99% of the credit active population in September. That's down from 12.09% in August, down from 12.61% six months ago and 12.12% a year ago.

In terms of home loan arrears these actually rose very slightly between August and September to 1.37%, but the overall trend is down, falling from 1.58% six months ago and 1.41% a year ago.

Separate RBNZ figures on non-performing housing loans confirm the overall direction of distressed mortgages. The RBNZ figures show that the total of non-performing housing loans fell for the third consecutive month in September and has dropped by $185 million (to $2.272 billion).

In terms of business, McLaughlin says business credit demand is up 3.5% over the same period in the prior year. The hospitality sector continues to lead credit demand, up 31% over the past 12 months, followed by Education/Training (+22%) and Retail Trade (+21%). Business credit defaults are down 13% year-on-year, easing from the peaks observed last year.

Company liquidations remain at elevated levels, but McLaughlin says signs of improvement in liquidation trends are now being observed across seven of the 19 industry sectors, notably in wholesale trade, financial and insurance services, and professional services.

Construction remains the leading industry for company liquidations, with 726 firms liquidated in the past year – an increase of 23% on the previous year, however, the 726 figure for the year to September is down from 761 recorded in the 12 months to August.

In terms of overall credit trends, McLaughlin says there is "a clear North and South Island divide".

"The South Island shows strong credit improvement, driven by lower arrears and renewed lending growth thanks to high confidence in dairy farming and an improving construction and hospitality outlook. Whereas a significant portion of the North Island continues to lag," he said.

McLaughlin said though that as see out the final quarter of 2025, there are "some cautiously optimistic signs".

"While some sectors and regions continue to face challenges, the overall improvement in credit demand, arrears, and business defaults is a good step towards confidence gradually returning to New Zealand’s households and businesses."

13 Comments

If people who are fed bu--sh-t or kept ignorant, are surveyed, what does that tell us?

Survey of Titanic passengers - who were assured it was unsinkable: 100% say it will be afloat tomorrow.

All wrong - because they were fed a falsehood.

Survey schurvey.

You certainly do like the Titanic analogy. Whether you can apply it willy nilly and still have it relevant, another story.

Well, it's good to know that PDK knows all the people surveyed personally, including their level of ignorance or intelligence.

Agree surveys can be made to say anything. Would add that this is at odds with what the IRD are reporting on unpaid taxes, and news of reduced business profits (thus tax take), businesses folding this year, and increasing mortgagee sales.

Believe half of what you see and little of what you read.

Debt is good

Only with supporting income.

Well of course.

We can have huge debt cause our balance of payments is sooooo good.

It's true peeps, things are improving (slowly) out there in NZ. 2026 will be better than 2025, barring a worldwide financial collapse (which is not unlikely).

Not if you value wealth properly.

Which is resources and energy stocks still available, plus infrastructure minus decay-demand.

On that basis, we are going backwards faster every day.

By "properly", you mean your way.

I'm just enjoying the long days and credited power bills after getting solar installed. Good times and free air con this summer!

No, I mean based on reality.

Real stuff.

The caption illustration might though have more accurately depicted the pusher being on quite an upslope, rather than horizontal.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.