Liquidity

Silvia Sgherri thinks the US needs to help build an open, interoperable, standards-based monetary order for the 21st century

30th Dec 25, 11:10am

Silvia Sgherri thinks the US needs to help build an open, interoperable, standards-based monetary order for the 21st century

New technologies are rewiring liquidity, payments, and economic stability

Martin Whetton says events in fixed income markets this week have no historical precedent, suggesting a sea-change in the way the US is viewed

11th Apr 25, 1:39pm

20

Martin Whetton says events in fixed income markets this week have no historical precedent, suggesting a sea-change in the way the US is viewed

Reserve Bank signals the high levels of cash seen in the banking system since the onset of Covid may be gone by the second half of next year

23rd Oct 24, 2:30pm

6

Reserve Bank signals the high levels of cash seen in the banking system since the onset of Covid may be gone by the second half of next year

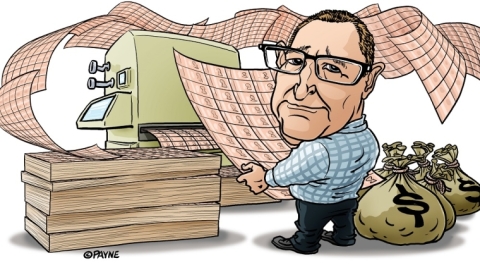

Banks may have profited by $2b on customer call accounts through RBNZ using settlement accounts for its LSAP programme, consultant tells Commerce Commission

17th Feb 24, 9:40am

13

Banks may have profited by $2b on customer call accounts through RBNZ using settlement accounts for its LSAP programme, consultant tells Commerce Commission

Westpac NZ CEO Catherine McGrath says changes to come will add value for customers

9th Nov 23, 9:30am

Westpac NZ CEO Catherine McGrath says changes to come will add value for customers

Assistant Governor Karen Silk says RBNZ to review how it manages settlement cash in the banking system during a crisis

14th Sep 23, 7:40am

Assistant Governor Karen Silk says RBNZ to review how it manages settlement cash in the banking system during a crisis

Raghuram Rajan shows why monetary policymakers must bear some of the blame for the latest US and EU banking-sector turmoil

28th May 23, 3:16pm

1

Raghuram Rajan shows why monetary policymakers must bear some of the blame for the latest US and EU banking-sector turmoil

Nouriel Roubini warns that liquidity support will not be enough to prevent a deeper financial crisis and economic downturn

31st Mar 23, 9:41am

70

Nouriel Roubini warns that liquidity support will not be enough to prevent a deeper financial crisis and economic downturn

[updated]

Raghuram Rajan and Viral Acharya show how the US central bank's liquidity policies created the conditions for runs on uninsured deposits

29th Mar 23, 10:39am

7

Raghuram Rajan and Viral Acharya show how the US central bank's liquidity policies created the conditions for runs on uninsured deposits

RBNZ points non-bank deposit takers grumpy about a lack of liquidity access to its settlement account access review

10th Mar 23, 1:08pm

RBNZ points non-bank deposit takers grumpy about a lack of liquidity access to its settlement account access review

Reserve Bank mulls changing the eligibility criteria for banks' liquid assets, adopting international bank liquidity standards, and how to apply liquidity requirements to non-bank deposit takers in liquidity review

10th Feb 23, 9:51am

1

Reserve Bank mulls changing the eligibility criteria for banks' liquid assets, adopting international bank liquidity standards, and how to apply liquidity requirements to non-bank deposit takers in liquidity review

TOP Leader Raf Manji says an inquiry into the RBNZ's Covid-19 response could help establish a blueprint for managing future crises

7th Aug 22, 6:00am

21

TOP Leader Raf Manji says an inquiry into the RBNZ's Covid-19 response could help establish a blueprint for managing future crises

Deloitte report says Westpac NZ probe shows improvements in the bank's liquidity management after courting the Reserve Bank's wrath last year

31st May 22, 7:50am

1

Deloitte report says Westpac NZ probe shows improvements in the bank's liquidity management after courting the Reserve Bank's wrath last year

Westpac NZ CEO Catherine McGrath says level of engagement and discussion with RBNZ now 'really good' after bank copped serves from the regulator last year

10th May 22, 9:48am

Westpac NZ CEO Catherine McGrath says level of engagement and discussion with RBNZ now 'really good' after bank copped serves from the regulator last year