Fintechs

CEO Dan Huggins says BNZ has no further plans 'period' for acquisitions to bolster its open banking position

7th Nov 25, 9:07am

CEO Dan Huggins says BNZ has no further plans 'period' for acquisitions to bolster its open banking position

Emerge pushes into personal banking services with Mastercard's help as it moves towards 'aspiration' of becoming a bank

29th Oct 25, 1:15pm

Emerge pushes into personal banking services with Mastercard's help as it moves towards 'aspiration' of becoming a bank

Worldline NZ chief executive says growing dominance of contactless payments ‘risks undermining local payments infrastructure and the resilience' of NZ’s financial system as increasing number of transactions are processed overseas

23rd Oct 25, 8:12am

3

Worldline NZ chief executive says growing dominance of contactless payments ‘risks undermining local payments infrastructure and the resilience' of NZ’s financial system as increasing number of transactions are processed overseas

ACT Party proposes surcharge ban amendment but Commerce and Consumer Affairs Minister says it would 'worsen and over-complicate' things and the shelf price should be the checkout price

17th Oct 25, 5:55pm

1

ACT Party proposes surcharge ban amendment but Commerce and Consumer Affairs Minister says it would 'worsen and over-complicate' things and the shelf price should be the checkout price

No API fees for open banking as government unveils regulations that will see MBIE levy fintechs & banks

17th Oct 25, 3:19pm

No API fees for open banking as government unveils regulations that will see MBIE levy fintechs & banks

[updated]

As Retail NZ calls on the Government to pause surcharge ban, Commerce and Consumer Affairs Minister says the organisation has 'overinflated the cost to retailers and consumers in this change'

14th Oct 25, 5:00am

As Retail NZ calls on the Government to pause surcharge ban, Commerce and Consumer Affairs Minister says the organisation has 'overinflated the cost to retailers and consumers in this change'

Errol Fonseca asks who will lead and who will lag with open banking set to ramp up in New Zealand

2nd Oct 25, 9:07am

Errol Fonseca asks who will lead and who will lag with open banking set to ramp up in New Zealand

All licensed non-bank deposit takers will be able to call themselves banks under the Deposit Takers Act, but fintechs will have to opt into the new regime

1st Oct 25, 8:30am

All licensed non-bank deposit takers will be able to call themselves banks under the Deposit Takers Act, but fintechs will have to opt into the new regime

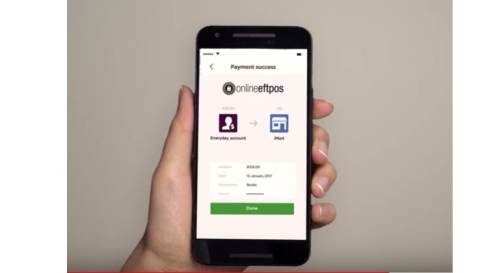

Open banking: Worldline launches Online EFTPOS Repeat Pay and POLi moves from 'overlay service' to APIs

11th Sep 25, 8:30am

4

Open banking: Worldline launches Online EFTPOS Repeat Pay and POLi moves from 'overlay service' to APIs

[updated]

Major banks 'locking in' their market power and hindering fintechs, the Commerce Commission says, adding BNZ 'has not met our expectations'

2nd Sep 25, 12:47pm

2

Major banks 'locking in' their market power and hindering fintechs, the Commerce Commission says, adding BNZ 'has not met our expectations'

Responding to political pressure, the RBNZ is citing a new, 'higher risk appetite' for lower bank capital settings

25th Aug 25, 2:06pm

6

Responding to political pressure, the RBNZ is citing a new, 'higher risk appetite' for lower bank capital settings

‘Businesses may have no option but to reflect those costs in their pricing’: Retailers and hospitality sector say Government’s surcharge ban raises wider issue of pricing

29th Jul 25, 5:00am

2

‘Businesses may have no option but to reflect those costs in their pricing’: Retailers and hospitality sector say Government’s surcharge ban raises wider issue of pricing

The Government will ban card payment surcharges, 'shoppers will no longer be penalised’ for how they pay, Commerce and Consumer Affairs Minister Scott Simpson says

28th Jul 25, 2:00pm

21

The Government will ban card payment surcharges, 'shoppers will no longer be penalised’ for how they pay, Commerce and Consumer Affairs Minister Scott Simpson says

UBS analysts anticipate that the Australian banks will likely respond over time to the card surcharges removal by raising cardholder fees, reducing rewards on credit cards, and potentially increasing interest rates

17th Jul 25, 5:20pm

UBS analysts anticipate that the Australian banks will likely respond over time to the card surcharges removal by raising cardholder fees, reducing rewards on credit cards, and potentially increasing interest rates

Financial Markets Authority picks six fintechs to test out new ideas in a regulatory sandbox pilot programme to take place this year

29th Apr 25, 3:06pm

Financial Markets Authority picks six fintechs to test out new ideas in a regulatory sandbox pilot programme to take place this year