It's not often in tax that you can genuinely say a bombshell has dropped, but last Thursday at 4:00pm Inland Revenue released one such bombshell for consultation, the somewhat innocuous sounding Improving taxation of loans made by companies to shareholders. “Improving” is doing a lot of heavy lifting there.

The basic position is Inland Revenue plans to completely change the current tax treatment because, as a handy information sheet released alongside the main issues paper points out:

Our current rules mean shareholders who borrow from their company can pay less tax compared with other taxpayers who are fully taxed on their salary, wages and dividends or profits they earn as a sole trader or partnership.

The problem

The current position is this; if a shareholder borrows money from a company, it's not treated as a dividend or income but is subject to interest. The company can either charge interest at an agreed market rate, or if the loan (or shareholder current account) is either below market rate or is interest free, the company is liable to pay interest calculated using the fringe benefit tax prescribed rate of interest, currently 6.67%.

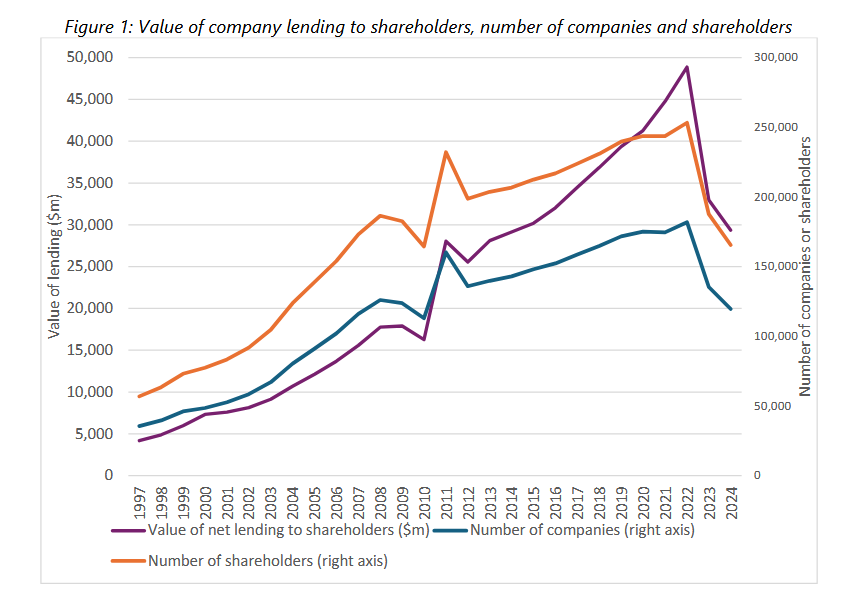

What has happened is that the amount owed by shareholders has built up over time, and the numbers are quite surprising. According to chapter 3 of the issues paper - paragraph 3.3 onwards - for the year ended 31 March 2024, approximately 119,000 companies (that's about 16% of the 730,000 total companies in New Zealand) were owed a total of nearly $29 billion by about 165,000 shareholders who are either natural persons or trustees. As the paper notes:

For context, these companies reported $8 billion of taxable income in that same period, so the loan balances were over 3.5 times their annual income.

The average amount loaned by these companies to the shareholders was over $245,000 per company, or over $177,000 per shareholders.

A $19 billion impact of the increase in the trustee tax rate?

In fact, the amounts owed were even larger. According to Inland Revenue the amount of shareholder loans made to natural person and trustee shareholders peaked in the year end 31 March 2022, when about 182,000 companies recorded loans totalling $48.8 billion. The drop in nearly $19 billion between 2022 and 2024 appears mainly due to the increase in the trustee tax rate to 39% from 1st April 2024. Companies took the opportunity to pay dividends to trustee shareholders prior to the increase in the tax rate.

Large numbers are involved here.

A $12 billion problem

The sheer volume of the loans is staggering. If you want to get an idea of how big a potential loss of revenue the present rules represent, if the total of outstanding loans at 31st March 2024 had instead represented income paid to a shareholder or a shareholder employee (that is, someone who's an employee and a shareholder in the company) and had been taxed at the highest marginal rate of 39%, about $12 billion of tax would have been payable.

A long-standing and fast-growing problem

The volume of outstanding shareholder loans is a considerable headache that has built up over time. Paragraph 3.7 of the paper notes that the annual growth in loans to shareholders has been approximately 8.7% per annum over the period 1997 to 2023. That surpasses the average growth in economic activity over the same period when nominal GDP growth on average was 5.4% per annum.

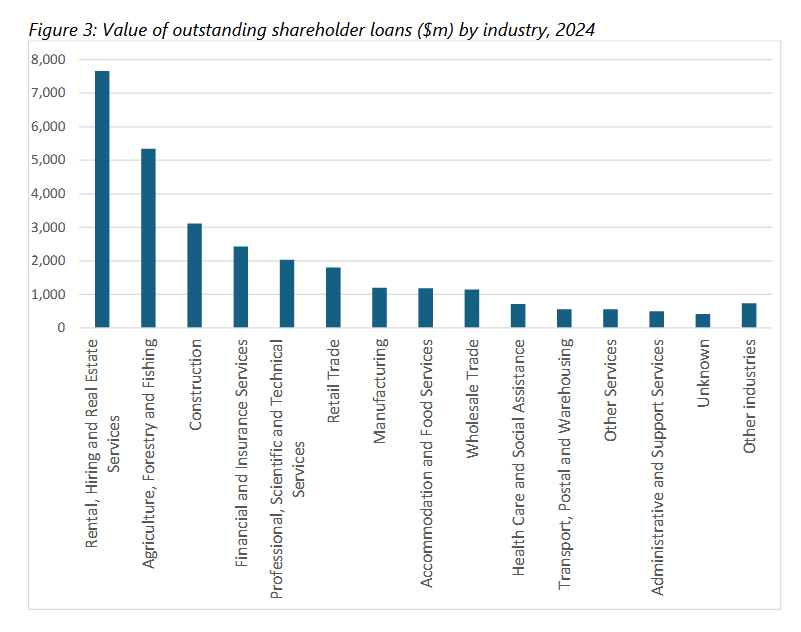

So which companies are lending?

There's an interesting analysis of what type of companies have been doing the lending. The biggest single group is the rental, hiring and real estate services sector who are responsible for about $7.5 billion of of that $29 billion. Then they're closely followed by agriculture, forestry and fishing, which is about $5.2 billion, and then construction, which is just over $3.1 billion. These three sectors between them have nearly 55% of all total borrowing outstanding at 31st of March 2024.

Liquidations and other removals

There's also another group of companies which I think would be of extremely great concern to Inland Revenue, and that’s companies with outstanding shareholder loans that have been liquidated or otherwise removed from the Companies Register.

Inland Revenue has analysed the approximately 184,000 such companies that were removed from the Companies Register between 1st April 2019 through to early 2025. The data suggests about 27,000 of those companies, nearly 15%, were owed money by their shareholders at the time they were removed based on the assumption that the shareholders at the time of removal were either individuals or trustees. In total those companies were owed approximately $2.3 billion, or about $85,000 per company. Further analysis shows about 15,000 of that group that were removed, were just simply struck off because they hadn't filed their annual returns. This group was owed nearly $935 million or $55,000 per company.

Another 10,000 companies with shareholder loans went through the formal request for removal process. At the time of formal removal this group was owed $923 million or $92,300 per company.

Finally, 2,000 of companies with shareholder advances were put into liquidation process, and they owed over $426 million or $213,000 per company. For this group it's quite possible the liquidator would have attempted to make a claim against shareholders with debts.

This group is of particular interest to Inland Revenue because it’s reasonably likely they had outstanding GST and PAYE debts. The shareholders in this group probably drew out loans for personal use which were effectively not taxed but the company later was liquidated owing GST and PAYE.

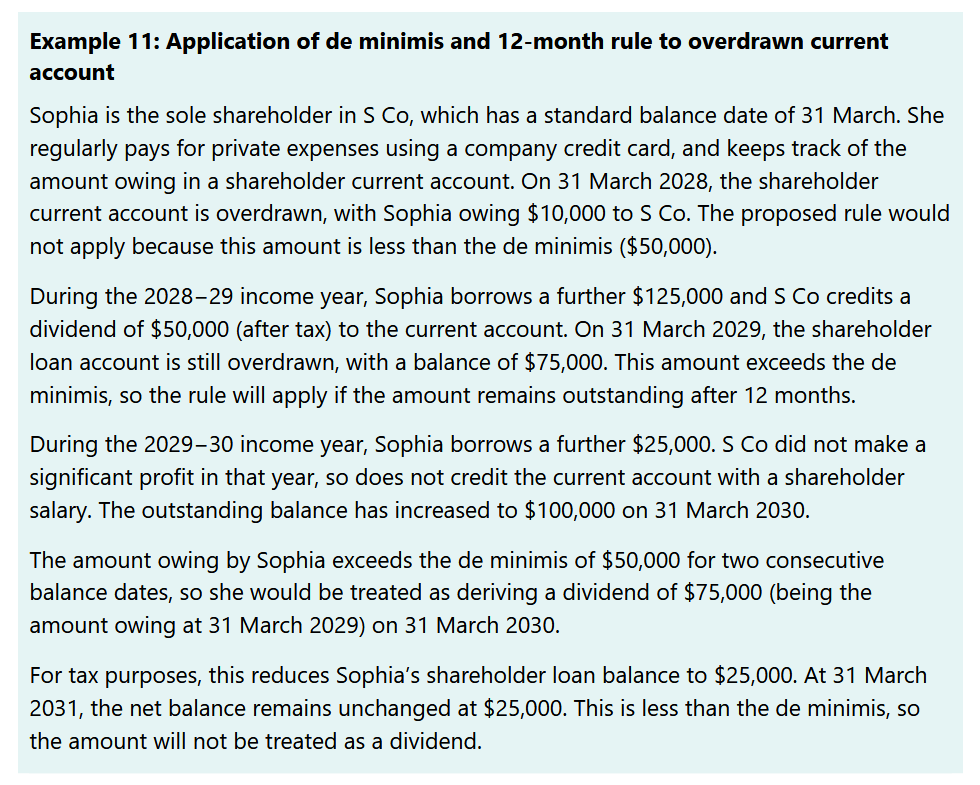

Bringing New Zealand into line with other countries

Inland Revenue’s main proposal is that as of 4th December, when the paper was released, if a shareholder loan has not been repaid within a set period, any outstanding balance above a threshold at the end of that period will be treated as a dividend and taxed accordingly. The repayment period will probably be 12 months which is the maximum time allowed for filing the company’s tax return if it is linked to a tax agent. The suggested threshold is $50,000, subject to consultation. With some reservations, Inland Revenue would permit imputation credits to be attached to any dividends deemed to arise under the proposal.

As the paper notes this change would bring New Zealand into line with most of our comparable jurisdictions. If you look at the treatment of shareholder advances across Canada, Australia, the UK and Norway, all take the approach that shareholder advances will be treated as income unless they're repaid within a certain period. Inland Revenue’s proposed regime would be closest to that of Canada.

This proposal represents a huge change and one which is likely to have significant revenue effect. Exactly how much isn't specified. At a guess it’s probably going to run to hundreds of millions, perhaps. It will be interesting to see exactly what happens because there's going to be a displacement activity. Companies will either start paying out higher dividends or increased salaries to avoid the charge. Either way the Government’s tax take will increase.

Not yet enacted but effectively in force

It’s important to remember that Inland Revenue is open to consultation on its proposal so there’s going to be some fine tuning. Whatever the final form agreed, it will apply to all loans to shareholders made on or after 4th December. In other words, although the legislation is not yet in place, it is now in force. Accordingly, I recommend companies should create new accounting ledgers to record all activity from 4th December 2025 separately from any existing shareholder loans as only “new” loans will be subject to the new rules.

What about existing loans?

Inland Revenue proposes the outstanding loan balances, an estimated $29 billion as of 31st March 2024, will not be required to be repaid. This is a pretty good outcome because requiring loan repayments would be a huge shock to the economy particularly for small and medium enterprises, where shareholder advances are commonly in place.

Treatment of capital gains

Shareholder advances often arise after a company realises a substantial capital gain and shareholders therefore want to access the proceeds. I've seen examples where the shareholders have withdrawn the tax-free gains from the sale of an investment property for example often before the accountant even knows what's going on. (This probably explains why the rental, hiring and real estate services sector has such a large amount of shareholder advances).

The problem is that capital gains even if they are tax-free, can only be distributed when the company is being liquidated. It may be interesting to see if Inland Revenue decides to allow some leniency in calculation of the loans for such advances on the basis that they would not be taxable if those gains had arisen in the hands of the shareholders directly. Inland Revenue’s starting position is that it “does not consider that an exception should be included for loans funded out of capital gain amounts” but it’s open to submissions on this point.

Treatment of shareholder loans on company’s cessation

In relation to companies which are removed from the Companies Register with outstanding loans to shareholders, the paper proposes that the amount of the outstanding loan is deemed to be income of the borrower. This will apply regardless of the reason for removal from the Companies Register. It would therefore apply if the company is struck off for not filing its annual Companies Office return (a fairly frequent event).

Furthermore, this measure would also apply from 4th December 2025. This is considered “necessary to minimise integrity concerns and structuring opportunities that could otherwise arise.” Although any legislation would effectively be retrospective Inland Revenue notes the proposal “does not result in an amount being subject to tax that would not be income under the current law.” It's very hard to disagree with this proposal, given that some companies may have accumulated PAYE and GST debts.

Time for a closer look? When 5% of companies are owed 55% of all debt

A group of companies which might find themselves under future scrutiny are those that have substantial amounts of loans. This is arguably one of the most interesting and perhaps surprising part of the paper. According to Inland Revenue there were about 5,500 companies that had outstanding loan balances of more than $1million. Approximately 55% of the total value of outstanding loans, or nearly $16 billion was owed to those companies. In sum 5% of all companies with shareholder advances were owed 55% of the total outstanding debt.

Then within that group, there's 540 companies that had outstanding loan balances of more than $5 million. In fact, that group alone had 22% of the value of all shareholder loans, roughly about $7 billion, even though they represented just 0.5% of all companies.

The present proposal is that there will be no requirement to repay those loans. However, I still think that Inland Review might take a closer look as to exactly what's going on with these companies because, as the paper notes, there does seem to have been some substitution of loans for income using the prescribed rate of interest rules to sort of bypass or to minimise the tax payable on the withdrawals.

Incidentally, there was a proposal in a draft I saw that the prescribed rate of interest, currently 6.67%, would be increased substantially to nearer credit card rates, i.e. nearly 20%. That has been dropped presumably after a fair amount of pushback.

A significant but logical change

In conclusion these proposals will significantly impact the small-medium enterprise sector. As Bernard Hickey pointed out, when we discussed the proposals on the Hoon just after the paper’s release, this group is very much part of the Government’s current voting base. It will therefore be interesting to see what happens during consultation.

The Organisation for Economic Cooperation and Development) had a paper in 2024 which looked at the question of small/medium enterprises and tax arbitrage in the sector. The proposals represent a significant change. But they are also logical when you look at what happens in comparative countries.

As previously noted affected companies need to take action now because whatever the final shape or form of the proposal comes out, it's effective from 4th December. The paper’s open for consultation until 5th February. Sharpen up your pens and get your thinking caps on as to how you see this will work and what you want to see in terms of repayment period and a threshold. Inland Revenue has proposed $50,000, but they may be open to suggestions on that.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

7 Comments

Taxpayers’ Union Executive Director, Jordan Williams, said:

“This is an unprecedented attack on the tax arrangements of the farming and SME sectors.”

https://www.taxpayers.org.nz/rd_announce_retrospective_tax_grab

Hilarious that the TAXPAYERS union is pushing against something that closes a loophole for minimising tax contributions. You can't make this stuff up.

Yes, the irony was not lost

The shareholders in this group probably drew out loans for personal use which were effectively not taxed but the company later was liquidated owing GST and PAYE.

Interesting that real estate and rentals make up such a high percentage, then again it has been used for decades to minimise tax. I wonder if owners of IP's see capital gains, take a loan against the gain for personal use or reinvestment as deposit for further investment. Then again, it must be rife if it results in minimising so much tax. Either way, watch for increases in car and boat sales on trademe.

the paper proposes that the amount of the outstanding loan is deemed to be income of the borrower. This will apply regardless of the reason for removal from the Companies Register.

This will hurt many a pocket who may have drawn loans to minimise tax then liquidate the company and rinse and repeat.

a Liquidator or IRD can chase those loans if the company fails, including starting personal bankruptcy if you cannot repay.

I look forward to that phrase changing to:

"a Liquidator or IRD will chase those loans if the company fails, including starting personal bankruptcy if you cannot repay."

Yet again highlights the culture rife around PIs. Avoid any tax at all cost. Burn them.

About time for a country that clearly needs more, not less, revenue if we are to fix our structural deficit..

dp..

tp.

$12Bn - could fund a major hospital

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.