This article first appeared in Russell Investments' Communiqué. It is reposted here with permission.

By Ronal Prasad*

The difference can be explained using an analogy – blockchain is to Bitcoin what a combustion engine is to a car. While the combustion engine became mainstream through its use in cars, the technology also transformed other industries such as manufacturing and agriculture.

Similarly, blockchain is what’s under the hood of Bitcoin – it gives Bitcoin the power to facilitate secure financial transactions. Much like the combustion engine, blockchain is not limited to digital currencies and can be applied to a wide range of services such as supply chain management, legal contracts and rights to property.

In this article, we first explain conceptually how blockchain works using a payments system example. The second part of the article focuses on how blockchain is currently being pursued in one aspect of financial services - securities trading.

Traditional payments system - centralised

In a traditional payments system, if John wants to transfer funds to Mary, the transaction would typically go through a financial intermediary – in most cases a bank.

Figure 1 – Traditional payments system

Figure 1 illustrates the flow of information in a traditional payments system. Firstly, John notifies the bank to transfer funds to Mary. Next, the bank checks if John has enough money for the transfer. The bank can verify the balance because it stores all of John’s transaction records (i.e., the ledger). Once the balance is confirmed, the bank transfers funds to Mary. The settlement date of the transaction varies, with some international transfers taking a couple of days to complete. The bank is incentivised to facilitate the transaction because it earns a fee for intermediation. As depicted in figure 1, the bank holds the ledger, the bank verifies ownership of funds and executes all transactions. This is a centralised payments system.

How blockchain is used in payments - decentralised

In contrast, a blockchain payments system transfer funds without the reliance on a financial intermediary. Furthermore, blockchain settles transactions faster and more cheaply than the traditional system. Blockchain technology is based on the concept of a decentralised distributed ledger, which is available to each participant in the network. To understand how blockchain works conceptually, let’s assume there are four participants in a public network transacting amongst themselves.1

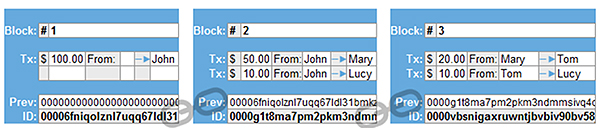

Figure 2 illustrates how transactions are stored and appended in the blockchain ledger. At the inception of the network, block #1 shows that John has $100. Each subsequent block lists the transactions made in the network. For example, block #2 shows that John transferred $50 to Mary and $10 to Lucy. Block #3 records further transactions. As shown in Figure 2, each list of transactions is linked to previous transactions all the way back to the first transaction.

Note that the storage of data in the blockchain is not limited to financial transactions and can also include changes in ownership of assets such as shares of a company or property.

Figure 2 – Blockchain ledger

In contrast to the traditional payments system where the bank is the only one holding the ledger, the blockchain ledger is distributed to all participants in the network. Everyone can see the history of transactions and, more importantly, anyone can decide whether a transaction is valid.

Figure 3 – Decentralised distributed ledger

For example, let’s say Mary wants to transfer $30 to Tom. First, Mary broadcasts the transaction to the network. As in the banking system, it must be proved that Mary has $30 to spend. Since all other participants have a copy of the ledger (Figure 3), they can calculate Mary’s balance. From the open ledger (Figure 2), everyone knows that Mary has $30 ($50-$20) to spend.

The participant verifying the transaction broadcasts Mary’s balance to the rest the network. If most of the participants in the network agree that the transaction is valid — that is, Mary’s balance matches their copy of the blockchain’s history — then the new transaction will be approved, and a new block created and linked to all previous transactions.

In blockchain, as in traditional systems, participants are incentivised to verify transactions because they earn a fee for the service.

The ledger is synchronised across the network every time a new transaction is validated. The ability to prove ownership of an asset – in this case money – is one of blockchain’s core capabilities. Furthermore, in the example, the fact that a participant is transacting with the entire network and not just through one financial intermediary significantly reduces the risk of counterparty default.

So how does blockchain ensure that no participant in the network can manipulate the data to his or her benefit?

To secure the system, blockchain uses a mathematical function to ensure any manipulated data is not accepted by the network. The function essentially generates a block ID that is unique to all the data in that block.

It is worth emphasising “all” because even a single change in data in the block, even adding a punctuation mark, will generate an entirely different ID. For example, if Tom alters his copy of the ledger, his block IDs will not match the rest of the network invalidating his subsequent transactions. The unique block IDs and chaining of blocks (Figure 2) ensures any altering of data by one participant is noticeable to the rest of the network. You can think of blockchain as an append-only system, where there is a single source of truth and proof of ownership can always be traced back to its inception.

Application of the blockchain in securities trading

Blockchain’s ability to prove ownership of an asset through its immutable distributed ledgers has many uses in financial services. For example, the financial crisis revealed that it is not always possible to identify the correct present owner of a security.

Furthermore, securities trading often requires the use of brokers, exchanges, clearing houses and custodians. In the current system, trades are often verified by a central clearing house that maintains its own central ledger. The involvement of so many intermediaries creates a drag on efficiency and increases the cost of facilitating transactions. Today, it may take up to two days to transfer the ownership of an asset.

Blockchain has the potential to streamline this process by tracking ownership of securities and distributing the ledger to many users in the network – as it was in the payments system example.

While the payments system example was in a public network, banks and market operators can build private networks where each user in the network has varying degrees of autonomy when it comes to updating and maintaining the ledger.

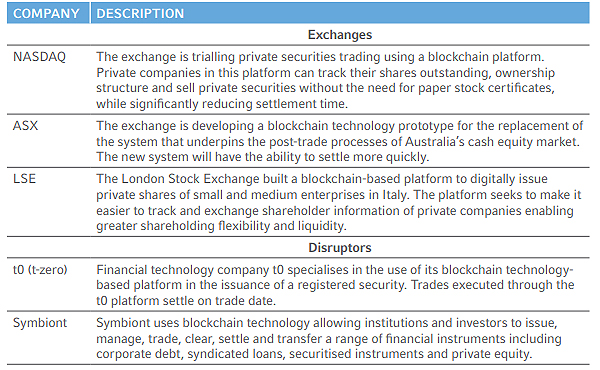

Many of the world’s exchanges are already exploring blockchain solutions to make the trade settlement process efficient by reducing the replication and verification of information by multiple parties, hence reducing settlement time. Table 1 describes the blockchain developments currently being pursued by different organisations (including disruptors) in securities trading.

Table 1 – Securities trading and settlement2

Potential implications for investors

Even though it’s in its early stages, blockchain has the potential to reduce costs and improve the efficiency of trade settlements.

The ability to settle trades intra-day would allow investors to manage transition exposures in their portfolios better and at a lower cost than previously.

Furthermore, blockchain developments in the private securities market reduce costs and improves the ability to buy and sell private securities. With more and more companies remaining private, the enhancement in liquidity broadens the universe of securities available to investors.

While blockchain is promising, the technology does have a few hurdles to overcome including network adoption, cybersecurity and legal and regulatory compliance. Notwithstanding these hurdles, blockchain is leading a revolution that will change not just the financial services industry, but the way we do business.

References:

ASX. (2016). ASX’s Replacement of CHESS for Equity Post-Trade Services: Business Requirements. ASX. Retrieved from: http://www.asx.com.au/documents/public-consultations/ASX-Consultation-Paper-CHESS-Replacement-19-September-2016.pdf

Irrera, A., Kelly, J. (2017). London Stock Exchange Group tests blockchain for private company shares. Reuters. Retrieved from: https://www.reuters.com/article/us-lse-blockchain-idUSKBN1A40ME

Nofer, M., Gomber, P., Hinz, 0., Schiereck, D. (2017). Blockchain. Bus Inf Syst Eng 59(3):183–187.

Norton, S. (2016). CIO Explainer: What Is Blockchain? WSJ. Retrieved from: https://blogs.wsj.com/cio/2016/02/02/cio-explainer-what-is-blockchain/

Olsen, T., Ford, F., Ott J., Zeng, J. (2017). Blockchain in Financial Markets: How to Gain an Edge. Bain & Company.

Notes:

1. Note that the example overlooks some details of the blockchain technology such as anonymity and accessibility and the focus of the example is on the underlying framework of blockchain.

2. Other exchanges pursuing blockchain solutions include: Japan Exchange Group, Korea Exchange, National Stock Exchange (India), Moscow Exchange, Santiago Exchange and Luxembourg Stock Exchange.

Ronal Prasad is an investment analyst at Russell Investments in Auckland. This article first appeared in Russell Investments' Communiqué. It is reposted here with permission.

12 Comments

Blockchain is going to be absolutely huge.

Almost any international and complex supply chain is a target, not just financial services. Those who harness it may gain a massive advantage in being able to establish a functional crypto currency inside a vertical market that, once tied up, might be quite monopolistic and hard to break into for competitors.

Sure that is why it has been around for a decade before bitcoin and used in other applications to cryptocurrencies. The recent fashion is an uneducated speculation market admiring old school tech and making money of consumer stupidity. Seriously there are better cutting edge R&D projects, (that can actually scale, are not incredibly inefficient, provide customer protections and are more functional), but because of a market bubble greed is fogging minds. But hey add blockchain to a businesses market brief and it too can benefit irrationally off the fashion without adjusting anything productively. All they need is a git repo, heck many tech companies have that already. But I hope you are using an adblocker. Most unreasonable sites will try to use your CPU for mining already. Some even advertise they do so openly.

Sounds seriously dodgy with cyber crime, hacking etc putting it all at risk and the cost of transacting far too high and unlikely to change as the miners have to be paid - suspect blockchain is a fad that will not go anywhere - banks and credit card companies etc perform perfectly fine and cost of transactions is dropping all the time (banks have just removed the transaction fee when using a competitors atm) whereas cost of transacting through a blockchain is constantly increasing.

Money laundering and anti terrorism laws mean proper id required so anonymous blockchain accounts will not be able to be used. Banks wont fund the crypto exchanges for the same reason and as for crypto - too volatile to be used as a real money currency alternate.

Good grief. Did you read the story? The blockchain is not 'bitcoin' or a crypto currency. And transparency is its key attribute - you can see evey transaction on the chain by each party. It is not anonymous! Suggest you read the article. It will help you understand why banks are key champions of the technology. As others have pointed out, it is not terribly new but a ubiquitos cloud means its time has come.

Just thinking out loud

Wondering when the Real Estate industry, LINZ, The Law and Criminal Justice System, Motor Vehicle Industry, Passports, start waking up to the use of Blockchain

I think international supply chains will lead the way because they, by nature, are more complex due to different currencies, regulatory regimes and uncertainty exists.

Well regulated and standardised processes benefit less from what blockchain can do.

.

Unfortunately tech businesses normally hitch a ride on fashionable key word recognition so those who have never done any engineering or even basic maths & science in their lives pour millions into projects they do not understand, (e.g. the dot com craze, the cloud craze, the social media craze etc anything that may have no relation to the main services you offer but by a wiff of a thread gets linked through marketing). Hence if you are in the blockchain business you will be tarred with the Bitcoin and cryptocurrency fashion, good in a speculative market but quite risky as it is being linked to the failures in that market as well.

It is worse in certain industries and often leads to many company & project failures trying to shoehorn a fashion in without the technical ability. Blockchain is only useful in certain applications but in most the listed solutions it can fail, be terribly inefficient, poor to scale and subject to data leaks. Hence why it is a tech better presented on its own honestly. It should not be linked to the speculative greed and FOMO for business performance & long term project health. However if you were a company starting out it would be foolish not to try to get a share in the pot of gold available. It would be unethical to do so but foolish not to use the fashion for cryptocurrencies to drive your marketing. Which is why businesses in blockchain tech are loud and proud on cryptocurrency news sites, even in NZ news. They want the appeal of a billion dollar speculation market to give their company bling and most morons cannot even identify the tech or issues. Most cannot even see past the toilet quality whitepapers with pretty icons (because it is all about those shiny 1 page websites with icons making grandiose promises they can never deliver on).

But then again I have one been reviewing hundreds of proposals and only a couple had an actual business plan, workable development and realistic deliverables, (many just threw a bunch of words together in the hopes of tricking stupid investors). All together it only proves the point that managers should never be in charge of selecting technical tools; that should always be left to the engineers and independently reviewed for security. You cannot trust someone who cannot review the code on even a junior open source project, (even the cream of the industry has code so poor and without QA they have lost millions in projects & customer money just from poor updates and developer infighting). Yet while professional technical companies lead with research and engineering they are lambasted for being cautious, security focused, honest & old.

I wish Ronal Prasad the best in his research, but since he is coming from a financial management perspective I can understand the lack in description and errors. It is relying on what many have presented in a simple dumbed down primers but unfortunately for the back end should be thoroughly be considered & tested first before even deciding to implement in any company. It is not like swapping servers or making db modifications. The engineering is a cost which should not be discounted due to misunderstanding. Although from company marketing perspective many tech companies can use blockchain in their marketing material already. No need to actually do anything effective to gain from the fashion. Plus leaking data is already an issue, so are security breaches, ineffectual & costly IT projects, inefficient maintenance, lack of scaling and poorly implemented services. The public would not see much of a difference at all in the end. To them the front end matters and the back end is a magic box.

Using Blockchain

Jessi Baker is the founder of Provenance, a social enterprise project in the UK that uses blockchain technology to help food companies be more transparent about the origins and histories of their products. She tells Emily Thomas exactly how it works, and how consumers may soon be able to scan their food to find out exactly where it came from

You might be surprised but this actually was already being tracked and available to NZ consumers from some NZ companies. They do not need blockchain tech to do any of it. It is very unethical to hook a ride on the blockchain bandwagon just for startup profit but they are hooking into the greed of the moment. In fact most of the tech around food tracking is rather simple stuff for processed & fresh foods but most consumers cannot even be bothered to read the ingredients or nutritional info, (hence why the move to health stars was such a failure and why companies do not get any profit from customer fronting apps like this). Next they are thinking of dumbing it down even more because most people cannot read info to see if a product contains sugar or know what a gram is. The business you link to is selling the stupid idea to investors to get the money and that is rather easy. It looks like you have been brought rather cheaply by a glossy ad. You might want to do a bit more research in the industry so you do not get hoodwinked by silly proposals like this one. I would recommend even investigating systems for food processing in NZ and the proportion of sales which rely on customers knowing the entire supply chain for every ingredient. Rather simple to research. I am surprised you could not do it yourself but there is stupidity in speculative fashions everywhere & too many have no engineering skills and poor due diligence research.

you say :- most consumers can't be bothered to read the ingredients or nutritional info

Don't know about bothered ...

Have you ever tried reading the nutrition panel on food packs - most (repeat most) are so small they are almost impossible to read

So you also cannot be bothered to look up the information available online in accessible font sizes either? Yeah, exhibit A, a customer who cannot be arsed with basic information online, or checking with the supplier, or checking the manufacturer data, or even asking someone to read it for you if you were blind physically. How about when you are at a restaurant do you quizz them on the originating source of all their ingredients with the intention of walking out if they do not suit you (right down to the salt)? Even the advertising for free range eggs is loud and proud and that neither is the main factor for purchases nor does it certify the actual processes on said farm, (junk data like that is pervasive often in the natural & organics branding). Then go into the cultural supermarkets which often have even less standards globally. No one is changing those systems beyond what is necessary for basic sales & advertising. I carefully inspect everything, have dealt with manufacturers, farms and supplement providers because it can be life and death for me and even I find the information easily available for simple people unfamiliar with numbers now (in many restaurants cross contamination is likely so 3 allergy treatments are normal practice to carry or you cannot go full stop, same for most friends & family who have deadly issues). Most people don't look beyond the sales pitch because they don't care or cannot handle basic information even when it is provided for them in multiple formats. Even for those who have life and death concerns with raw produce we know there are limits, & cross contamination is likely (even in controlled conditions).

Why can you not admit you were sold a very simple lie, based on a fashion. It happens often. Accept it and move on. If they were advertising manufacturer process chain management for batch control & logistics it may have had a limited application. Not much in an established system and chain, but when able to spend on refactoring it can streamline architecture setup a little. But they are not. They are trying to hook into 2 fashions for a money scam in a very obvious flawed system that will change nothing to the main consumers, (and still nothing to those whose lives depend on research but often face junk data and cross contamination regardless). You are backing a dead horse and you cannot even use the meat for a curry (* I suppose your spices are all preprocessed and mixed as well without working with the raw ingredients from scratch to make sauces and preserves). A bit sad we now have a generation who cannot even handle food information let alone prep their own food from scratch. Although I do admit the cheeses and liquors can be a poorer quality, and there are not as many places to source good hog gut for making sausages, although I have still easily been able to find a few by actually looking. You need to learn to look though.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.