Even as mortgage rates come down, the amount of non-performing mortgage loans is continuing to rise, now getting close to $2.5 billion.

Latest monthly loans by asset quality figures from the Reserve Bank (RBNZ) show that the amount of mortgage money classified by the banks as non-performing pushed up by another $9 million in June to to $2.457 billion.

Within this figure, the amount specifically designated as 'impaired' increased by $12 million to $546 million.

The overall non-performing housing loans tally has increased $550 million (28.9%) compared with the same time in 2024. (The RBNZ's summary of the loans by asset quality figures is here.)

While mortgage rates have been coming down, unemployment has been going up, which is likely a factor in the continued rise in the non-performing figures.

The unemployment rate rose from 4.0% to 5.1% during 2024 and then stayed at 5.1% in the March quarter. However, new figures out next week for the June quarter are widely predicted to show a rise to 5.3%.

The non-performing housing loans figure currently represents a little under 0.7% of the over $374 billion worth of outstanding bank mortgage loans. That percentage is well down on the 1.2% figures seen in the aftermath of the Global Financial Crisis, but is well above the 0.2% level seen as recently as in late 2022.

The rise in the non-performing loans ratio was forecast by the banks, but equally they have forecast that 0.7% will be the peak, with this ratio expected to start falling in the last quarter of this year.

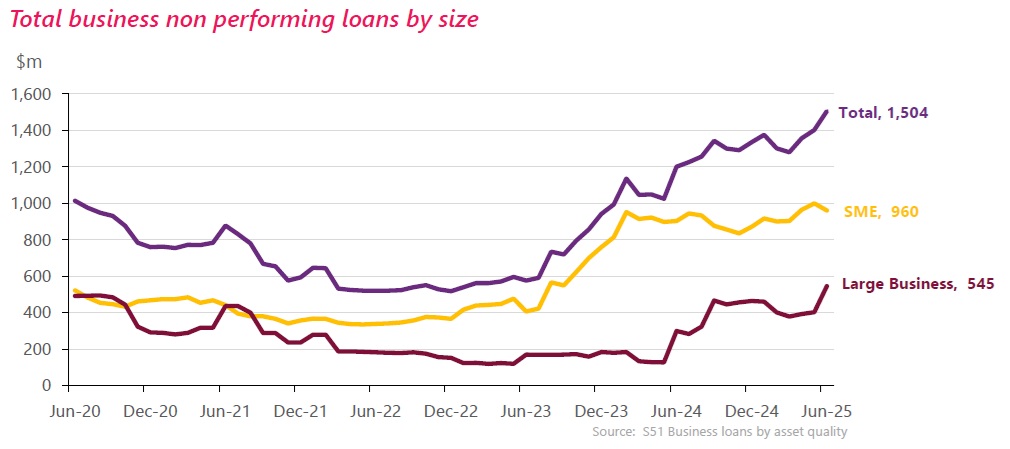

Meanwhile, the business lending by asset quality figures show that non-performing loans figures for the small-to-medium-sized businesses (SMEs), after spiking sharply through 2023-24, have levelled off.

However, the non-performing loan figures for large businesses (characterised as having annual turnovers in excess of $50 million) have taken off after being at relatively low levels through 2023-24.

Of the $47.491 billion of 'large business' loans, as per June $545 million was non-performing. That's a rise of $143 million (35.5%) in the past month.

Compared with June 2024 the large business loan non-performing figure is up $246 million, or 82.4%.

For some, the hoped-for economic recovery is clearly not happening yet.

11 Comments

Can you get that chart back to before the GFC for context?

Is it increasing at a linear rate ?

Banks fiddle while they make super profits elsewhere.

Update on my non-scientific tracking of trademe mortgagee listings

October 2022 = 26

March 2023 = 37

February 2024 = 44

March 2025 = 65

July 2025 (today) = 75

starting to see a few 10-25mil mortgage sales banks over it, time to use provisions.

Also IRD and suppliers calling in credit

Can any banking aficionado with mortgagee sales indicate that banks invariably bleed mortgagee sales into the market and also are there not a substantial number of mortgagee sales that are not advertised as such.

They know human psychology well the old banks. They don't want to spook the market and have everyone try sell up at once for risk of the banks bottom line. Remember, the bank loaned the money into existence and if they have to sell a house for a loss, they have to actually lose something for once.

It's hard to pay a mortgage when you lose your job or your business goes under. There happens to be a lot of both in NZ at the moment. Falling interest rates are not going to make much difference.

I note the sudden steepening of the graph from July 2023. Why is that?

I'd hazard a guess of fast rising OCR = low interest commercial loans as well as mortgage rates roll over to higher, and coupled with decreased govt spending as well as decreasing private spending.

Little dip in Dec 2023 and the off we go again.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.