By David Skilling*

It was great to be back in New York this month. As always, there was fantastic energy and dynamism. Airports and restaurants were full, consistent with ongoing resilience in the hard US economic data. Certainly US equity markets are pricing in good scenarios, on hopes that the tariff end-state will be OK, that technology will continue to support earnings and GDP growth, and so on.

But this might be a touch complacent. Beneath the surface, there is concern about economic risks (tariffs, fiscal) as well as growing political/institutional stress (from Fed independence to higher education and research). Indeed, from tariffs to monetary policy and geopolitical relations, it is evident that we are moving towards a new economic and geopolitical regime. Although much of this is not yet evident in the economic and firm-level data, it will come.

This note discusses seven recent global economic and geopolitical developments that provide insight into how this new world is shaping up. Do get in touch if you would like to discuss. I’m at david.skilling@landfallstrategy.com or on LinkedIn.

1. Tariff ‘deals’

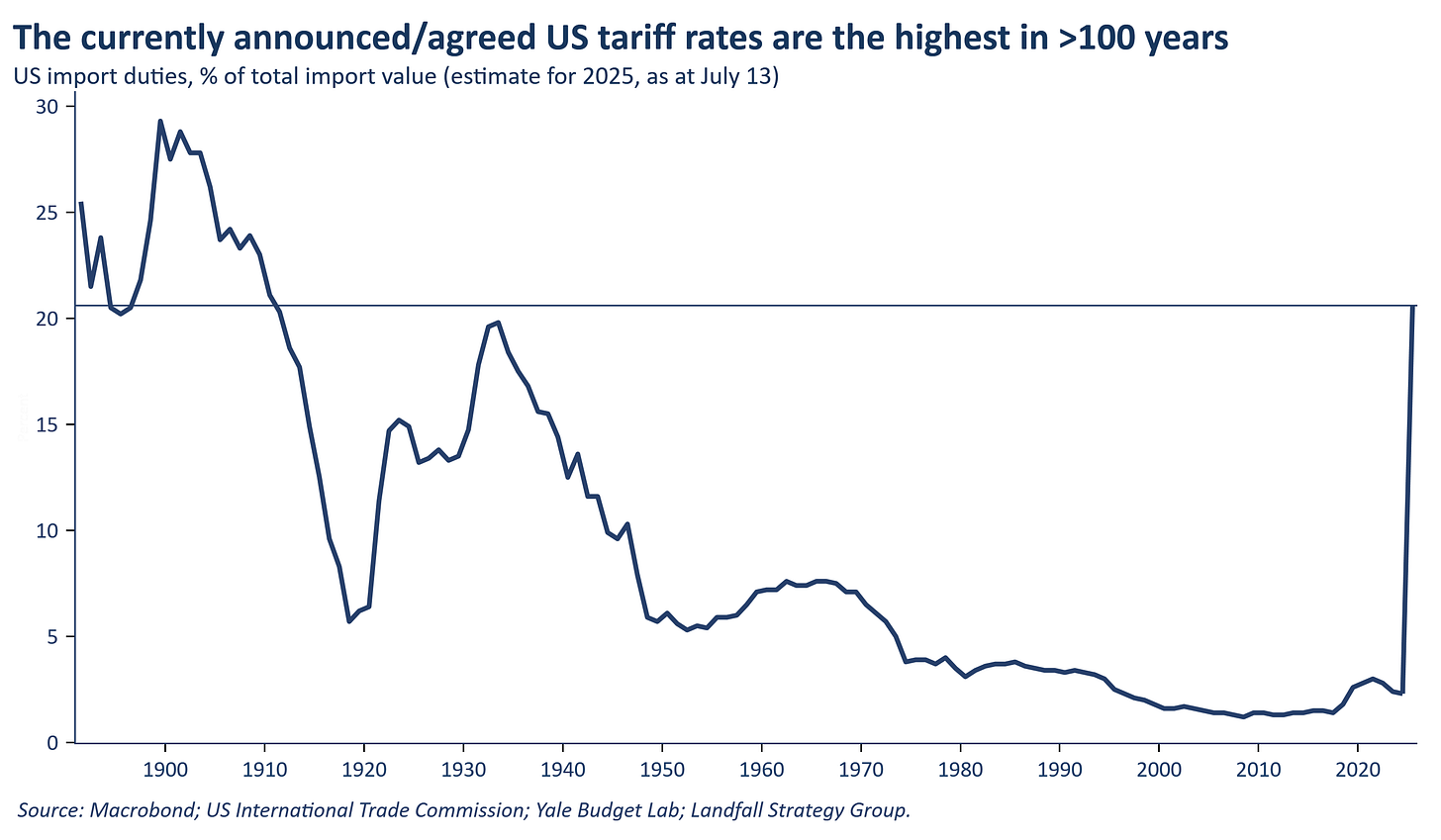

After several weeks of relative calm on tariffs, Mr Trump - likely emboldened by several recent domestic and international wins - has again been acting aggressively: sending out letters with higher-than-expected tariff demands and conducting rapid-fire discussions with countries. Neither political or judicial forces are constraining Mr Trump on tariffs so far; and markets have been relatively sanguine because the tariffs are lower than the worst-case scenarios that had been imagined. But the average tariff rate is now sitting at ~20%, not far below Liberation Day rates and an order of magnitude higher than last year. Tariffs at this level will impose substantial costs on firms and economies. And although markets have responded positively to the deals with Japan and others, partly on an assessment of reduced uncertainty, no deal is ever really final with Mr Trump - and so uncertainty will persist. Indeed, the deals signed so far are particularly provisional in nature. Over time, I expect Mr Trump to relitigate: he has encountered little meaningful pushback so far from other countries (ex China). This process is far from over.

2. Fed showdown

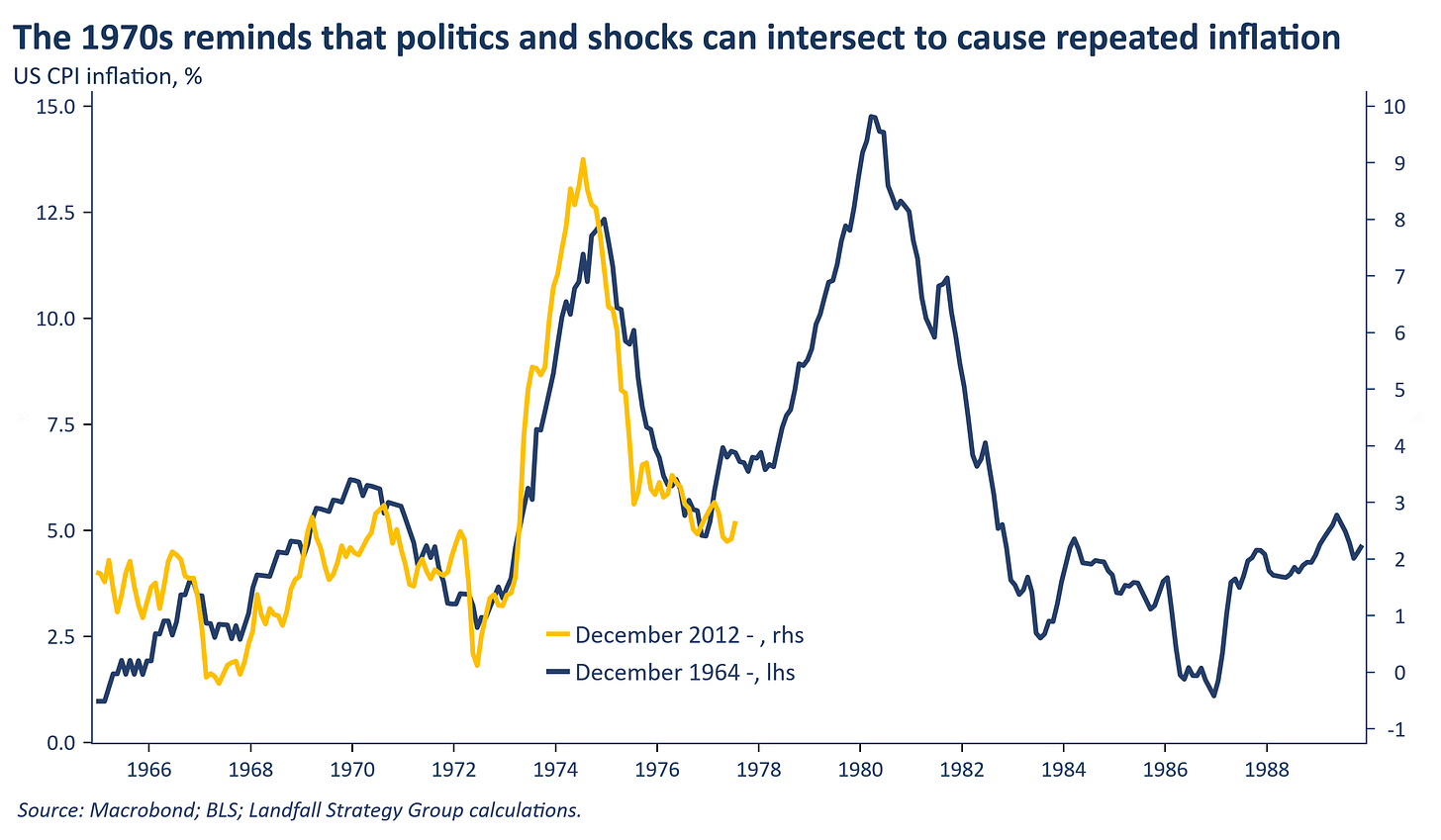

Inflation in the US may be stirring: core CPI was up slightly to 2.9% in June. This process is likely to continue for several reasons. First, higher tariff rates will begin to show through: already, inflation for core goods is moving up with big monthly increases in categories directly exposed to tariffs. As the pause period tariffs roll off in August, and pre-tariff inventories are exhausted, expect higher prices. This will be reinforced by tighter US labour markets on reduced inward migration and significantly increased deportation rates; the weaker USD; as well as ongoing fiscal stimulus. A softening US economy may remove some inflationary pressure, but I think higher inflation is more likely (consistent with higher inflation expectations in consumer surveys). This will reduce the space for the Fed to cut rates sharply in the way that Mr Trump is pushing for. These higher rates will collide with US public debt, raising debt servicing costs and reinforcing political challenges to Fed independence. History is not a perfect guide of course, but parallels to the 1970s (see chart) bear considering: the interaction of political/policy decision-making with shocks can be a potent inflationary mix. With apologies to Milton Friedman, inflation is always and everywhere a political phenomenon.

3. The normalisation of Japan

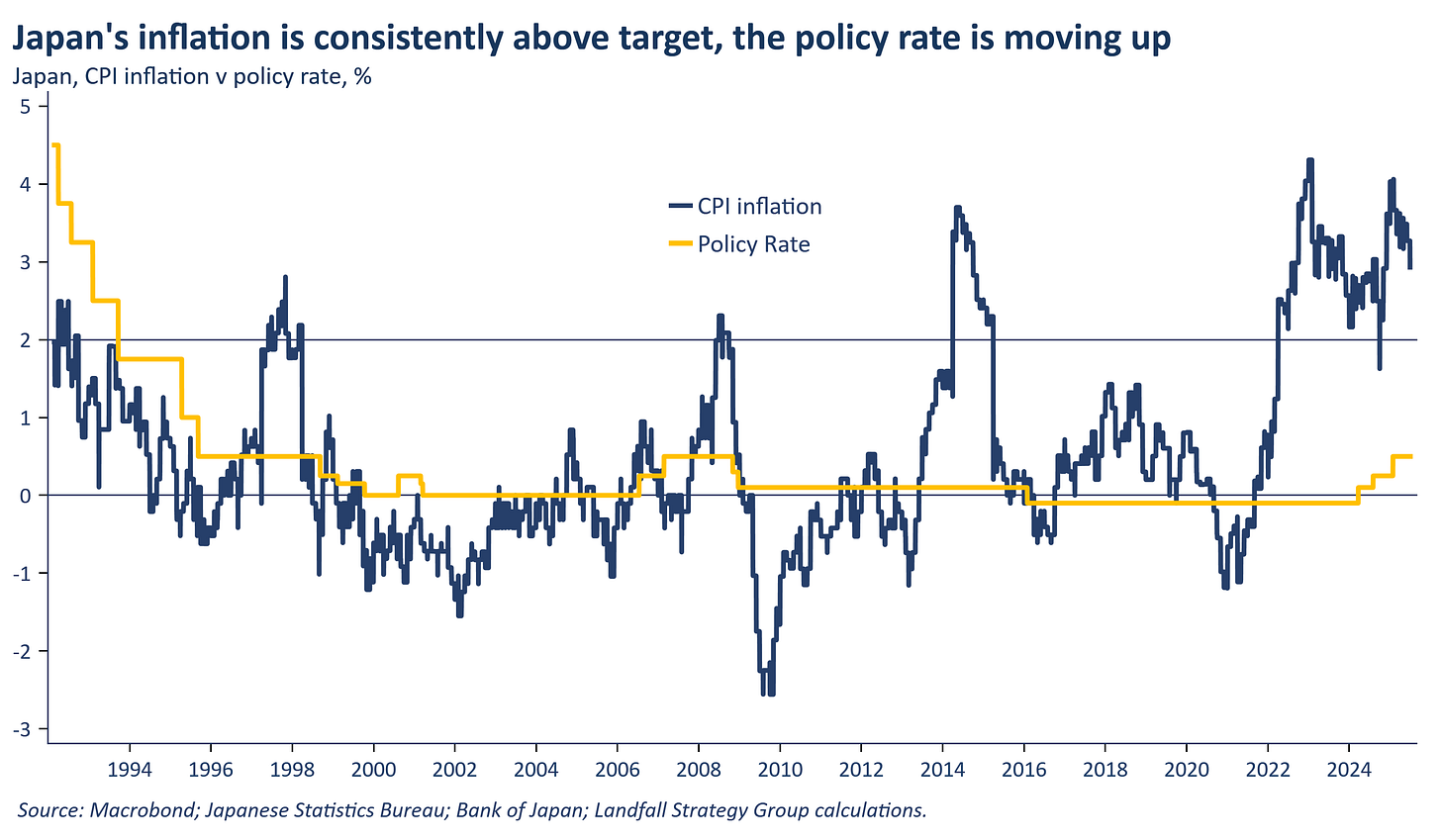

Japan is becoming a more ‘normal’ economy. Inflation is above target at ~3% after a period of deflation; and policy rates are 0.5% after being in negative territory. There are other ways in which Japan is becoming less distinctive. As with other countries, its large public debt stock is attracting increased investor scrutiny: 30 and 40-year government bond yields are at record levels. Last weekend’s election, in which the LDP lost its majority in the Upper House, also showed similarities with political dynamics elsewhere: the rise of anti-migrant parties. And along with other US allies, Japan faces the strategic challenge of a reset in US relations. Despite this week’s provisional trade deal (including 15% tariffs and a very unclear investment agreement), there is concern about the outlook for Japan’s economic relationship with the US (after a pronounced pivot in Japan’s trade towards the US over the past few years) as well as about the credibility of the US security commitment. Change is coming to Asia’s second largest economy, with significant global economic and geopolitical spillovers - from a weakening carry trade to a changing strategic posture.

4. Soft power

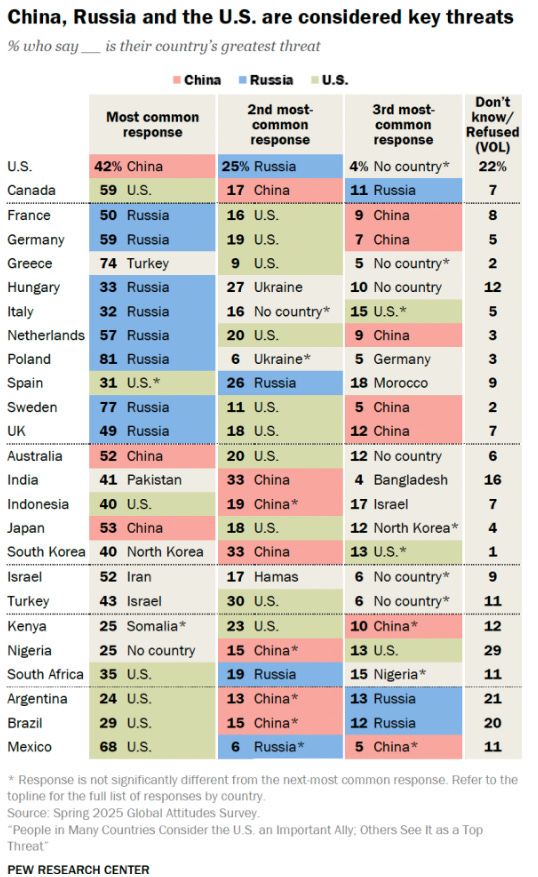

Recent Pew surveys describe a broad-based shift in the international perception of the US. Strikingly, substantial shares of publics in historical US allies (from Canada to Europe) now regard the US as a threat – ahead of China. It is not unprecedented for Western opinion to sour on the US: previous episodes happened in the George W. Bush Administration as well as the first Trump Administration. But the actions and rhetoric of the second Trump Administration (from tariffs and weakened security comments to criticism of democratic political systems) represents a structural economic and geopolitical reset of US engagement with the world. This suggests that some of this change in perception of the US might be enduring. Indeed, from Europe to Asia, countries are investing in military capabilities as well as new economic/trade partnerships to de-risk exposures to the US.

5. AI leadership

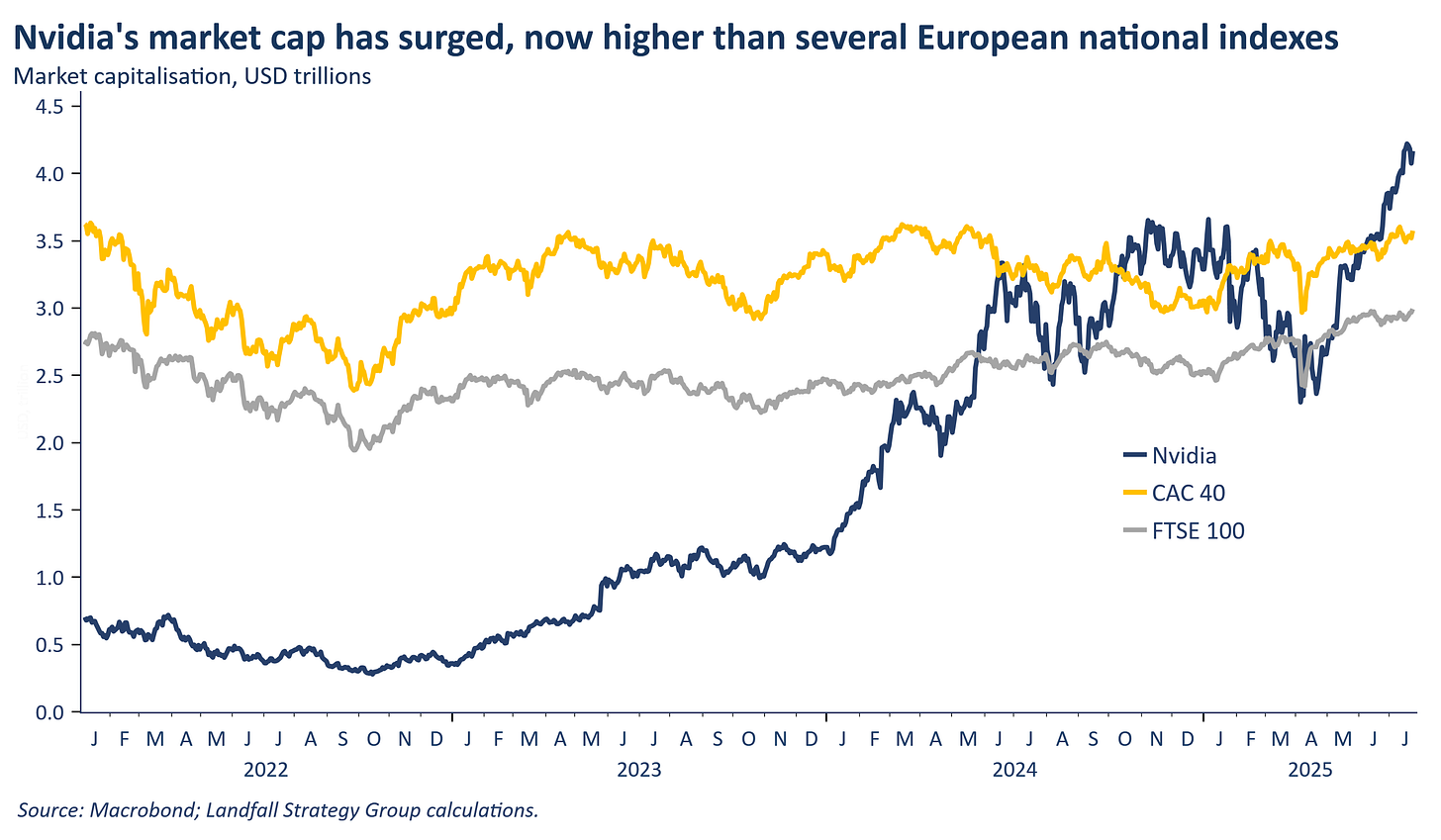

After a sell-off, partly in response to US export restrictions on selling advanced chips to China, Nvidia’s share price has soared over the past few months. Nvidia recently became the first private company to exceed market capitalisation of $4 trillion (currently ~$4.2 trillion). This is more than the market cap of each of the German DAX40, the French CAC40, and the UK’s FTSE100; and not too far away from the market cap of the Euro Stoxx 50. Alongside the strong performance of multiple other AI companies in the US, this reflects the strength of the US’s AI leadership relative to Europe and others. However, AI leadership is a marathon not a sprint and ongoing US dominance at current levels is not inevitable. [On this, I recommend a recent book by Jeffrey Ding on technology and the rise of great powers - although I am not fully persuaded by his assessment of the outlook.]

6. Risk free assets

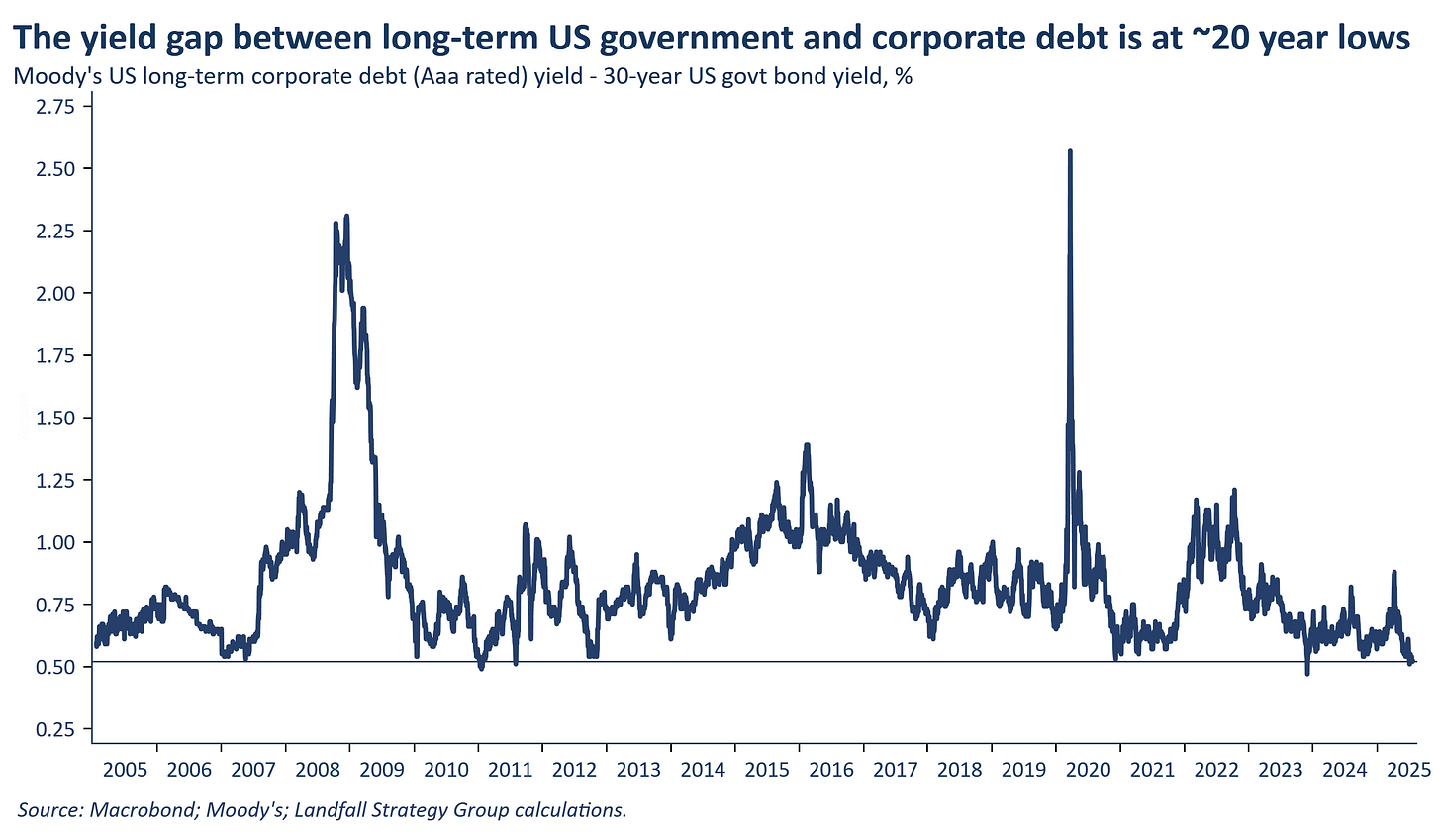

Previous notes have discussed growing fiscal risks across advanced economies, as public debt levels have continued on unsustainable trajectories. This is reflected in the rising yields on long-dated government bonds across advanced economies, as investors demand a risk premium. 30-year government bond yields have continued to rise over the past month; the US 30-year rate is just under 5% after the recent passage of the federal budget. The US fiscal track, as well as concerns about Fed independence, raises questions about the status of US Treasuries as a safe haven asset. One instructive measure of this changing investor sentiment is the yield gap between US sovereign debt and AAA-rated US corporate debt: this has now reduced to ~50bp, around 20-year lows and well below historical averages.

7. EU strategic challenges

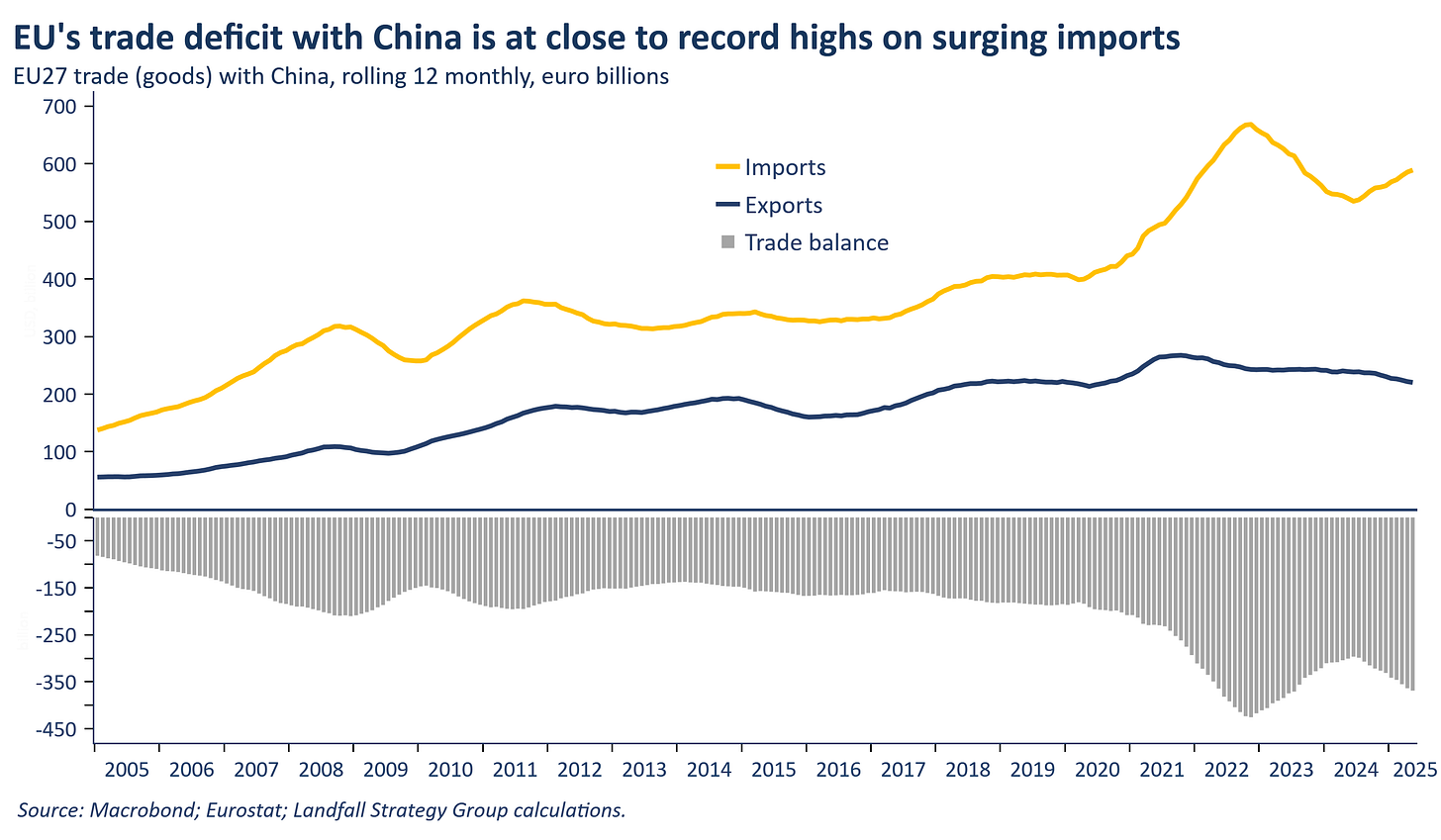

The EU is facing economic tensions with two key partners: tariffs from the US (expected/hoped to be 15% at time of writing, with higher rates on some goods) and also with China. Thursday’s EU/China Summit in Beijing – compressed to one day – provided a sense of the tensions, with President von der Leyen talking of an ‘inflection point’ for the bilateral relationship. The EU has been imposing tariffs and sanctions on Chinese EVs and other goods in response to Chinese subsidies/dumping, and is bracing for substantial flows of diverted Chinese goods in response to US tariffs. Already, the bilateral trade deficit is at close to record levels with Chinese exports to Europe surging. Despite tariffs, Chinese EVs are becoming a common sight on European roads. Europe values Chinese green tech and other technology, but the challenges to European industry from Chinese mercantilism and other frictions (e.g. rare earth export restrictions) as well as geopolitical differences (notably Ukraine) are forcing a response.

Thanks for reading small world. This week’s note is free for all to read. If you would like to receive insights on global economic & geopolitical dynamics in your inbox every week, do consider becoming a free or paid subscriber. Group & institutional subscriptions are also available: please contact me to discuss options (more information is available here).

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original is here. You can subscribe to receive David Skilling’s notes by email here.

4 Comments

Risks are very high.....yet share markets, property and gold are at among or near the higher valuations ever.

The Gold one, makes some sense.

What could possibly go wrong here???? I hear both 1929 and 1987 calling.

--------------------------------------------------------------------------------------------------

Another death stab, at the punch drunk and staggering NZ Property Ponzi BBBubble:

New Zealanders urged to break up with property | Stuff

High holding costs and population decline = Super Kryptonite Killer to the NZ Property bubble...

Risks are very high.....yet share markets, property and gold are at among or near the higher valuations ever.

The Gold one, makes some sense.

What could possibly go wrong here???? I hear both 1929 and 1987 calling.

Why? 1929 / 87 are very different to now. Because, as you know, the Anglosphere model can simply patch up the holes with printed money and liquidity.

The Fed was criticized for not expanding the money supply during the early 1930s, and scholars have argued that more aggressive action could have lessened the Depression. However, these actions were systematically limited by structural and legal requirements tied to gold.

By 1987, the U.S. was no longer on the gold standard and had more policy flexibility. However, central banks, especially the Fed, responded to the stock market crash not by simply "printing money," but by injecting liquidity into credit markets, lowering interest rates, and assuring financial institutions they would supply reserves as needed to ensure liquidity and confidence.

The Fed’s approach was targeted. Rather than flooding the economy with money, it lowered short-term rates and made open market operations to ensure banks had enough cash to meet withdrawals and loans - supporting market function without triggering runaway inflation or panic.

Another death stab, at the punch drunk and staggering NZ Property Ponzi BBBubble:

Article talks about the ol' rat poison returning 45,000% over the past decade and "we're unlikely to see that happen again".

I think the kids are gambling on other dogsh*t coins to try to catch up - the ruling elite, boomer pandering, and financial community have indirectly encouraged this nihilism. The kids are hoping for 50x-100x opportunities (5,000%-10,000%). Possible but quite a degenerate activity to be involved in.

And Ethereum's price has increased by roughly 2,840x (or about 284,000%) in USD over the past decade. You could have bought ETH at $100 not that long ago (2017-18) meaning an approx 3,700% return today.

Thank you David.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.